巴菲特致股东的信(1992年)

⑧固定收益证券

固定收益证券

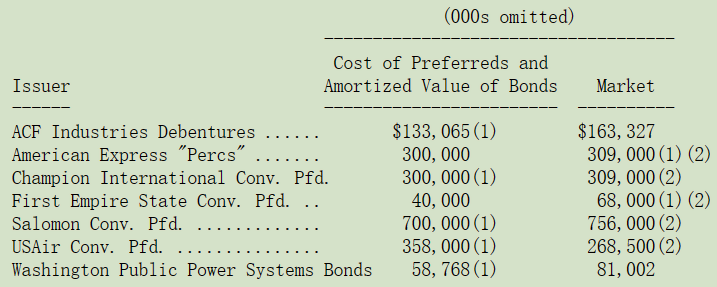

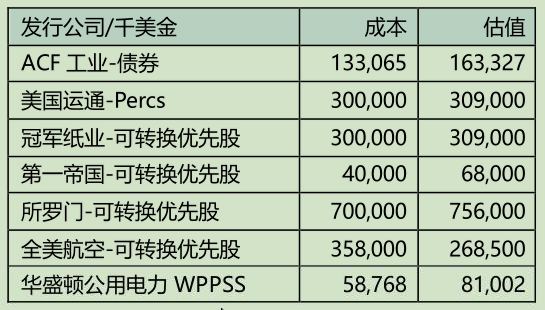

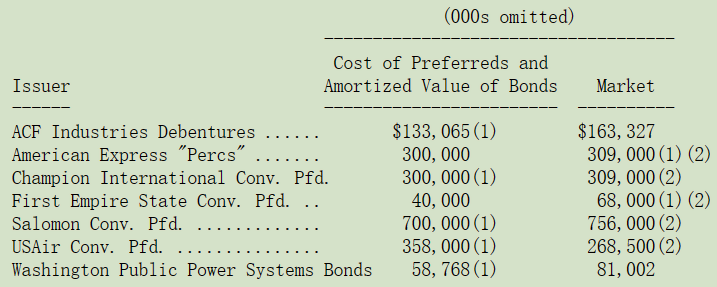

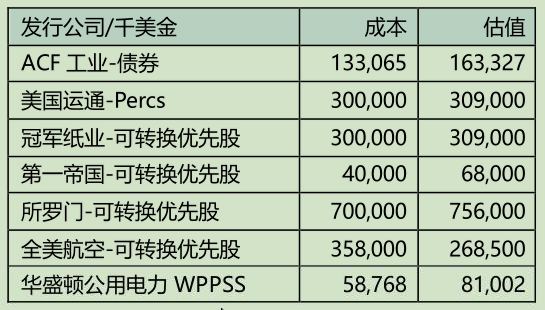

下表是我们持有的主要固定收益证券仓位:

(1)在我们财务报表中的账面价值

(2)由查理和我确定的公允价值

1992 年我们增加了美国汽车铸造公司(ACF)债券的部位,另外华盛顿公用电力系统债券(WPPSS)有部分被赎回,另外 RJR Nabisco 的仓位已出清。

过去几年来,我们在固定收益证券的表现还不错,靠着他们不但实现了可观的资本利得(包含 1992 年的 8000万美元)与利息收益,克莱斯勒财务公司、宾州中央铁路、Texaco 石油、时代华纳、WPPSS 与 RJR Nabisco 都是相当好的投资,与此同时,发生损失的部分也相当少,虽然过程一度紧张但幸好最后并没有搞砸。

虽然我们在吉列优先股的投资还算是成功(在 1991 年转换为普通股),但整体而言,这类协议谈判所取得的优先股投资的总体绩效还是略逊于从二级市场投资所取得的业绩,不过这种结果我们早已预期到,这也与我们的信念相一致,即一个聪明的投资人在二级流通市场的投资表现,会比他一级市场协议收购表现的更好。

原因与两个市场设定价格的方式有关,二级市场周期性地被大众愚蠢的心理情绪所影响,经常出现「清算价」,不管价格是多么的离谱,对于那些希望或需要出售的股票或债券的持有人来说,这个价格才是最重要的,不论何时总会有一小部分人会有这种念头。在很多的情况下,一家价值为 X 的股票往往以不到 1/2X 或更少的价格求售。

另一方面,新股发行市场则受到发行公司与大股东所掌控,通常会选择对他们最有利的时点发行,当市场状况不理想的时候,甚至会避开发行,可以理解的是,卖方不太可能让你有任何便宜可占,不管是通过公开发行或私下协议的方式都一样,你不可能以一半的价格买到你想要的东西。事实上,在发行普通股时,原股东只有在他们认为市场价格明显过高时,才会主动出手,(当然,这些卖方会以不同方式强调,如果市场过于低估其股份时,他们是不可能贱价出售的)。

到目前为止,我们通过协议所作的投资,算是勉强达到我们在 1989 年年报所作的预期,这些优先股投资应该可以产生比一般固定收益债券还好一点的回报。事实上,若是我们当初不是通过协议而是直接在公开市场上买进类似的投资的话,我们的表现可能会更好,只是考量到我们的规模太大与市场的状况,这样的做法在执行上有其困难度。

1989 年报还有一段值得铭记的话:我们没有能力去预测投资银行业、航空业以及造纸业的前景。在当时或许有很多人怀疑我们这样公开的承认有点无知,不过到如今,连我的母亲都不得不承认这项事实。

就像我们在全美航空的投资,在我们签发支票的墨水还没干之前,产业情况就已经开始恶化,如同先前所提到的,没有人强迫我,是我自己心干情愿跳下水的。没错,我的确预期到这个产业竞争会变得相当激烈,但我没想到这个行业的龙头企业竟会从事自杀性的竞争行为,过去两年以来,航空业者的行为就好象觉得自己是公务人员抢着办退休好领退休金一样,为求尽快达到目的而不择手段。

在一片混乱之中,全美航空的 CEO 塞斯·斯科菲尔德(Seth Schofield)在重新调整该公司体质之上,花了不少的工夫,尤其是去年秋天他勇于承受了一次罢工事件,若是处置不当,再拖延下去很可能让公司面临倒闭的命运,而若是屈服于工会抗争的压力,则其下场一样悲惨:该公司所面对的沉重薪资成本与工会要求,比起其它竞争同业来说要繁杂得多,而事实很明显,任何成本过高的业者到最后终将面临淘汰的命运,还好罢工事件在发生几天后圆满地落幕。

对那些为竞争所苦的行业,如全美航空来说,比起良好经济效益的产业需要更好的管理技巧,然而,不幸的是,这种管理能力的短期好处,只不过是让公司得以继续存活下去,并不能让公司繁荣起来。

在 1993 年初,全美航空为确保存活以及长远发展,做了一项重大的决定:接受英国航空所提出的巨额但仍为少数股东的投资。通过这次的交易,查理跟我本人被邀请担任该公司的董事。我们同意了,虽然此举将使得我要同时担任五家公司的外部董事,远超过我个人认为对公司能做的贡献。不过即便如此,只要我们的被投资公司以及其董事认为查理跟我加入其董事会,会对其公司有所帮助,我们还是会欣然接受。在我们期望被投资公司的经理人努力工作以增加公司价值之时,身为公司大股东的我们,有时也应该多尽一点自己的本分。

〔译文源于芒格书院整理的巴菲特致股东的信〕