巴菲特致股东的信(1980年)

④盈余报告

盈余报告

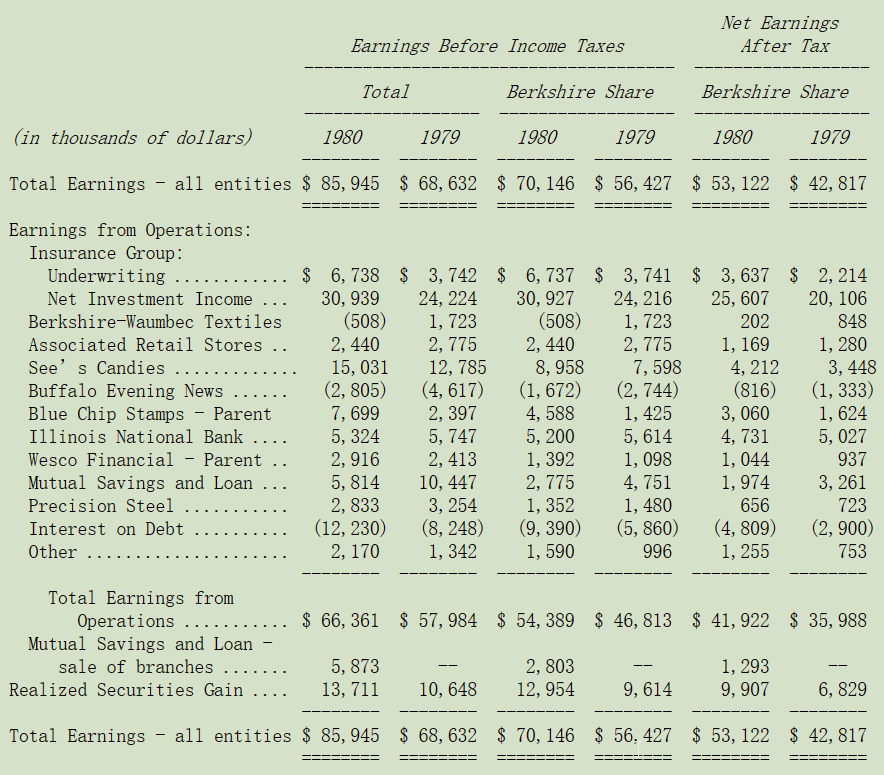

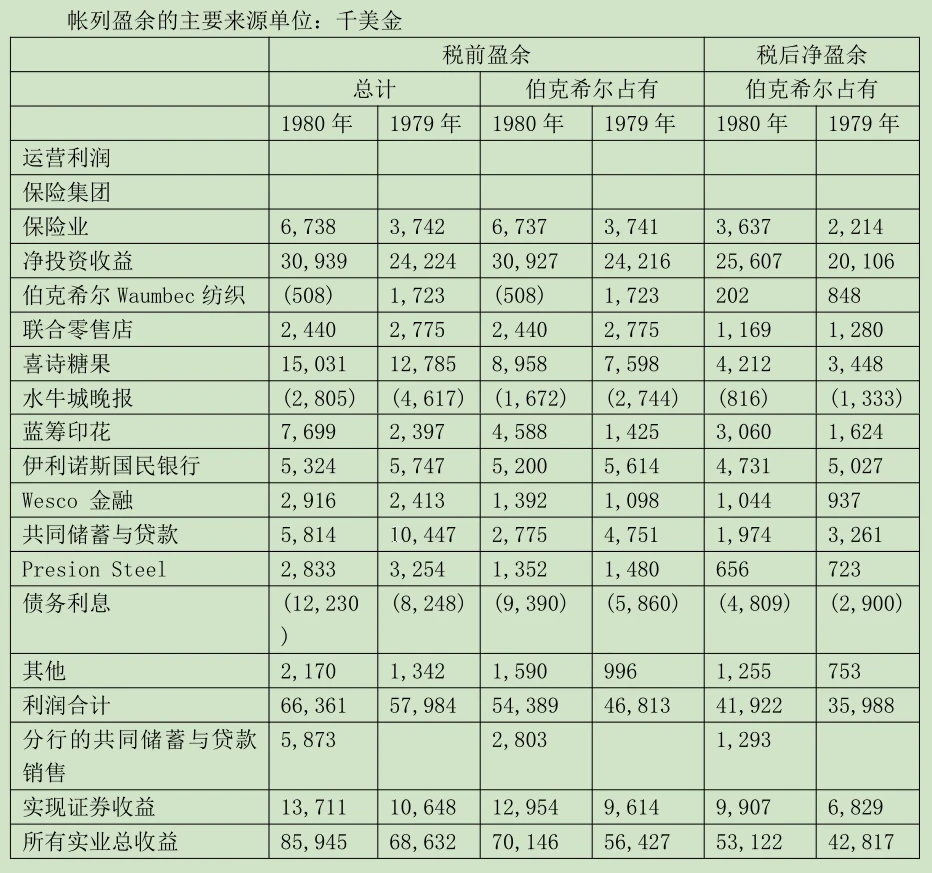

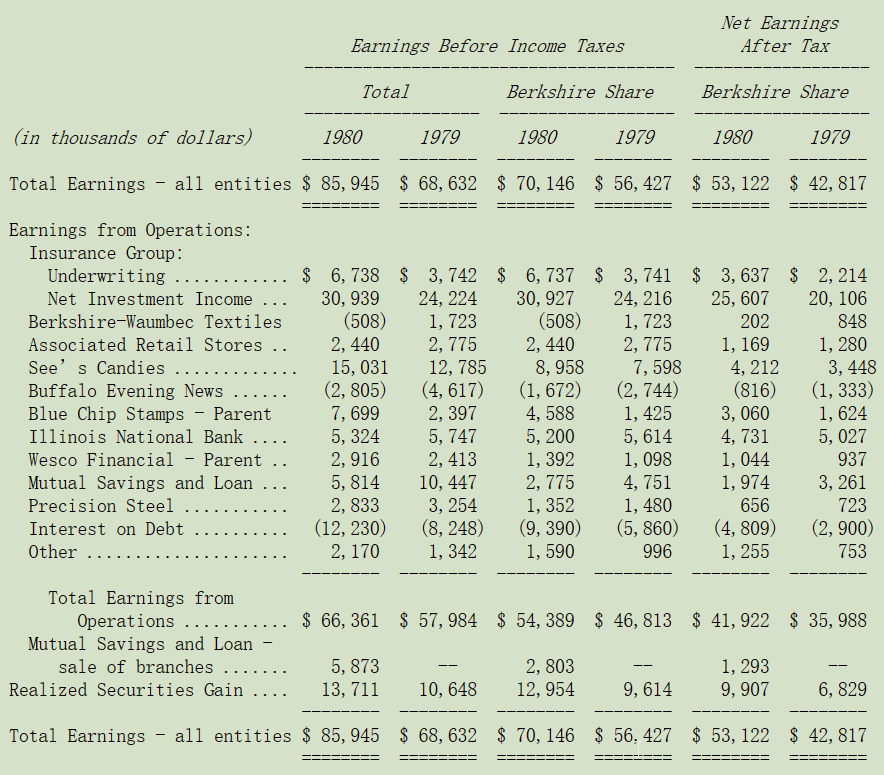

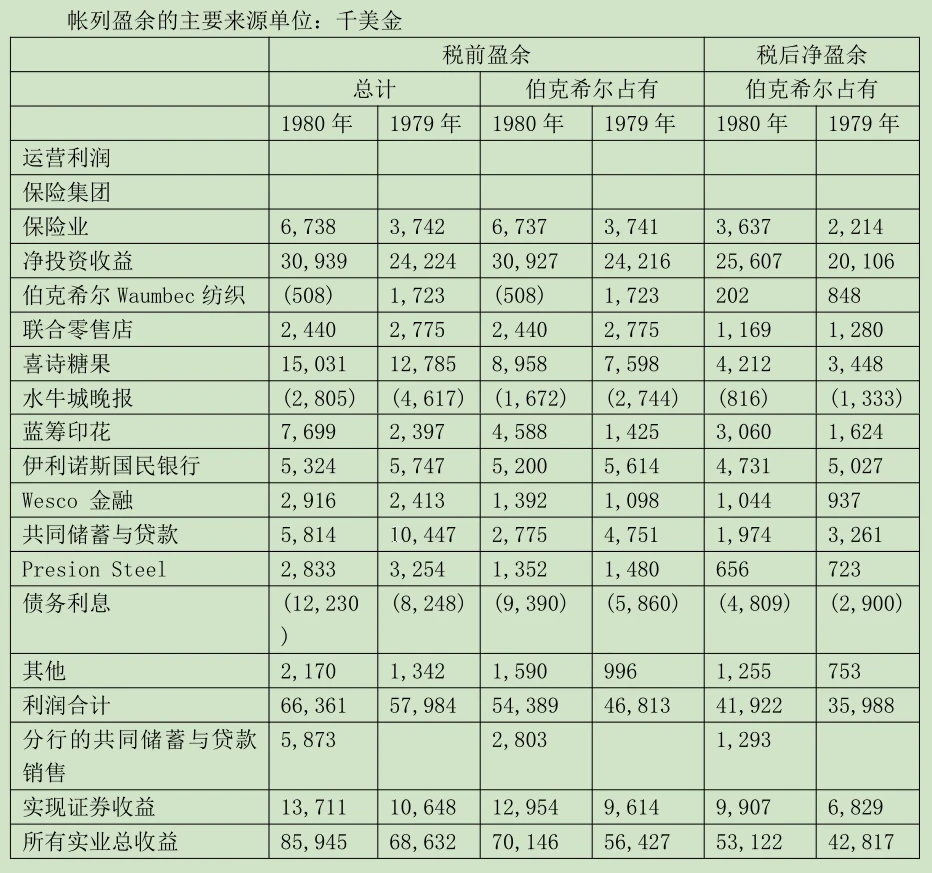

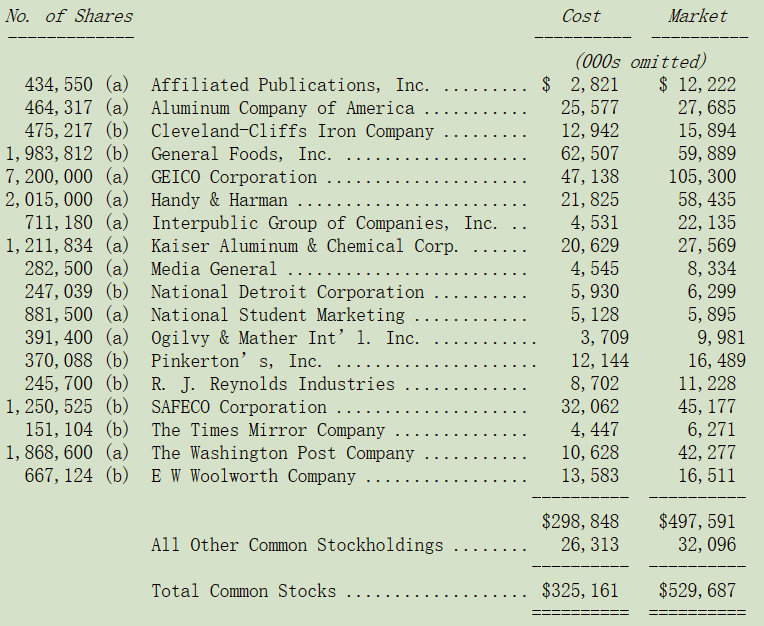

下表显示伯克希尔依照各个公司持股比例来列示帐面盈余的主要来源,而各个公司资本利得损失并不包含在内而是汇总于下表“已实现出售证券利得”一栏中,虽然本表列示的方式与一般公认会计原则不尽相同,但最后的损益数字却是一致的:其中伯克希尔拥有蓝筹印花60%的股权,而后者又拥有Wesco财务公司80%的股权。此外,本期的帐面盈余并不包括联合储贷处份分公司办公室的利得,也因此使得表中“未包括已实现投资利得前盈余”与经会计师签证的财务报表数字有所不同。

蓝筹印花及Wesco两家公司因为本身是公开发行公司以规定编有自己的年报,我建议大家仔细阅读,尤其是有关Louie Vincenti和Charlie Munger对联合储贷业务所作的改造,若有需要伯克希尔的股东可向Mr.Robert(地址:加州洛杉矶5801 South Eastern Avenue)索取蓝筹印花的年报或向Mrs.Bette(地址:加州Pasadena 315 East Colorado Boulevard)索取Wesco的年报。

就像先前我们所提到的,那些不具控制权的股票投资其未分配的盈余的的重要性已不下于前面表列的帐面盈余,至于那些已分配的部份则透过认列投资利列示在保险公司投资收益项下。

我们在下面展示了伯克希尔在那些非控股企业中的比例持股,这些企业的分配收益(股息)只包括在我们自己的收益中。

(a)全部归伯克希尔或其保险子公司所有。

(b) 蓝筹印花和/或维斯科拥有这些公司的股票。所有数字都代表了伯克希尔在该集团更大的总持股中的净权益。

从本表你会发现本公司背后所创造盈余的动力系来自于各行各业,所以我们只能约略地看个大概,譬如保险子公司约持有Kaiser Alumnium 3%和Aloca 1.25%的股份,在1980年我们光是从这些公司依持股比例可得约1,300万美金(当然若将这些盈余实际转为资本利得或股利,则大约会被课以25%的税负),因此单单在制铝这门行业,我们的经济利益就大于其它那些我们可以直接控制且须详尽报告的公司。如果我们的持股不改变,则制铝产业的景气变动,将比那些我们具有实质控制权的产业,对本公司长远的绩效表现更有影响力。

〔译文基于梁孝永康所编《巴菲特致合伙人+致股东的信全集》修改完善〕