巴菲特致合伙人的信(1967年)

①业绩②基金公司

1968年1月24日

1967年业绩

按照大多数标准衡量,我们1967年的业绩都相当好。我们整体上涨35.9%,道指上涨19.0%,超过了我们原来定下的领先道指十个百分点的业绩目标。我们的整体收益是19,384,250美元,即使在今天通胀日益加剧的情况下,也能买很多百事可乐。我们卖出了一些重仓长期持有的有价证券,实现了27,376,667美元的应税收入,这与1967年业绩无关,但是4月15日那天,各位都应该会有一种积极参与了“伟大社会”建设的感觉。(译注:“伟大社会”(The Great Society)是1964-1965年民主党总统林登·约翰逊提出的旨在消灭贫穷和种族歧视的一系列政策。4月15日是美国申报个税的截止日。)

我们为我们的业绩感到欣喜,但近距离观察一下1967年的股市,就会冷静下来。或许历史上没有哪一年像去年这样,市场中有那么多人远远跑赢道指。1967年,对于许多人来说,天上掉金子了,盆越大的,接的越多。现在我手里还没有最终的统计数据,但是估计95%以上的股票型基金都取得了领先道指的业绩,很多甚至把道指远远甩在了后面。去年,赚钱多少和年龄大小成反比,理念像我这样的,得被送到老年病房了。

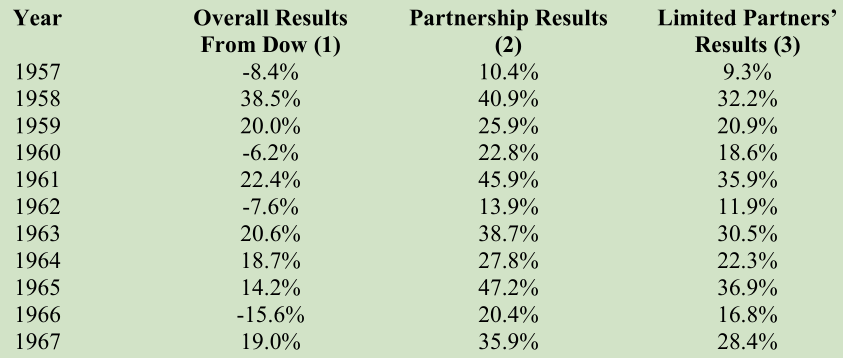

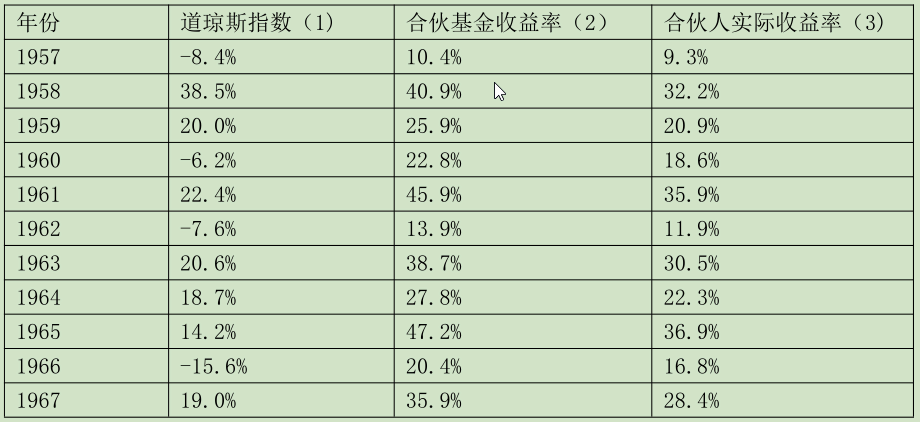

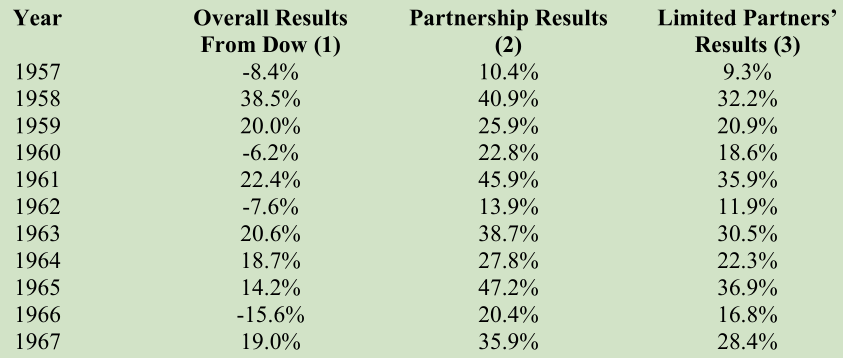

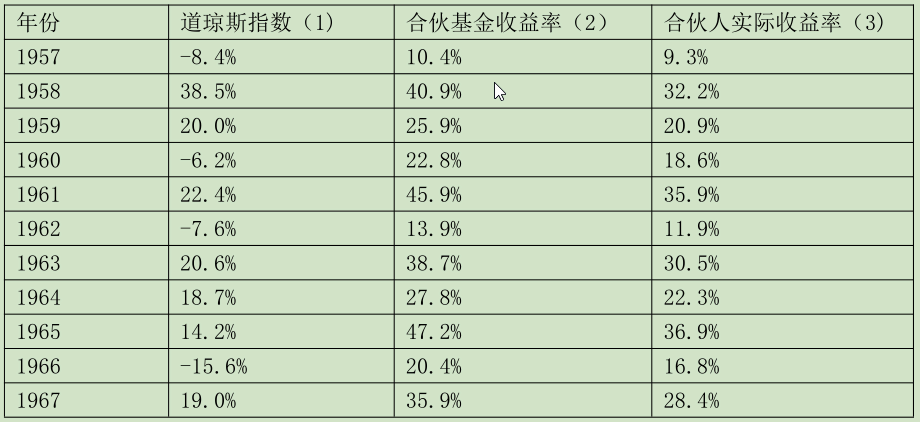

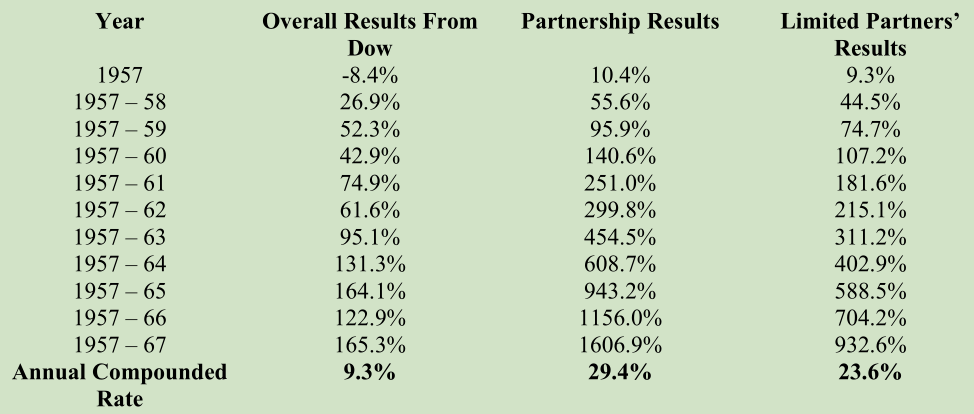

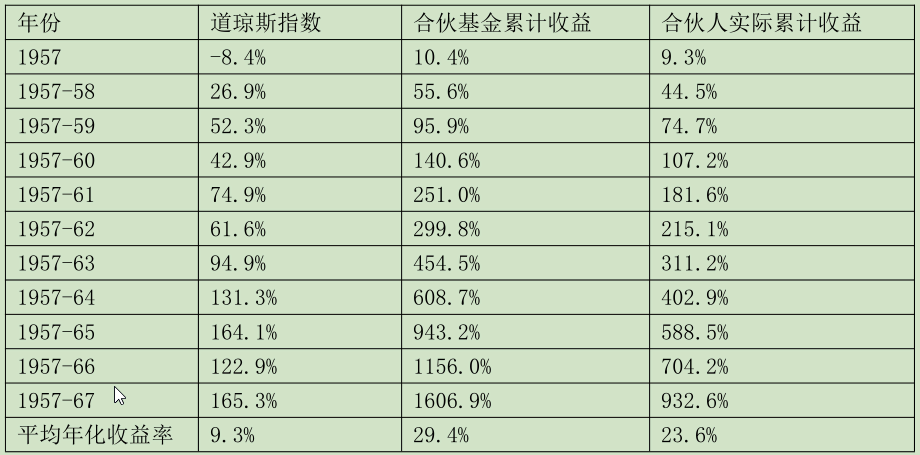

下面是道指收益率、普通合伙人分成前合伙基金收益率(收益超过6%的部分,普通合伙人提取25%)以及有限合伙人收益率的最新逐年对比情况。

(1)根据道指年度涨跌计算,其中包含股息。表格中为合伙基金整年运作的年份。

(2)1957-61年的数据是之前全年管理的所有有限合伙人账户的综合业绩,其中扣除了经营费用,未计算有限合伙人利息和普通合伙人分成。

(3)1957-61年的数据按前一列合伙基金收益率计算得出,按照当前合伙协议,扣除了普通合伙人分成,未计算有限合伙人的每月提现。

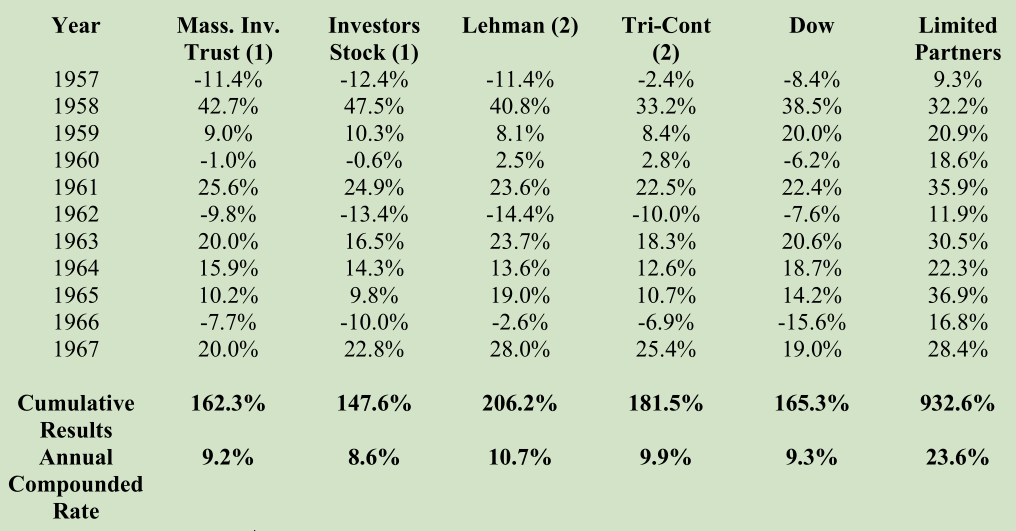

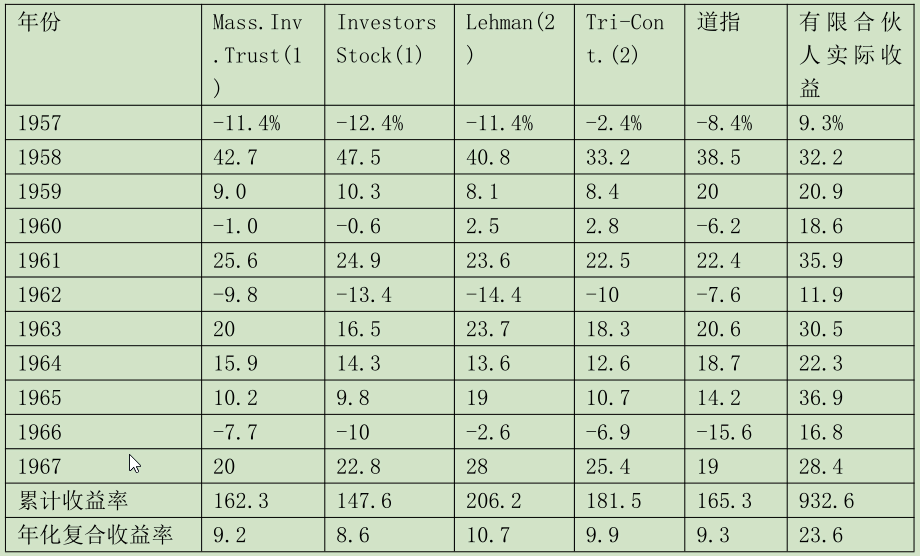

下表是累计收益率或复合收益率:

基金公司

和往常一样,下面是股票投资占95-100%的最大的两只开放式股票型基金(巴菲特合伙基金成立之初,这两只基金是规模最大的,今年德莱弗斯基金(Dreyfus Fund)超过了它们)和分散投资的最大的两只封闭式股票型基金的业绩,与合伙基金的收益率的对比情况。

(1)计算包括资产价值变化以及当年持有人获得的分红。

(2)来源:1967 Moody's Bank&Finance Manual for 1957-1966。1967年数据为估算值。

我在去年的信中说过:

“有一些基金和一些私募机构,它们创造的业绩记录远远高于道指,其中有些也远远高于巴菲特合伙基金。它们的投资方法一般和我们不一样,不在我的能力范围之内。”

1967年,这个情况更加明显。许多机构的业绩远远领先巴菲特合伙基金,收益率高达100%以上的不在少数。在如此靓丽的收益面前,大量资金、人才和精力汇集到一起,不遗余力地追求在股市迅速捞一笔。在我眼里,这是投机风气盛行,其中隐藏着风险,但是许多当局者肯定会矢口否认。

本·格雷厄姆是我的良师益友,他说过一句话:“投机不缺德、不犯法,也发不了家。”去年,有人天天吃投机的糖,吃成了大胖子,赚了很多钱。虽然我们还是吃燕麦,但是什么时候整体股市都患上消化不良,别以为我们能不疼不痒。

〔译文来源于梁孝永康所编《巴菲特致合伙人+致股东的信全集》〕