巴菲特致合伙人的信(1963年)

⑦登普斯特农具机械制造公司

登普斯特农具机械制造公司

这笔投资是1956年作为低估类开始的。当时,它的股价是18美元,净资产72美元,流动资产(现金、应收账款和存货)减去所有负债是50美元。登普斯特曾经是一家很赚钱的公司,但是在我们买入时,它只能维持盈亏平衡。

定性分析是负面的(行业竞争激烈,管理层平庸),但是从数字上看太有吸引力了。经验表明,买入100只这样的股票,在一到三年之内,其中七八十只能实现不错的收益。买入的时候,很难说哪只就能涨,只知道整个组合的前景良好。促使组合中个股上涨的因素很多,可能是行业状况好转、收到收购要约、投资者心理变化等等。

此后五年里,我们每次只能买到很少,但一直在买这只股票。这五年里,我担任了公司的董事,越来越不看好现有管理层领导下的盈利前景。在此期间,我也对公司的资产和经营状况有了更深的了解,通过定量分析,我仍然认为这家公司很便宜。

1961年中期,我们持有登普斯特30%的股份(我们几次提出收购要约,都无功而返)。1961年8月和9月,我们以每股30.25美元的价格完成了几笔大宗交易,随后以相同的价格提出了收购要约,我们的持股达到了70%以上。在之前五年里,我们的买入价格在16美元到25美元之间。

取得控股权后,我们将副总裁提升为总裁,为他解除公司先前策略的束缚,看他能否带来转变。结果还是没起色。1962年4月23日,我们聘请哈里·博特尔(HarryBottle)出任总裁。

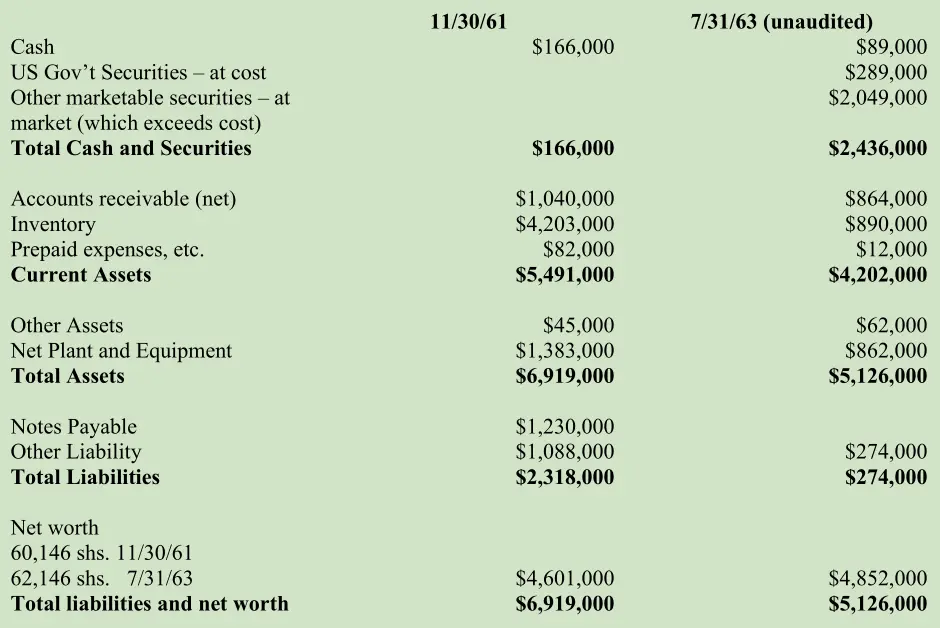

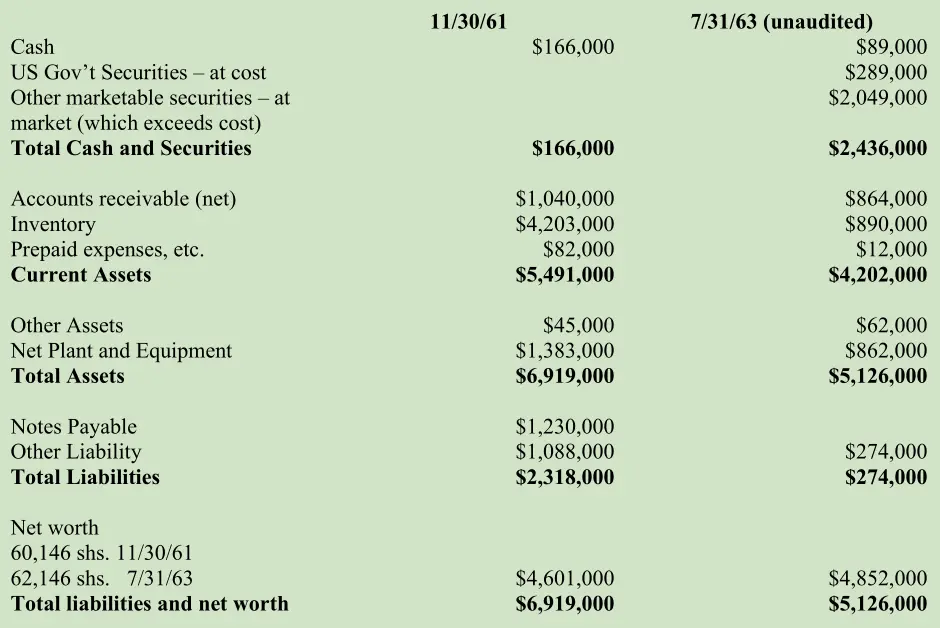

哈里是这份工作的最佳人选。我之前盛赞过哈里取得的成绩,不必多说,请看下面资产负债表的前后对比,资本重新配置的成果一目了然。

哈里:

(1)把存货从400多万美元(大多数是周转率极低的)降低到100万美元以下,极大地降低了存货持有成本和淘汰过时的风险。

(2)释放出资本,我们将其用于投资有价证券,获得了40多万美元的收益。

(3)将销售和管理费用从每月150,000美元降低到75,000美元;

(4)将工厂营运成本从每直接工时6美元降低到4.5美元;

(5)关闭了五家不赚钱的分公司(保留了三家赚钱的),用效率更高的分销商取而代之;

(6)整顿了内布拉斯加州哥伦布市经营混乱的一家配件工厂;

(7)砍掉了消耗大量资金,却不能贡献利润的承包工程业务(释放出的资金可以投资证券获利);

(8)调整了维修配件的价格,在不影响销量的情况下,增加了超过200,000美元的利润;

(9)最重要的是,通过包括上述措施在内的努力,让登普斯特恢复到与投入资本相称的盈利能力。

1963年,一方面,哈里恢复登普斯特盈利能力的速度比我预想的快得多,我们很快就用完了税损结转,需要缴纳巨额税款,另一方面,登普斯特公司有大量流动资金用不完,我们别无选择,只能想办法把公司注销或卖出去。

我们着手在1963年末之前解决这个问题。注销公司很麻烦,但是我们的合伙人可以多获得一倍的收益,而且不用为登普斯特持有的证券缴纳资本利得税。

我们最初谈了几笔交易,都是快谈到最后时没谈妥。几乎到了最后一刻,我们达成了一笔出售资产的交易。虽说我们对这笔交易里的很多细节并不满意,但是整体来说,我们大概获得了净资产的价值。加上我们通过有价证券投资组合获得的收益,我们实现的价值是每股80美元。登普斯特(已更名为FirstBeatriceCorp.,我们将登普斯特商标出售给了新公司)现在几乎只剩下现金和有价证券了。在巴菲特合伙基金的年末审计中,我们持有的FirstBeatrice的估值方法是用资产价值(以市价计算证券价值)减去200,000美元储备金。

顺便说一句,我认为买方会把登普斯特经营得很好。他们是很有能力的人,对于将来如何拓展业务和提升盈利能力,制定了完善的计划。无论是以非法人的形式经营登普斯特,还是以合理的价格卖出去,我们都很乐意。我们在投资中追求的是买得好,不是卖得好。

哈里和我一样,我们都喜欢丰厚的奖赏。他目前已经是巴菲特合伙基金的有限合伙人,下次我们再有需要瘦身的公司,就会派哈里上阵。

从登普斯特的故事里,我可以得到以下两点启示:

(1)我们所做的投资需要耐心。有的投资组合里都是股价高飞、人见人爱的股票,我们根本不买这些股票。在热门股风头正劲时,我们的投资可能看起来乏善可陈。对于我们看好的股票,在我们买入时,它们的股价几个月甚至几年呆滞不动,对我们来说是好事。所以说,要给我们足够的时间,才能看出来我们的业绩如何。我们认为这个时间至少是三年。

(2)我们不能透露我们正在做的投资。把我们的投资说出去,提高不了我们的收益,还可能给我们带来严重损失。包括合伙人在内,无论是谁问我们是否看好某只股票,我们都会援引“宪法第五修正案”保持沉默。

〔译文来源于梁孝永康所编全集〕