巴菲特致股东的信(1992年)

⑦普通股投资

普通股投资

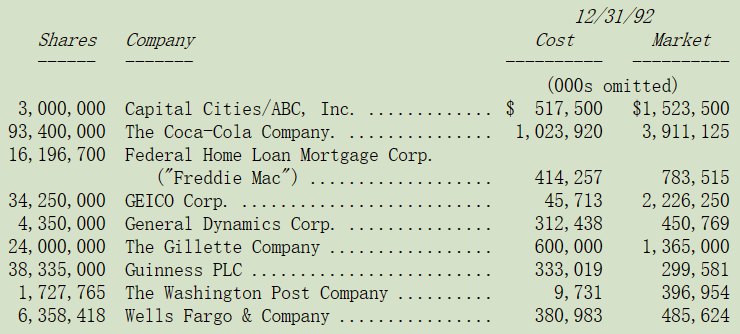

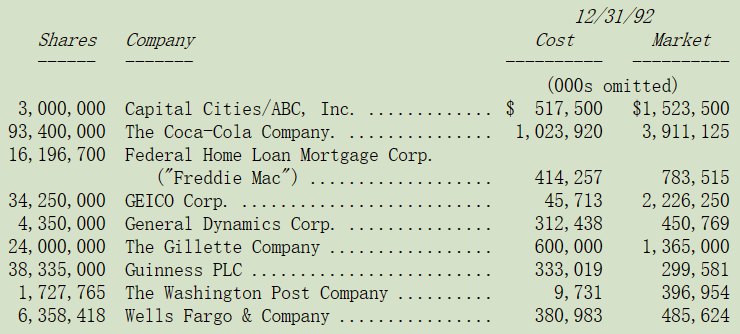

下表是我们超过一亿美元以上的普通股投资,一部分的投资系属于伯克希尔子公司所持有。

除了股票拆分(可口可乐 1 拆 2,GEICO 保险 1 拆 5),我们 1992 年在这些主要投资的持股只有四项变动,我们小幅增加健力士与富国银行的持股,另外将房地美的持股增加一倍,至于通用动力则是全新增加的投资。

我们很喜欢买股票,不过卖股票又是另外一回事,就这点我们的步伐就像是一个旅行家发现自己身处于只有一个小旅馆的小镇上,房间里没有电视,面对慢慢无聊的长夜,突然间他很兴奋地发现桌上有一本书名为”在本小镇可以做的事”,只是当他翻开书后,里面却只有短短的一句话:“那就是你现在在做的这件事”。

我们很高兴能买到通用动力,之前我并未特别留意这家公司,直到去年夏天该公司宣布通过荷兰式招标回购30%的流通股,看到这样难得的套利机会,我开始替伯克希尔买进这家公司的股票,预期通过公司买回股份可以小赚一笔,在过去几年中,我们曾经做了大约六次类似的交易,让短期投入的资金获得相当丰厚的回报。

之后我开始研究这家公司,以及 Bill Anders 在担任该公司 CEO 的短暂期间所做的事,没想到让我眼睛一亮,Bill 制定了一套清晰合理的策略,并且相当专注地付诸实行,而最后所得到的成果也相当不错。

没多久,我就抛弃了短期套利的念头,决定伯克希尔应该成为 Bill 的长期投资者,而受惠于买回股份的消息,成交量迅速扩大,我们得以买进大量的仓位,不到一个月,我们就一口气买进通用动力 14%的股份,这是公司回购完成之后流通在外的比例。

* * * * * * * * * * * *

我们在股权投资的策略跟 15 年前并没有多大的变化,我在 1977 年度报告写道:在选择股票投资所采用的评估方式与买下一整家企业的情况非常相似,我们希望投资的对象是(1)我们所能理解的业务(2)具有良好的长期远景(3)由才德兼具的人所经营(4)非常吸引人的合理价格。但考量到目前市场的情况与我们公司的资金规模,我们现在决定将“非常有吸引力的价格”改成“有吸引力的价格”。

或许你又会问,那么到底应该如何判断价格够不够吸引人呢?在回答这个问题时,大部分的分析师通常都会选择两种看起来对立的方法,“价值法”与“成长法”,事实上有许多投资专家认为,将这两种方法搅合一起,就像是知识上的异装癖一样。

我们觉得这种观念似是而非(必须承认,好几年前我也是这么想的),我们认为这两种方法本为一体,成长是价值计算的一个很重要的组成部分,这个变量的重要性从很小到极大,所造成的影响有可能是正面的,也有可能是负面的。

此外,我们认为“价值投资”这个词根本就是废话,若是所投入的资金不是为了换取相对应的价值的话,那还算是投资吗?明明知道为一只股票支付的成本,已经大幅高出其所应有的价值,而只是寄希望在短期之内,可以用更高的价格卖出,这根本就是投机的行为。当然这种行为不违法,跟道德也不相干,只是在我们看来,财务上不会真正的增值。

不管适不适当,“价值投资”这个名词已被广泛引用。一般而言,这意味着购买的股票属性如:低市净率PB,低市盈率 PE,高股息率 DR 等,很不幸的是,就算是满足以上所有指标,投资人还是很难确保所买到的股票确有所值,从而确信他的投资行为,是依照获得企业价值的原则在进行。相对地,以高 PB 或高 PE 或低股息率买进股票,也不一定就代表这不是一项有”价值”的投资。

同样的,企业的成长对股东而言也很难保证就一定代表价值。当然成长通常会对价值有正面的影响,有时影响相当惊人,但这种影响却不是绝对的。比如,过去投资人将大笔的资金投入到国内的航空业,来支持无利可图(甚至是悲惨)的成长。对于这些投资人来说,应该会希望莱特兄弟当初没有驾着小鹰号成功起飞,航空产业越发达,这些投资人亏得越惨。

只有当相关业务的投资,可以带来诱人的持续增量回报时,成长才有可能让投资人受惠。换句话说,只有当为增长投入的每一美元可以在未来创造出超过一美元的长期市场价值时,成长才有意义。至于那些需要新增资金但却只能创造出低回报的公司,成长对于投资人来说反而是有害的。

在约翰·伯尔·威廉姆斯(John Burr Williams,The Theory of Investment Value,1938 年)50 年前所写的《投资价值理论》当中,老早便已提出计算价值的公式。我把它浓缩列示如下:今天任何股票、债券或是企业的价值,都将取决于其未来年度剩余年限的现金流入与流出,以一个适当的利率加以折现后所得的期望值。请特别注意,这个公式对于股票与债券皆一体适用,不过这里有一点很重要但却难以处理的差异:那就是债券有票息和到期日,可以清楚的定义未来的现金流入。但就股票而言,投资者必须自己去分析未来可能得到的票息。此外更重要的是,管理层的品质对于债券票息的影响相当有限,顶多因为公司无能或是诚信明显不足而延迟债息的发放。但是对于股票投资者来说,管理层的能力将大大影响未来股权票息发放的能力。

根据这种现金流量折现的公式计算,投资人应该选择的是价钱最低的那一种投资,不论他的收益变化大不大、营收有没有成长,与现在的收益以及帐面价值差多少,虽然大部分的状况下,投资股票所算出来的价值会比债券要来的划算,但是这却不是绝对,要是当债券所算出来的价值高于股票,则投资人应该买的就是债券。

先撇开价格不谈,最值得拥有的企业,是那种能够在很长一段时期内,以非常高的回报率利用大量新增资本的企业。最糟糕的企业,是那种跟前面例子完全相反的,也就是以相当低的回报率持续使用越来越多资金的企业。不幸的是,第一类的企业可遇不可求,大部分拥有高回报的企业都不需要太多的资金,此类企业的股东通常因公司大比例分红或大量回购股份而受惠。

虽然评估股权投资的数学计算并不难,但是即使是一个经验老到、聪明过人的分析师,在估计未来年度票息时也很容易发生错误,在伯克希尔我们试图以两种方法来解决这个问题。首先,我们试着坚守在我们自认为理解的业务之上,这意味着他们通常相当简单和稳定。如果企业很复杂并且产业环境也一直在变化,我们实在是没有足够的聪明才智去预测其未来的现金流。碰巧的是,这个缺点一点也不会让我们感到困扰。对于大多数投资人来说,投资最重要的不是他们到底知道多少,而是他们如何界定,到底有多少是他们自己所不知道的。只要投资人能够尽量避免去犯重大的错误,几乎就不需要去做什么正确的事。

第二点同样很重要,那就是我们在买股票时,必须要坚持安全边际。如果我们所计算出来的价值仅略高出其价格,我们就不会考虑买进,我们相信恩师格雷厄姆十分强调的安全边际原则,是投资成功最关键的基石。

〔译文源于芒格书院整理的巴菲特致股东的信〕