巴菲特致合伙人的信(1967年半年度)

①业绩②基金公司

1967年7月12日

上半年业绩

和往年一样,因为我们一家要去加州度假,这封信也是六月末写的。为了与往年相称(对于损益表,我总是克服我对美感的追求,不讲对称),有些地方我先保留了空白,等数字补上后,相信我的结论也不会有问题。

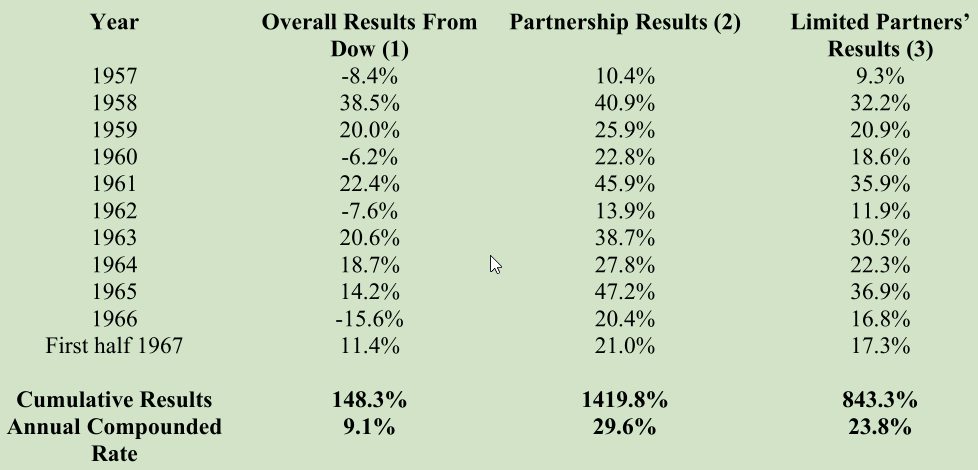

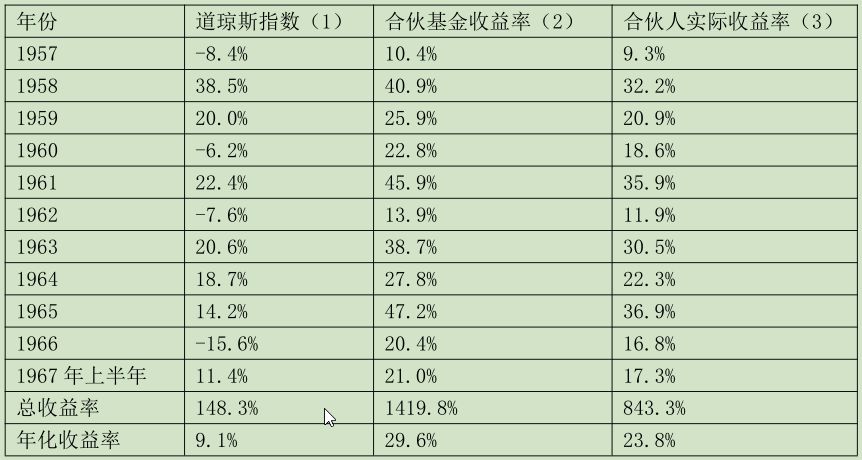

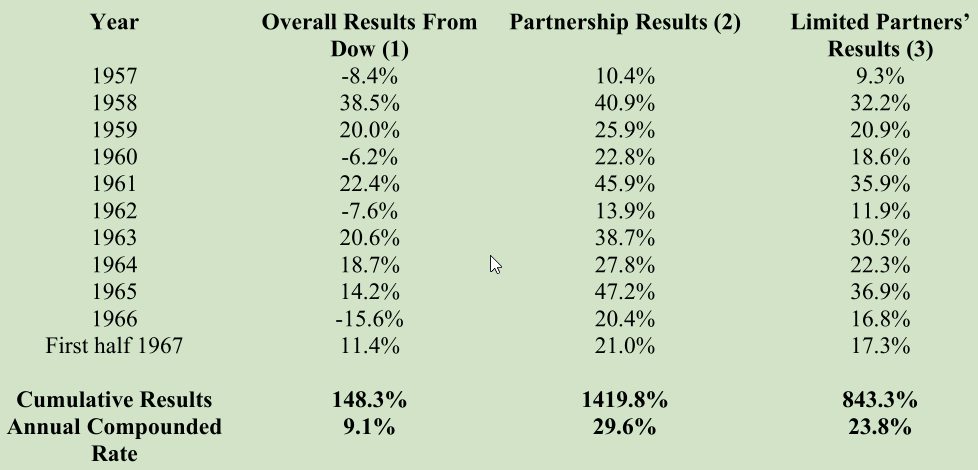

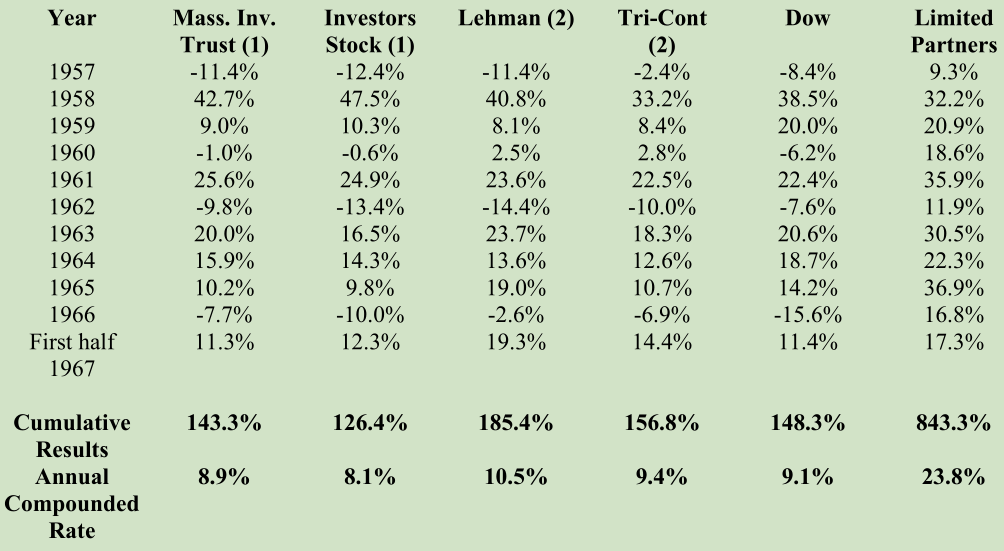

1967年,我们一开局就很受伤,一月份表现惨淡,道指上涨8.5%,合伙基金上涨3.3%。尽管开局不利,上半年结束之时,我们还是取得了21%的收益率,领先道指9.6个百分点。今年上半年和去年一样,打败道指比较容易(很多人觉得战胜道指很容易,不可能每年都如此),很多基金经理都跑赢了道指。按照惯例,下表汇总了我们上半年的业绩:

(1)根据道指年度涨跌计算,其中包含股息。表格中为合伙基金整年运作的年份。

(2)1957-61年的数据是之前全年管理的所有有限合伙人账户的综合业绩,其中扣除了经营费用,未计算有限合伙人利息和普通合伙人分成。

(3)1957-61年的数据按前一列合伙基金收益率计算得出,按照当前合伙协议,扣除了普通合伙人分成。

在合伙基金上半年业绩统计中,控股公司的估值保持不变,我们的收益完全来自有价证券投资。今年年初,我们投资有价证券的部分占净资产的63.3%。

在12月份承诺书最终生效之前,我们会考虑所有相关情况(包括经营、市场和信用情况),决定是否对多元零售公司(Diversified Retailing Company,DRC)和伯克希尔·哈撒韦公司重新估值。

上半年,多元零售公司和伯克希尔哈撒韦公司都进行了大型收购。多元零售公司(我们持有80%股份)及其两个子公司(霍赫希尔德科恩公司(Hochschild Kohn)和联合棉布商店(Associated Cotton Shops))都非常令人满意。纺织行业的伯克希尔哈撒韦却步履维艰。虽然现在我没看到它的内在价值有任何减损,但是它的纺织业务是不可能取得像样的资产回报率了。如果道指继续上涨,投资组合中的伯克希尔纺织业务会严重拖累我们的相对表现(今年上半年就是如此)。在市场强劲上涨时,控股公司的相对表现较弱是意料之中的,但是如果控股公司本身的业务也没起色,那就麻烦了。我一个朋友有句话说得好:“想要的东西没得到,就得到了经验。”(Experience is what you find when you're looking for something else.)

基金公司

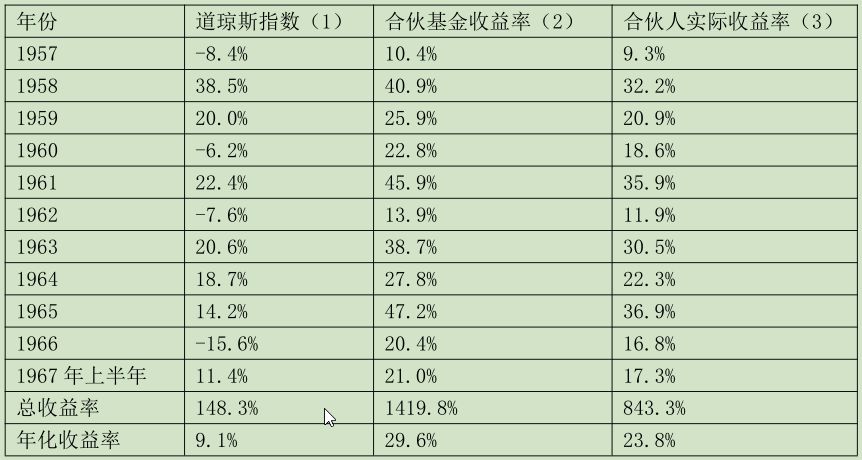

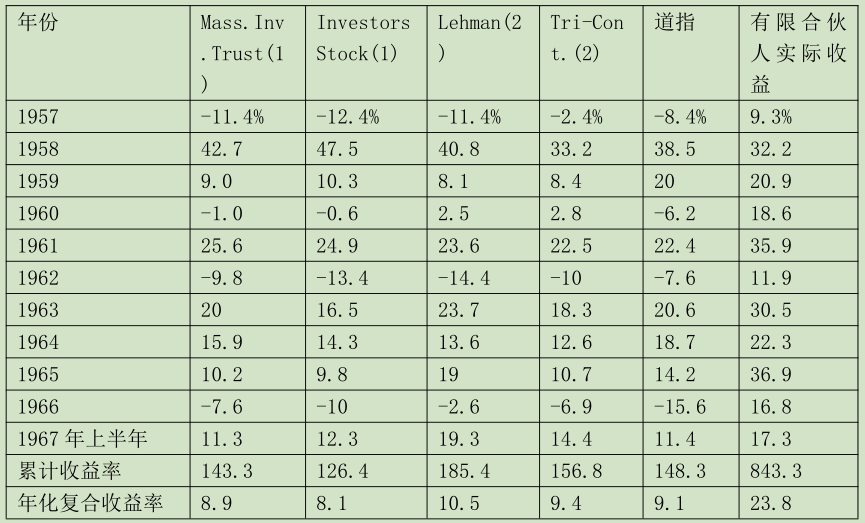

与往常一样,下面是合伙基金与股票投资占95-100%的最大的两只开放式股票型基金(共同基金)和最大的两只封闭式基金的对比情况。

(1)计算包括资产价值变化以及当年持有人获得的分红。

(2)来源:1967 Moody's Bank&Finance Manual for 1957-1966。1967年上半年数据为估算值。

主要还是靠潮涨潮落,不是游泳的真本事。

〔译文来源于梁孝永康所编《巴菲特致合伙人+致股东的信全集》〕