巴菲特致合伙人的信(1961年)

①业绩

1962年1月24日

1961年的业绩

我一直告诉合伙人,我们会在下跌或平盘的市场中跑赢,但在上涨的市场中可能落后,我预期如此,也希望如此。在强劲上涨的行情中,我们应该很难跟上大盘。

虽说1961年股市大涨,而且我们的绝对收益和相对收益都很高,我在上一段中所写的预期仍然不变。

1961年,以道指为标准,包括股息在内,市场总体收益率是22.2%。我在全年管理的合伙人账户,扣除经营费用之后,向有限合伙人支付利息以及向普通合伙人分成之前,平均收益率是45.9%。请查看附录,了解各个合伙人账户的收益以及1961年新成立的合伙人账户的收益。

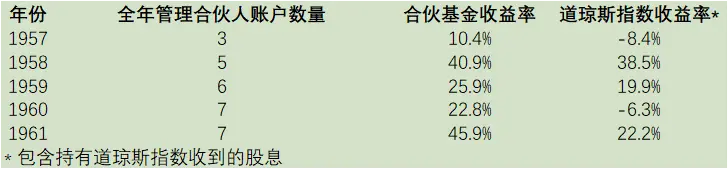

我们的合伙基金已经运行了整整五年,以下是这五年的逐年业绩以及按复利计算的业绩。业绩按照上一段中所述计算:扣除经营费用之后,向合伙人支付利息以及分成之前。

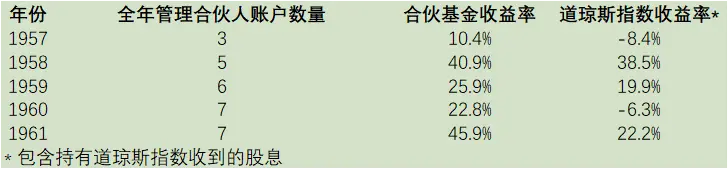

按复利计算,累计业绩如下:

上述收益不等同于大家最关心的有限合伙人收益。由于过去几年存在不同的分成方案,我在这里使用合伙人整体净收益(根据年初和年末市值计算)来衡量整体表现。

根据我们目前的巴菲特合伙有限公司协议中对收益的分配进行调整,结果将是:

〔译文来源于梁孝永康所编全集〕