巴菲特致股东的信(1983年)

④账面盈余来源

帐面盈余来源

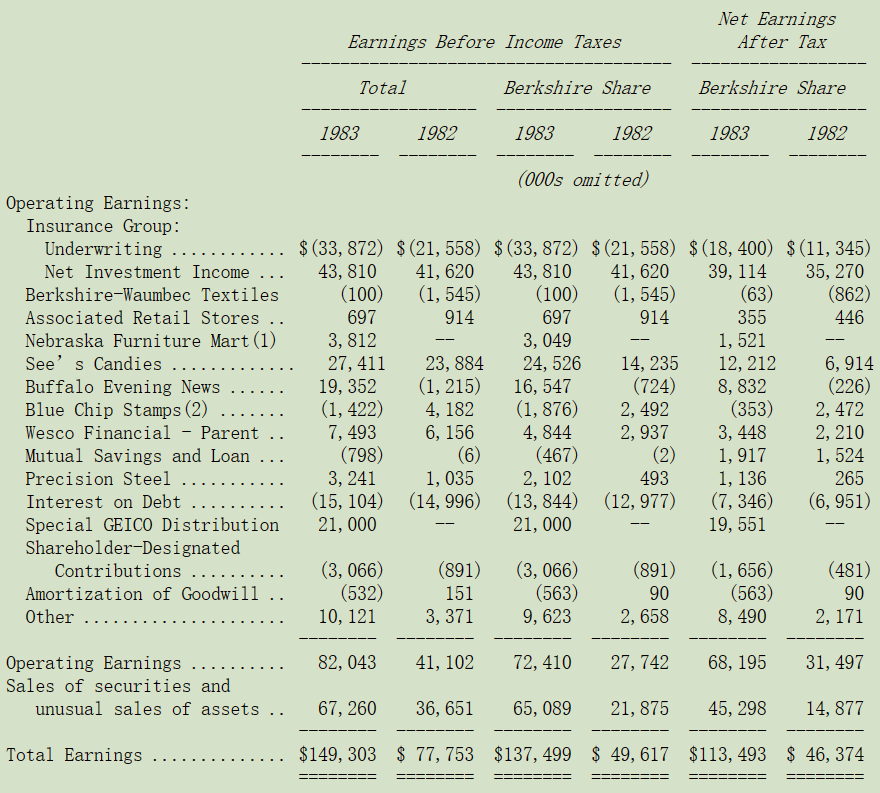

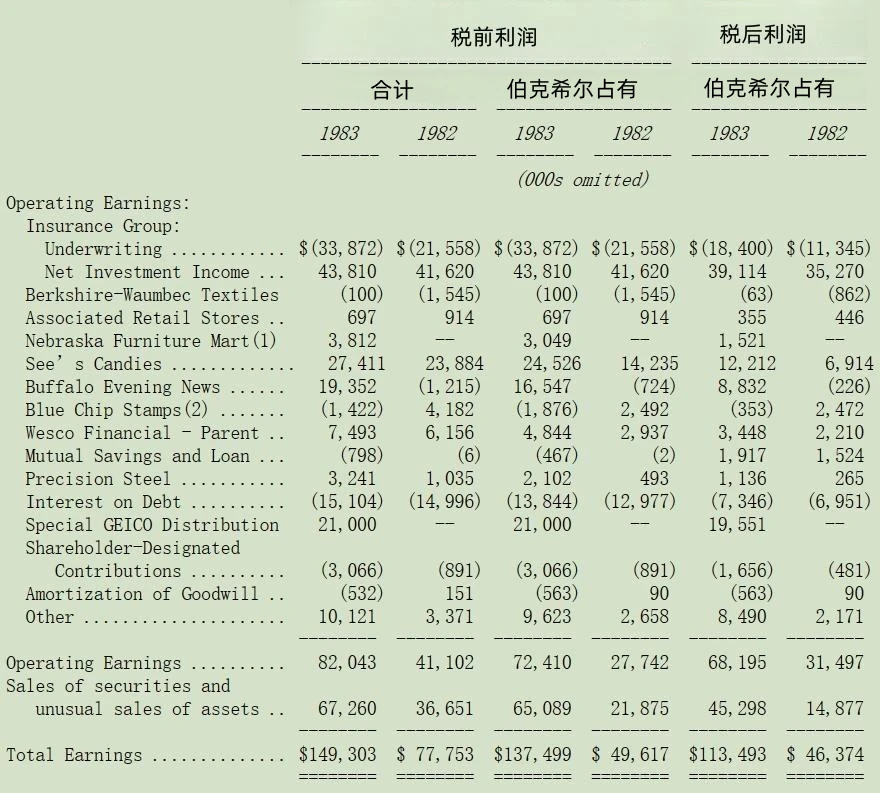

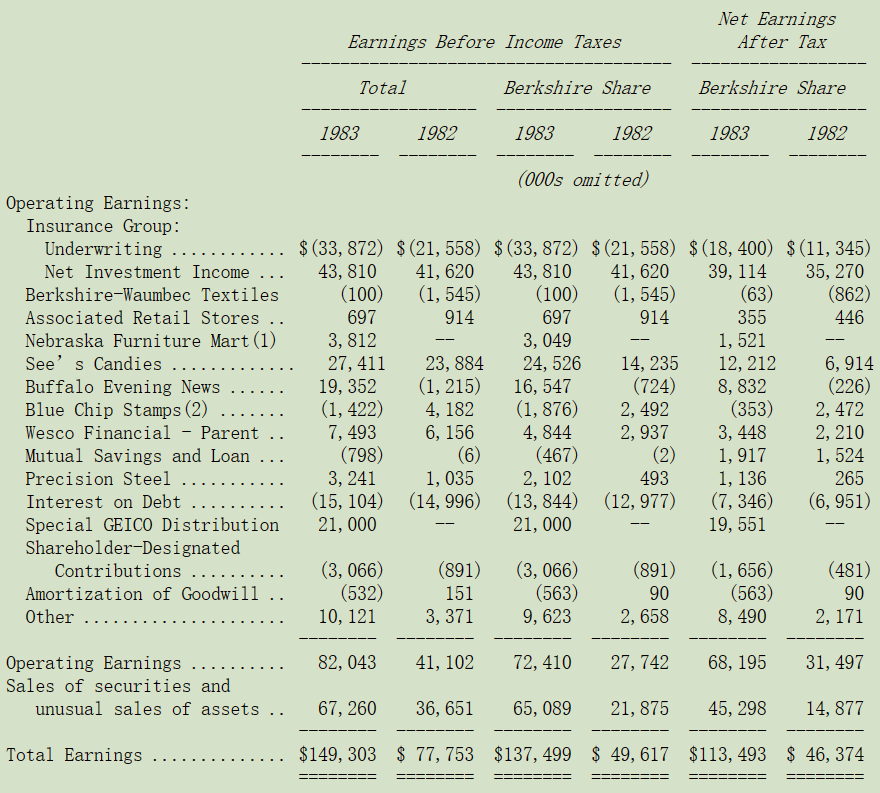

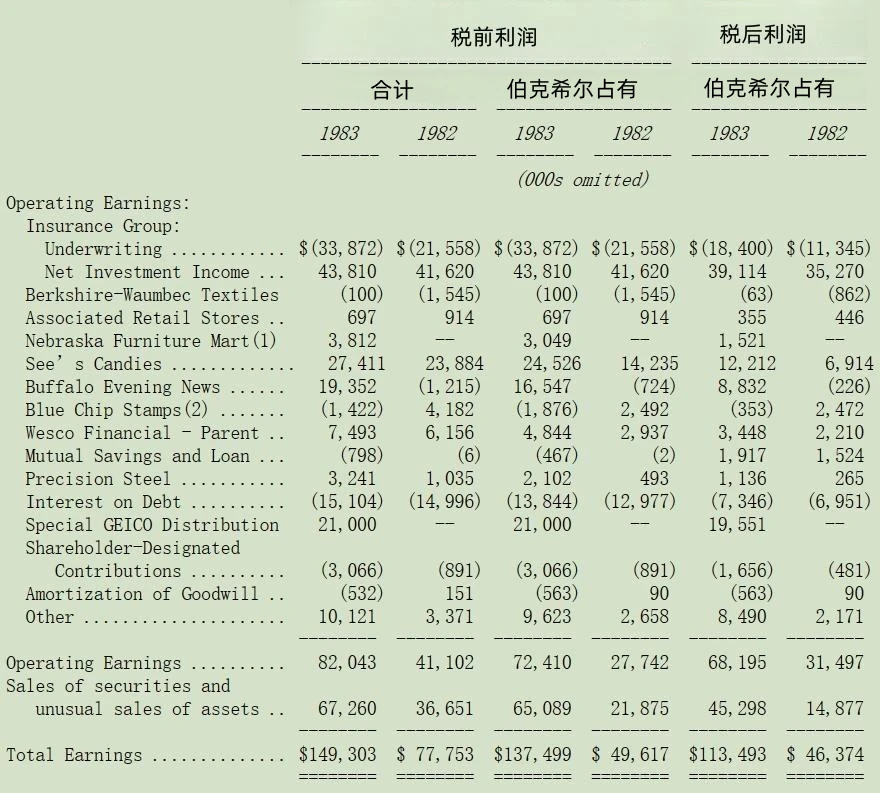

下表显示伯克希尔依照各个公司持股比例来列示帐面盈余的主要来源。在1982年伯克希尔拥有蓝筹印花60%的股权,但到了1983年下半年这个比例增加到100%,而蓝筹印花又拥有Wesco财务公司80%的股权,故伯克希尔间接拥有Wesco的股权亦由48%增加到80%。表的前两列提供了基础业务表现的最佳度量。

各个公司资本利得损失并不包含在内而是汇总于下表最后“已实现出售证券利得”一栏(我们认为单一年度的出售证券利得并无太大意义,但每年加总累计的数字却相当重要),至于商誉的摊销不从具体业务中扣除,而是以单一字段另行列示,原因在附录中概述。

(1) 10月至12月

(2) 1982年与1983年不具有可比性;主要资产在合并中转换。

有关Wesco旗下事业会在查理的报告中讨论,他在1983年底接替Louie Vincenti成为Wesco的董事长,Louie由于身体健康的关系以77岁年纪退休,有时健康因素只是借口,但是Louie这次情况确是事实,他实在是一位杰出的经理人。

盖可保险的特别股利系由于该公司自我们及其它股东手中买回自家股票,经过买回后我们持有的股权比例仍维持不变,整个买回股权的过程其实等于是发放股利一样,不像个人,由于企业收到股利的实际联邦税率6.9%较资本利得税率28%低得许多,故前者可让公司股东获得更多实质收益。

而即使把前述特别股利加入计算,我们在1983年从盖可保险所收到的现金股利还是远低于我们依比例所赚到的盈余,因此不论从会计或经济的角度来说,将这项额外收入计入盈余当中是再适当也不过了,但由于金额过于庞大因此我们必需特别加以说明。

前表告诉大家我们盈余的来源,包括那些不具控制权的股权投资所收到的现金股利,但却不包括那些未予分配的盈余,就长期而言,这些盈余终将反映在公司的股票市价之上,而伯克希尔的内含价值亦会跟随着增加,虽然我们的持股不一定表现一致,有时让我们失望,但有时却会让我们惊喜,到目前为止,情况比我们当初预期的还要好,总得来说,最后所产生的市场价值要比当初我们保留的每一块钱还要高。

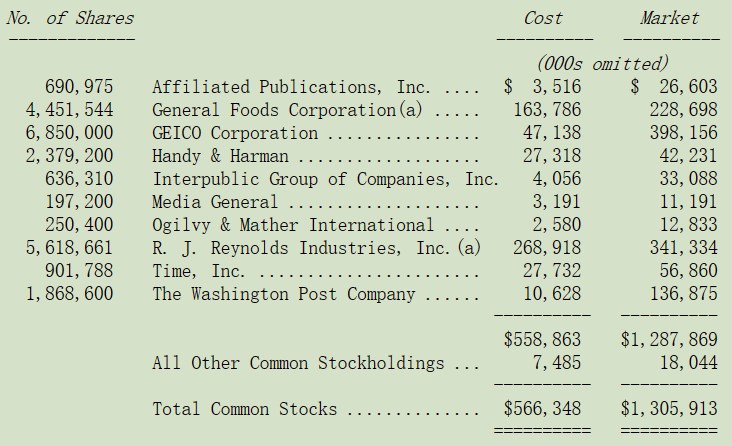

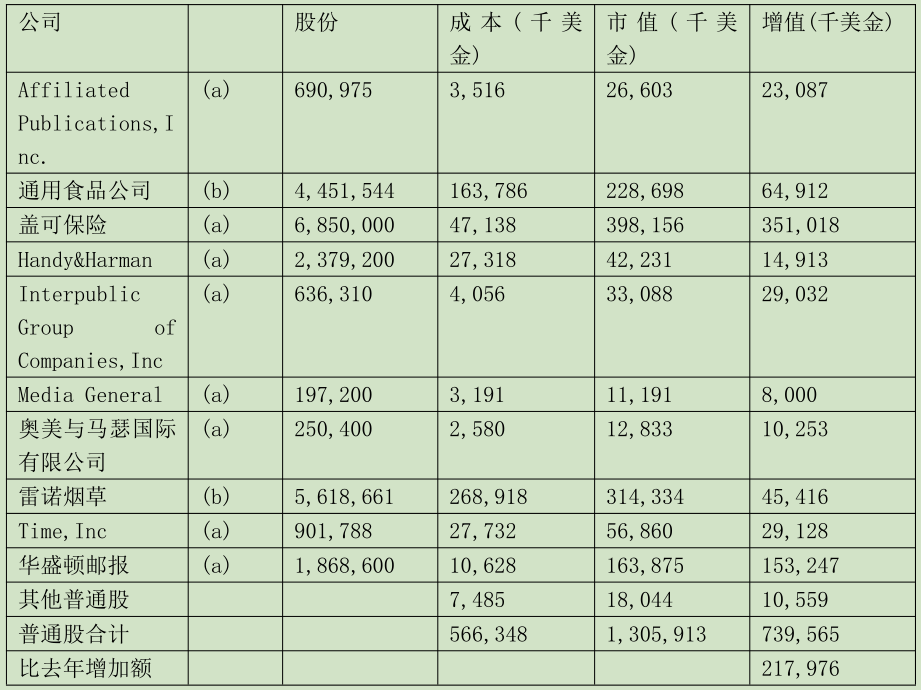

下表显示在1983年底我们持有不具控制权的股权投资,所有的数字包含伯克希尔与80% Wesco的权益,剩下的20%已予以扣除:

(a)代表全部股权由伯克希尔及其子公司所持有

(b)代表由伯克希尔子公司蓝筹印花与Wesco所持有,依伯克希尔持股比例换算得来。

依照目前持股情况与股利发放率(扣除去年盖可保险发放特别股利的特例)我们预期在1984年将收到约三千九百万美金的现金股利,而保留未予发放的盈余估计将达到六千五百万,虽然这些盈余对公司短期的股价将不会有太大影响,但长期来说终将显现出来。

除了已经提供的数字外,关于我们控制的业务的信息出现在管理层第40-44页的讨论中。其中最重要的是《布法罗晚报》、喜诗和保险集团,我们将在这里特别关注它们。

〔译文基于梁孝永康所编《巴菲特致合伙人+致股东的信全集》修改完善〕