巴菲特致合伙人的信(1965年半年度)

②基金公司③预先存入和提取资金④其他事项

基金公司

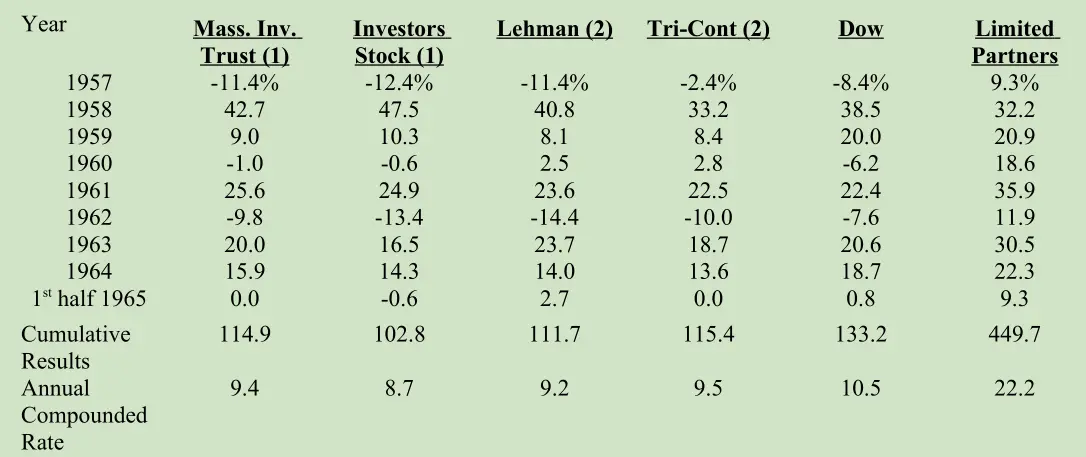

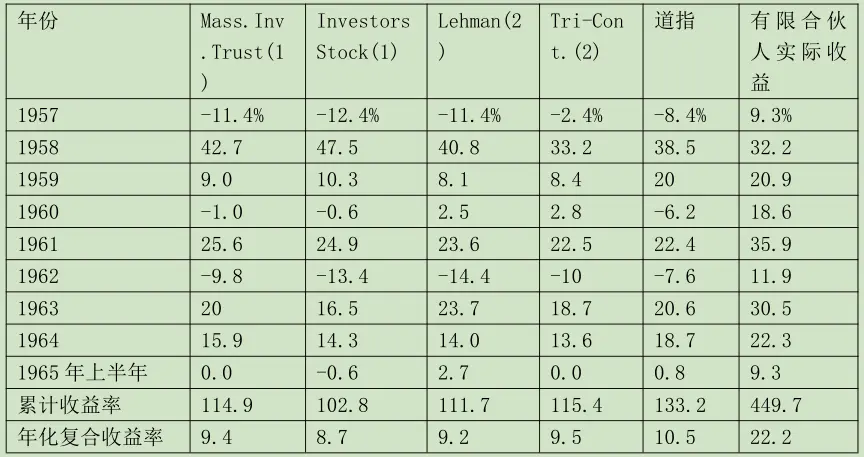

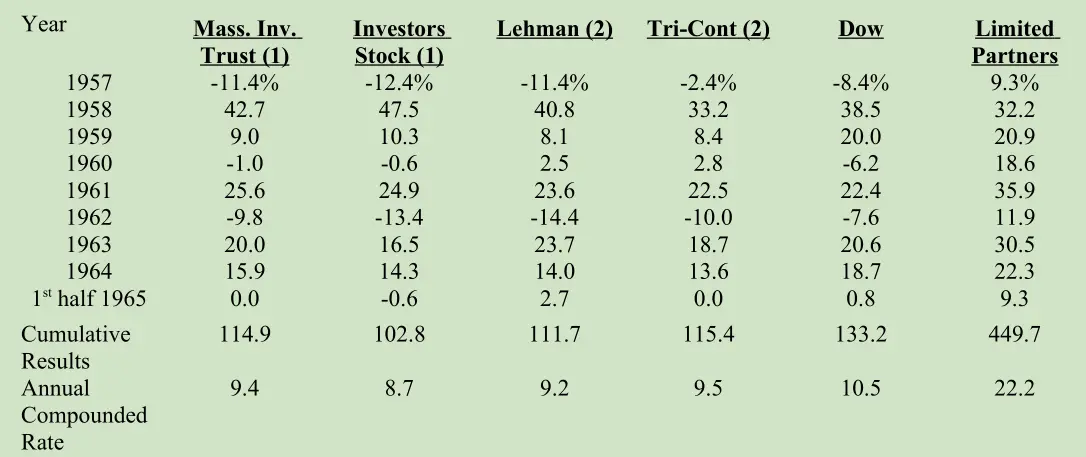

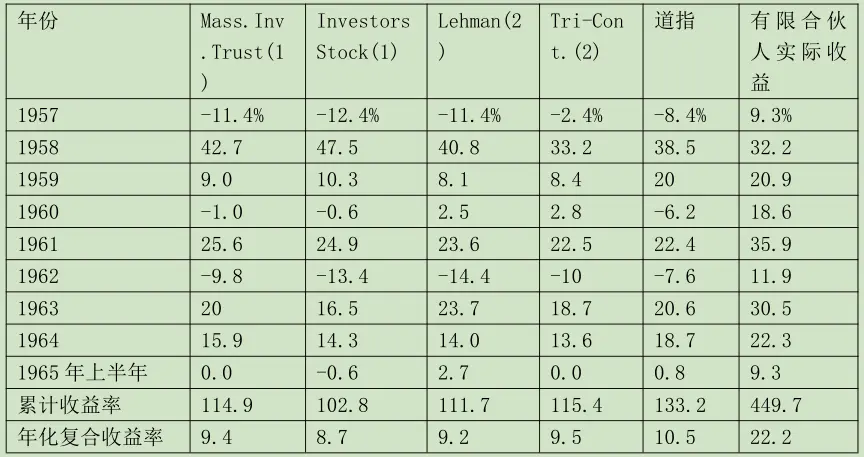

我们一直拿最大的两只开放式股票型基金(股票占 95-100%)和最大的两只分散投资的封闭式股票型基金的业绩,与合伙基金的收益率做对比。Massachusetts Investors Trust、 Investors Stock Fund,Tri-Continental Corp. 这四家公司管理着 40 多亿美元的资金,基金行业管理的总资产是 300 亿美元,它们应该能代表大多数的基金公司。以下是这四只基金的业绩。有些投资顾问机构管理的资产规模更大,它们绝大多数的业绩应该和这四家基金公司不相上下。

(1) 计算包括资产价值变化以及当年持有人获得的分红。

(2) 来源: 1965 Moody's Bank&Finance Manual for 1957-64。1965 年上半年数据为估算值。

去年,我说基金就像漂在池塘上的鸭子。水(市场)涨起来时,鸭子跟着往上涨;水(市场)落下去时,鸭子跟着往下落。1965 年上半年,池塘的水位几乎没变。如表格所示,鸭子也趴在池塘上。

我在报告业绩时说了,五月份和六月份落潮的时候,我们未能幸免。但是我们在前四个月里拍打了翅膀,所以最后我们比其他鸭子飞得高一些。芝加哥大学证券价格研究中心主任詹姆斯 H.洛瑞(James H.Lorie)说得更直白。他在 1965 年 5 月 25 日的《华尔街日报》上说: “我们找不到证据,无法证明基金公司的选股能力优于随机选股。”

美国经济大环境好,过去这些年,随机选股都能获得很好的业绩。水位一直在上涨。我认为,从概率的角度讲,长期来看,美国经济会越来越好,水位会越来越高,但中间少不了大的波折。无论潮起潮落,我们都将矢志不渝地搏浪击水。要是我们业绩下降,还不如各位自己在水面上漂浮,我们只能引咎辞职。

预先存入资金和提取资金

我们接受合伙人以及潜在合伙人预先存入资金,并从资金存入之日起到年末支付 6%的 利息。合伙人没有责任在年末将存入的资金转为合伙基金权益,但是在预先存入基金时应当 以在年末转为基金权益为意向。

我们同样允许合伙人在年末之前预先提取资金,最高取款金额为其合伙基金账户资金的 20%,并从资金提取之日起到年末收取 6%的利息,利息扣除时间为年末。这么安排不是打算把合伙基金变成合伙人的银行,而是通过允许预先提取资金,满足合伙人的紧急资金需求。 像每季度需要向联邦政府税款,这样的资金需求可以预知。合伙人应当在年初从资本账户中提取,不要在年中预先提取资金。预先提取资金的安排是为了应急。

存款(预先存入资金)和贷款(预先提取资金)利率都是 6%,看起来不是我巴菲特的风格。(我肯定对这样的生意提不起来兴趣。)从旁观者的角度来看,我们合伙基金的大部分活动都是商业性质的,但是关于预先存取资金的安排没有利差。尽管如此,我认为这个安排和合理,符合所有合伙人的利益。

我们的合伙人间接持有大量流动资产,有的合伙人投入了自己的大部分资金。我们应该为合伙人的权益提供一定的流动性,不能只等到年末才允许存取。实际上,我们有理由相信,预先存入资金的数量会远远超过预先提取资金的数量。例如,截止1965 年6月30日,预先提取资金的金额是 98,851 美元,预先存入资金的金额是 652,931 美元。

预先存入资金远远高于预先提取资金,但是我们能从商业银行获得利率更低的贷款,为什么还要为预先存入资金支付 6%的利率?原因有两点:第一,我们相信我们的长期收益率会高于 6%(达不到这个目标,普通合伙人一分钱分成都没有),短期内能否超过 6%有很大偶然性。第二,提前存入的资金,在可以预见的短期内能成为我们的权益资本,和短期银行贷款相比,我用这些资金投资,心态不一样。提前存入资金对我们还有个好处:我们平时总是在 1 月份集中收到大量资金,允许提前存入资金后,可以在一年中分批收到追加投资。对合伙人来说,6%的利率比任何短期低风险投资收益率都高,这对我们来说是互利互惠。

其他事项

在去年的信中,我说计划将办公室大举扩张到 84 平米。一切很顺利(计划完成时,百事可乐还凉着呢)。

四月份,约翰·哈丁(John Harding)加入了我们。我们选员工从来没看走眼过,约翰也是那么出色。

按照惯例,我们将在 11 月 1 日左右(向合伙人以及有意在 11 月 1 日前后加入的准合伙人)寄出 1966 年承诺书以及 1965 年纳税估算数据等文件。

沃伦 E.巴菲特谨上

〔译文来源于梁孝永康所编全集〕