巴菲特致合伙人的信(1966年半年度)

①业绩

1966年7月12日

上半年业绩

1966年上半年,道指从969.26点下跌到870.10点。在此期间,股息约为14.70个点,投资道指的整体收益率为亏损8.7%左右。

长期平均每年跑赢道指10个百分点,这是我的目标,也是我的希望(但我保证不了一定能做到!)。今年上半年,我们的表现远高于预期,整体收益率大约是8.2%。各位都应该明白,这样的业绩绝对是特殊的例外情况。业绩偏离预期,好的超出预料,这样的情况我们之前也遇到过,各位合伙人总能不为所动,我曾经在信里赞许各位表现出的温和与宽容。许多合伙人一定也想经历一下业绩偏离预期、差的超出预料的情况,考验一下自己的承受能力。既然是做投资,长期来看,各位一定会有这样的机会。

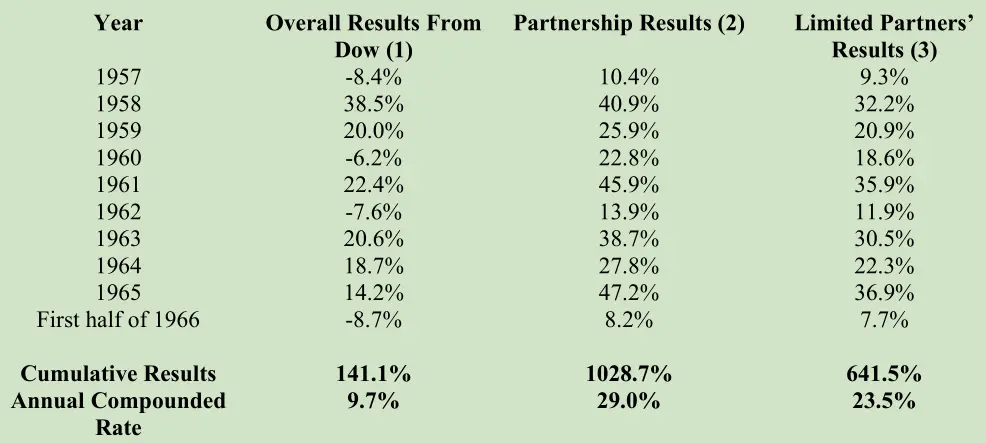

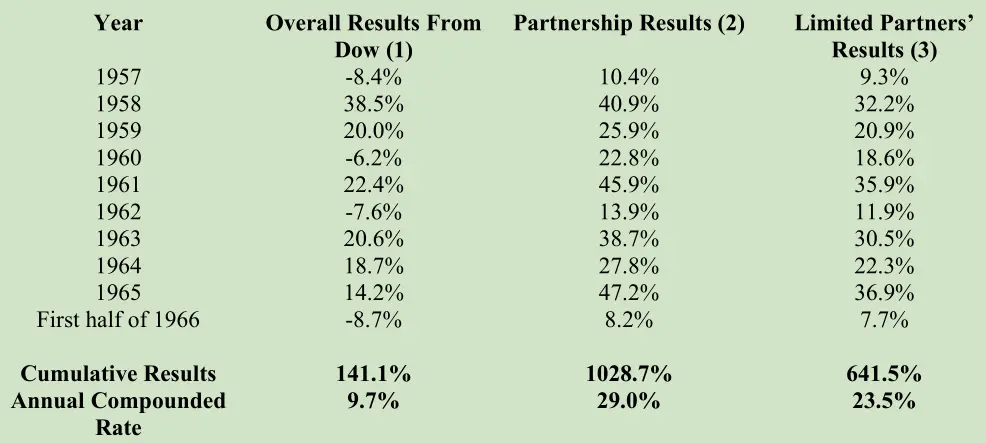

下面是道指收益率、普通合伙人分成前合伙基金收益率以及有限合伙人收益率的最新逐年对比情况。

1.根据道指年度涨跌计算,其中包含股息。表格中为合伙基金整年运作的年份。

2.1957-61年的数据是之前全年管理的所有有限合伙人账户的综合业绩,其中扣除了经营费用,未计算有限合伙人利息和普通合伙人分成。

3.1957-61年的数据按前一列合伙基金收益率计算得出,按照当前合伙协议,扣除了普通合伙人分成。

就连大力士参孙(Samson)也有被痛扁的时候。假如你今年1月1日拿出100,000美元,把资金平均分成8份,买入下列公司:

a.世界上最大的汽车公司(通用汽车);

b.世界上最大的石油公司(新泽西标准石油);

c.世界上最大的零售公司(西尔斯罗巴克);

d.世界上最大的化学公司(杜邦);

e.世界上最大的钢铁公司(美国钢铁);

f.世界上最大的上市保险公司(安泰保险);

g.世界上最大的公用事业公司(美国电话电报);

h.世界上最大的银行(美国银行)。

到6月30日,你的投资组合的总资产(包括股息)是83,370美元,亏损16.6%。1月1日,这八家巨无霸的总市值是1000多亿美元。到了6月30日,这八家公司都跌了,无一例外。

〔译文来源于梁孝永康所编全集〕