巴菲特致合伙人的信(1964年)

⑦税项

税项

今年,有不少合伙人齐声抱怨交的税太多。要是税单一片空白,可能也会有不少人抱怨。

很多人本来脑子很清楚,一到要交税的时候就糊涂了。我有个朋友是西海岸有名的哲人,他说,人生中的绝大多数错误是因为忘了初心。当人们面对税收,被情绪冲昏了头脑而犯错,就属于这个情况。我还有个朋友是东海岸有名的哲人,他说,他不在乎有没有人代表他的权益,只在乎要交多少税。(译注:这句话源于“无代表,不纳税”(No Taxation Without Representation),是 18 世纪 60 年代英属北美殖民地反抗英国统治的一句口号。)

还是回到西海岸哲人说的那句话。我们投资到底追求的是什么?在投资过程中,虽然我们要考虑税收因素,但投资肯定不是为了交最少的税。我们追求的是最高的税后复合收益率,不能舍本逐末。要是有两种情况,税前复合收益率相同,一种情况要交税,另一种情况不需要交税,无疑后者更合适。现实中很少有这种情况。

现在,从 3000 只股票中选出 20 只来构建一个最佳投资组合。一年后,所有股票的价格都截然不同(无论是组合里的,还是组合外的),这时候,这 20 只股票能仍然是最佳组合吗?不可能。既然我们的目标是实现税后复合收益率最大化,我们就必须持有按当前价格计算最有价值的股票。3000 多只股票,每一只都无时无刻不在变化,所以我们必然要对投资组合进行调整。我们当然希望调整投资组合时,卖出去的是赚钱的,这时候就要交税。

现在是否要持有一只股票,它去年或上个月表现如何,不重要。一只股票下跌了,没办法回本,不重要。去年一只股票赚了大钱,你很欣喜,可是在考虑它是否能纳入今年的最佳投资组合里时,你因为它赚了大钱而对它的喜爱,也不重要。

只要是取得了收益,调整投资组合时就要交税。除了极其特殊的情况(确实有这样的情况),只要预期收益很高,交的那点税根本不算什么。我总是搞不懂,为什么那么多投资股票的人对交税如此深恶痛绝。其实,长期资本利得税比大多数行业的税率都低(从税收政策的规定来看,做苦力的对社会的贡献不如炒股票的)。

我知道合伙人里有不少是特别务实的,所以我还是说点有用的吧。要彻底避免交税,只有三个办法:(1)把资产留到死——我觉得这个办法太终极了,就算狂热的避税分子对这个办法也一定很纠结;(2)将资产赠予他人——这样你就不必交税了,可我们买东西、交房租,也不交税啊;(3)把赚来的钱亏回去——要是你听到这个避税办法眼前一亮,那我很佩服你,你真有坚持信念的勇气。

综上所述,我们的合伙基金将一如既往地追求实现投资收益最大化,而不是把税款降到最低限度。我们愿意尽全力为国库创收,但也会尽全力按税法规定的最低税率纳税。

提到投资管理中的税收问题,前几年有这么个趣事。有些基金公司推出了“互换基金” (swap funds),投资者可以用自己手里的股票交换基金的份额。销售员在推销这种基金时力推的卖点是,用一只股票交换一个分散的投资组合可以延期缴纳资本利得税(销售员在说延期缴税时,说的好像不用交一样)。只有赎回互换基金份额时才需要交税。要是有人走运,实现了上面提到的三种可以避免交税的情况,那就真不用交税了。

这些互换基金投资者的逻辑真是有意思。他们显然不喜欢自己手里的股票,要不也不会拿出去换(更别说要交数额不小的手续费,通常是 4%,最高可达 100,000 美元)。他换到手里的同样是一袋子烫手的山芋,是其他不愿意交税的投资者丢掉的。说实在的,这些互换基金的投资者要是看看换来的是些什么股票,他们很可能不会买,我知道真能看的人没几个。

自从第一只互换基金 1960 年成立以来,一共出现了 12 只互换基金,现在有几只新成立的正处于募集期。它们的总销售额超过了 6 亿美元,还是很有市场的。这些基金都聘请基金经理,收取资产的 0.5%作为管理费。互换基金的基金经理面对的问题很有意思:投资者付给他们薪水,要他们管理好基金(五只规模最大的基金,每年的费用在 250,000 美元到 700,000 美元之间),但是因为投资者提供了股票,基金的课税基础很低,基金经理无论怎么操作,都会产生资本利得税。基金经理也清楚,他们的操作会产生税项,尽管基金的投资者都是非常不愿意交税的,要不他们根本就不会买互换基金。

上面的话,我说得有些重了,在有些情况下,有的投资者在处理纳税和投资问题时,或许互换基金是最佳解决方案。不过,我觉得这对那些受人尊敬的投资顾问是个挑战,他们怎么才能既少交税,又管好钱呢?

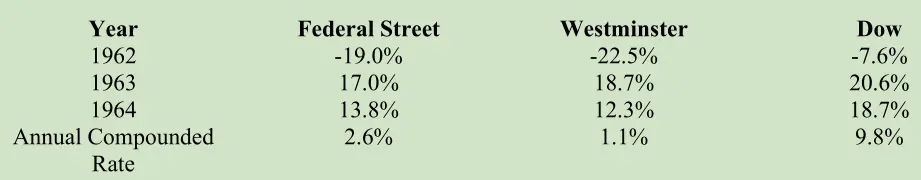

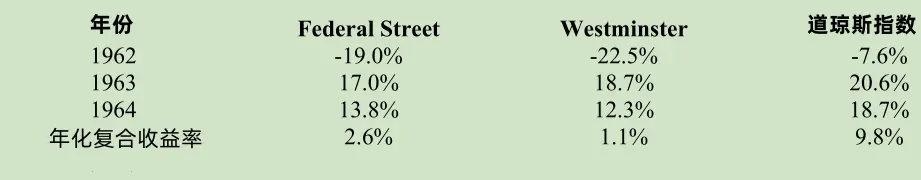

三只规模最大的互换基金都是 1961 年成立的,现在管理的总资产规模是 3 亿美元左右。 其中有一只是 Diversification Fund,它的财年和日历年不一致,很难进行对比。另两只是 Federal Street Fund 和 Westminster Fund(分别是规模第一大和第三大的),它们由专业投资顾问管理,这些投资顾问还为机构投资者管理 20 多亿美元的资金。

下面是它们的历年业绩:

这单纯是管理业绩,其中没扣除手续费,包含基金替投资者交纳的税金。

找谁能少交税呢?

提醒:打卡可获取书签。不知如何打卡?请点击查看

〔译文来源于梁孝永康所编全集〕