巴菲特致股东的信(1986年)

附录:购买法会计调整与现金流量谬误

购买法会计调整与现金流量谬误(「股东盈余」vs「现金流」)

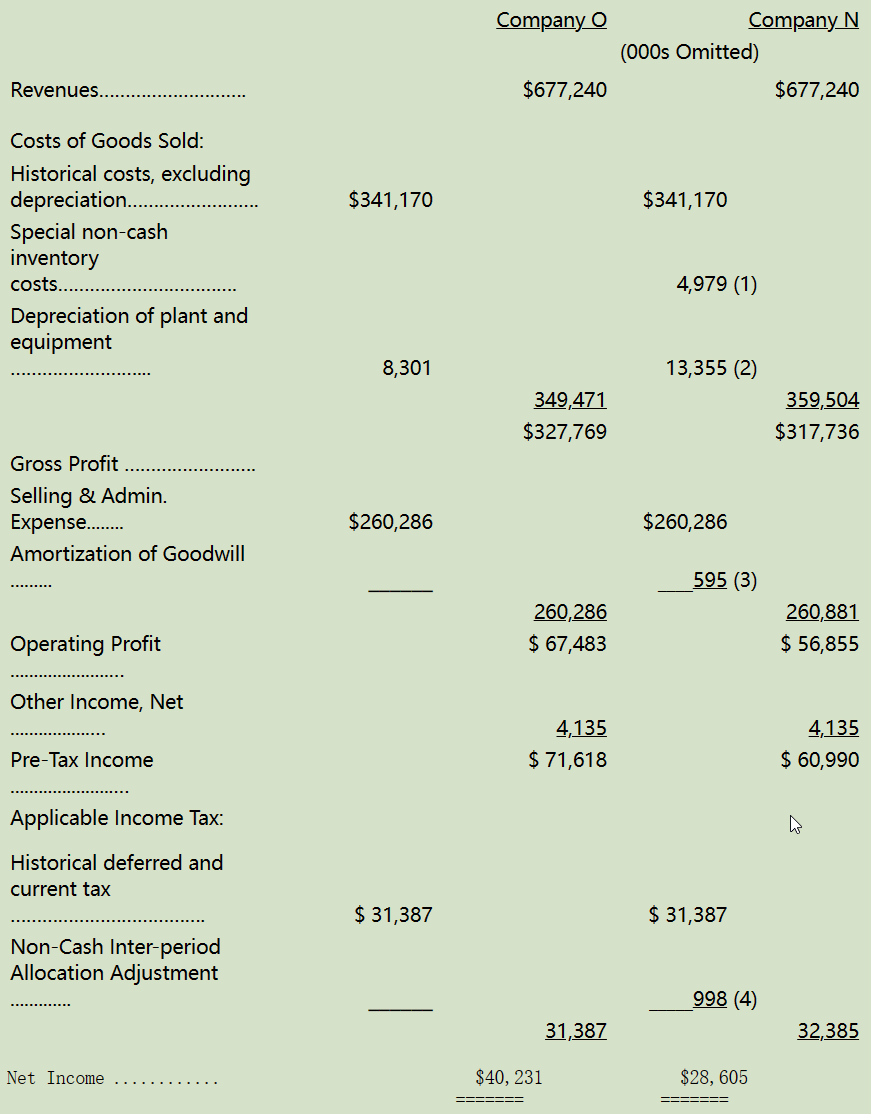

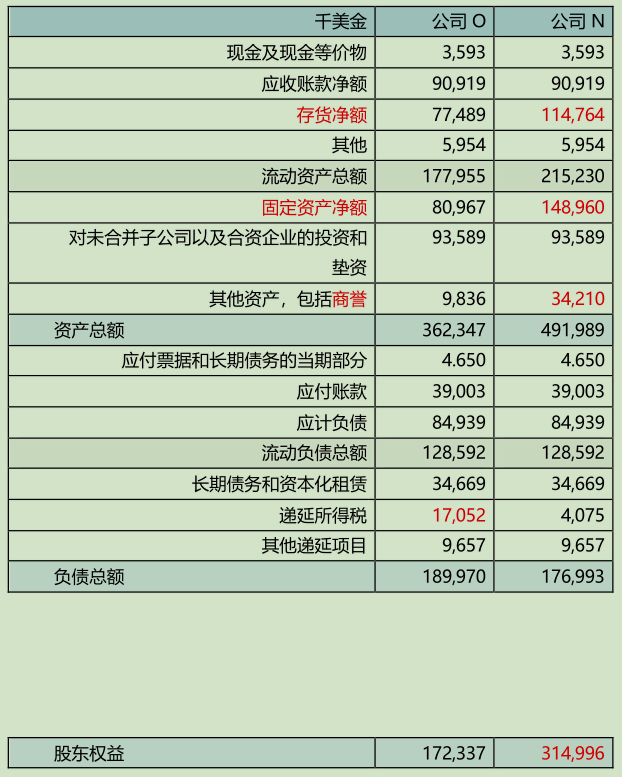

首先是一个简短的测验:以下是两家公司 1986 年的简要损益表。哪个公司更有价值?

(数字(1)到(4)表示本节稍后讨论的项目。)

正如你可能已经猜到的那样,公司 O 和公司 N 是同一家公司:Scott Fetzer。 公司「O」代表旧公司,指的是假设我们在 1986 年没有购买该公司,按照 GAAP 会计准则编制的损益表,公司「N」代表新公司,指的是在1986 年伯克希尔收购该公司后,按照 GAAP 会计准则编制的损益表。

应该强调的是,这两家公司描述了同一个经济现实,就是营收、薪资、税收等相同。并且两个公司贡献给股东的现金流也一样,唯一不同的就是适用的会计规则。

那么,各位专家们,哪一份报表才是事实?管理者和投资者应该关注哪一份报表?

在处理这些问题之前,让我们先看看这两家之间到底有哪些差异。我们将试着在某些方面简化讨论,当然简化不会导致错误的分析或结论。

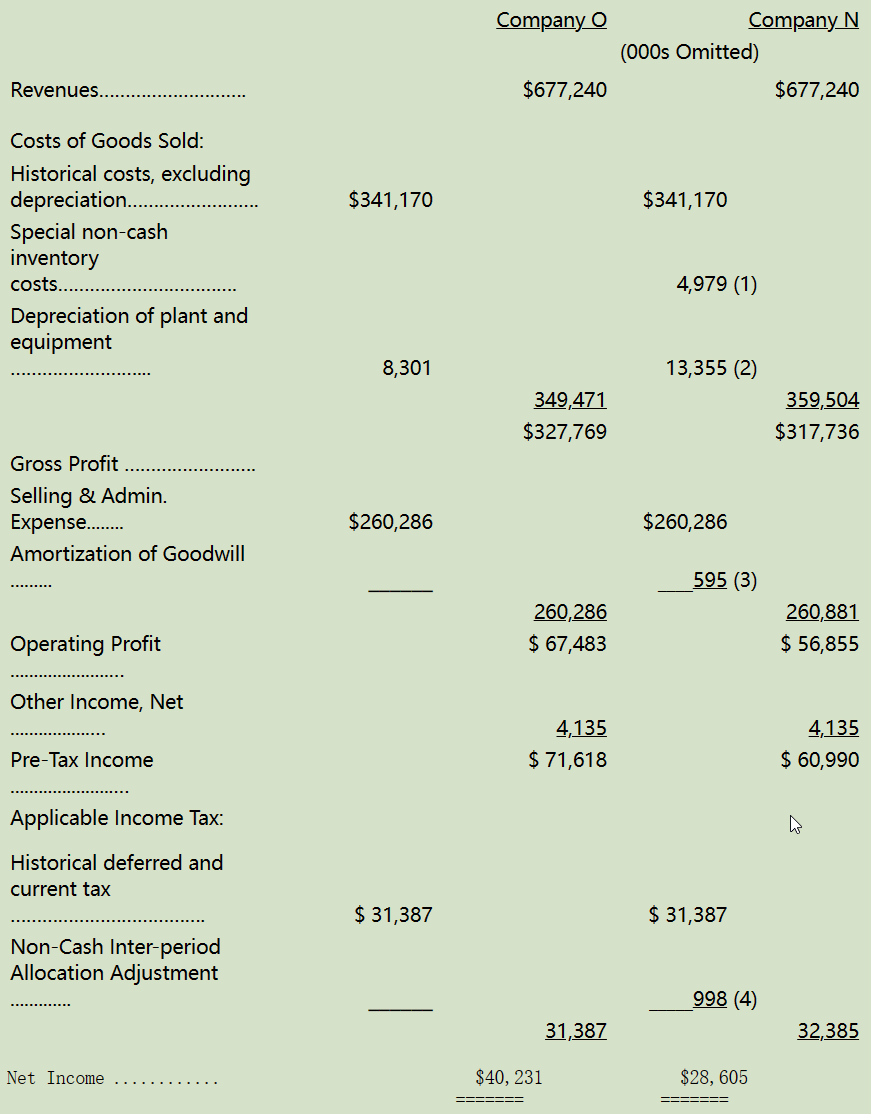

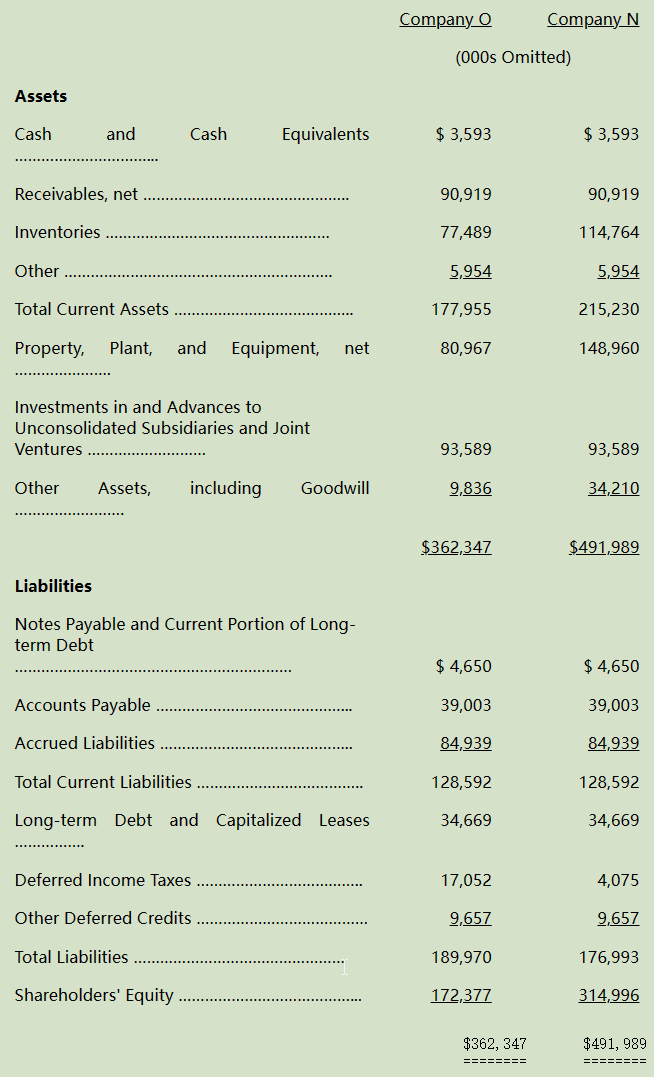

新公司 N 和旧公司 O 之间的差异是因为我们购买 Scott Fetzer 支付的金额与其会计公布的账面价值不同。根据 GAAP 会计准则,这种差异(溢价或折价)必须计入「购买法差异调整」来说明。就本例而言,我们支付了 3.15 亿美元买下账面价值 1.724 亿美元的资产,中间产生 1.426 亿美元的溢价。

会计原则规定处理支付溢价的第一步是将流动资产的账面价值调整为现在价值。在实务中,这一要求通常受影响的是存货等资产,可立即变现的应收账款则不受影响。由于存货计价方式采用后进先出法和其他复杂的会计核算,Scott Fetzer 的 2290 万美元早期存货的帐列价值比市价折让 3730 万美元。因此,第一个会计举措就是将1.426 亿美元溢价中的 3730 万美元用来调整存货的账面价值。

假设流动资产调整后剩余任何溢价,下一步是将固定资产调整为现值。在我们的情况下,这种调整还需要一些与递延税项有关的会计技巧。由于这已经被称为一个简化的讨论,我将跳过细节,给出底牌:6800万美元增加到固定资产,1300万美元从递延税项负债中消除。在进行了8100万美元的调整后,我们还剩下2430万美元的保费要分配。

如果有必要,接下来通常需要采取两个步骤:一个是将商誉以外的无形资产调整为当前公允价值,一个是将负债重述为当前公允价值,通常影响长期债务和无准备金的养老金负债。然而,在 Scott Fetzer 的案例中,这些步骤都不是必要的。

我们需要进行的最后一项会计调整是将剩余溢价分配给商誉这个科目(专业解释为“取得成本超过所收购净资产公允价值的部分”)。这笔剩余金额为 2,430 万美元。因此,收购前的 Scott Fetzer 公司 O 的资产负债表,并购交易之后,转换为公司 N 的资产负债表。实际上,两个资产负债表都描述了同一家公司的资产和负债。但是,如你所见,某些科目差异巨大。

公司 N 利润数字比公司 O 低了很多,这是因为资产负债表中的某些资产必须减值或者定期折旧或摊销所致。帐列资产数额越高,每年折旧或摊销的费用就越高。资产负债表减计而流入损益表的费用在前面损益表中进行了编号注释:

(1)、497.9 万美元存货跌价损失,主要是由于 Scott Fetzer 在 1986 年期间减少存货所致,此类费用在未来几年将会变小或消失;

(2)、505.4 万美元由于固定资产减值产生的额外折旧,在接下来的 12 年的金额与此数相当;

(3)、59.5 万美元用于商誉的摊销,该费用还要持续 39 年。由于我们的购买是在 1986 年 1 月 6 日进行的,应占当年摊销的 98%,因此以后每年的金额会略高; (4)、99.8 万美元递延所得税摊销,这部分处理非常复杂超出了我简要解释的能力,总之该费用还会持续 12年以上。

有一点很重要,这些新增的总计 1160 万美元会计摊销成本是不能抵扣所得税的。所以新公司缴纳所得税与旧公司完全相同,尽管依照 GAAP 会计准则这两个公司的损益表差异很大,就净利润而言,未来也是如此。当然,万一 Scott Fetzer 出售其部分业务,两者的税负影响就会有不同。

到 1986 年底,通过扣除 1160 万美元的摊销成本后,新旧两家公司的净资产之间的差额已从 1.426 亿美元减少到 1.310 亿美元。随着时间的流逝,类似的摊销费用将导致大部分收购溢价消失,两个公司的资产负债表将趋于一致,然而土地或存货的向上重估必须等到这些资产出售后才会消失

* * *

这一切对股东意味着什么?伯克希尔的股东是购买了一家在 1986 年盈利 4020 万美元的公司,还是买了一家年盈利 2860 万美元的公司?这 1160 万美元的新成本对我们来说是真正的经济成本吗?投资者是否应该付出更多的代价买旧公司呢?而且,如果一家企业的价值是某个固定的市盈率倍数,那么 Scott Fetzer 在我们购买它的前一天是否比第二天更值钱呢?

如果能想通这些问题,我们就能明白所谓的「股东盈余」。它代表(a)报告收益,加上(b)折旧、损耗、摊销和某些其他非现金成本(例如新公司 N 的 1-4 项目),减去(c)为充分保持其长期竞争地位和规模,企业必须为厂房、设备等年均资本化支出。(如果企业需要额外的营运资本来维持其产能和竞争地位,这部分增量也应包括在(c)中。但是,如果营收规模没有变化,存货计价采用 LIFO 后入先出法的企业通常不需要额外的营运资本。)

我们的「股东盈余」公式与 GAAP 会计准则报告的精确收益数字并不会完全相同,因为(c)本身是一个估计值,而且有时很难精确估量。尽管存在这个问题,我们认为股东盈余比 GAAP 数字,对于购买股票的投资者和购买整个企业的经理人来说,用来评估企业价值很有意义。我们同意凯恩斯的观点:“我宁要模糊的正确也不要精确的错误。”

用我们的方法评估旧公司 O 和新公司 N 会得出相同的「股东盈余」,这意味两者的评估价值也相同,正如常识告诉你的那样。之所以得到这个结果是因为(a)和(b)的总和在 O 和 N 中相同,至于(c)两种情况下本来就相同。

作为股东和管理者,查理和我认为 Scott Fetzer「股东盈余」的正确数字是多少呢?在当前情况下,我们认为(c)项非常接近旧公司 O 的(b)项 830 万美元,远低于新公司 N 的(b)项 1,990 万美元。因此,我们认为 O 列中账面收益比 N 列中的账面收益更接近「股东盈余」。换句话说,我们认为 Scott Fetzer 的「股东盈余」远大于我们 GAAP 报告的数据

这显然是一种令人高兴的结果。但此类计算通常不会带来如此好的消息。大多数管理者可能会承认,长期而言,他们需要在业务上花费比(b)更多的资本,才能维持既有产能和竞争地位。当这种观念存在时,也就是(c)远超过(b)时,那么也代表 GAAP 报告的收益过分高估了「股东盈余」,而且高估程度非常惊人。近年来,石油工业就是一个显著的例子,如果大多数大型石油公司每年只花费(b)的资金,那他们的报告业绩将大幅萎缩

所有这些充分表明了华尔街报告中经常提到的「现金流」数字的荒谬性。这些数字通常只包括(a)+(b),却不减去(c)。大多数投资银行家的销售手册也使用类似欺骗性的陈述。这意味着所推介的公司就像商业世界里的金字塔——永远先进,无需更换、改进或翻新。事实上,如果全美企业正如这些投资银行所描述的,那么政府对这些工厂和设备支出的预测(采购经理人指数 PMI)将不得不削减 90%

「现金流」的概念,在评估某些最初支出巨大,而后期支出却很小的企业是合适的,比如某些房地产企业,比如一家仅持有桥梁或极长寿命油气田的企业等,但在制造业、零售业、采掘业和公用事业等企业中毫无意义,因为对他们来说必须持续投入(c)的金额是巨大的。可以肯定的是,此类企业在特定年份内可以推迟重大的资本支出,但长期从 5-10 年时间段来看,他们不得不进行投资,否则企业必然走向衰败

那么,为什么「现金流」概念在今天如此流行?作为回答,我们承认我们存在偏见:我们相信这些数字经常是那些企业和证券的营销人员,企图将一些烂公司粉饰包装出售所惯用的手法。当(a)项 GAAP 的账面收益看起来不足以偿还其垃圾债券的债务或维持其愚蠢的股价的时候,销售人员就会顺理成章的专注于(a)+(b)这个好看的数字上,但是你加上(b)就必须要减去(c)。虽然有些牙医会告诉你,如果你能忘记牙痛的痛楚,那么它们就等于不存在,但对于(c)来说并不会消失。一家经理人或投资人在评估一个企业的偿债能力或股权价值时,只注意(a)+(b)而忽略(c),麻烦一定会找上门来

* * *

总而言之:对于 Scott Fetzer 和我们其他业务而言,在扣除无形资产摊销和购买法价格调整数后,我们认为(b)在历史成本的基础上应当接近于(c)。举例来说,在喜诗糖果我们每年为了维持既有竞争力作出的资本化支出约超过折旧 50-100 万美元。这也是为什么我们在前面表格中分别列示了摊销项目和其他购买价格调整项目。同时我们认为,与 GAAP 相比,我们旗下个别企业的收益数字更接近真实「股东盈余」

或许某些人会觉得我们竟然胆敢对 GAAP 会计准则的报告收益提出质疑。但毕竟如果会计上不能告知我们企业的“真相”,我们为什么还要付钱给他们呢?当然会计师的工作是记录,而不是评估,评估工作还是要落在投资者和企业家的肩上

当然,会计数字是商业的语言,因此对任何想要评估企业价值和跟踪其进展的人都有很大帮助。如果没有这些会计数字,查理和我会迷失方向:它们总是我们评估自己和他人业务的起点。然而,管理者和所有者需要记住,会计只是商业思维的一种辅助工具,绝不是完全代替品。

〔译文源于芒格书院整理的巴菲特致股东的信〕