巴菲特致合伙人的信(1965年半年度)

①业绩

1965年7月9日

上半年业绩

1965 年上半年,道指从 874.13 下跌到 868.03。它的下跌幅度很小,但走的不是直线线路,而是观光线路,在 5 月 14 日曾达到 939.62 的高点。加上 13.49 点的股息,道指上涨 7.39 点,整体收益率是 0.8%。

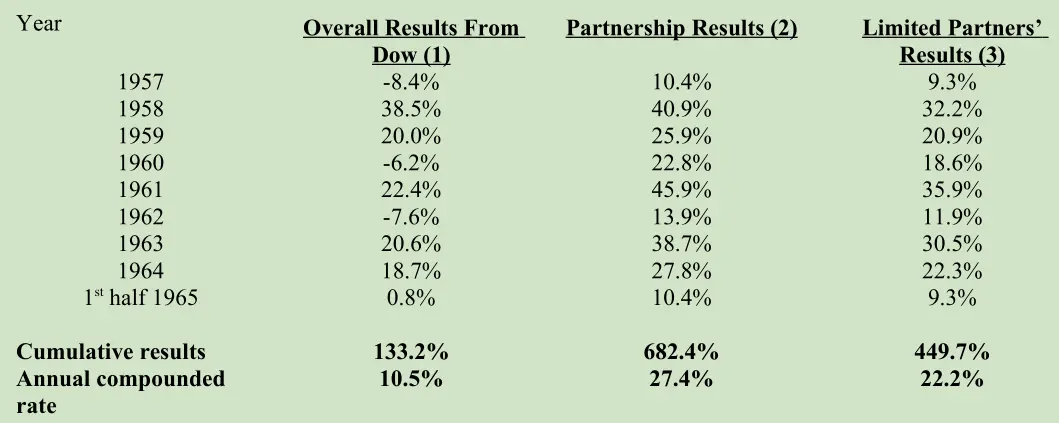

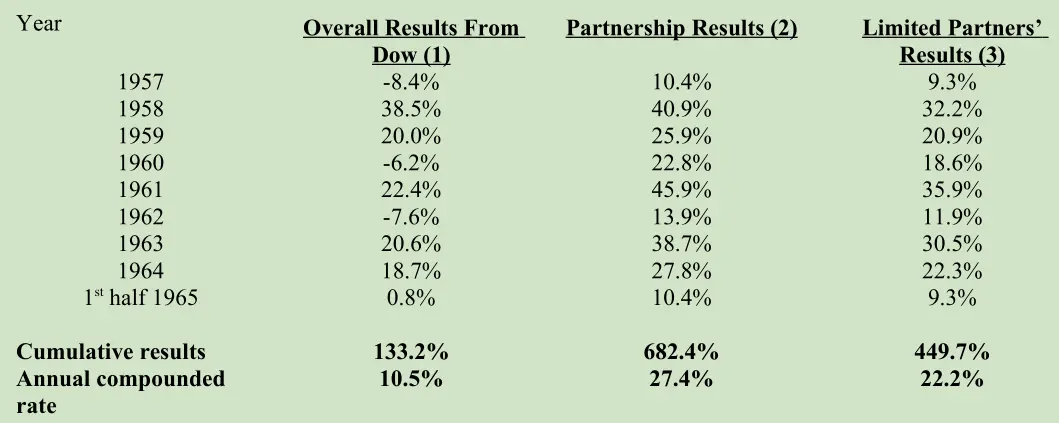

我们上半年的业绩不错,未扣除普通合伙人分成的收益率是 10.4%,领先道指 9.6 个百分点。下面是道指收益率、普通合伙人分成前合伙基金收益率以及有限合伙人收益率的最新逐年对比情况。

(1)根据道指年度涨跌计算,其中包含股息。表格中为合伙基金整年运作的年份。

(2) 1957-61 年的数据是之前全年管理的所有有限合伙人账户的综合业绩,其中扣除了经营费用,未计算有限合伙人利息和普通合伙人分成。

(3)1957-61 年的数据按前一列合伙基金收益率计算得出,按照当前合伙协议,扣除了普通合伙人分成。

我们一直提醒各位:(1)三年以下的短期业绩毫无意义,我们有一部分投资是控股类, 短期业绩对我们更没意义。(2)与道指和公募基金相比,在市场下跌时,我们能跑在前面, 在市场泡沫中,我们可能望尘莫及。

按照上面的第二点,我们的表现应该是:上半年前四个月道指大涨时,难以跟上指数;五月份、六月份,道指下跌时,我们逐渐取得领先优势。实际情况则完全相反:在今年上半年,市场大涨时,我们遥遥领先;后来市场下跌时,我们跟随道指下跌。

对于上述表现,我并不引以为傲。我更愿意看到的情况是,我们能按照我们的设想取得领先优势。之所以如实报告,有两个原因:(1)无论我做对了,还是做错了,各位合伙人都有权知道;(2)从这个现象可以说明,虽然我们有既定的概率和预期,实际情况可能远远偏离预期,短期情况尤其如此。在上一封年度信中,我告诉大家,我们的长期目标是每年领先道指 10 个百分点。今年前六个月,我们就领先了 9.6 个百分点,远远高于平均水平。当与平均水平相比,我们的业绩偏好时,合伙人总是能处变不惊,这值得赞许。与平均水平的偏离,不总是偏好,偏向差的一面时肯定会有,各位要做好准备。

在上一年的年度信中,我们讲了有几个“低估类(基于产业资本视角)”投资。上半年,通过一系列买入活动,我们取得了其中一只股票的控股权。在取得控股权后,评判价值的首要决定因素就变成了企业的资产和盈利能力。在持有一家公司的少数权益时,盈利能力和资产当然也非常重要,但是从短期看,价格的决定因素是供求关系,盈利能力和资产只能间接影响价值,未必能主导股价。

取得控股权益后,我们拥有的不再是股票,而是公司,这时要按公司本身估算价值。在今年中期的报告中,我们以保守的方法计算控股公司的价值。在年末的报告中,我们将按照资产和盈利能力的变化重新估值。在1966 年 1 月的年度信中,我将详细介绍这笔控股投资的情况。现在我只告诉大家,我们对收购成本和企业运营都非常满意,也非常看好公司的管理层。

〔译文来源于梁孝永康所编全集〕