巴菲特致合伙人的信(1968年)

①业绩②基金公司

1969年1月22日

1968年业绩

谁都有犯错的时候。

1968年年初,我对巴菲特合伙基金的前景感到前所未有的悲观,但是,去年我们实现了40,032,691美元的总收益。主要是因为我们抓住了一个很简单、很合理的机会,这个机会正好成熟了(投资机会像女人一样,招人喜欢,却难以捉摸)。

我相信各位都保持着知识分子的纯洁性,不会把上面的收益数字当回事,而是希望我报告一下相对道指的表现。去年,将股息计算在内,道指的收益率是上涨7.7%,我们的收益率是上涨58.8%,创造了新纪录。大家应该把这个业绩看成是极端异常情况,就像在桥牌中一连抓了13张黑桃,你叫到大满贯,却不动声色,把钱装在兜里,继续打下一局。我们也会有运气不好的时候。

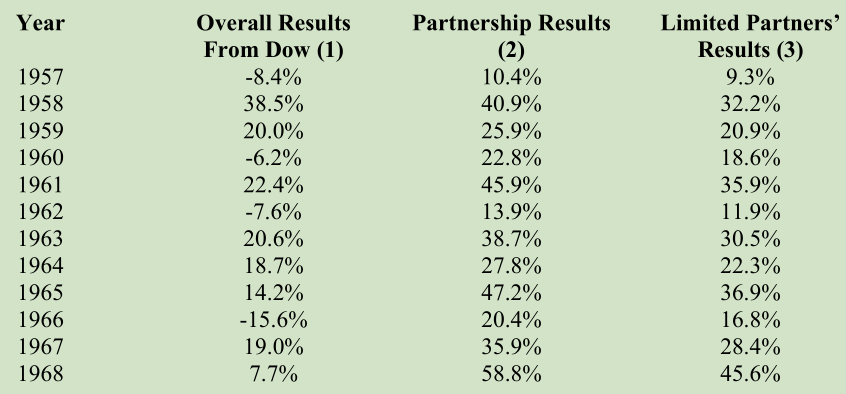

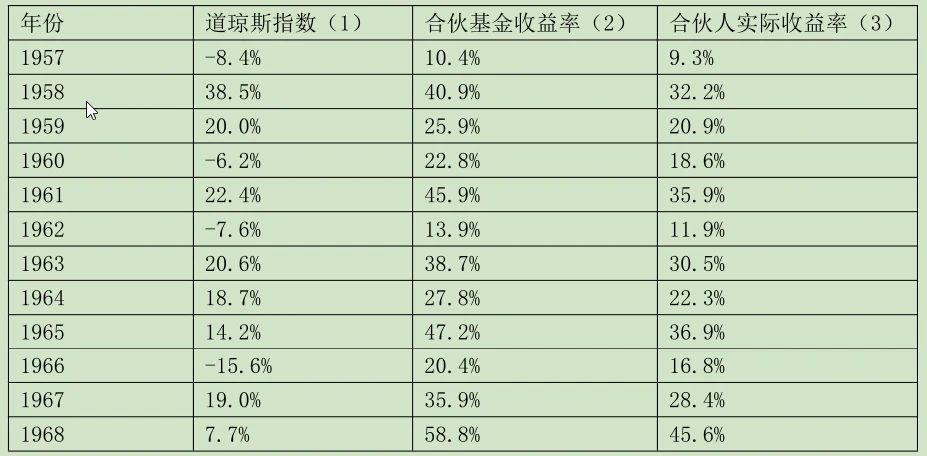

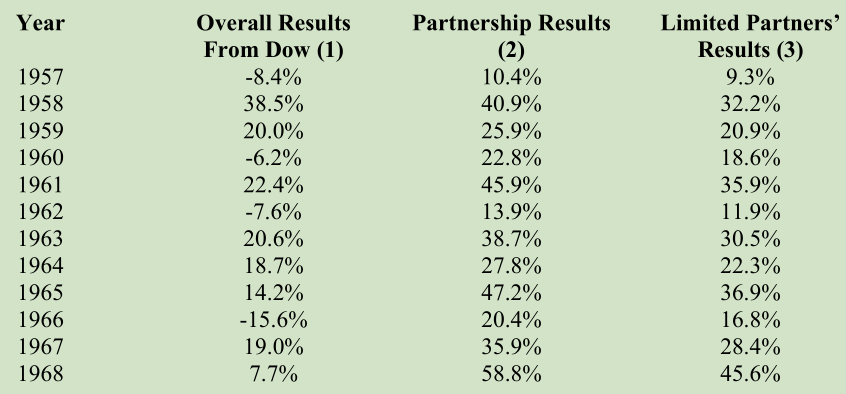

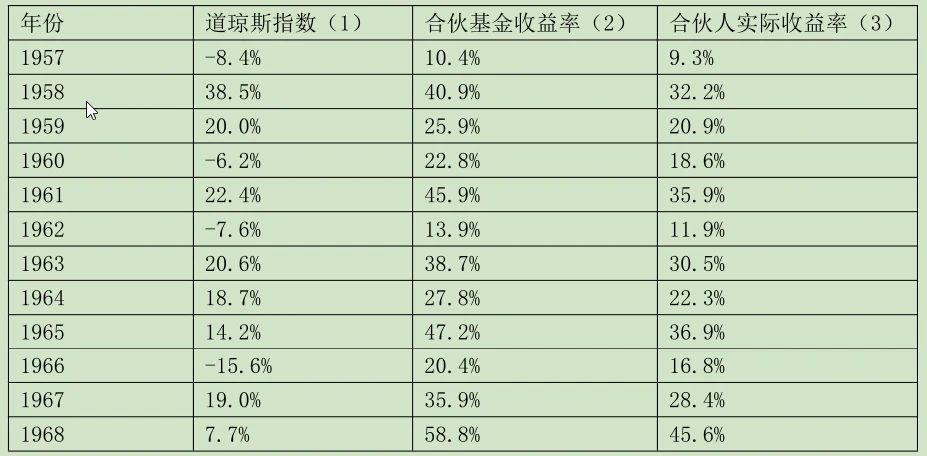

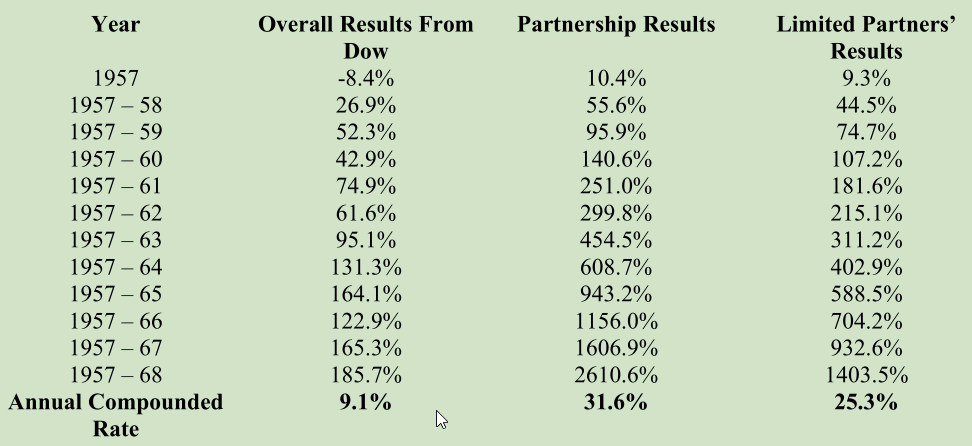

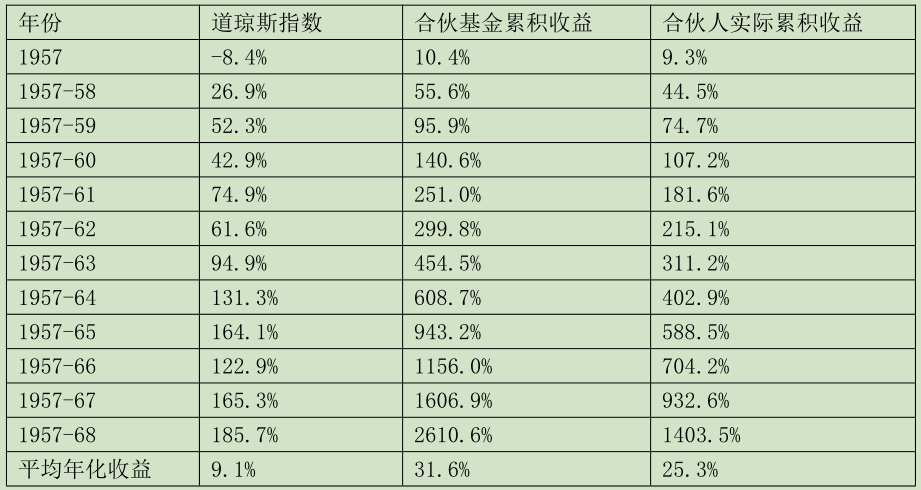

下面是道指收益率、普通合伙人分成前合伙基金收益率(收益超过6%的部分,普通合伙人提取25%)以及有限合伙人收益率的最新逐年对比情况。

(1)根据道指年度涨跌计算,其中包含股息。表格中为合伙基金整年运作的年份。

(2)1957-61年的数据是之前全年管理的所有有限合伙人账户的综合业绩,其中扣除了经营费用,未计算有限合伙人利息和普通合伙人分成。

(3)1957-61年的数据按前一列合伙基金收益率计算得出,按照当前合伙协议,扣除了普通合伙人分成。

下表是累计收益率或复合收益率:

基金公司

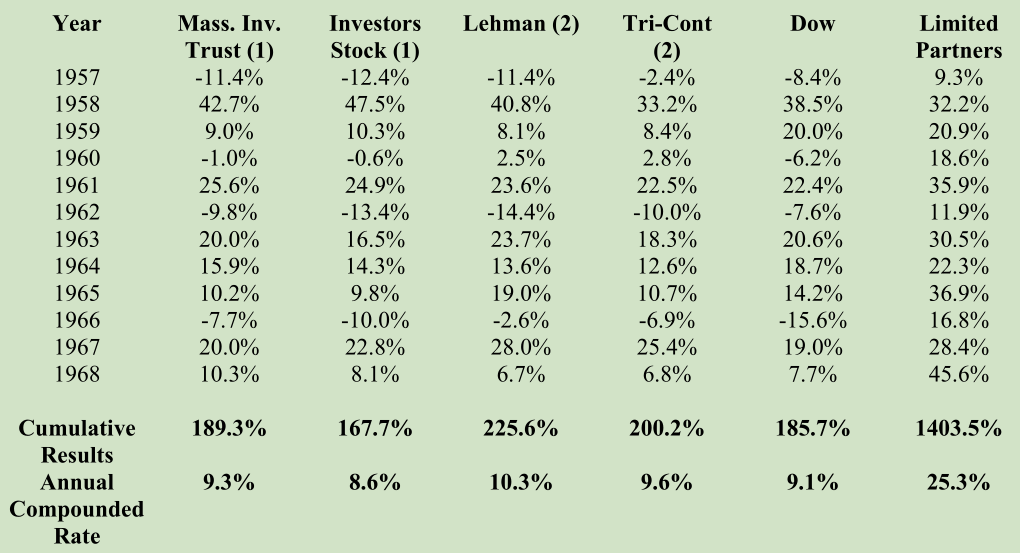

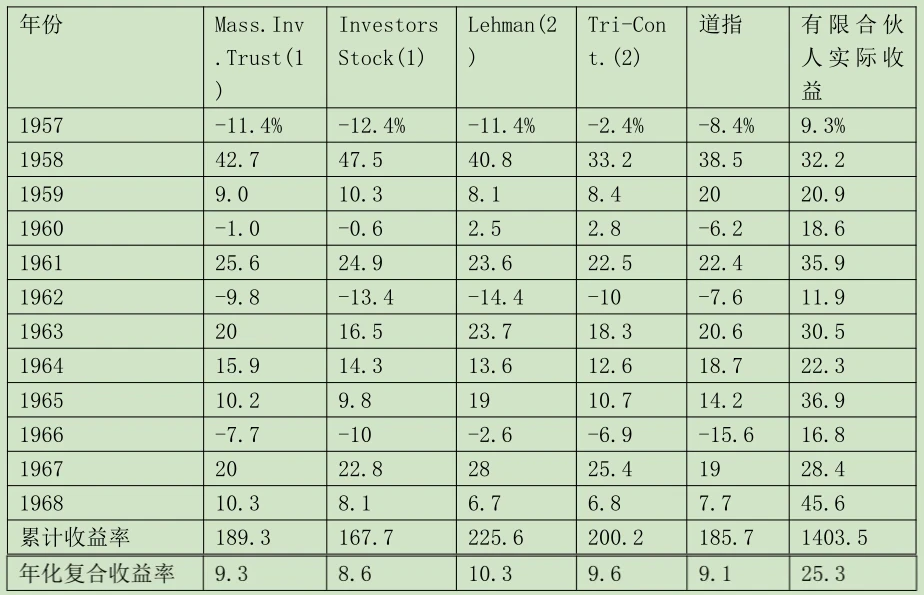

和往常一样,下面是股票投资占95-100%的最大的两只开放式股票型基金(从1957年到1966年,这两只基金是规模最大的,现在是第二大和第三大)以及分散投资的最大的两只封闭式股票型基金的业绩,与合伙基金的收益率的对比情况。

(1) 计算包括资产价值变化以及当年持有人获得的分红。

(2)来源:1968 Moody's Bank&Finance Manual for 1957-1967。1968年数据为估算值。

12年过去了,这四只基金目前管理50多亿美元的总资产,占基金行业总规模的10%以上,但是按年化复合收益率计算,他们的平均收益率竟然才比道指高零点几个百分点。

前几年高歌猛进的一些基金最近偃旗息鼓了。在投资风格激进的基金公司中,蔡至勇(Gerald Tsai)的曼哈顿基金(Manhattan Fund)最负盛名,但它1968年只取得了亏损6.9%的业绩。1968年,很多规模较小的基金继续大幅跑赢大市,但是与前两年跑赢大市的基金数量相比,就少多了。

在往年的信中,每次写到基金公司这部分,我经常斥责基金公司慵懒散慢,现在很多基金公司来了个一百八十度大转弯,变得高度紧张了。有一家基金公司(这家基金公司历史悠久,一说名字各位肯定知道)的基金经理掌管着10亿美元以上的资金,1968年,在发行一只新产品时,他说:

“国内国际经济环境日益复杂,资产管理已成为全天候工作。一位称职的基金经理研究证券不能只看每周或每天的情况。研究证券,必须关注每一分钟的动向。”

哇喔!

听他这么一说,我每次起身去拿百事喝都感到惭愧。掌管着大笔资金的人像打了鸡血一样,而且这样的越来越多,股票就那些,谁都不知道最后的结果会怎样。这个场面,看起来很热闹,也很吓人。

〔译文来源于梁孝永康所编《巴菲特致合伙人+致股东的信全集》〕