巴菲特致合伙人的信(1961年)

②衡量标准

关于衡量标准

我在最初选择合伙人,以及随后处理与合伙人的关系时,最看重的就是我们要达成一致,使用同样的衡量标准。如果我的业绩差,合伙人就该撤资,我自己也不会继续在股市投资了。如果业绩好,我明确知道自己表现出色,我可以很坦然。

问题在于,什么是好,什么是差,我们一定要达成一致。衡量标准应该事先定好。事后再找参照标准,无论业绩如何,总能找到更差的。

我一直把道指作为我们的衡量标准。我的个人观点是要检验投资表现,至少要看三年时间,最能检验出真实水平的是期末道指点位与期初很接近,看在此期间投资表现如何。

什么衡量标准都不十全十美,道指也如此,但是参照道指的好处是,它众所周知、历史悠久,可以相当准确地反映一般投资者的表现。我不反对使用其他标准来衡量股市表现,例如,可以用其他的指数、大型基金、银行共同信托基金等。

你可能认为,道指不就是无人管理的30只蓝筹股吗,跑赢道指应该很容易,我选的参照标准是不是太低了。道指其实是很难战胜的。亚瑟·威辛保(Arthur Wiesenberger)写过一本很有名的书,是关于基金公司的,其中列出了所有大型基金从1946到1960这15年里的业绩。目前,美国基金掌管的资产规模是200亿美元,基金的整体表现可以反映几千万投资者的收益率。我没有相关数据,但我认为大多数投资咨询机构和银行信托的收益率和这些基金不相上下。

在《Charts & Statistics》中,威辛保统计了1946年以来有持续业绩记录的70只基金。我把其中32只基金剔除了,它们有些是平衡型基金(因此没充分参与股市上涨),有些是专门投资某个行业的基金。我觉得用这32只基金进行比较不合适。这32只基金里,有31只跑输道指,排除它们不会影响我们得出的结论。

剩下的38只基金与道指更有可比性,其中32只跑输道指,6只跑赢。1960年末,跑赢道指的6只基金资产规模约为10亿美元,跑输的32只基金资产规模约为65亿美元。跑赢的这6只基金,每年领先幅度也不到几个百分点。

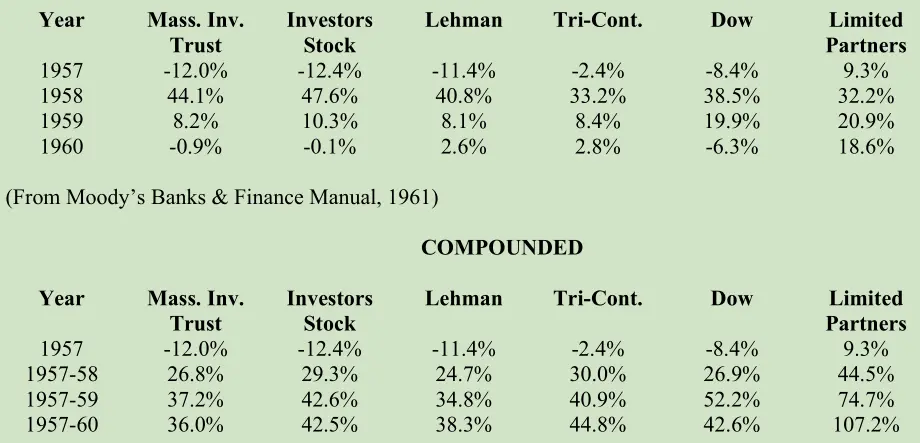

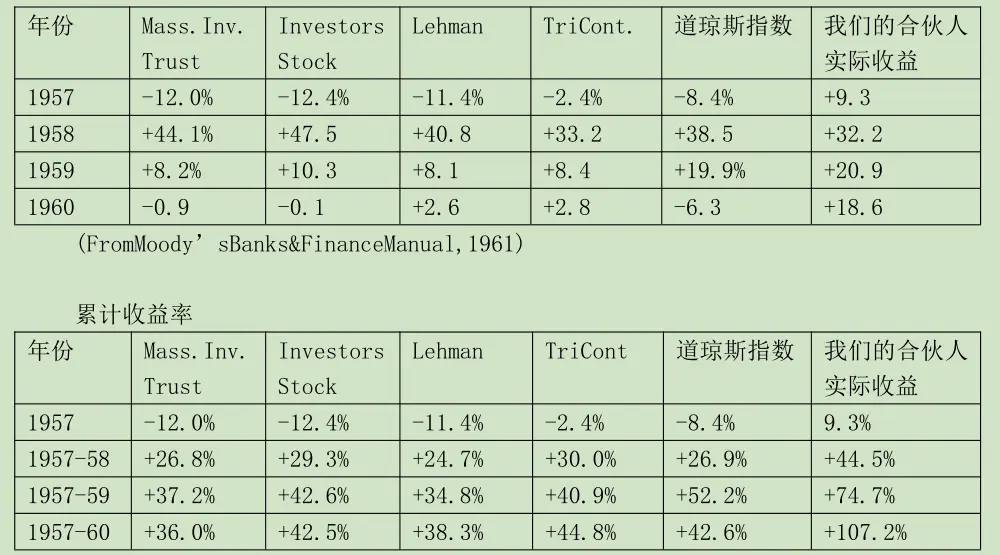

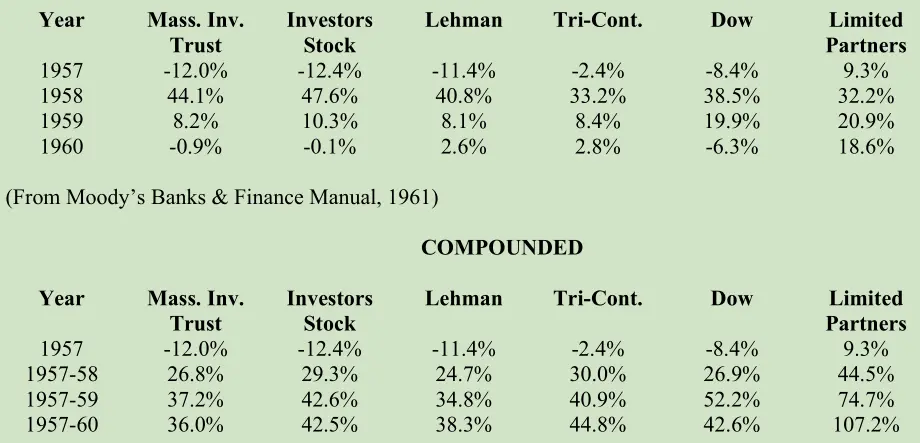

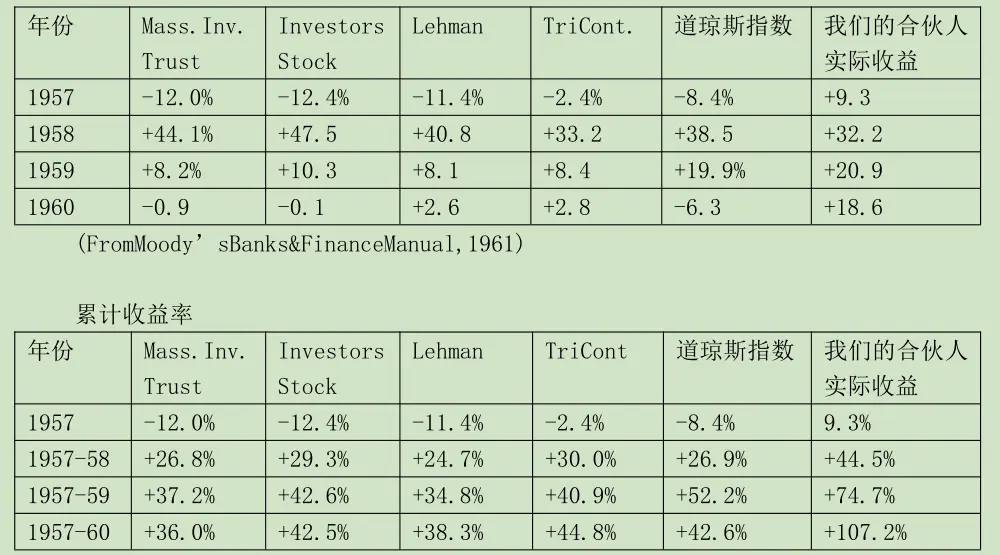

以下是我们这几年的业绩与最大的两只开放式股票基金与最大的两只封闭基金的对比情况(没有1961年的对比,因为我没有这年的准确数据,粗略估算应该和1957-60差不多):

Massachusetts Investors Trust的净资产有18亿美元左右;Investors Stock Fund约有10亿美元;Tri-Continental Corporation约5亿美元;Lehman Corporation约3.5亿美元。它们的净资产总和是35亿美元以上。

我整理上述表格和信息,目的不是批评基金公司。让我管这么多钱,受到种种限制,不能像管理我们的合伙基金这样投资,我的业绩也不会比它们强多少。我是想用上述数据说明战胜道指没那么容易,别说跑赢,美国大多数基金连跟上道指都很难。

我们的投资组合和道指的成分股完全不同。我们的投资方法和基金的投资方法差别很大。我们的大多数合伙人,如果不把资金投到我们的合伙账户中,可供选择的投资方式可能就是买基金,获得与道指类似的收益率,因此,我认为把道指作为我们的业绩衡量标准很合理。

〔译文来源于梁孝永康所编全集〕