巴菲特致合伙人的信(1966年半年度)

②基金公司

基金公司

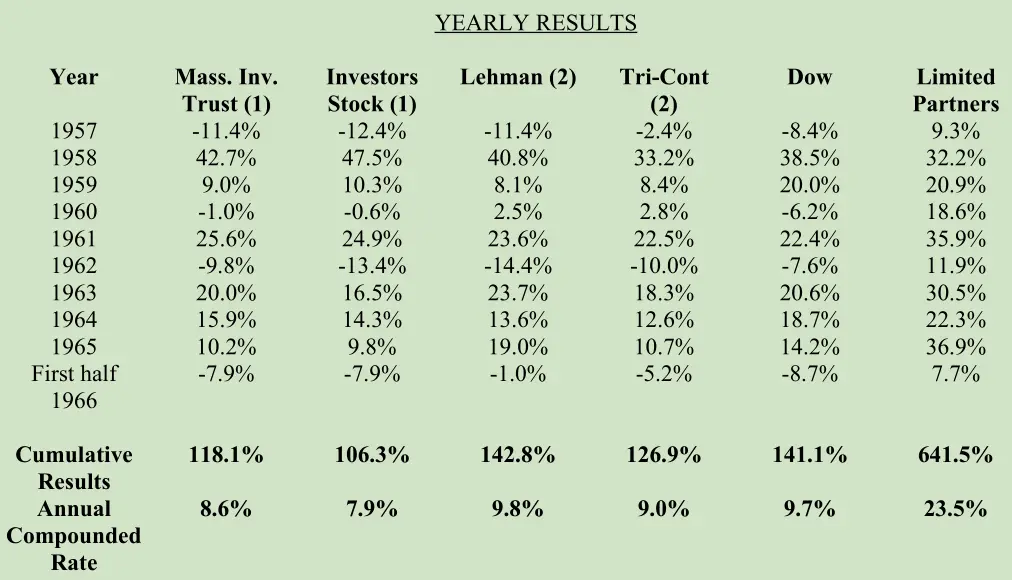

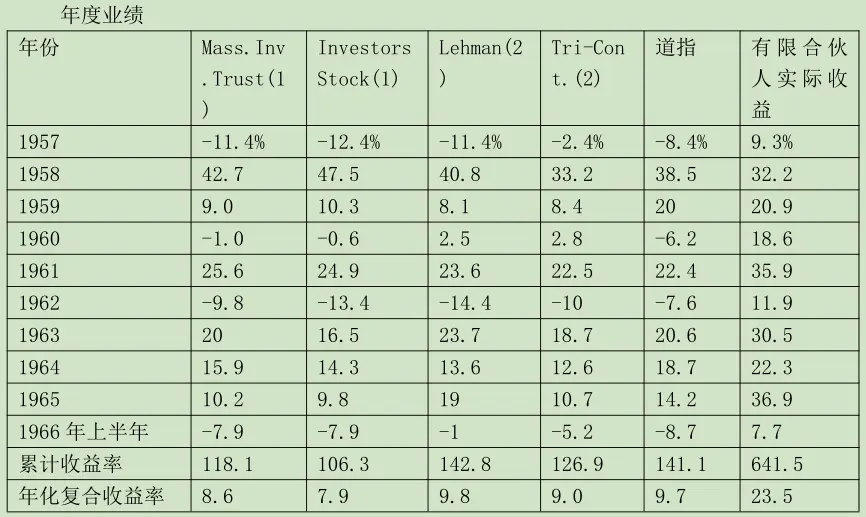

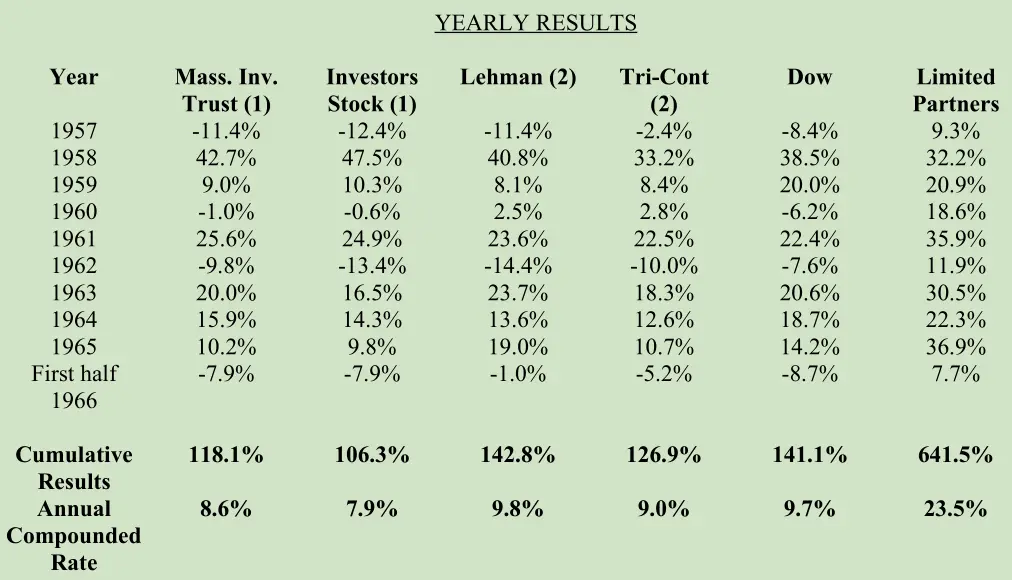

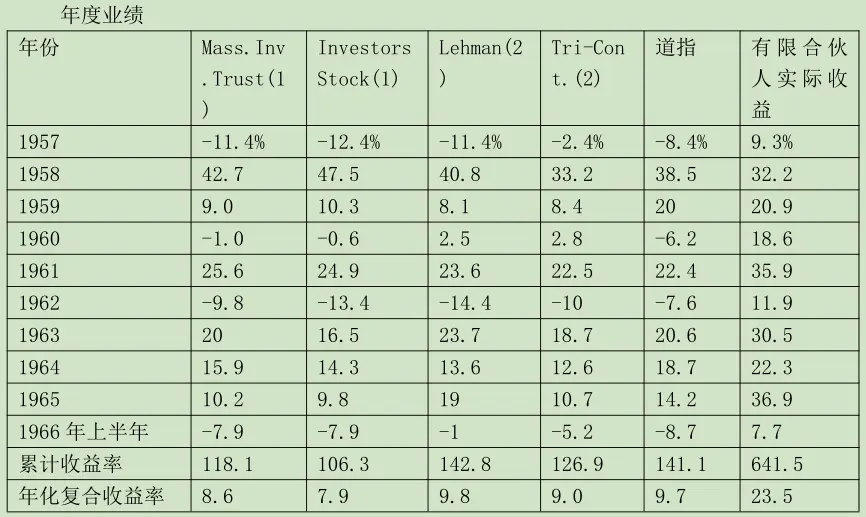

我们一直拿股票投资占95-100%的最大的两只开放式股票型基金(共同基金)和分散投资的最大的两只封闭式股票型基金的业绩,与合伙基金的收益率做对比。以下是最新对比情况。

(1)计算包括资产价值变化以及当年持有人获得的分红。

(2)来源:1966 Moody's Bank&Finance Manual for 1957-65。1966年上半年数据为估算值。

机构投资者经常以保守标榜自己。如果他们所谓的“保守”意思是“业绩和平均水平亦步亦趋”,那我没意见。广泛分散投资优质证券,最后取得的业绩差不多就这样。长期来看,“平均水平”也相当不错,普通投资者选择基金没什么不对。

依我之见,保守要这么定义才更合理:“与平均水平相比,承受远远更低的价值损失,无论是暂时的,还是永久的。”按这个定义衡量,从这四只大型基金(目前管理资产超过50亿美元)的历史业绩来看,它们都没做到保守。1957年、1960年、1962年和1966年上半年,道指都下跌了。将57年、60年和62年的下跌累计计算,道指下跌20.6%。按同样的计算方法,四大基金分别下跌9.7%、20.9%、22.3%和24.6%。再把1966年上半年的下跌也算上,道指累计下跌27.5%,四大基金分别累计下跌14.4%、23.1%、27.1%和30.6%。按照上述保守的第一种定义,这几只基金是保守的。按照第二种定义,它们算不上保守。(这几只基金的业绩可以代表机构投资者。)

大多数投资者,要是他们能分清上述两种不同的保守定义,他们的投资理念就上了一个台阶。第一种保守可能叫“随大流”(conventionalism)更合适,它的意思其实是说“股市普遍上涨,别人都赚钱时,我们一样赚;别人亏钱时,我们一样亏。”我所说的保守是这样的:“别人赚钱时,我们一样赚;别人亏钱时,我们少亏。”这两个保守不一样。在投资中,能做到第二种保守的,很少。我们保证不了就能做到,但会以追求这种保守为目标。(耶鲁橄榄球队当年输得很惨,曾经在一个赛季里输掉八场比赛,教练Herman Hickman解释说:“我争取把我的工作做好,不把校友们惹火就行,他们不满意就不满意吧。”我始终觉得我们应该有更高的追求。)(译注:引用这句话的原文是I see my job as one of keeping the alumni sullen but not mutinous.这句话是教练Herman Hickman说的。耶鲁橄榄球队很弱,高校之间橄榄球比赛很激烈,教练很难常胜。他这句话是在解释球队成绩为什么那么差的时候说的,意思是,成绩肯定好不了,校友不满意也没办法。只是成绩别太差,别把校友们惹火了就行。)

提醒:打卡可获取书签。不知如何打卡?请点击查看

〔译文来源于梁孝永康所编全集〕