巴菲特致合伙人的信(1966年)

①第一个十年

第一个十年

1966年是合伙基金成立十周年。这一年,我们创造了我们领先道指的最高纪录(这是过去的最高纪录,也是将来的最高纪录),这是献给成立十周年最好的礼物。合伙基金上涨20.4%,道指下跌15.6%,我们领先36个百分点。

我们之所以能取得如此喜人且无法重现的成绩,一部分原因是道指表现欠佳。1966年,几乎所有基金经理都跑赢了道指。道指是按照30只成分股的市值加权计算出来的。市值最高的几只成分股可以左右指数(例如,杜邦和通用汽车),但它们去年跌得很惨。另外,人们普遍回避传统的蓝筹股,导致道指表现比一般投资水平逊色,这个现象在最后一个季度尤其明显。

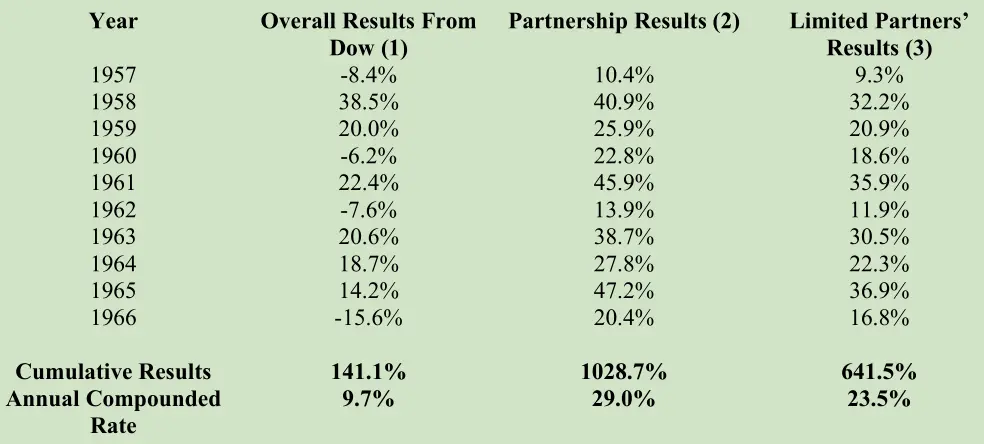

下面是道指收益率、普通合伙人分成前合伙基金收益率(收益超过6%的部分,普通合伙人提取25%)以及有限合伙人收益率的最新逐年对比情况。

(1)根据道指年度涨跌计算,其中包含股息。表格中为合伙基金整年运作的年份。

(2)1957-61年的数据是之前全年管理的所有有限合伙人账户的综合业绩,其中扣除了经营费用,未计算有限合伙人利息和普通合伙人分成。

(3)1957-61年的数据按前一列合伙基金收益率计算得出,按照当前合伙协议,扣除了普通合伙人分成,未计算有限合伙人的每月提现。

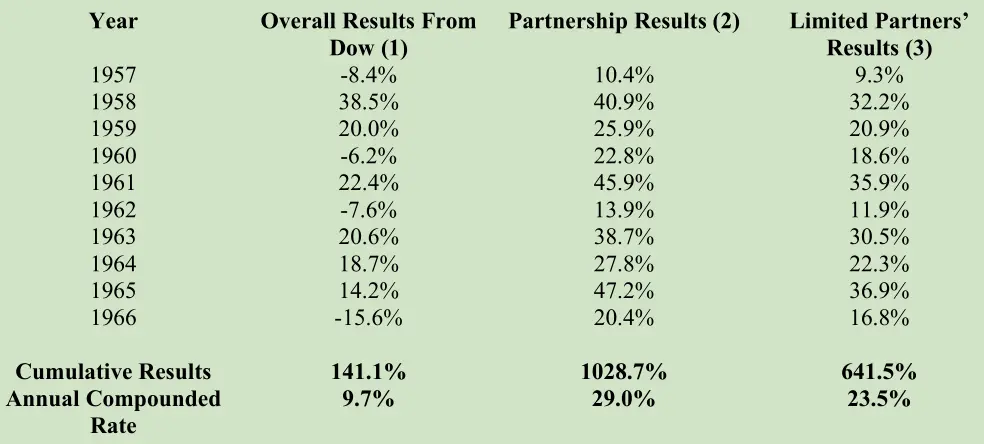

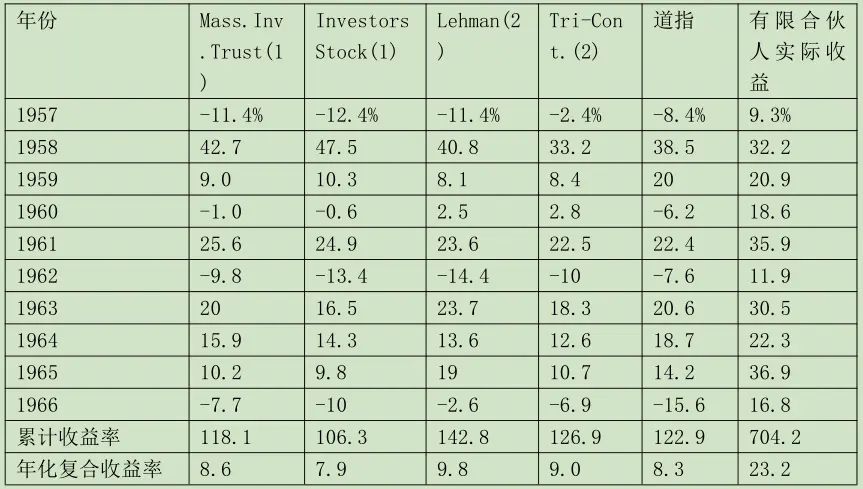

下表是累计收益率或复合收益率:

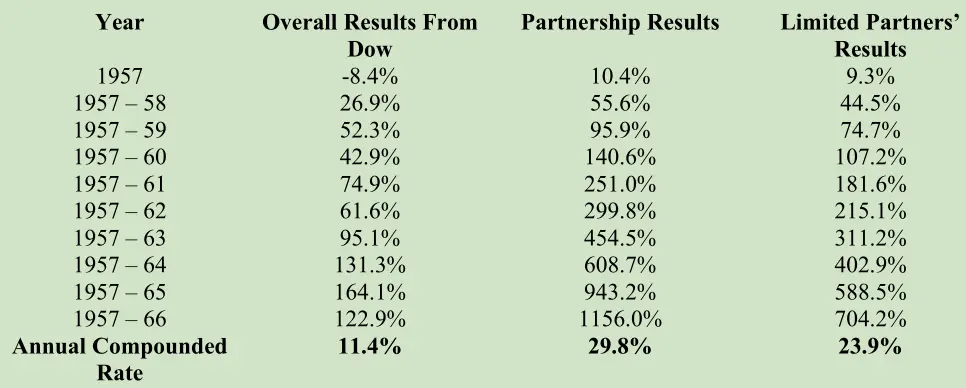

投资公司

我们一直拿股票投资占95-100%的最大的两只开放式股票型基金(共同基金)和分散投资的最大的两只封闭式股票型基金的业绩,与合伙基金的收益率做对比。与往常一样,下面是最新对比情况。

(1)计算包括资产价值变化以及当年持有人获得的分红。

(2)来源:1966 Moody's Bank&Finance Manual for 1957-65。1966年数据为估算值。

之所以在每年的信里都列出基金公司的业绩,是为了说明道指作为衡量投资业绩的指数,不是那么容易战胜的。我有必要重复一下。虽然我们选这些基金公司进行对比,但是它们和巴菲特合伙基金有很多差异。例如:(1)基金公司的投资活动,受许多内部和外部因素的限制,我们则没这些限制;(2)基金公司投资的分散程度远远高于我们。任何一年,与道指相比,它们相对收益极差的可能性比我们小。(3)按照这些基金公司的激励机制,它们的经理人更愿意随大流,没我们这么大的动力去追求出类拔萃的业绩。

职业基金经理受人尊敬、薪水丰厚。从上面的业绩记录中,我们可以看到他们投资股票的表现如何。投资管理领域有不少选择,这些基金经理承载了60多万美国投资者的寄托。或许绝大多数职业基金经理的业绩都是如此。

然而,这些基金经理的业绩不代表投资领域的最高水平。有一些基金和私募机构,它们创造的业绩记录远远领先道指,其中有些也远远高于巴菲特合伙基金。它们的投资方法一般和我们不一样,不在我的能力范围之内。但是,它们的管理人一般都很聪明、很努力。既然是在讨论职业基金经理的业绩,我就得如实告诉各位,确实有能取得超一流业绩的基金经理。

〔译文来源于梁孝永康所编《巴菲特致合伙人+致股东的信全集》〕