巴菲特致合伙人的信(1963年)

②基金公司

基金公司

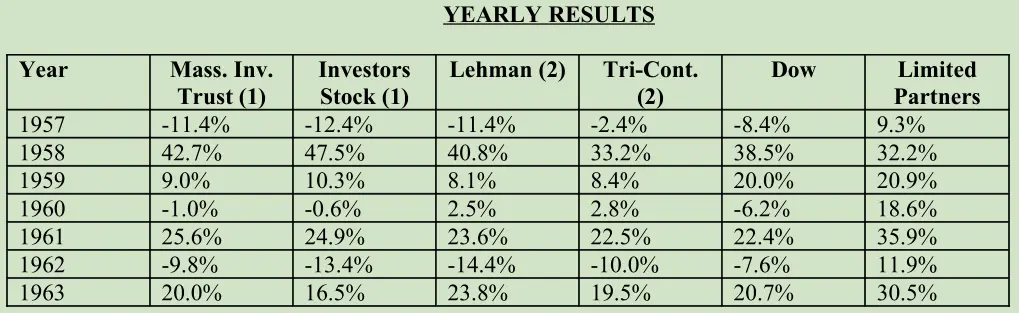

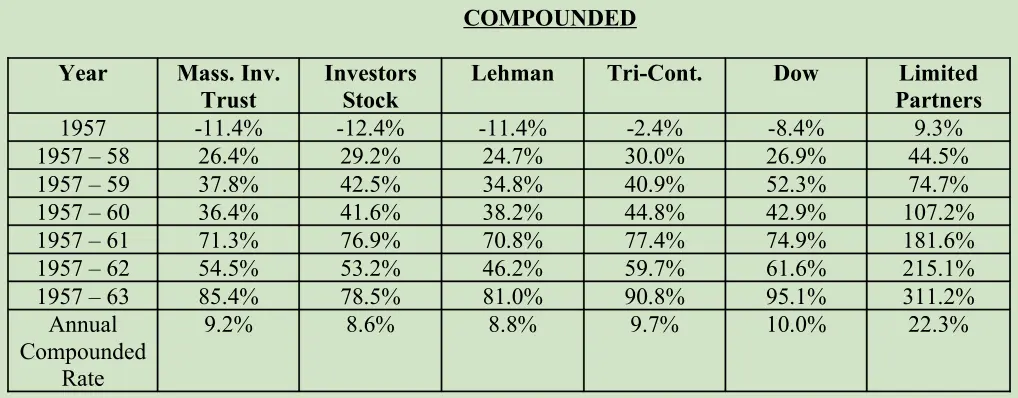

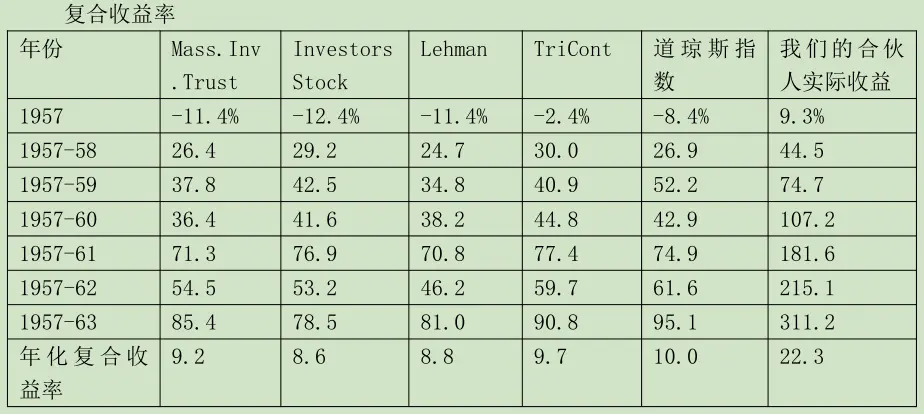

我们一直拿最大的两只开放式股票型基金(股票占 95-100%)和最大的两只分散投资的封闭式股票型基金的业绩,与合伙基金的收益率做对比。它们是 Massachusetts Investors Trust、Investors Stock Fund,Tri-Continental Corp.和 Lehman Corp.。它们管理着 40 多亿美元的资产,基金行业管理的总资产是 250 亿美元,这四家公司应该能代表大多数基金公司。我认为,这四家基金公司的业绩也能代表资产规模更大的银行信托部门和投资咨询机构。

我想用下面的表格说明,作为衡量投资业绩的指数,道指不是那么容易战胜的。上述四家基金由能力出众的经理人管理,它们每年收取的管理费是 700 多万美元,整个基金行业收取的管理费数额就更庞大了。从这些高薪经理人的打击率(batting average)来看,他们的业绩和道指相比略逊一筹。

我们的投资组合和公募基金迥然不同,我们的投资方法也和它们迥然不同。对于我们的大多数合伙人来说,如果不把资金投到我们的合伙基金中,其他的选择可能就是基金等投资公司,获得与基金类似的收益率,从这个角度来看,我认为与基金对比来检验我们的业绩很有意义。

(1)计算包括资产价值变化以及当年持有人获得的分红。

(2)来源:1963 Moody's Bank&Finance Manual for 1957-62。1963 年为估算值。

道指是无人管理的指数,读者可能觉得奇怪,这些华尔街大牛拼尽全力,怎么还跑不过道指,连打平都做不到。无可争议,现实就是如此。别以为公募基金跑不赢道指,是因为它们的投资比道指更保守。从业绩对比中可以看出来,也有大量研究结果证实,整体而言,公募基金投资组合中的股票和道指的下跌是同步的。按照市场下跌时的表现来检验,我们的投资方法比公募基金更保守。过去我们做到了,不保证将来也能做到。

我对公募基金的评价可能说得有些重了,但是我只是在讲事实,不是要抨击它们。基金经理在机构的条条框框内要管理几十亿上百亿的资金,只能取得这样的业绩。想要突破条条框框特立独行,太难了。公募基金的业绩自然只能和整体股市亦步亦趋。一般来说,公募基金的好处不是帮助投资者取得更高的业绩,也不是提供更出色的抗跌能力。在我看来,公募基金的意义在于简单方便、省心省力、自动分散。另外,基金可以帮助投资者抵制诱惑,避免落入吞没了大量散户的陷阱。

〔译文来源于梁孝永康所编全集〕