巴菲特致合伙人的信(1964年)

②基金公司

基金公司

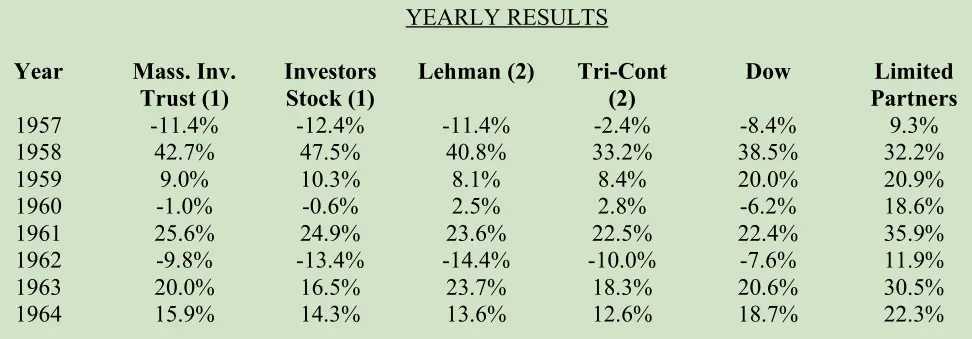

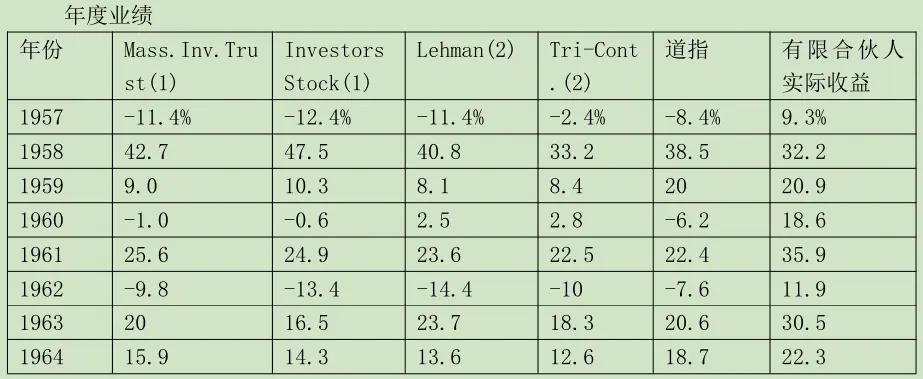

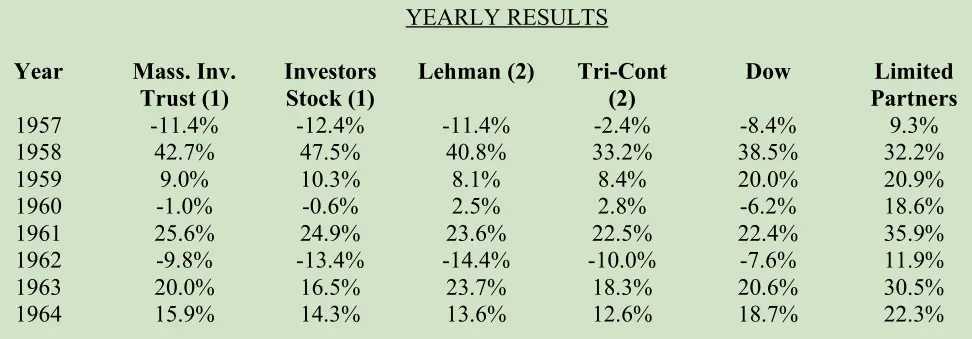

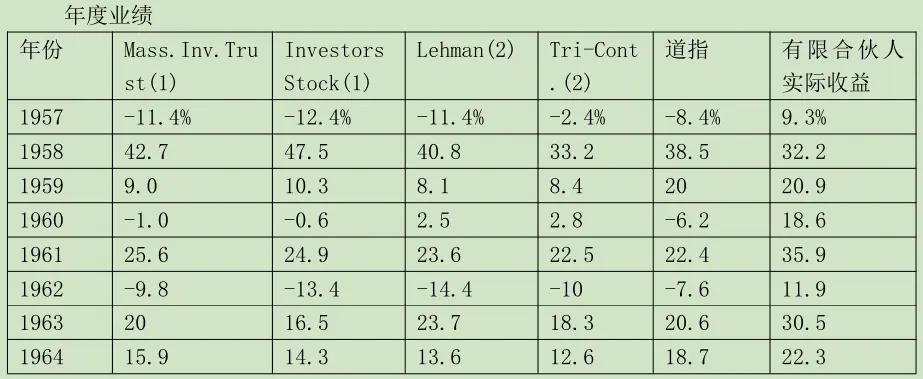

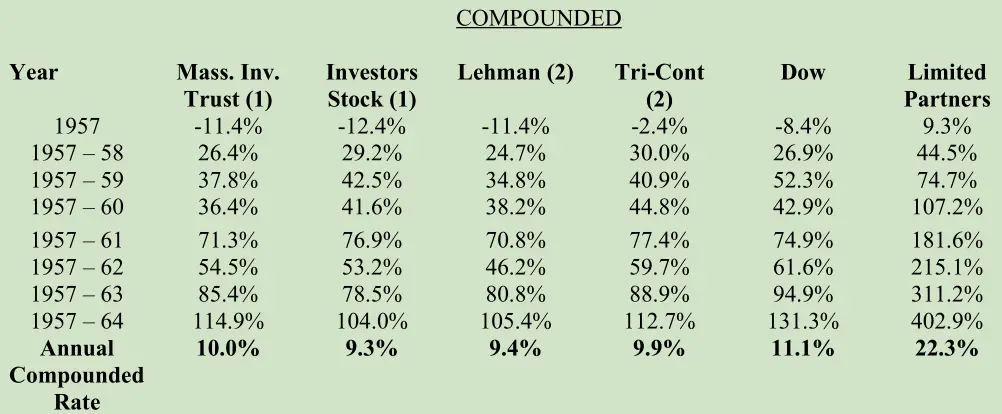

我们一直拿最大的两只开放式股票型基金(股票占 95-100%)和最大的两只分散投资的封闭式股票型基金的业绩,与合伙基金的收益率做对比。Massachusetts Investors Trust、 Investors Stock Fund,Tri-Continental Corp.这四家公司管理着约 45 亿美元的资金,有55万投资者。基金行业管理的总资产是 300 亿美元,它们应该能代表大多数的基金公司。有些投资顾问机构管理的资产规模更大,它们绝大多数的业绩应该和这四家基金公司不相上下。

我想用下面的表格说明,作为衡量投资业绩的指数,道指不是那么容易战胜的。上述四家基金由能力出众的经理人管理,它们每年收取的管理费是 800 多万美元,整个基金行业收取的管理费数额就更庞大了。从这些高薪经理人的打击率(batting average)来看,他们的业绩和道指相比稍逊一筹。

(1)计算包括资产价值变化以及当年持有人获得的分红。

(2)来源:1964 Moody's Bank&Finance Manual for 1957-63。1964 年数据为估算值。

合伙人在每年的信中都会看到上述表格,他们问我:“大型基金的经理人才智超群,他们有聪明勤奋的下属、用之不竭的资源、深厚广博的人脉,他们的投资经验加到一起都有几百年了,最后业绩怎么能做成这样?(说到“投资经验加到一起都有几百年了”,我想起了 一个段子。有个人去面试,他说自己有 20 年的从业经验,他之前的老板说,不是“20 年的从业经验”,应该是“一年的经验,重复了 20 年”。)

这个问题很有意义,按理说,基金经理和广大投资人都应该深入研究一下。300 亿美元的 1%可就是 3 亿美元。令人匪夷所思的是,在华尔街连篇累牍的长篇大论中,关于这个问题的研究几乎没有;在分析师团体行行色色的会议上,关于这个问题的探讨寥寥无几。在我看来,无论哪家投资管理机构,在对美国各大公司的管理能力和经营业绩品头论足之前,都应该好好分析一下自己的方法和业绩。

大基金的业绩超不过甚至跟不上无人管理的指数,在大多数情况下,绝对不是因为基金经理能力或品行的问题。我把这个现象的主要原因归结为如下几点:(1)群体决策——这或许是我的偏见:我认为,只要是一个群体,所有成员共同参与决策,投资管理工作就几乎不可能达到一流水平;(2)与其他声誉卓著的大型机构保持一致的倾向,无论是策略,还是部分投资组合;(3)机构框架的束缚——平均水平很“安全”,对于个人而言,特立独行的回报与风险毫不相称;(4)僵化固守某些不理智的分散投资策略;最后一点,也是最重要的一点:(5)惯性。

也许我对基金经理的这些评论不公平。也许就连上面的统计数据对比都不公平。我们的投资组合和公募基金迥然不同,我们的投资方法也和它们迥然不同。但是,我相信无论是我们的合伙人,还是大基金的投资者,他们有一点是相同的,他们都认为自己的资产管理人追求同一个目标:通过持续投资股票,在将资金永久损失的风险控制在最低限度的同时,实现长期资本回报率的最大化。对于我们的大多数合伙人来说,如果不把资金投到巴菲特合伙基金中,其他的选择可能就是基金等投资公司,获得与基金类似的收益率,因此,我认为与基金对比来检验我们的业绩很有意义。

毫无疑问,基金公司、投资顾问、信托部门等为投资者提供了不可或缺的服务,其中包括实现足够的分散、坚持长期投资、简化投资决策和方法、最重要的是,它们可以帮助投资者避免散户常犯的低级错误。在机构的宣传资料中,它们着力凸显专业管理人士,公众自然会以为他们有能力取得高收益,但绝大多数机构并未对实现超额收益做出具体承诺。

各位合伙人,我在这里向大家保证,我现在说上述业绩对比有意义,将来也会如此,无论将来如何。同时,我向各位合伙人提议,如果你认为这个标准不合适,请现在就告诉我,并提出其他标准。标准要定在前面,不能事后再说。

我还有个想法。很多人自己管理资产,他们是自己的投资顾问。上面的表格里没有“自我管理”一列。人们很关心自己的体重、高尔夫球分数、油费,但是对自己的投资管理水平却刻意回避,不进行量化评估。他们管理的可是自己的钱,客户是全世界最重要的人,是他们自己。研究 Massachusetts Investors Trust 或 Lehman Corporation 等基金的业绩,这种评估的意义是理论上的。客观研究你的资金管理人的表现,即使这个管理人是你自己,这种评估的意义是真金白银的。

提醒:打卡可获取书签。不知如何打卡?请点击查看

〔译文来源于梁孝永康所编全集〕