巴菲特致合伙人的信(1965年)

①业绩

1965 年业绩

1965 年,我们打赢了脱贫战(译注:1964 年美国总统林登·约翰逊在国情咨文中提出向贫穷开战(War on Poverty),当时美国的贫困率是 19%)。

我们年末的资产比年初多了 12,304,060 美元。

去年的信中有一段是“我们的目标”(注意,我写的不是“我们的承诺”),我说我们追求的是“…扣除普通合伙人分成之前,巴菲特合伙基金平均每年领先指数 10 个百分点。合伙基金的领先优势会剧烈波动:在不利环境中可能落后 10 个百分点;在顺风顺水时可能领先 25 个百分点。”

去年刚定完目标,今年我们的业绩就偏离了目标,我的预测真是不靠谱。包含股息在内,道指的整体收益率是 14.2%,我们的整体收益率是 47.2%,这是巴菲特合伙基金成立以来取得的最大相对优势。我犯了错,大家都看到了,换了是谁,都会感到惭愧。以后应该不会有这样的事了。

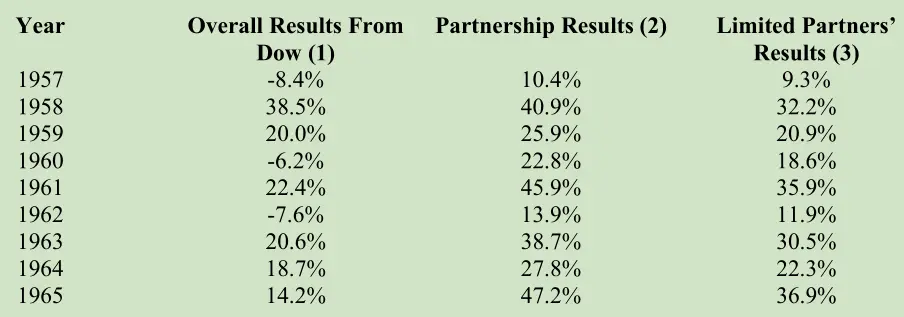

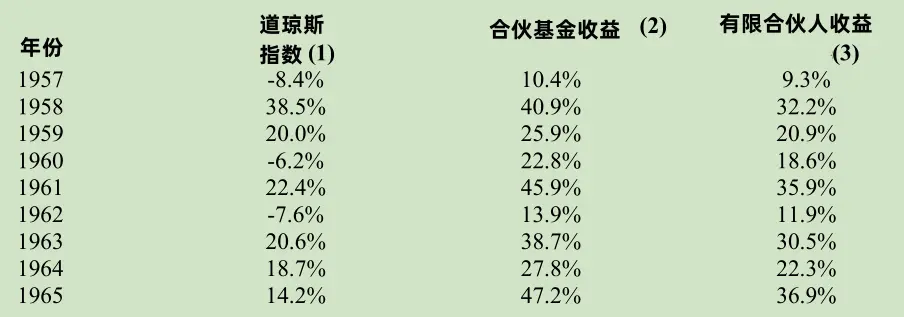

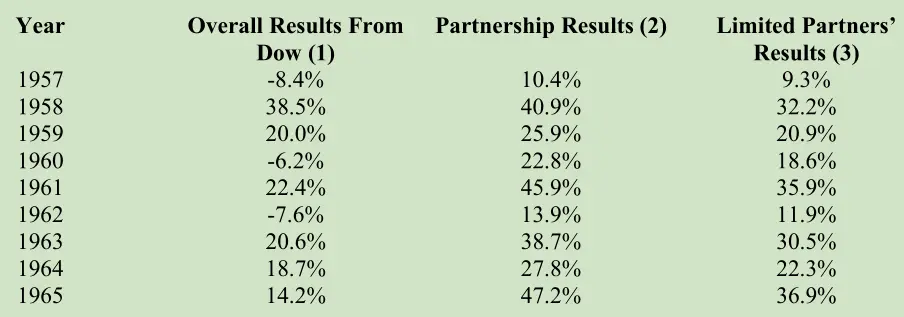

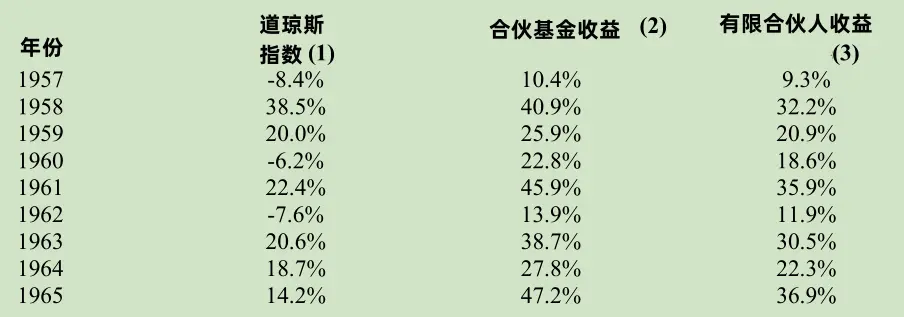

下面是道指收益率、普通合伙人分成前合伙基金收益率(收益超过 6%的部分,普通合伙人提取 25%)以及有限合伙人收益率的最新逐年对比情况。

(1)根据道指年度涨跌计算,其中包含股息。表格中为合伙基金整年运作的年份。

(2)1957-61年的数据是之前全年管理的所有有限合伙人账户的综合业绩,其中扣除了经营费用,未计算有限合伙人利息和普通合伙人分成。

(3)1957-61年的数据按前一列合伙基金收益率计算得出,按照当前合伙协议,扣除了普通合伙人分成。

下表是累计收益率或复合收益率:

去年收益率这么高,合伙人自然会问:“我们后面还有什么高招?”投资这行有一点不好,前一年强劲的势头对下一年基本没什么用。如果1965年通用汽车在国内上牌新车中占54%,由于用户忠诚度、经销商能力、产量、品牌形象等因素,可以相当肯定地说,1966年,通用汽车的销量应该和去年不相上下。我们的合伙基金不一样。每一年,发令枪一响,我们都一切按市值计算,从零开始。1964年和1965年,我们也努力了,但来到1966年,对于新老合伙人来说,我们过去的努力带不来多少收益。过去的赚钱方法和机会就是过去的,将来总要找新的方法和机会。

长期而言,我仍然希望我们能实现去年信中所说的“我们的目标”。(如需去年的年度信,请联系我们。)要是有人相信1965年的收益率能频繁出现,他们可能是在出席哈雷彗星观测者俱乐部的每周会议。亏损的年份,落后道指的年份,我们肯定会有。但是,我仍然相信我们将来的平均业绩能战胜道指。假如有一天,我认为我们达不到这个目标,我会立即告诉各位。

〔译文来源于梁孝永康所编《巴菲特致合伙人+致股东的信全集》〕