巴菲特致合伙人的信(1960年)

①整体情况②业绩

1960年股市的整体情况:

1959年,道指从583点到679点,上涨16.4%,我说指数有些失真。当年,几乎所有投资公司都赚钱了,但是其中只有不到10%赶上或超过了道指涨幅。另外,道琼斯公用事业指数略微下跌,道琼斯铁路指数大幅下跌。

1960年,情况反了过来。道指从679点到616点,下跌了9.3%。加上股息,持有指数的整体亏损仍然有6.3%。道琼斯公用事业指数却录得较大涨幅。现在还有的投资公司没公布业绩,我估计90%左右的投资公司都跑赢了道指。大部分投资公司去年的收益率似乎都在5%上下。在纽约股票交易所上市的股票中,653只下跌,404只上涨。

1960年的业绩:

我管理合伙人资金的目标始终是长期跑赢道指。我认为,从长期来看,道指的表现基本上就是大型投资公司的业绩表现。除非我们跑赢道指,否则我们的合伙公司没有存在的意义。

我也说了,不要以为我们追求长期跑赢道指的目标,就代表我们要每年都领先指数。我们长期跑赢指数的方法是,在平盘或下跌的行情中领先指数,在上涨行情中跟上甚至落后于指数表现。

与我们和指数都上涨20%的年份相比,我认为,在指数下跌30%而我们下跌15%的年份,我们的表现更出色。长期来看,一定会有表现好的年份,也会有表现差的年份。在这个长期过程中,因为某一年的表现好坏而兴高采烈或垂头丧气完全是做无用功。就像打高尔夫球,重要的是总成绩低于标准杆。高尔夫球有三杆洞,也有五杆洞。五杆洞打出五杆,比三杆洞打出四杆好。要是以为无论几杆的洞,我们都能低于标准杆,那就不现实了。

因为我们今年新增了不少合伙人,所以我又用了些篇幅讲理念。我希望让新合伙人了解我的目标、我衡量是否实现目标的方法,以及什么是我能做到的,什么是我做不到的。

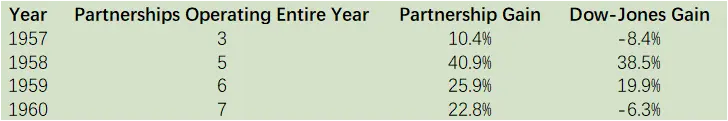

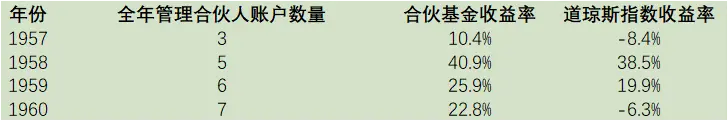

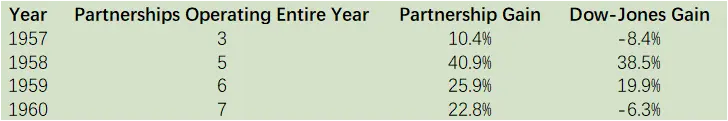

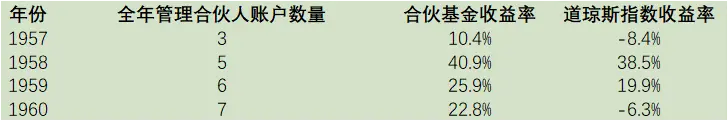

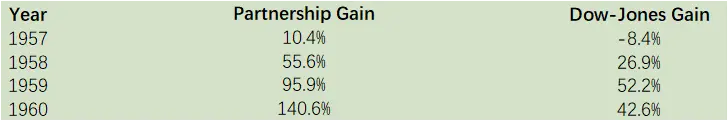

说完了这些,大家应该知道了,1960年是我们战胜指数的一年。去年,道指整体亏损6.3%,我管理的七个合伙人账户取得了22.8%的收益。在扣除经营费用之后,不算支付给有限合伙人的利息和普通合伙人的分成,在过去四年中,合伙公司的业绩如下:

需要再强调一下,这是合伙公司的净收益,有限合伙人的净收益取决于他们各自选择的合伙协议。

整体收益或亏损按照市值计算。把资金进出也计算在内,这个方法在计以年初和年末清算价值为计算依据。它的计算结果和用于税收申报的数据不同,因为报税时证券按成本价计算,并且证券的收益或亏损只有在售出时才计算。

On a compounded basis, the cumulative results have been:

按复利计算,混合起来四年累计业绩如下:

四年时间实在太短,不足以用于判断我们的长期业绩,但是从我们这四年的表现可以看出,我们确实能做到在温和下跌或平盘的市场中跑赢指数。我们能做到这一点,是因为我们投资的股票绝对和大多数人不一样,与持有蓝筹股的人相比,我们的投资组合更保守。在蓝筹股强劲上涨时,我们可能很难追上它们的涨幅。

〔译文来源于格隆汇〕