巴菲特致合伙人的信(1963年)

①业绩

1964 年 1 月 18 日

1963 年业绩

1963 年业绩很好。虽然有的合伙人讲求实际,对今年的收益率很满意,但 1963 年业绩好,不是因为我们的净资产比年初增加了3,637,167 美元,取得了38.7%的收益率。1963 年业绩好,是因为我们把我们的衡量基准道指远远甩在了后面。就算我们下跌 20%,道指下跌 30%,我一样会说“1963 年业绩很好”。某一年的涨跌不必在意,只要从长期看,我们相对道指能保持适度领先优势,我们就能取得理想的长期业绩,能赚钱,心也不会乱。

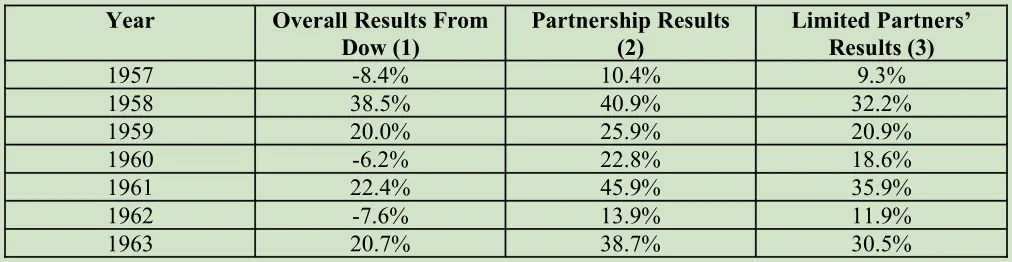

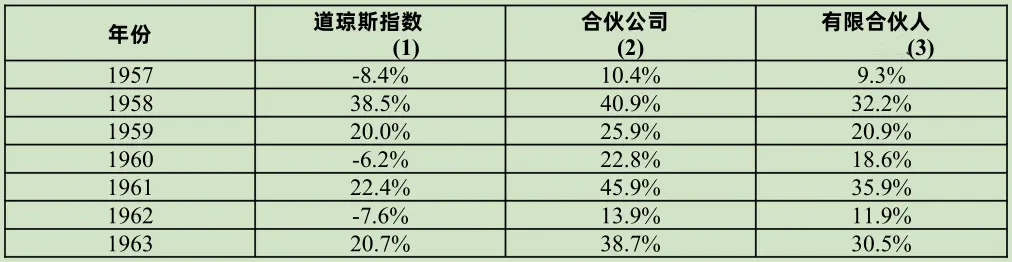

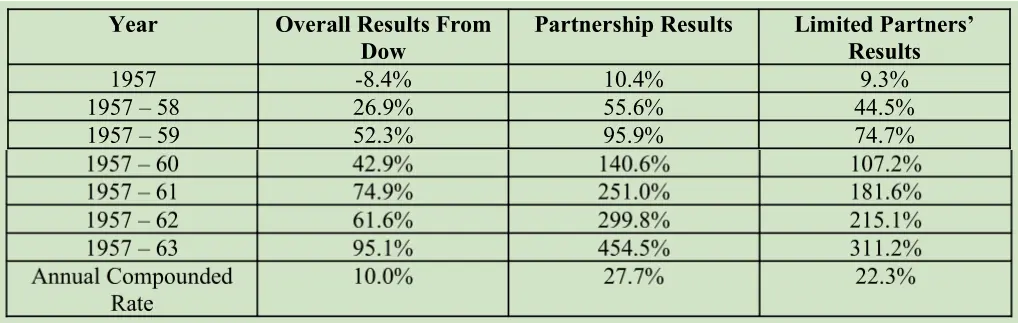

下面是道指收益率、普通合伙人分成前合伙基金收益率、全年管理的有限合伙人的收益率、以及合伙基金早年收益率的最新逐年对比情况。

(1)根据道指年度涨跌计算,其中包含股息。

(2)1957-61 年的数据是之前全年管理的所有有限合伙人账户的综合业绩,其中扣除了经营费用,未计算有限合伙人利息和普通合伙人分成。

(3)1957-61 年的数据按前一列合伙基金收益率计算得出,按照当前合伙协议,扣除了普通合伙人分成。

有位合伙人和我开玩笑,说怎么不再加一列,普通合伙人的收益率是多少。这么说吧,普通合伙人也跑赢道指了。

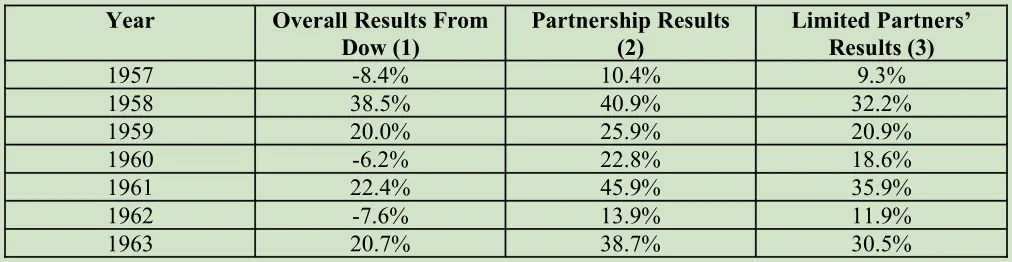

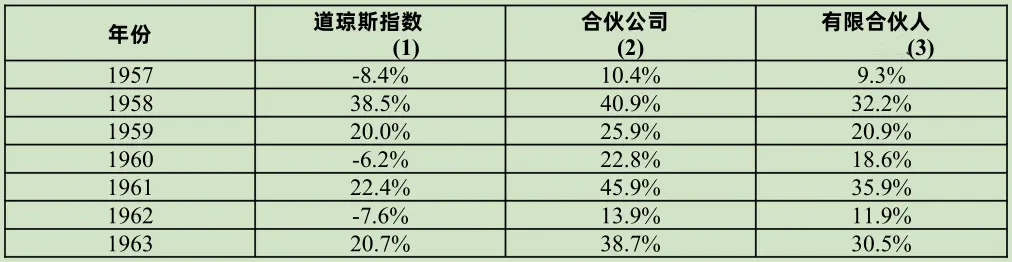

下表是累计收益率或复合收益率:

我们已经连续七年大丰收。抱歉了,约瑟(Joseph),我们不打算相信圣经中的金科玉律(译注:在圣经故事中,上帝向埃及法老托梦,埃及将迎来七个丰年,随后是七个荒年,约瑟受命在丰年存粮,为荒年做准备)。(我对像诺亚方舟一样分散投资的做法也一直不感冒。)

不开玩笑了。去年,我们跑赢了道指17.7个百分点。大家一定要注意:根据我的判断,我们不可能长期取得这样的领先优势。只要能长期跑赢道指10个百分点就很了不起了,就算领先优势不到10个百分点,也能创造惊人的收益,这个我们稍后会讲到。我的判断是主观的,不管我有什么依据,都是主观的。但是我们要清楚,按照我的判断,在很长时间内,我们相对道指的领先优势很可能大幅缩小,甚至有些年可能大幅落后道指,我们必须做好准备。

我们每年 11 月份都会给大家发一份“基本原则”(The Ground Rules),刚才讲的这些 道理在基本原则里都有,但是这些道理说多少遍都不过分。

〔译文来源于梁孝永康所编全集〕