巴菲特致股东的信(1981年)

⑥报告收益来源

报告收益来源

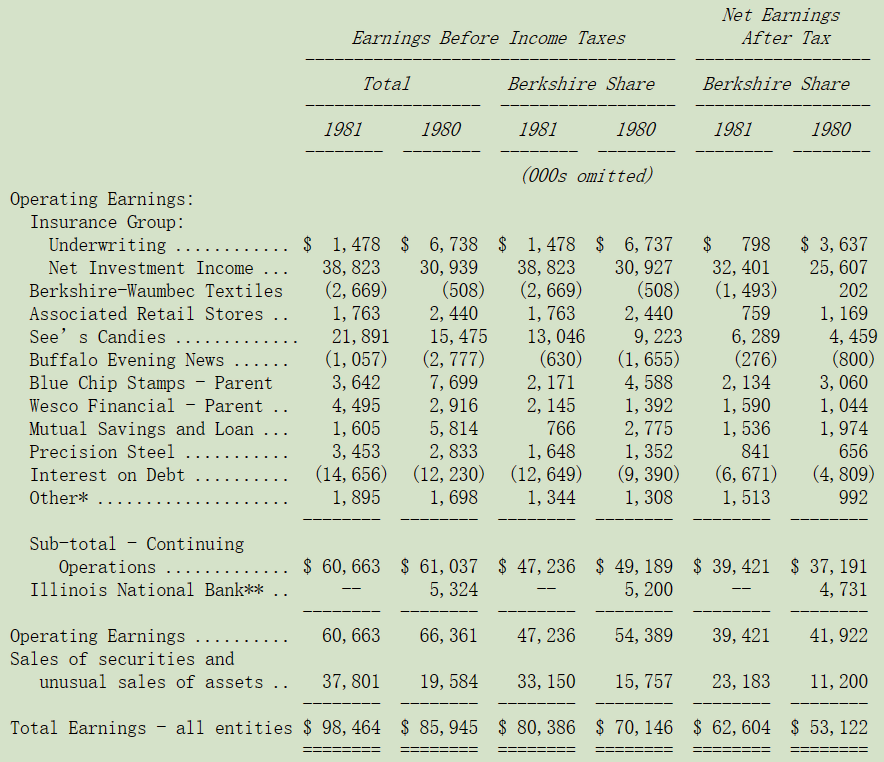

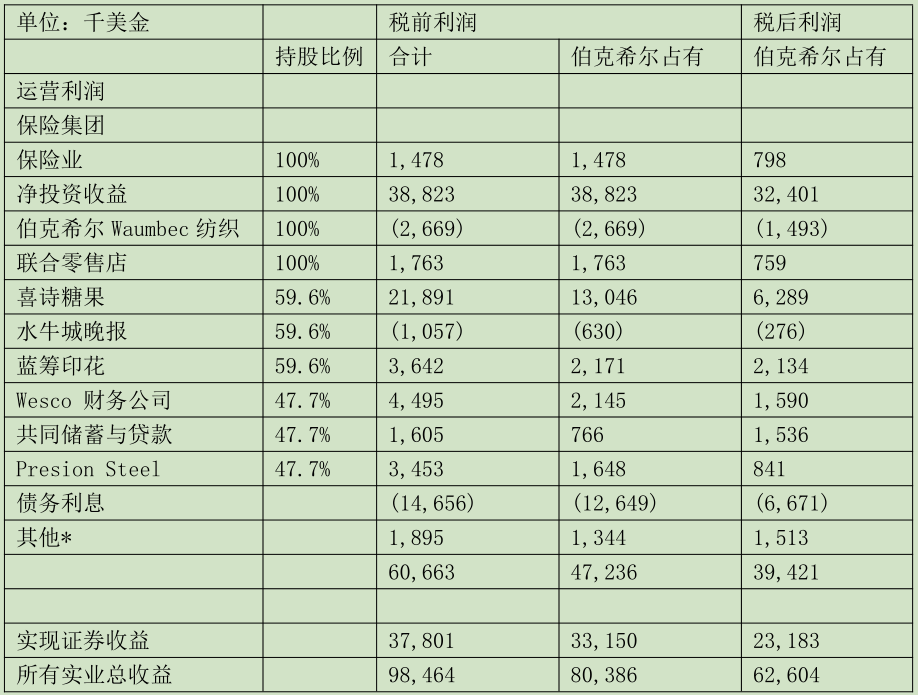

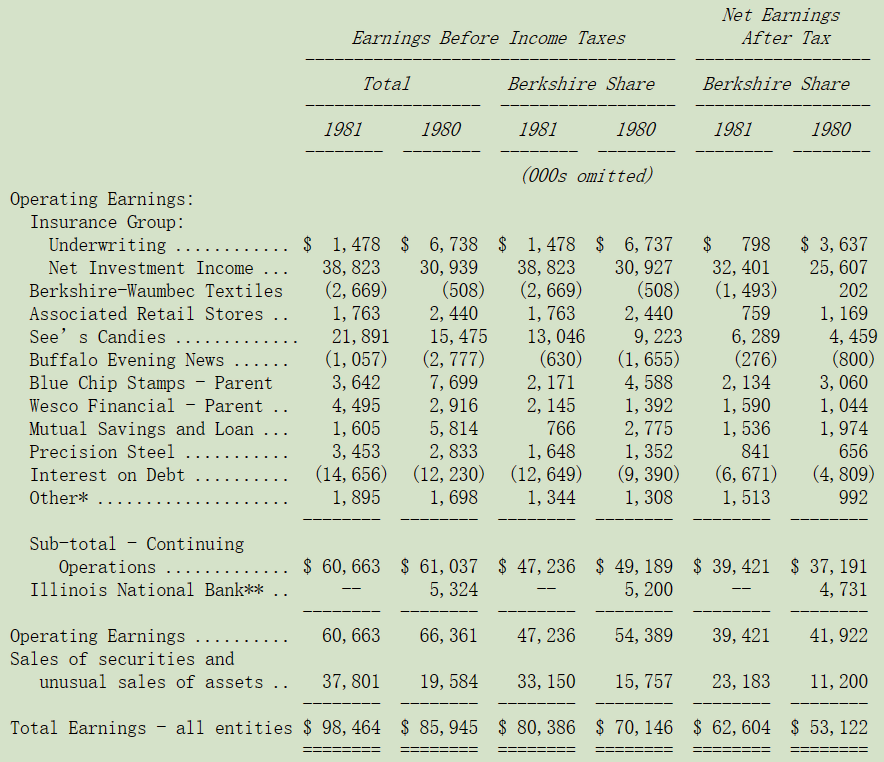

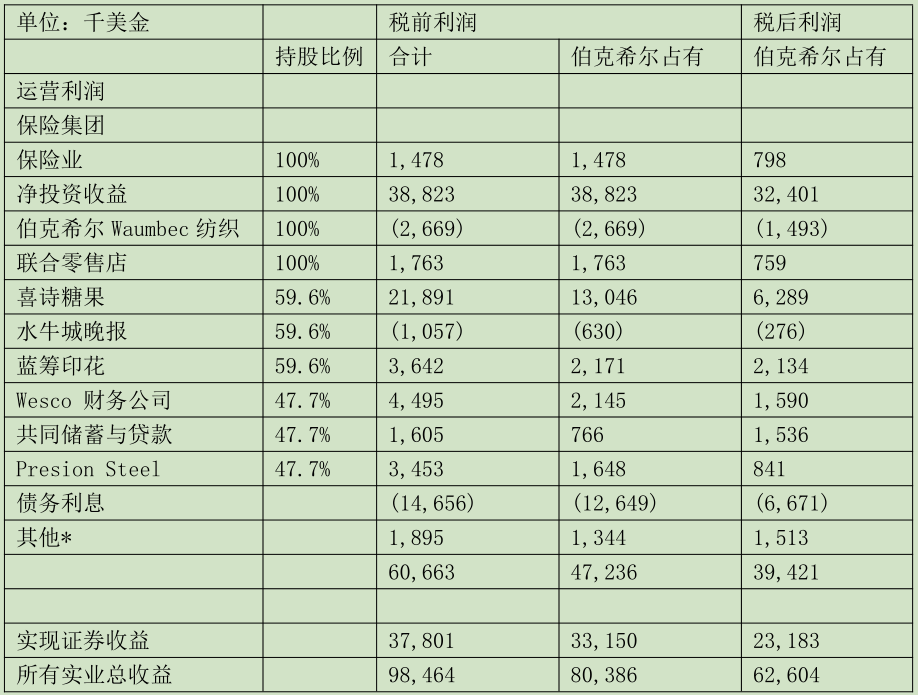

下表显示了伯克希尔公布的收益来源。伯克希尔拥有蓝筹印花公司约60%的股份,而蓝筹印花公司又拥有维斯科金融公司80%的股份。这个表格显示了各种商业实体的总营业收益,以及伯克希尔在这些收益中的份额。任何业务实体因异常出售资产而产生的所有重大损益,均与表底一行的证券交易收益进行了汇总,但不包括在营业收益中。

*1 包含购并企业商誉的摊销(如See's Candies; Mutual; Buffalio Evening News等)

*2 Illinois National Bank已于1980.12.31从伯克希尔脱离出去

蓝筹印花和维斯科都是上市公司,有自己的报告要求。在本报告第38-50页,我们转载了两家公司首席执行官的叙述性报告,他们在报告中描述了1981年的业务。任何一家公司的完整年度报告副本都将邮寄给伯克希尔股东,请向Robert H. Bird先生(Blue Chip Stamps, 5801 South Eastern Avenue, Los Angeles, California 90040)或Jeanne Leach夫人(Wesco Financial Corporation, 315 East Colorado Boulevard, Pasadena, California 91109)索取。

就像先前我们所提到的,不具控制权的股权投资其已分配的盈余已列示于保险事业的投资收益之中,但未分配盈余占本公司的重要性已不下于前面表列的帐面盈余。

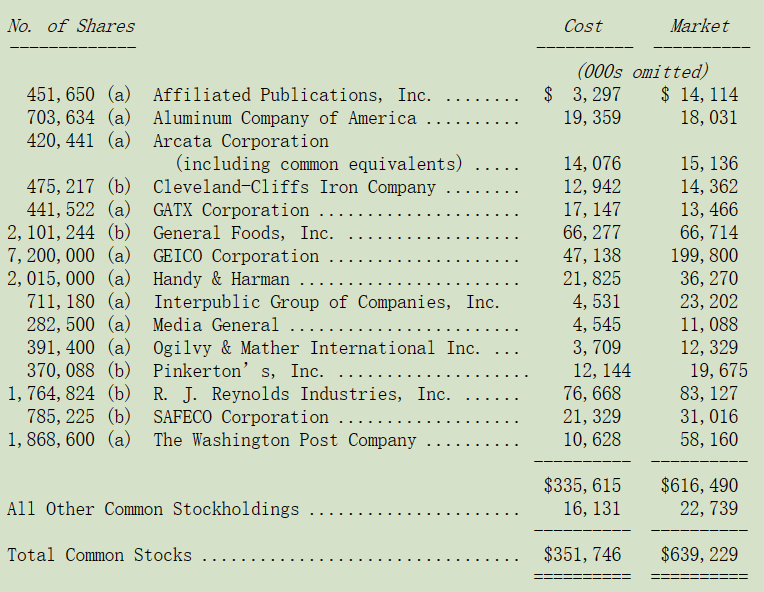

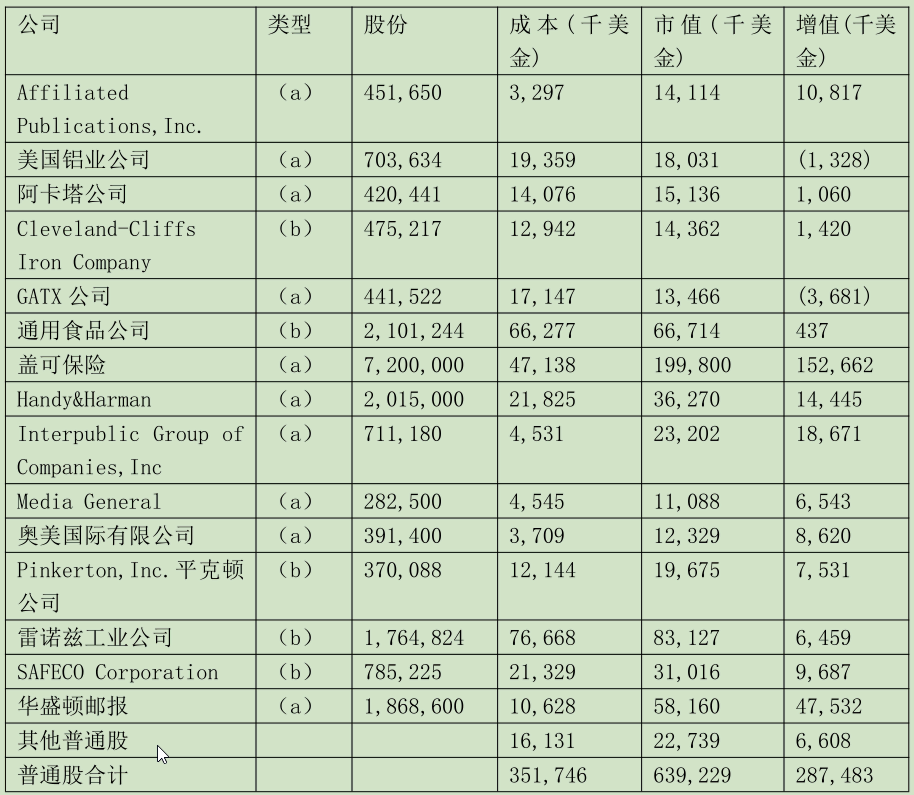

我们在下面展示了伯克希尔在那些只包括分配收益(股息)的非控股企业中的比例持股。

(a)代表全部股权由伯克希尔及其子公司所持有

(b)代表由伯克希尔子公司Blue Chip与Wesco所持有,依伯克希尔持股比例换算得来。

我们的控股和非控股业务遍布各行各业,所以恕我无法在此赘述。更多的财务资料载于第34-37页的管理层讨论和第38-50页的叙述性报告。然而,我们最大的控股和非控股业务领域一直是,而且几乎肯定会继续是财产保险领域,所以对该行业的重要发展进行说明是有必要的。

〔译文基于梁孝永康所编《巴菲特致合伙人+致股东的信全集》修改完善〕