巴菲特致合伙人的信(1964年)

①业绩

1964 年业绩

1964 年,我们的整体收益是 4,846,312.37 美元,然而按照我们的衡量基准道指来看,和往年相比,我们这一年的业绩一般。道指的整体收益率是 18.7%,巴菲特合伙基金的整体收益率是 27.8%,有限合伙人的整体收益率是 22.3%。去年,合伙基金领先道指 9.1 个百分 点,有限合伙人领先道指 3.6 个百分点。这是 1959 年以来,我们相对道指的领先优势最微弱的一年。(1959 年的业绩和道指差不多。)

不过,我并不因此而沮丧。去年,市场很强劲。在市场走强的年份,我们总是很难胜过道指。早晚会有道指把我们远远甩在后面的时候。1964 年,我们没被道指彻底打败,我还有些庆幸。急剧上涨的市场给我们带来重重困难,1965 年,如果道指继续去年的行情,我们一定很难跟上,更别说取得一定的领先了。

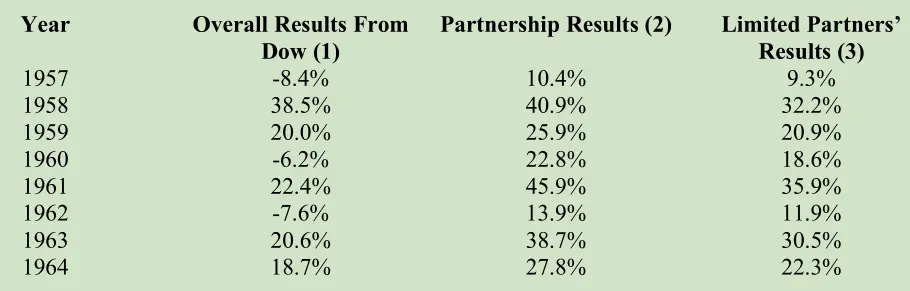

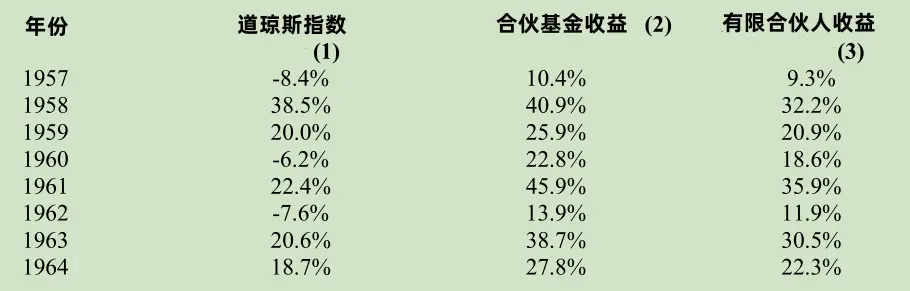

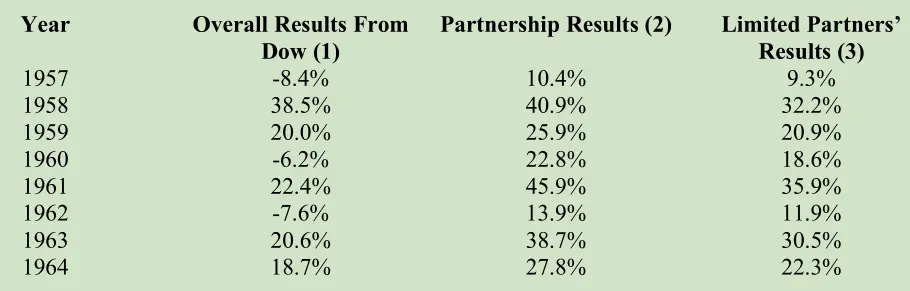

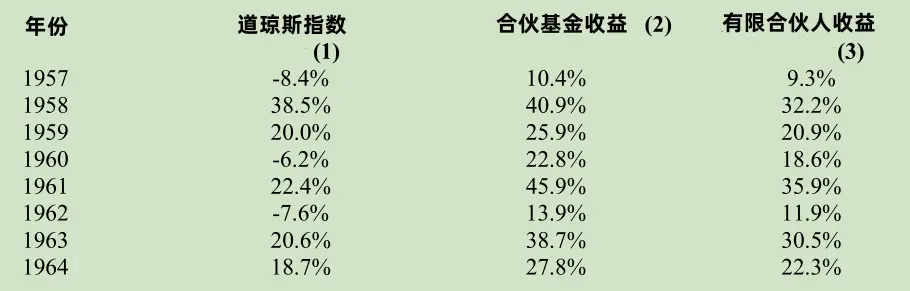

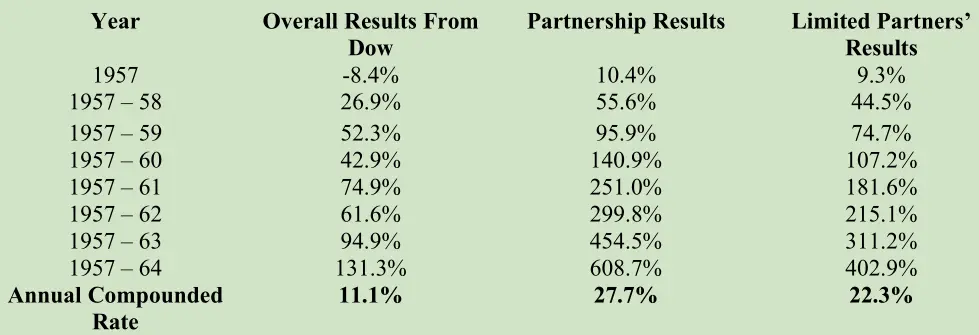

下面是道指收益率、普通合伙人分成前合伙基金收益率以及有限合伙人收益率的最新逐年对比情况。

(1)根据道指年度涨跌计算,其中包含股息。表格中为合伙基金整年运作的年份。

(2)1957-61 年的数据是之前全年管理的所有有限合伙人账户的综合业绩,其中扣除了经营费用,未计算有限合伙人利息和普通合伙人分成。

(3)1957-61 年的数据按前一列合伙基金收益率计算得出,按照当前合伙协议,扣除了普通合伙人分成。

下表是累计收益率或复合收益率:

〔译文来源于梁孝永康所编全集〕