巴菲特致合伙人的信(1962年)

②业绩情况

1962 年业绩

我一直告诉合伙人我的这个期望:道指下跌的年份,我们要大显身手;道指上涨的年份,无论涨多少,我们都可能羞得脸红。1962年符合我的预期。

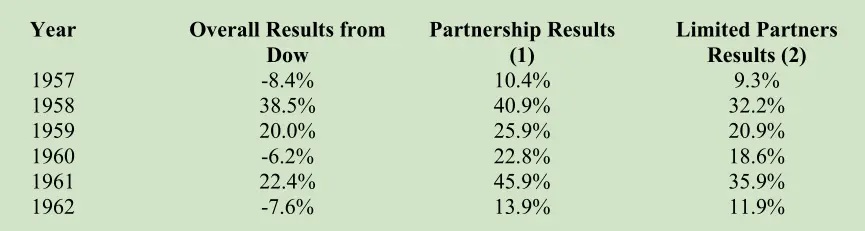

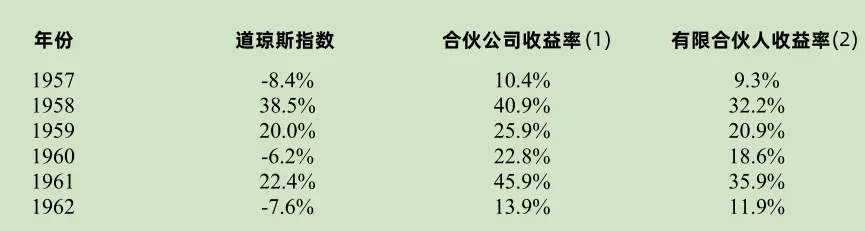

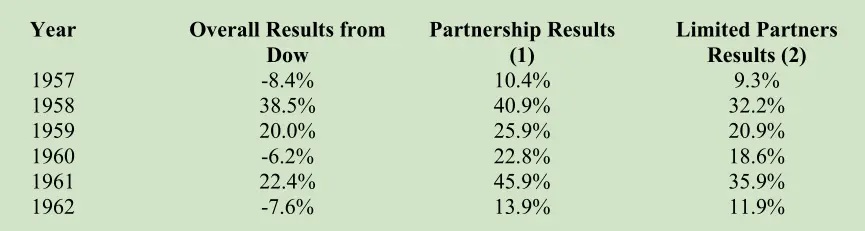

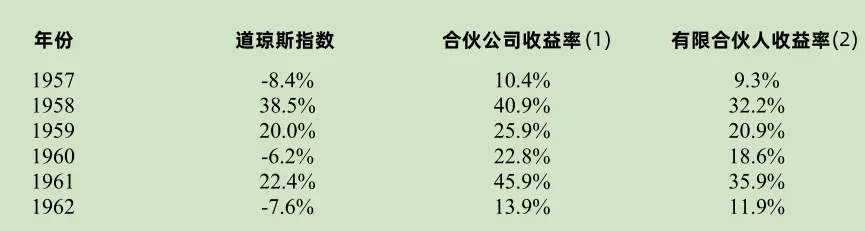

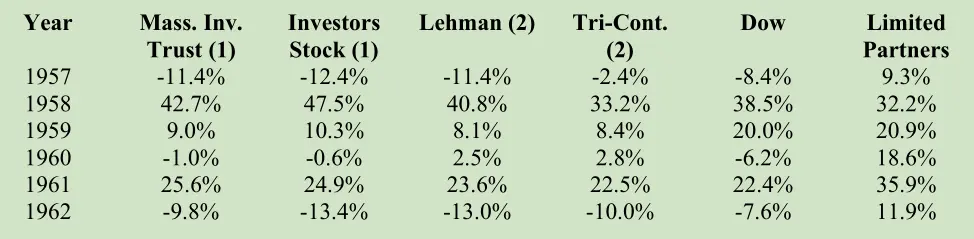

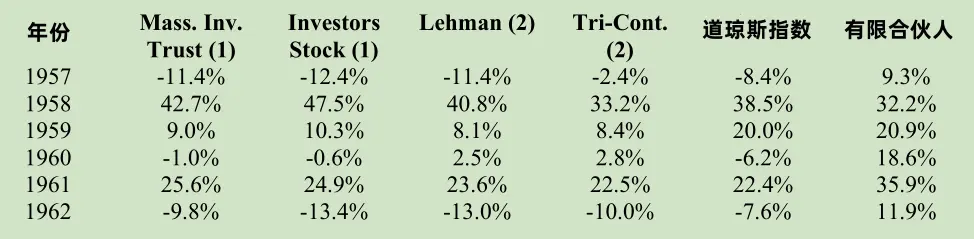

由于市场在最后几个月大涨,按照道指涨跌幅来看,大盘的下跌幅度没有很多人想的那么恐怖。道指年初 731 点,六月份下探到 535 点,但年终收于 652 点。道指 1960 年的收盘价是 616 点,虽然过去几年上蹿下跳,从整体来看,股市投资者又回到了 1959 或 1960 年附近。1961 年持有道指的投资者市值下跌 79.04 点或 10.8%。去年,还有人在炒那些股价在天上的股票,我猜他们里面应该有人后悔还不如买指数。持有道指的投资者还得到了大约23.30 点的股息,加上股息,去年道指的整体收益率是下跌 7.6%。我们的整体业绩是上涨13.9%。下面是道指收益率、Buffett Partnership,Ltd 普通合伙人分成前合伙基金收益率、 我全年管理的有限合伙人的收益率、以及合伙基金早年收益率的逐年对比情况。

(1)1957-61 年的数据是之前全年管理的所有有限合伙人账户的综合业绩,其中扣除了经营费用,未计算有限合伙人利息和普通合伙人分成。

(2)1957-61 年的数据按前一列合伙基金收益率计算得出,按照当前合伙协议,扣除了普通合伙人分成。

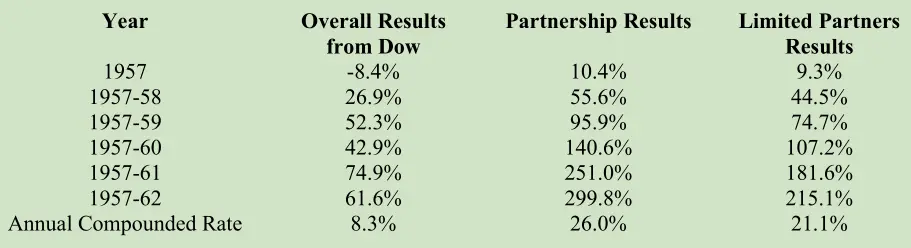

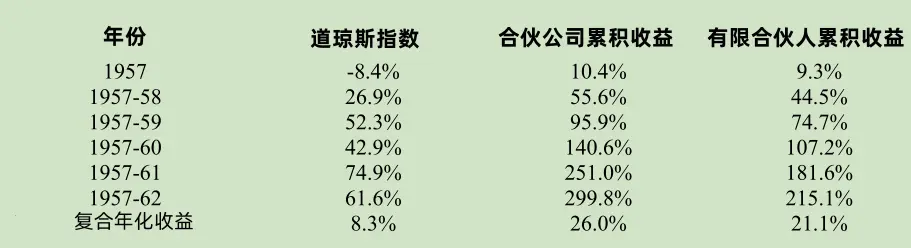

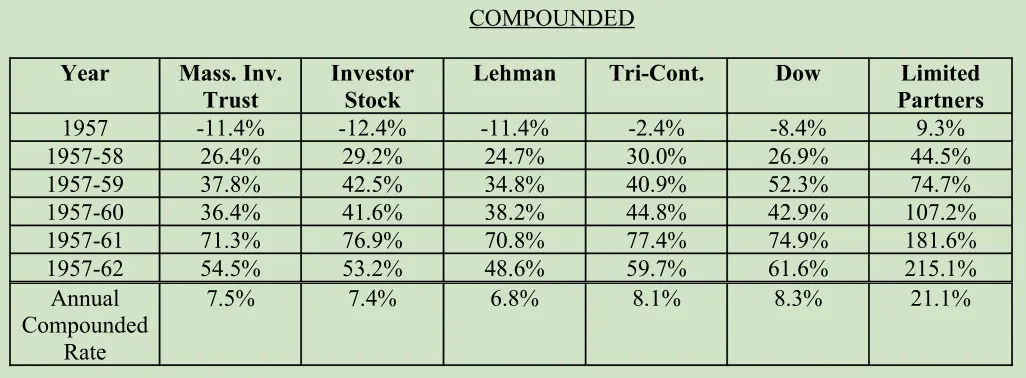

下表显示的是三者的累计收益率或复合收益率以及平均年化复合收益率:

我有个不科学的观点,我认为,投资的长期收益率能超越道指 10 个百分点就顶天了, 所以请各位读者自行在心里调整上述某些数字。

有的合伙人担心我们的规模会影响业绩。我在去年的年度信中讲过这个问题。当时我的结论是:有的投资类型,规模大有帮助,有的投资类型,规模大是拖累,此消彼长,规模不会影响我们的业绩。我说了,如果我的看法变了,我会告诉大家。从 1957 年初到 1962 年初,有限合伙基金的总资产从 303,726 美元增长到 7,178,500 美元。我们的资产一直在增加,尽管如此,到目前为止,我们相对道指的优势并没有减少的迹象。

基金公司的业绩

除了与道指对比,我们通常还会列出两家最大的开放式股票型基金和两家最大的分散型封闭式投资公司的业绩。Massachusetts Investors Trust、Investors Stock Fund、Tri-Continental Corp.和Lehman Corp.这四家公司管理着30多亿美元的资金,基金行业管理的总资产是200亿美元,这四家公司应该能代表大多数的基金公司。银行信托部门和投资咨询机构管理的资产总规模更大,我认为它们的业绩也和这四家基金公司不相上下。

我想用下面的表格说明,作为衡量投资业绩的指数,道指不是那么容易战胜的。上述四家基金由能力出众的经理人管理,它们每年收取的管理费是700万美元左右,整个基金行业收取的管理费数额就更庞大了。我们可以看看这些高薪人才的打击率(batting average),他们的业绩和道指相比略逊一筹。我在这里绝不是要批评别人。基金经理在机构的条条框框内要管理几十亿上百亿的资金,根本不可能取得更高的平均业绩。基金经理的贡献不在于更高的收益率。

我们的投资组合和投资方法都与上述基金差别很大。对于我们的大多数合伙人来说,如果不把资金投到我们的合伙账户中,其他的选择可能就是基金等投资公司,获得与基金类似的收益率,因此,我认为与基金对比来检验我们的业绩很有意义。

(1)计算包括资产价值变化以及当年持有人获得的分红。

(2)来源:1962 Moody's Bank&Finance Manual for 1957-61。1962年数据为估算值。

〔译文来源于梁孝永康所编全集〕