巴菲特致合伙人的信(1964年)

⑥投资方法

我们的投资方法

在以前的信中,我一直把我们的投资分为三类,现在我觉得分成四类更合适。新增加的类别是“低估类(相对低估)”(Generals Relatively Undervalued)。我们的“低估类” 投资中一直存在这个细微差别,现在我觉得有必要把这个差别体现出来。此类投资以前只是 “低估类”中的一个小类,现在已经发展到在我们的整体投资组合中占据更加重要的地位, 因此有必要单独划为一类。这类投资的重要性与日俱增,迄今为止的收益率也非常出色,值得投入大量时间和精力在其中寻找更多投资机会。这个新类别反映了我们已经形成一种独具特色的全新投资方法并将其付诸实践,这个新方法的应用有助于我们改善此类投资的预期收益和稳定性。目前,我们的四类投资如下:

1.“低估类(基于产业资本视角)”(Generals-Private Owner Basis)——这类投资包含整体低估的股票,我们主要通过定量分析判断是否低估,但是也特别重视定性分析。一般来说,低估类的投资,几乎看不出来或根本不知道短期内怎么能上涨。低估的股票不光鲜, 市场不喜欢。它们唯一的好处就是价格低廉,经过审慎分析可以看出,公司的市值远远低于产业资本所能给予的估值。我重申一下,虽说定量是第一位的,是根本,定性也很重要。我们喜欢优秀的管理层,我们喜欢好行业,我们希望有一定的“催化剂”刺激不作为的管理层或股东,但是我们要买得值。

在此类投资中,我们很多时候都可以做到“进退有余”,最后要么外部因素刺激股价上涨,要么我们以低廉的价格获得一家公司的控股权。虽说外部因素刺激股价上涨属于绝大多数情况,但廉价取得控股权相当于一个保单,这是其他类型的投资中所没有的。在 1964 年的中期报告中,我们提到了我们是三家公司的最大股东,我们一直在加大这三家公司的仓位。 我对这三家公司创造基本面价值的速度都非常满意。对于其中两家公司,我们完全是被动投资者。在第三家公司中,我们只是略微采取了一些主动措施。对于这三家公司,我们对任何一家可能都不会采取完全主动的策略,但是如果有必要,我们肯定会出手。

2.“低估类(相对低估)”(Generals-Relatively Undervalued)——此类投资中的股票是价格相对便宜的,参照对象是质地相差无几的其他股票。我们对此类股票的要求是按照当前市场估值标准严重低估,但是此类股票一般是大盘股,参照产业资本给予的估值没意义。 在这类股票的投资中,一定要进行同类比较,否则就牛头不对马嘴了,这一点我们非常注意。 在绝大多数情况中,我们对行业和公司不够了解,无法做出合理的判断,会直接跳过。

我刚才说了,这个新类别的投资比重在增加,收益率也非常令人满意。股市整体估值标准的变化会给我们带来风险。例如,在我们以 12 倍市盈率买入一只股票时,同等质地或较差质地的股票市盈率是 20 倍,但随后出现了一波估值调整,原来 20 倍市盈率的那些股票,市盈率跌到了 10 倍。我们最近开始应用一个方法,有望显著削弱这种由于估值标准变化而导致的风险。

这个风险一直给我们带来极大的困扰,这类投资与“低估类(基于产业资本视角)”或 “套利类”不同,一旦出现估值标准变化的风险,我们无路可退。现在我们能把这个风险削弱了,此类投资大有前途。

3.“套利类”(Workouts)——套利类投资有时间表可循。套利投资机会出现在出售、并购、重组、分拆等公司活动中。我们做套利投资不听传闻或“内幕消息”,只看公司的公告。在白纸黑字上读到了,我们才会出手。套利类投资有时也受大盘影响,但主要风险不是大盘涨跌,而是中途出现意外,预期的进展没有实现。常见的意外包括反垄断等政府干预、股东否决、税收政策限制等。许多套利类投资的毛利润看起来很低,就像我们平时在生活里找哪个停车计时器还有剩余时间。但是,套利投资的确定性高、持有时间短,去除偶尔出现的重大亏损,年化收益率是相当不错的。套利类投资每年贡献的绝对利润要比低估类稳定。在市场下跌时,套利类投资积少成多,能给我们带来很大的领先优势;在牛市中,此类投资会拖累我们的业绩。从长期来看,我认为套利类能和低估类一样跑赢道指。

4.“控制类”(Controls)——我们的控制类投资比较少见,但这类投资只要做了,就是大规模的。控制类有的是一开始就通过大宗交易买入,有的是从低估类发展而来的。有的低估类股票,价格在低位徘徊的时间很长,我们能买到很多,实现了部分或完全控股,有能力对公司施加影响,这笔投资从低估类转到了控制类。这时候,我们根据对公司前景以及管理层能力的评估,决定是采取主动,还是保持相对被动。

我们不愿为了主动而主动。在其他条件一样的情况下,我更愿意放手让别人做。不过, 大家可以放心,如果必须要采取主动,才能让资本得到合理运用,我们不会袖手旁观。

不管主动还是被动,投资控制类有一点是必须的:投资时就得把钱赚到。控制类投资的必要条件是物美价廉。取得控股权后,我们的投资价值几何,就不再取决于经常失去理智的市场报价,而是企业本身的价值。

在“低估类(基于产业资本视角)”中,我们提到有三只股票我们是最大股东。由于进可攻、退可守,这三只股票都可能变成控制类,这样很好。如果这三只股票股价上涨,达到比较符合内在价值的价位,这样也很好。我们可以卖出去,成功完成“低估类(基于产业资本视角)”的投资。

衡量控制类的投资收益,至少要看几年时间。按部就班地买入需要时间。另外,可能还要改善管理层、重新配置资本、寻求出售或并购等,控制类中的这些工作都需要时间,所以此类投资不能看几个月,要看几年。因为投入时间长,在控制类投资中,我们要求获利空间一定要大。如果赚不了多少,我们不做。

在买入阶段,控制类的表现和道指基本趋同。在末期阶段,控制类的表现和套利类更相似。

我们以前做过一笔控制类投资,登普斯特农具机械制造公司,后来卖了出去。这里告诉大家一下,登普斯特的买方现在把这家公司经营得有声有色。我们实现了自己的初衷,感到很欣慰。做投资,别想着坑人,指望最后让傻子接盘(华尔街有个“博傻理论”,说的就是这种做法),这么做长远不了。在极其低贱的价格买入,平价卖出也能获得喜人的收益,这多有成就感。

我说过,在我们的投资组合中,各类投资的分配主要是见机行事,视投资机会而定。单独拿出某一年来,低估类、套利类或控制类的投资占比有很大的随机性。各类投资所占比重有偶然性,但对我们当年相对道指的业绩有很大影响。所以说,单独一年的业绩不重要,无论好坏,都别看得太重。

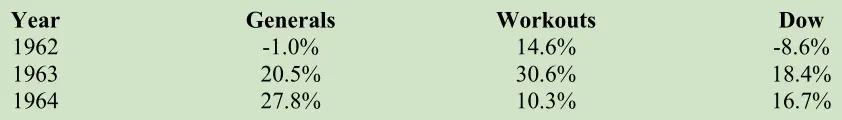

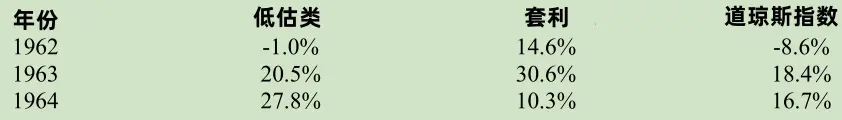

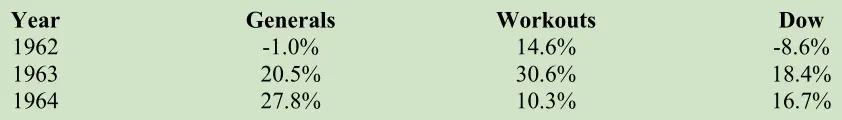

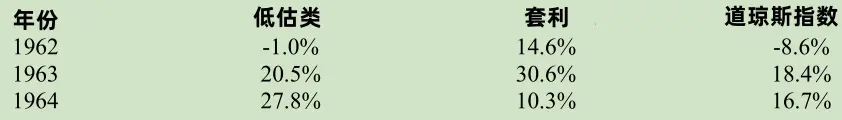

我就以过去三年为例,说明各类投资占比的随机性对我们的业绩有多大影响。在这里, 我们使用另一种完全不同的计算方法。在衡量巴菲特合伙基金业绩时,我们计算的是整体收益率。现在,我们以各类投资的每月平均市值为准,分别计算每类投资的收益率,计算时将借钱和经营开支因素扣除(这样可以最准确地比较各类投资,但并不能反映合伙基金的整体业绩)。低估类(包括当前的两种低估类)、套利类和道指的收益率如下所示:

显然,1962 年,套利类(和控制类)扭转了局面。这一年如果我们的套利类投资占比较低,与大盘相比,我们的收益率仍然会相当出色,但最终收益肯定没那么高了。这一年, 我们的套利类占比完全有可能很低,这类投资就看有没有合适的机会,不是我在预知了市场走势后刻意分配的。所以说,大家要明白,1962 年我们各类投资有这样的配比,纯属运气好。

1963 年,我们做了一笔漂亮的套利投资,对整体收益贡献很大。再加上低估类也表现出色,全年收益率非常抢眼。假如这一年套利类的收益比较正常(例如,像 1962 年一样), 我们相对道指的优势会大幅缩水。在这一年,我们不是因为各类投资的配比占了便宜,而是受益于良好的形势。

再看 1964 年。这一年,套利类严重拖累了我们的业绩。在像 1964 年道指大涨这样的年份中,这种情况实属正常。但是这一年套利类的表现实在乏善可陈,对业绩的拖累超出了我的预期。回过头来看,我们当时要全投资低估类就好了,但是投资不能重头再来。

希望通过我对上述表格的阐述,各位能确实明白某一年的业绩受许多变量的影响,有些因素我们既无法控制,也无法预知。我们认为我们的各类投资都是好投资。我们不是只靠一类投资,而是有几类可供选择,这对我们是好事。正因为如此,我们可以在各个类别中精挑细选,而且一个类别的投资机会没了,我们还可以投别的,不会彻底失去投资机会。

提醒:打卡可获取书签。不知如何打卡?请点击查看

〔译文来源于梁孝永康所编全集〕