巴菲特致股东的信(1981年)

⑦保险业状况

保险业状况

“预测”如同SamGoldwyn所说的是相当危险的,尤其是那些有关对未来的预测,(伯克希尔的股东在过去几年的年报中读到你们的董事长对纺织业未来的分析后,可能也会深有同感。)

但若预测1982年的保险业承销会很惨,那就不会有什么好怕的了,因为结果已经由目前同业的杀价行为加上保险契约的先天性质获得了印证。

当许多汽车保险保单以六个月为期来定价并发售,而许多产物保险以三年为期,而意外保险同业一般流通的期间则略低于十二个月,当然价格在保险有效的期间内是固定的,因此今年销售的合约(业内的说法,称之为保费收入)大概会决定明年保费收入的一半,而另外一半则由明年签下的保险契约来决定,因此获利的情况自然而然会递延,也就是说若你在定价上犯了错误,那你所受的痛苦可能会持续一阵子。

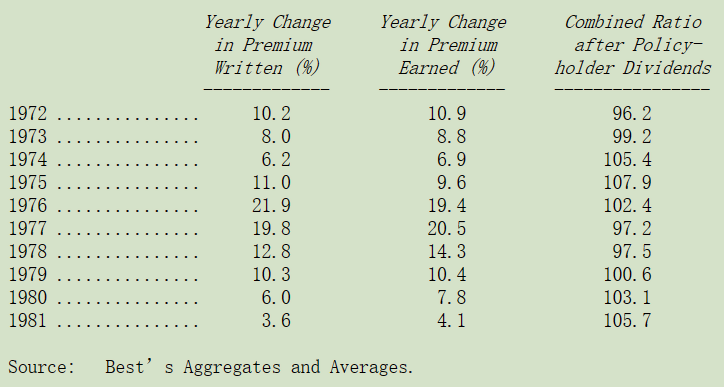

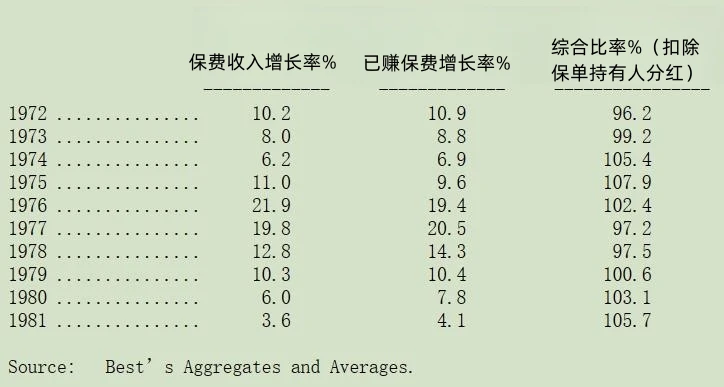

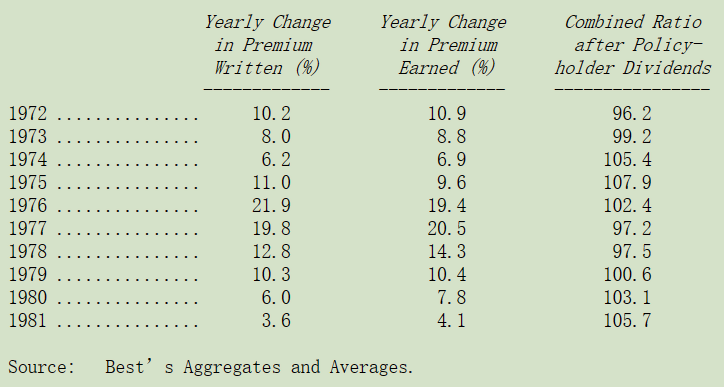

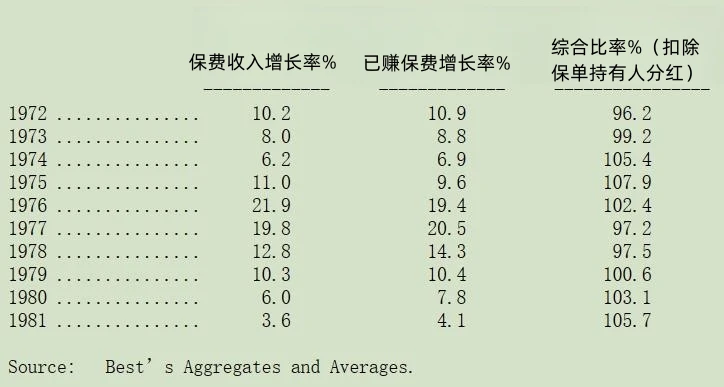

注意下表所列为每年保费收入成长率与其对当年与隔年度获利的影响,而结果正如同你所预期的一样,当保费收入以二位数成长,则当年与隔年的获利数字就会很好看,但若保费收入仅能以个位数成长,则表示承销结果就会变得很差。

下表反映一般同业所面临的情势,综合比率表示所有营运成本加上理赔损失占保费收入的比率,百分之一百以下表示有承保利益,反之则表示有损失:

诚如Pogo所说:“未来绝不会与过去相同”。现在的订价习惯已注定日后悲惨的结果,尤其若因近几年无重大灾难所得的喘息机会结束时。保险承保的情况会因大家运气好(而非运气坏)而变差,近几年来飓风大多仅停留在海上,同时摩托车骑士较少在路上跑,但他们不会永远都那么守规矩。

当然货币与社会的双重通胀是无法抵挡的(法院与陪审团对保险投保范围认定超越合约与判例的扩张),财产修复与人身医疗等这些被视为保险合同义务的成本也无情的不断增加。

若没遇上什么倒霉事(如大灾难或驾驶行为增加等)同业保费收入平均至少要增加十个百分点才能使1982年的承销比率不会再恶化(大部份同业估计承担损失每年以十个百分点成长,当然大家都期望自己公司成长较少)。保费年增长率低于10%均衡数字的每一个百分点都会加快恶化的速度。1981年的季度数据突显了这样一个结论:糟糕的承保状况正在加速恶化。

在1980年的年报中,我们讨论了一些投资政策,这些政策破坏了许多保险公司资产负债表的完整性,迫使它们放弃承保纪律,不惜一切代价承保业务,以避免出现负现金流。很明显,持有大量不合理高估的债券(从会计角度来看)的保险公司,它们别无选择,只能以低得离谱的价格出售大量保单,以保持资金周转。这些保险公司对业务量大幅下降的担忧,肯定超过了对承保损失的担忧。

但不幸的是,所有保险公司都受到了影响,因为很难在定价上与你最受威胁的竞争对手有很大不同。这种压力有增无减,并迫使愈来愈多的同业跟进,盲目追求规模而非盈利能力,害怕失去的市场占有率永远无法恢复。

无论原因是什么,即使大家一致认同费率极不合理,我们认为没有一家保险业者,能够承受现金极度流出的情况下不接任何保单,而只要这种心态存在,则保单价格将持续面临调降压力。

产业专家认为保险行业是景气周期循环的,并且长期而言承保损益接近两平。对此我们则持不同的看法,我们相信承保面临巨额损失(虽然程度不一)将成为保险业界的常态,未来十年内最好的表现在以往仅能算得上是普通而已。

虽然面临持续恶化的未来,伯克希尔的保险事业并无任何良方,但我们经营阶层却已尽力力争上游,虽然承保数量减少了,但承保损益相较于同业仍显优越。展望未来,伯克希尔将维持低保单的现状,我们的财务实力使我们能保持最大的弹性,这在同业间并不多见。而将来总有一天,当同业保单接到怕之时,伯克希尔的财务实力将成为营运发展最有利的后盾。

我们认为盖可保险在我们非控股的主要股权投资中更是个中翘楚,它堪称企业理念的最佳实践典范。

〔译文基于梁孝永康所编《巴菲特致合伙人+致股东的信全集》修改完善〕