巴菲特致合伙人的信(1964年)

③关于保守

关于保守

看到上述大基金的业绩,有人可能会问:“这些大基金的业绩是差一些,但是它们的投资是不是比我们更保守?”要是你这么问基金经理,他们会绝对坦诚地告诉你,他们更保守。要是你这么问 100 位分析师,我相信他们大部分人也会说基金公司更保守。我不同意。我 90%的净资产都在巴菲特合伙基金里,我的很多亲戚都在合伙基金里有投资,当然了,这只能说明我的诚意,证明不了我的投资更保守。

没错,与我们相比,大基金的投资方式更符合常规。很多人以为符合常规就是保守。我觉得这种想法错了。一种投资方法是否保守,不在于是否符合常规。

真正的保守投资源于正确的前提、正确的事实、正确的逻辑。按照这三点做出的投资, 有与常规相符的时候,但更多时候是与常规背道而驰。在世界的某个角落,平坦地球协会 (Flat Earth Society)或许还在定期开会呢。

我们不因为重要的人、善辩的人或大多数人赞同我们,而感到踏实。我们也不因为他们不赞同我们,而感到踏实。民意调查替代不了独立思考。有时候我们会释然一笑,这是因为我们找到了一个投资机会,我们能看懂、事实清楚明了、一眼就能看出来该怎么做。遇到这种情况,不管是常规,还是非常规,不管其他人同意,还是不同意,我们都觉得自己是在保守地投资。

上面的论述有很强的主观色彩。没错。大家应该要求我进行客观分析。我也愿意进行客观分析。如何合理地评估既往投资策略是否保守?我的建议是研究市场下跌时的业绩表现。 表格中市场下跌的年份只有三年,而且都是温和下跌,不足以用于此项检验。在这三年里,我们的投资业绩都明显优于更常规的投资组合。

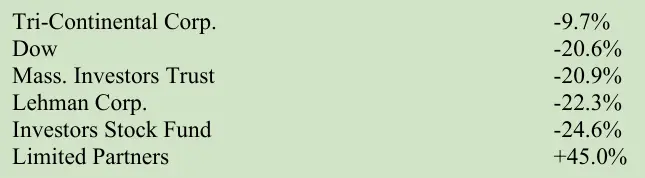

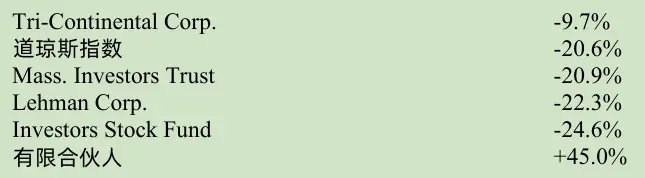

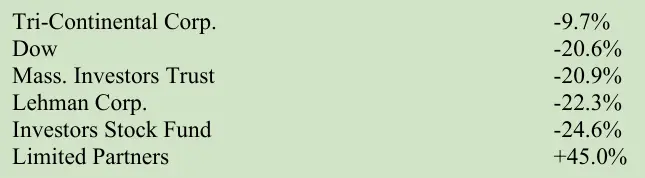

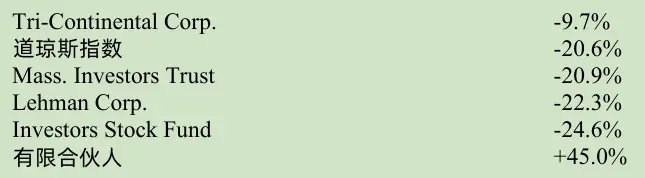

如果我们把这三年连在一起,则累计业绩如下所示:

这个比较算不上多重要,但是可以说明一些问题。不谈价格,只说“我们拥有美国电话电报公司(AT&T)、通用电气(General Electric)、IBM 和通用汽车(General Motors),所以很保守”,这样的观点,我们不敢苟同。总之,评估投资方式或资产管理人(包括自己管理)是否保守,要以合理的客观标准为依据,衡量下跌行情中的业绩表现是一种行之有效的检验方法。

提醒:打卡可获取书签。不知如何打卡?请点击查看

〔译文来源于梁孝永康所编全集〕