巴菲特致股东的信(1984年)

①报告收益来源

致伯克希尔·哈撒韦公司全体股东:

本公司 1984 年的账面价值增加了 1.526 亿美金,每股约 133 美金,这个数字看起来似乎还不错,不过若考虑所投入的资本,实际上只能算一般。从 1965 年的 19.46 美元到 1984 年的 1,108.77 美元,20 年来我们的账面价值年化增长率约 22.1%,但 1984 年的股东回报率只有 13.6%(标普 6.1%)。

如同我们去年讨论过的,真正重要的经济衡量标准是每股内在商业价值的增长。不过由于其涉及太多主观的意见而难以计算,所以以我们的情况,通常用帐面价值当作近似代替,尽管有些低估。在我看来,1984 年内在价值与帐面价值增加的程度可谓相当。

过去我曾从学术的角度跟各位提到,资本规模的迅速增加必将拖累资本的回报率。不幸的是,今年我们以报导新闻的方式跟各位报告:过去 22%的增长率已成历史,为了达到 15%的增长率,接下来十年我们要赚约 39 亿美金(假设我们仍维持目前的股利政策,后面我会详加讨论)。想要顺利达成目标,必需要有一些极棒的点子,小创意可不大行,我跟我的执行合伙人查理·芒格目前并无任何好点子,不过我们的经验是有时它会突然冒出来。(但这要怎么做战略计划啊?)

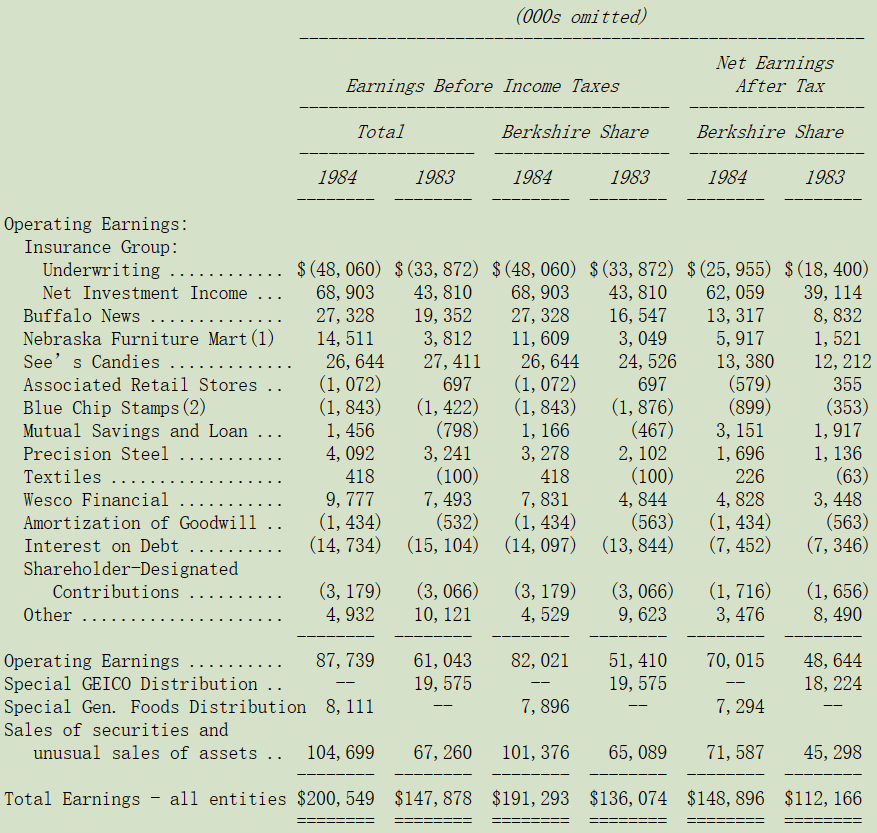

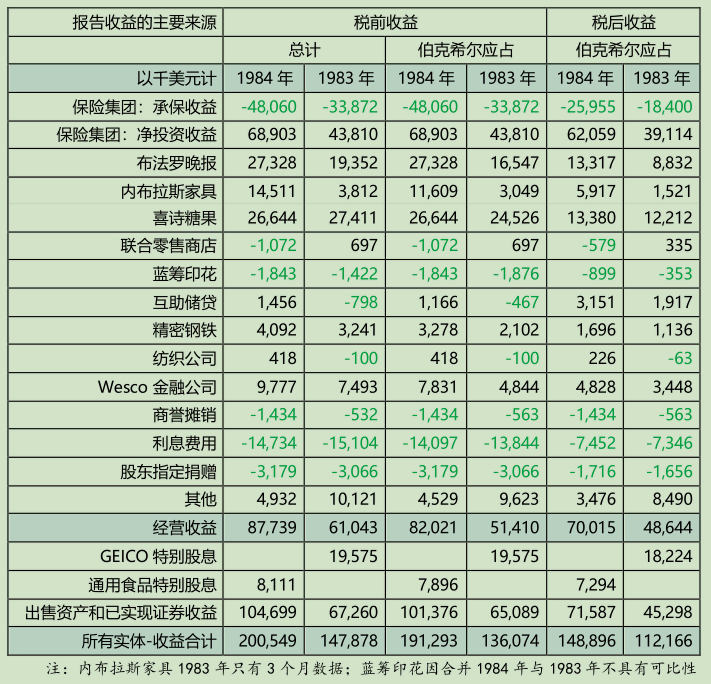

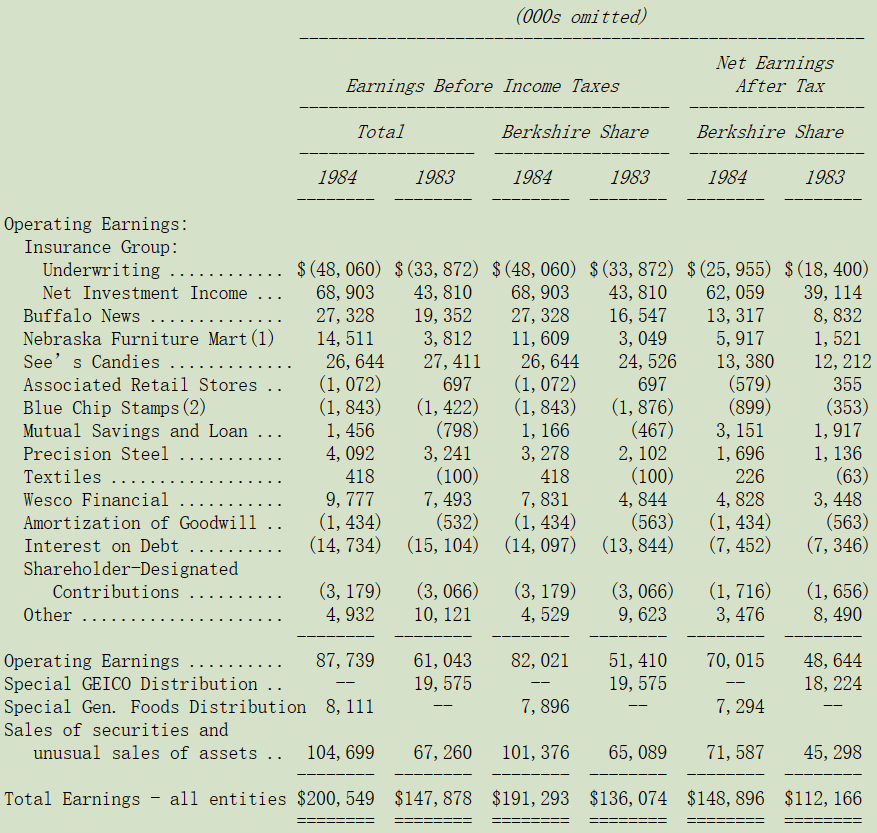

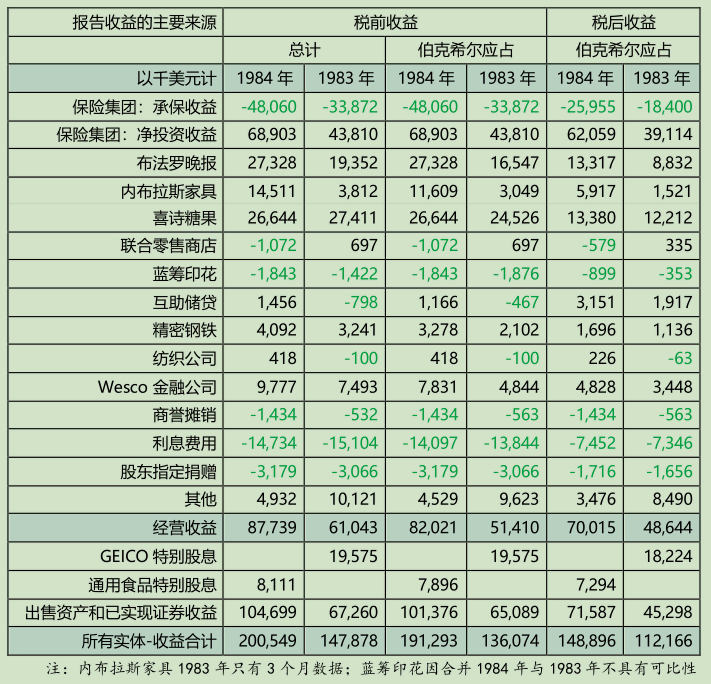

报告收益来源

下表显示伯克希尔报告收益的来源,由于年中与蓝筹印花合并致使我们在一些长期投资的股权发生变动,在1983 年中,伯克希尔和蓝筹印花合并,许多公司股权结构发生了一些变化,所以,表格前两列更能体现这些业务的基本情况。

各个公司的因出售股权的非经常性损益并不包含在经营收益内,而是汇总于底部“已实现出售证券利得”一栏。我们认为,单一年度的资本利得并无太大意义,但加总累计的已实现和未实现总额却相当重要。

至于商誉的摊销不计入对应业务而单独列示,原因我在 1983 年年报附录中已详加说明了:

(1) 1983年的数据是10月至12月的数据。

(2) 1984年与1983年不具有可比性;1983年年中蓝筹印花合并,主要资产发生转移。

眼尖的股东可能会发现 GEICO 保险特别股利的金额与其分类的位置有变动,虽然会计收益在数字上有所减少,但实质上并无太大差别,但背后的故事却相当有趣。

如同去年我报告过的,(1)1983 年中 GEICO 保险宣布收购要约回购自家股票,(2)我们签署合约同意 GEICO保险按比例回购我们手中的股份,(3)最后我们按比例交付给 GEICO 保险 35 万股,并收到 2,100 万现金,并保持持股比例不变,(4)GEICO 保险与我们的交易相当于按比例赎回,律师事务所给予无保留意见,(5)税法在逻辑上认为这种按比例赎回基本上相当于股息,因此,我们收到的 2,100 万现金仅按 6.9% 的公司间股息率征税,(6)最重要的是这 2,100 万现金远低于我们拥有的未分配的收益,所以就经济实质而言,我们认为这相当于股息。

由于它很重要且常见,所以在去年季报与年报中我们特别加以说明,此外,我们向我们的会计师事务所Peat、Marwick、Mitchell & Co 解释了交易,他们无异议地同意我们的股息说明。

1984 年通用食品也发生同样的交易,不同的是,通用食品直接自公开市场中回购,而 GEICO 是要约收购,所以我们每天卖出一点股份以使我们在该公司的持股比例维持不变,我们的交易是根据回购开始前的书面合同进行的,同样,我们收到的现金比我们在该公司未认列的未分配收益少得多,总计我们收到 21,843,601 现金,而持股比例则维持在 8.75%不变。

这时会计师事务所纽约总部的人来了,否决了其奥马哈办事处和芝加哥审查合伙人的结论,他们认定我们与GEICO 保险与通用食品之间的回购交易属于股权买卖而非股利分配,在这种情况下,我们所收到的现金被认定为出售股票收益,在扣除原始投资成本后,应列示为资本利得而不是股息收益,但这只是会计上的处理与税务无关,他们同意交易属于税收优惠目的的股息。

虽然我们从经济实质和适当会计的角度并不认同纽约方面的看法,但为免会计师出具保留意见,我们在此采纳了事务所 1984 年的观点,并相应重申了 1983 年的观点。然而,这些都对内在商业价值没有任何影响,我们在这两家公司的权益、帐上的现金、所得税以及持股市值和税收基础都保持不变。

今年我们又与通用食品签订类似的协议,我们将在他们进行公开市场回购的同时出售持股,以维持我们的所有权权益保持不变,通过保持这种安排,我们将确保自己的股息待遇是出于税收目的。但在我们看来,这种交易的经济实质就是股息分配。然而,除非出现明确的会计规定,否则,我们将回购记为股票卖出而不是股息收益进行核算,并在未来报告中特别强调此类特殊交易。

虽然我们对按比例的赎回享受低税收并参与几次类似的交易,但我们觉得此类回购对不卖出股份的股东同样有利,当一家经营绩效良好且财务基础健全的公司发现自家的股价远低于其内在价值时,买回自家股票是保障股东权益最好的方法了。

我们对于回购的认可仅限于那些基于价值角度的回购,并不包括那种令人厌恶不道德的「绿邮讹诈」回购,在这类交易中,双方为自身私利协议剥削不知情的第三方。「股东勒索者」(Corporate Raider 公司狙击手)在买下足以对公司控制权构成威胁的股份之后,便对公司管理层发出要钱或是要命的勒索公告,即敌意收购。「公司管理层」为自保让恶意股东退出,愿意高价买回其股票,只要这个钱不要是管理层出的就好。「无辜的股东」的资金被「公司管理层」用来打发「股东勒索者」。随着交易尘埃落定,抢劫公司的恶意股东说是为了自由企业,被抢劫的公司管理层则说是为了公司最佳利益,而不知情的股东只能呆呆的被宰还不自知。

(注:绿邮讹诈 Greenmail Repurchase:1980 年代的美国是公司恶意并购狂潮席卷的时代。“绿色邮件”通常被定义为先购买一家公司足够多的股份后以威胁收购取得控制权,然后利用这种影响力迫使目标公司管理层以溢价回购这些股份以放弃收购的做法。详见附录)当价格和价值之间存在巨大差异时,我们重大仓位投资的公司都进行了大规模的股票回购,对于股东而言,有两点好处:第一点很明显,是一个简单的数学问题,以远低于每股内在商业价值的价格进行的重大回购会以非常显著的方式立即增加每股价值,等于花 1 美元的代价便能够获得 2 美元的价值。而企业并购计划从来没有这么美好,大量案例令人沮丧,每花掉的 1 美元根本无法获得 1 美元的回报。

第二点比较微妙,不太容易去精确计算,但时间一长其效果一样明显。管理层通过以远低于内在价值的价格买回自家的股票的行为,向股东宣示其重视股东利益的态度,而不是专注于扩张其经营业务的版图,因为后者往往不利于股东的利益。如此一来,原股东与潜在股东将会对公司的前景更具信心,这种向上修正趋势会使市场价格符合企业内在商业价值,使其价格趋为合理。投资者应该给那些有维护股东利益倾向管理层管理的企业更高的估值,而不是那些自私自利、沉迷各种吹捧的管理层管理的企业。(说得极端一点,你愿意花多少钱,成为罗伯特·威斯科(Robert Wesco)控股的通用食品公司的少数股东?)

不要看他说什么,得看他做什么。当回购显然是为了维护股东利益时,一个总是拒绝回购的管理层所揭示的动机远比他所知道的要多。无论他多么频繁或多么雄辩地说些为维护公共关系而炮制的说辞,如本年度最受欢迎的:股东财富最大化,市场都会正确地估值他们所管理的资产。总是说一套做一套,一段时间后,市场就会用脚投票弃之而去。

我们最大的三大持股:GEICO 保险、通用食品与华盛顿邮报,都大量回购自家股票,我们的持股很大程度上增加了内在价值。我们的第四大持股埃克森石油也积极回购股票,只是因为我们是最近才建立仓位,所以影响不大。这些公司通过低价回购,使股东对这些优秀企业的投资得到了实质性的增强。我们对于投资这种具竞争优势同时拥有注重股东权益意识的管理层的优质企业感到相当安心。

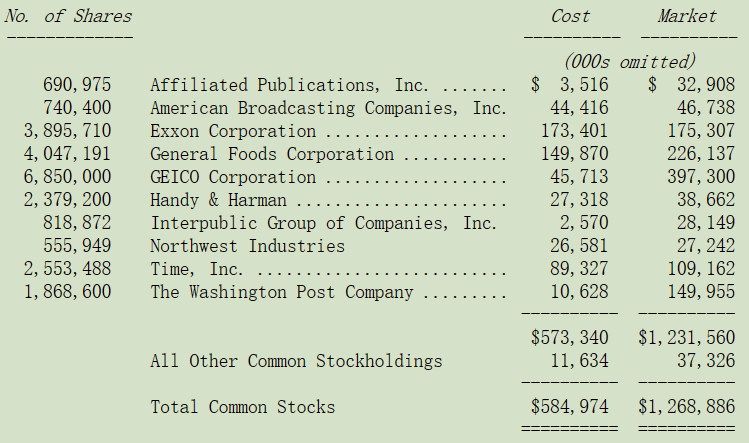

下表是我们在 1984 年底主要的投资部位(所有数字已扣除 Wesco 等公司的少数股权):

符合我们的企业价值评估定性标准,又符合我们的价值与价格定量标准的企业,最近十年来实在很难找得到。我们尽量避免降格以求,但我们发现什么事都不做才是最困难的。有一位英国政治家将该国十九世纪的伟大归功于统治者的无为而治,这种策略历史学家称赞起来很容易,但后继统治者却很难真正做到。

除了先前曾提到的数字,有关 Wesco 的经营理念在查理·芒格写的报告中会详加描述,你会发现他对储蓄行业状况的评论特别有趣。此外我们实际掌控的企业,如内布拉斯加家具店、喜诗糖果、布法罗日报与保险业务集团的经营,将在稍后加以说明。

〔译文源于芒格书院整理的巴菲特致股东的信〕