巴菲特致股东的信(1991年)

⑥糖果店的二十年

糖果店的二十年

我们刚刚跨过历史性的一页,20 年前也就是 1972 年 1 月 3 日,蓝筹印花公司(原伯克希尔子公司,后来并入其中),买下喜诗糖果,西海岸的一家盒装巧克力制造与销售厂商,当时卖方所提的报价,以最后取得的 100%股权换算约为 4,000 万美元,但当时光是公司帐上就有 1,000 万美元的现金,所以认真算起来真正出的资金只有3,000 万美金,不过当时,查理跟我还没有完全意识到特许经营权所拥有的真正经济价值,所以在看过账面价值只有 700 万美元的报表之后,竟向对方表示 2,500 万是我们可以出的最高上限(当时我们确实是这样子认为),很幸运的是卖方接受了我们的报价。

之后蓝筹印花公司的印花销售收入从 1972 年的 1 亿美元下滑到 1991 年的 1,200 万美元,但在同一期间喜诗糖果的销售收入却从 2,900 万增长到 1.96 亿美元,更甚者,其盈利增长的幅度还远高于收入增长的幅度,税前盈利从 1972 年的 420 万增长为去年的 4,240 万美元。

为了正确评估利润增长,必须将其与产生利润所需的增量资本支出考量进去,就这点儿言,喜诗的表现实在是相当惊人,这家公司现在的账面价值只有 2,500 万美元,意思是说,除了买入时的初始 700 万美元,只需要再投入 1,800 万的收益,此外,喜诗将这 20 年来剩下所赚的 4.1 亿美元,在扣除所得税之后,全部发还给蓝筹印花与伯克希尔,将资金分配到更有利的投资之上。

在买下喜诗时,有一点是我们已预见的,那就是它尚未被发掘的提价能力,另外我们有两方面算是很幸运,第一,整个交易还好没有因为我们愚昧地坚持 2,500 万美元的上限而告吹,第二,我们选中 Chuck Huggins,当时喜诗糖果的副总经理,立即走马上任。不管是在公事或是私交方面,我们与 Chuck 共处的经验都相当棒,有一个例子可以说明,当并购案完成后,我们在短短五分钟内就与 Chuck 协议好他担任总经理的薪资回报,而且连书面契约都没有签,就一直延续到今天。

1991 年,喜诗糖果的销售金额与前一年度相当,但是若是以销售磅数来算,则减少了 4%,所有减少的部分大多来自于占年度盈利 80%的最后两个月,不过尽管业绩疲软,盈利还是增长了 7%,税前利润率更创下 21.6%的新记录。

喜诗糖果 80%的收入都来自于加州,而我们的生意很明显地受到当地经济衰退的影响,尤其下半年更为显著。另外一个负面因素是,加州在年度中开始对零食课征 7-8%的营业税(依每个市镇有所不同),当然巧克力糖果也不能幸免。

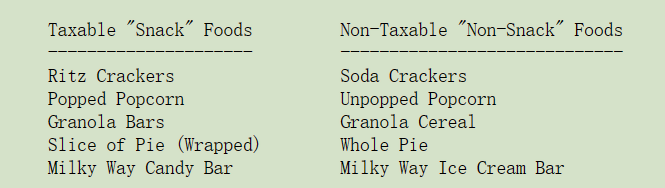

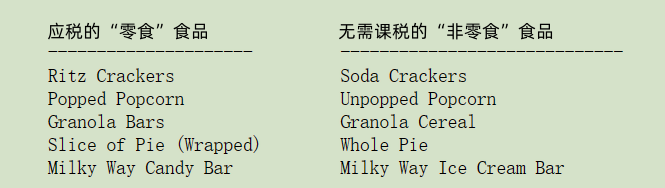

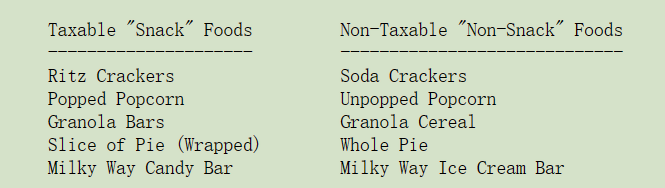

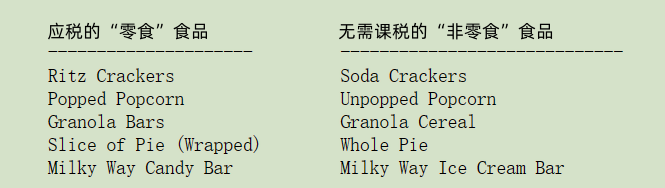

若是精研认识论差异的股东应该会觉得加州对于零食与非零食的分类感到相当有兴趣。

你一定会问,那融化的牛奶冰淇淋棒要不要课税呢?在这种模棱两可的状态下,它到底是比较像冰淇淋棒还是晒化的糖果棒呢?也难怪加州公平交易委员会的主席 Brad Sherman,虽然反对这项法案但还是必须负责监督执行,他说:我以税务专家的身份到这个委员会任职,但我觉得大家要选的对象,应该是小孩子才对。

查理跟我有太多理由要感谢查克跟喜诗糖果,最明显的原因是他们帮我们赚了那么多钱,而且其间的过程是如此令人愉快,还有一点同样重要的是,拥有喜诗糖果让我们对于特许经营权有了更深一层的认识,我们靠着在喜诗身上所学的东西,在别的股票投资上,又赚了更多的钱。

〔译文源于芒格书院整理的巴菲特致股东的信〕