巴菲特致合伙人的信(1963年半年度)

③登普斯特风车制造公司

登普斯特风车制造公司(Dempster Mill Manufacturing Company)

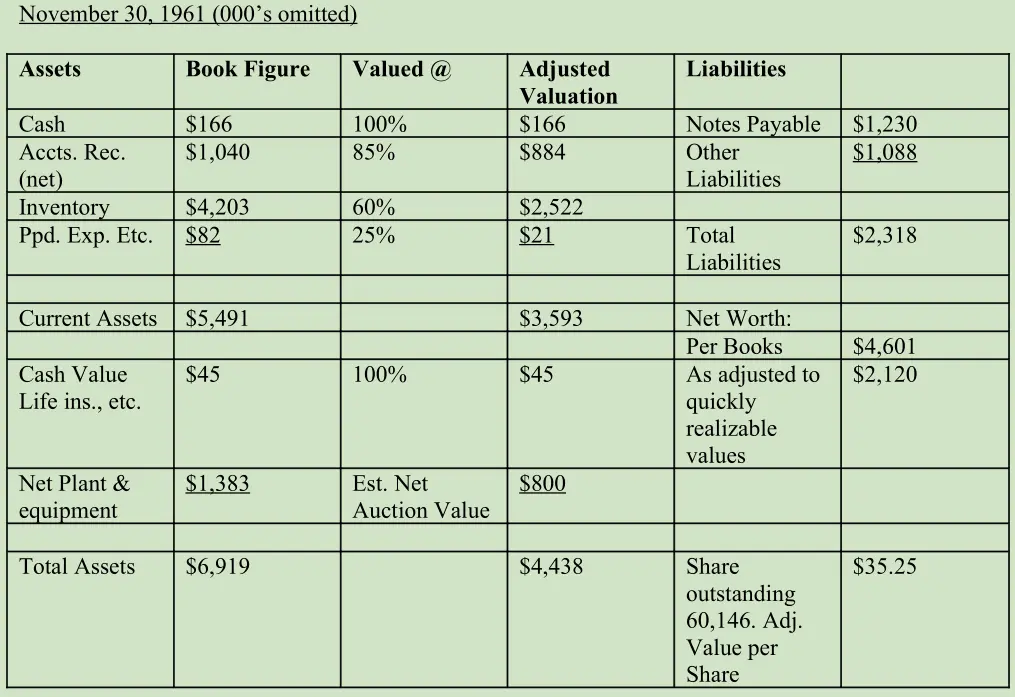

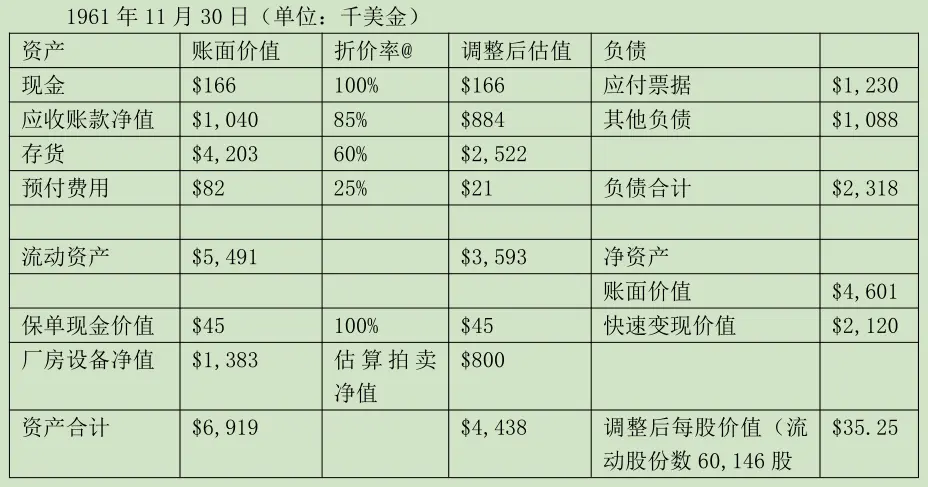

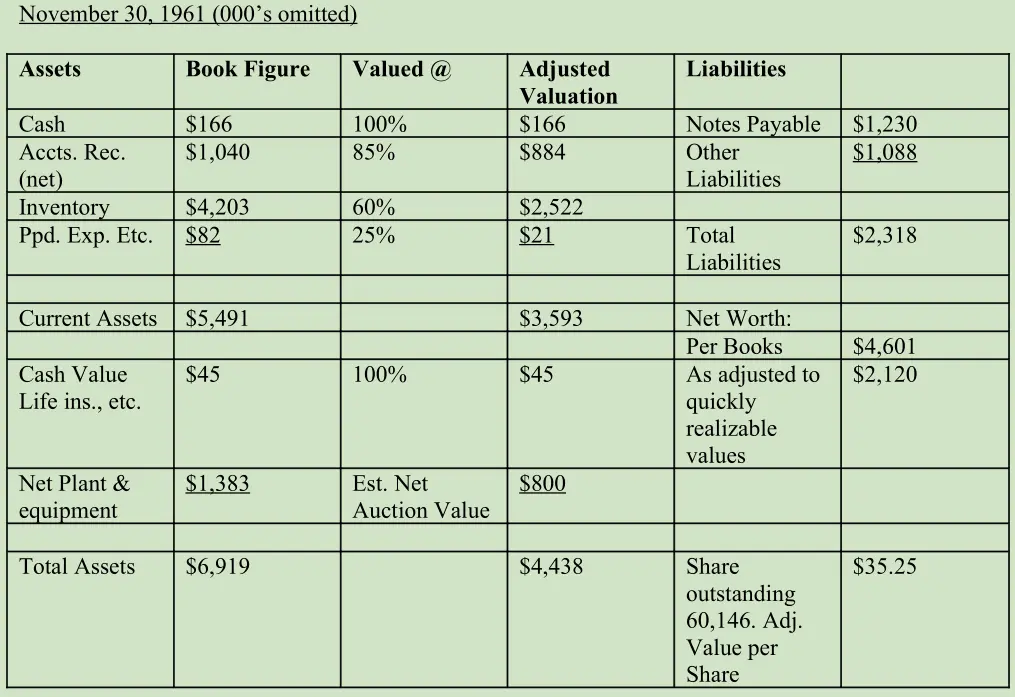

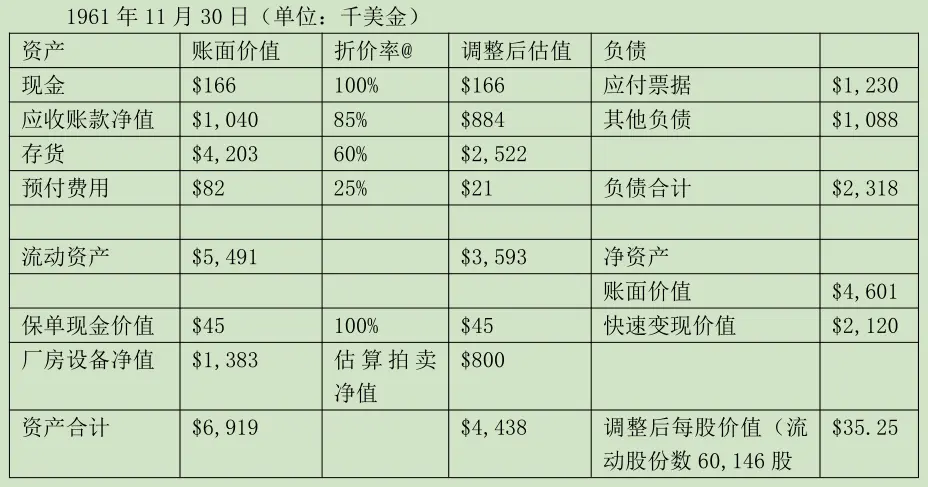

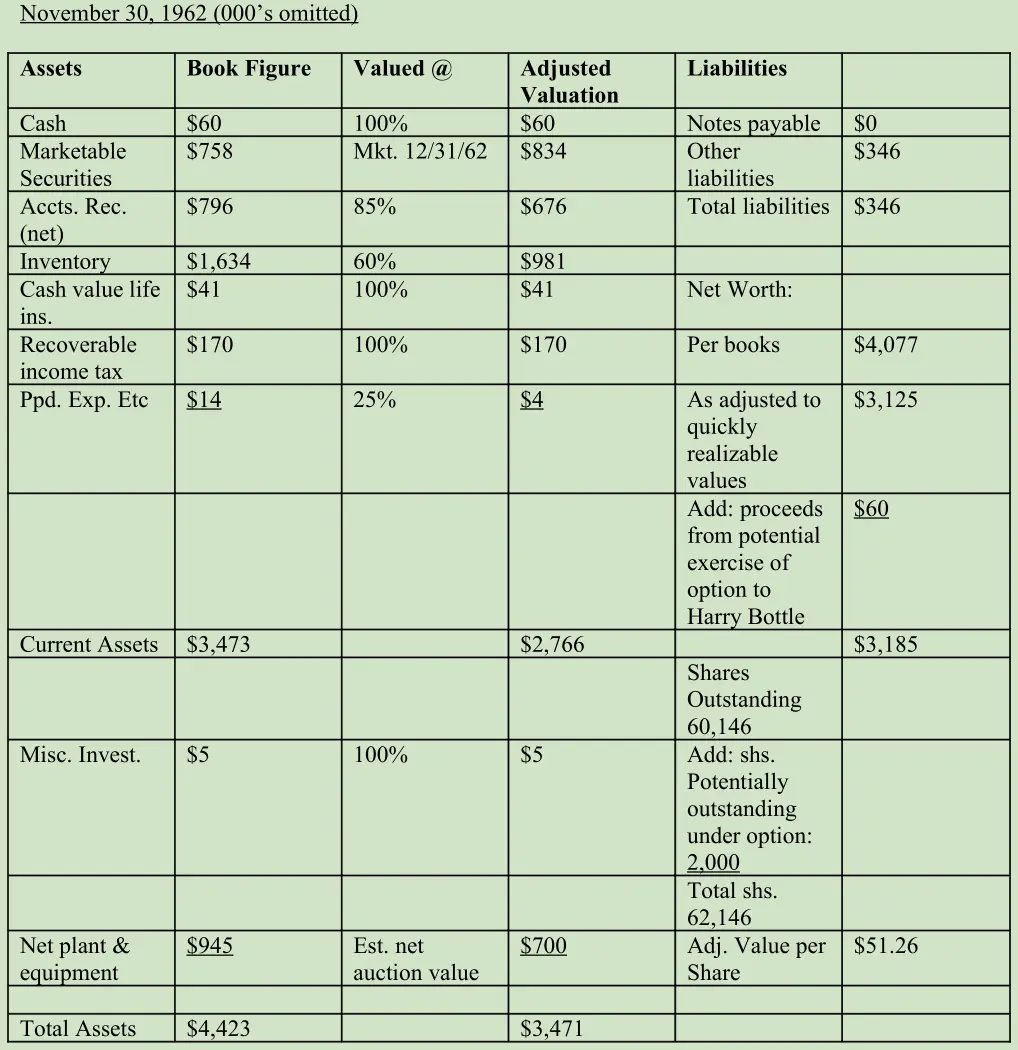

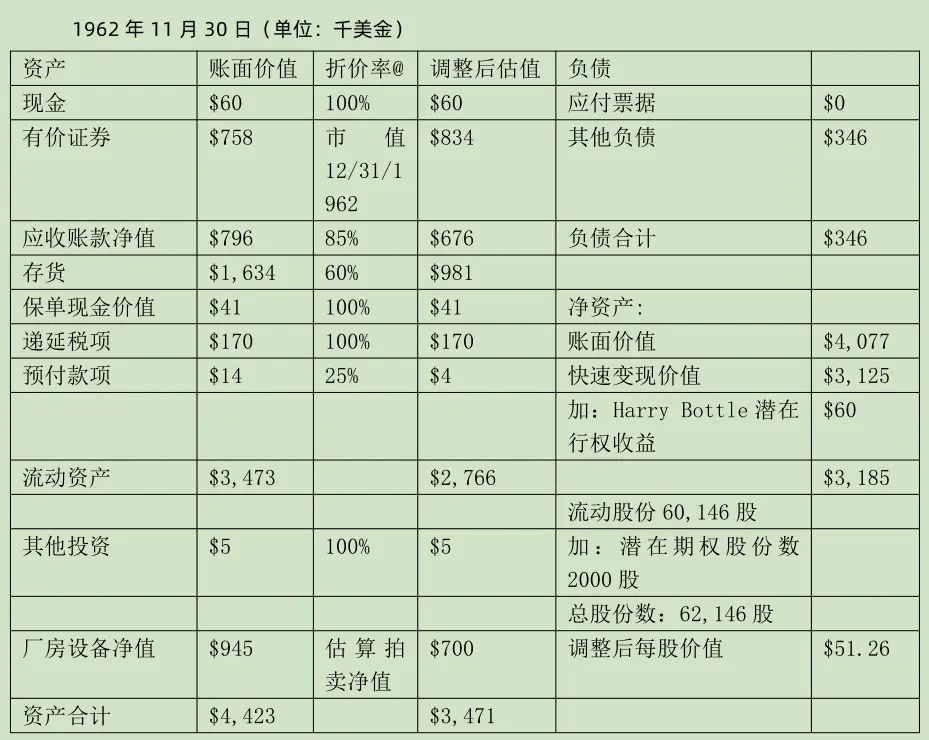

在上一封年度信中,我称赞哈里·博特尔(Harry Bottle)是“年度之星”。哈里岂止是 年度之星?去年,哈里出色地将效益低下的资产变现,我们随后就把这些现金投资,买了低估的股票。今年,哈里继续变卖效率低下的资产,留下来的资产效益也更好了。经过他 19 个月的努力,登普斯特的资产负债表发生了质变:

我们以前给登普斯特估值时,针对各个资产负债表项目使用了不同的折价率,不考虑资产的盈利能力,估算它的短期清算价值。

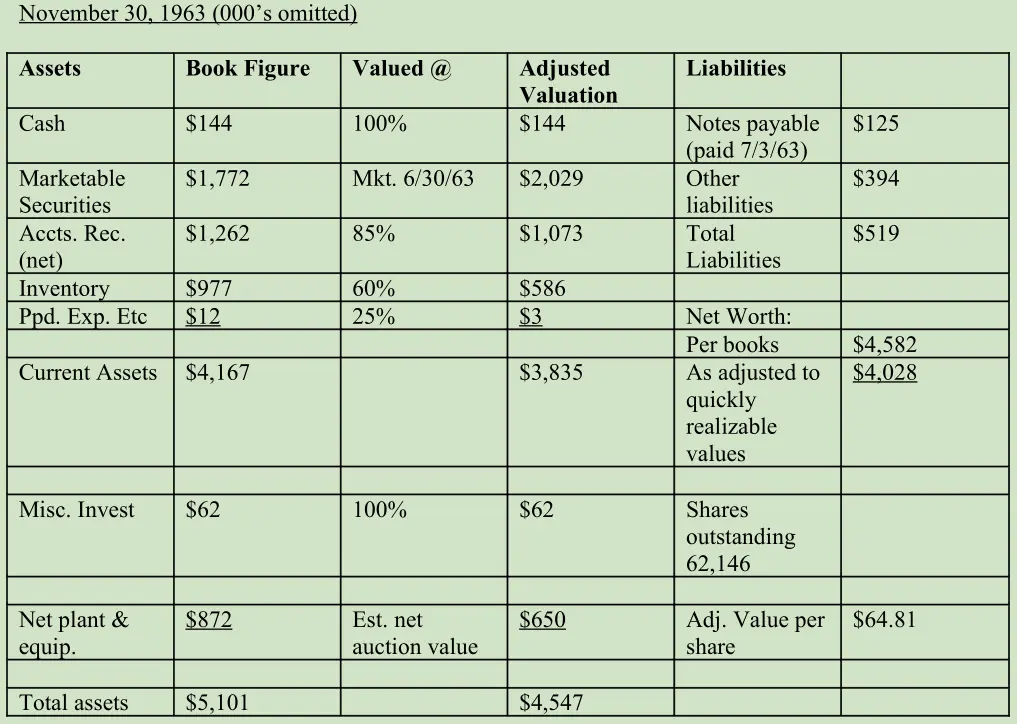

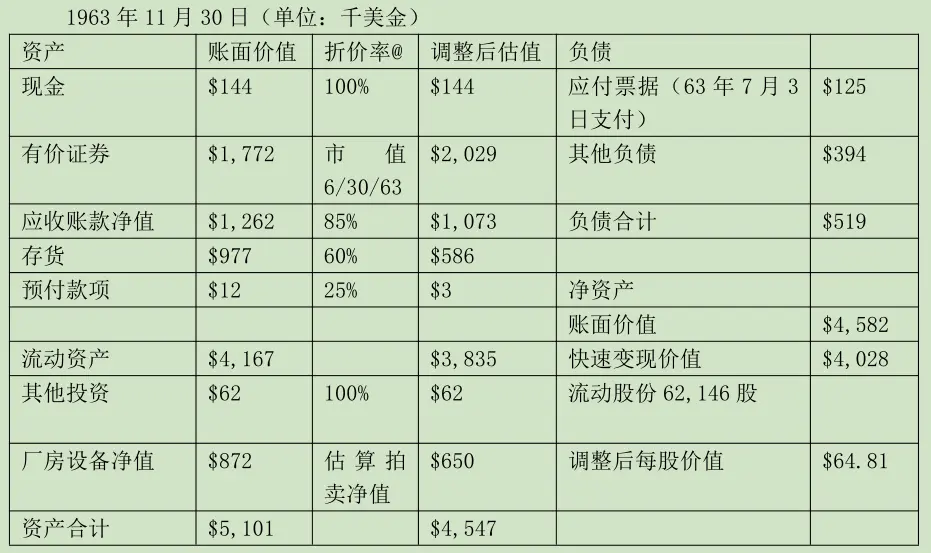

报表中列出了我们使用的折价率。如报表所示,哈里变现资产得到的价值比我的估值高得多。这说明我的估值比较保守,但主要得益于哈里的能力。

从报表中还可以看出来,上半年登普斯特创造了非常令人满意营业利润(还有大量证券未实现收益)。毫无疑问,经过大刀阔斧的资产精简之后,现在公司的主营业务至少有一般水平的盈利能力了。由于公司经营受季节性因素影响很大,而且有税款抵减,单纯比较 62 年 11 月 30 日和 63 年 6 月 30 日的资产负债表,无法准确推断公司的盈利能力。一方面是经营的季节性因素,更主要的是,年底登普斯特可能还有新进展。今年上半年,我们仍然将它的估值定为 1962 年末的 51.26 美元。今年年底,登普斯特的价值不高于 51.26 美元就怪了。

我再给喜欢基本面分析的合伙人讲个好玩的:合伙基金拥有登普斯特 71.7%的股份,成本是 1,262,577.27 美元。1963 年 6 月 30 日,登普斯特在奥马哈国民银行有个小保险箱,里面存着价值 2,028,415.25 美元的证券。我们拥有这 2,028,415.25 美元的 71.7%,即 1,454,373.70 美元。所以公司土地上面(还有一部分在地下)的所有东西都是我们赚的。 我的证券分析师朋友们可能觉得我这个会计方法太原始了,说真的,我还是愿意用我这样数手指头和脚趾头的方法,不愿意痴痴地指望别人明年会给我开出个 35 倍市盈率的报价,还是我的原始方法更靠谱些。

〔译文来源于梁孝永康所编全集〕