巴菲特致股东的信(1983年)

⑦保险业-受控制的部分⑧盖可保险

保险业-受控制的部分

我们本身除了经营保险业外,还在这项产业有庞大的投资部位,而这些由本人作决策的事业,其经营成果显而易见的很惨,所幸那些不受本人控制的部份,如盖可保险表现杰出,才避免整个集团经营亮起红灯,没错你心里想的完全正确,几年前我犯下的错误如今已找上门来了。

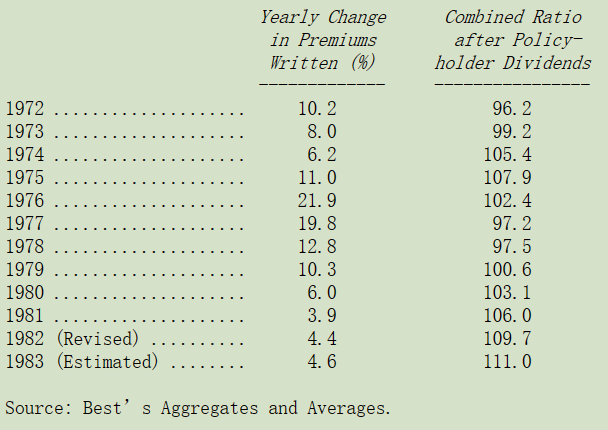

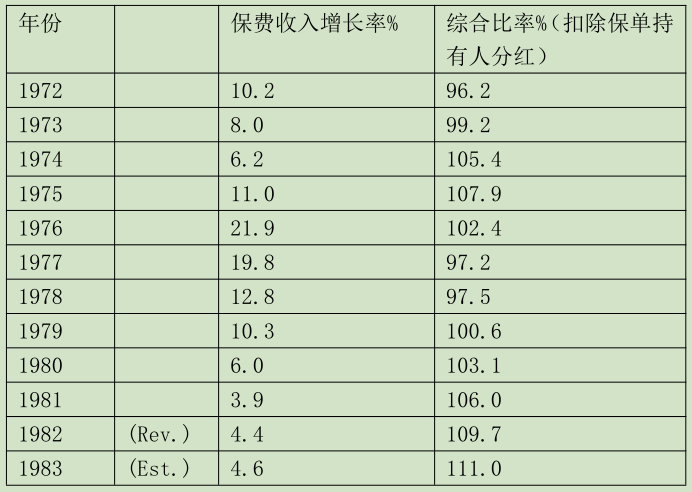

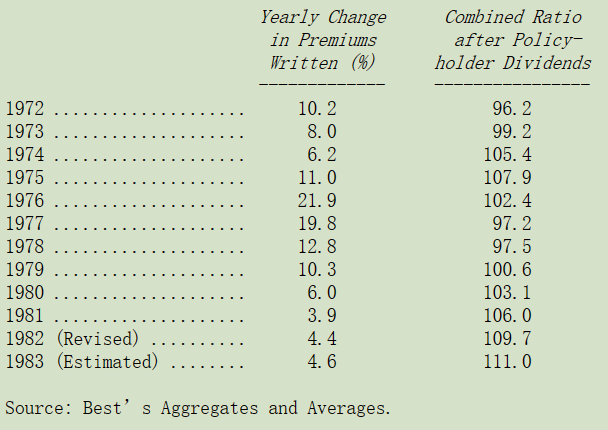

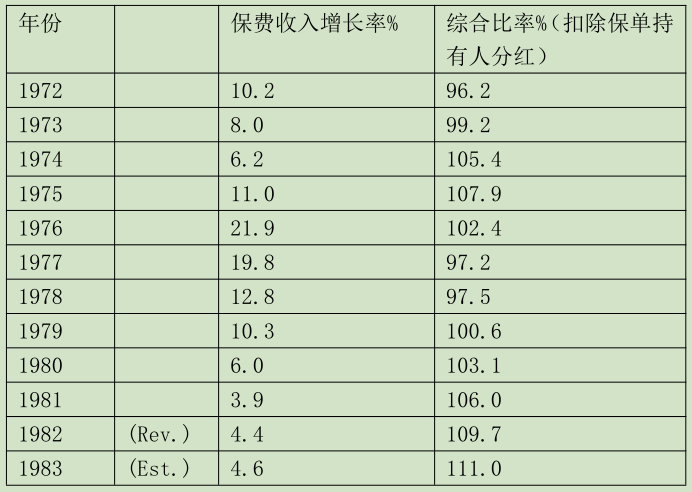

整个产业如下表所示,已低迷了好几个年头:

资料明白显示出目前整个产业,包括股市、共同基金与互助会所面临的惨况,综合比率代表所有的保险成本(发生的理赔损失加上费用)占保费收入的比重,一百以下表示有承销利益,反之则发生亏损。

如同去年我们所揭示的原因,我们认为1983年的惨况仍将持续好几个年头,不过并不表示情况不会好转,事实上一定会,只是要未来几年的平均综合比率明显低于前几年的水准将不太可能,基于对通货膨胀的预期,除非保费收入每年以超过10%成长,否则损失比率将很难压到比现在的水准还低。

我们自己的综合比率是121,由于最近MikeGoldberg已接手负责保险事业的经营,所以这个烫手山竽交给他来解决,要比本人亲自处理要来得好得多了。然而不幸的是,保险这行业前置期很长,虽然企业政策与人员可随时改进,但其效果却须要相当长的一段时间才能显现,(事实上我们就靠这点在投资盖可上赚了很多钱,我们可以在公司营运效益真正显现之前,先一步预期),所以目前的窘境事实上是我两三年前直接负责营运时所捅下的篓子。

尽管整体表现不佳,但其中仍有几位经理人表现杰出,Roland所领导的国民保险在同业对手一片惨淡时,一支独秀,而Tom在科罗拉多州展露头角,我们可说是挖到宝了。

近来我们在再保险领域的表现极为活跃,而事实上我们希望能够更活跃一些,在这行投保者相当注重承保者长期的债信以确保其对之多年后的承诺得以实现,这一点伯克希尔所提供坚实的财务实力使我们成为客户倚赖的首选。

这行生意的来源主要是终身赔偿,即损害请求者每月定期领取赔偿费直到终身而非一次给付,这对请求者来说可享受税赋上的优惠,也可避免一下子把赔偿款花得精光,通常这些被害人皆严重伤残,所以分次给付可确保其往后数十年的衣食无虞,而关于这点我们自认为可提供无与伦比的保障,没有其它再保业者,即使其资产再雄厚,有比我们更坚强的财务实力。

我们也想过或许靠着本身坚强的财务实力,可承受有意愿移转其损失赔偿准备的公司,在这类个案中,保险公司一次付给我们一大笔钱,以承担未来所有(或一大部份)须面临的损害赔偿,当然相对的受托人要让委托人对其未来年度的财务实力有信心,在这一点上我们的竞争力明显优于同业。

前述两项业务对我们而言极具潜力,且因为它们的规模与预计可产生的投资利益大到让我们特别将其承销成绩,包括综合比率另行列示,这两项业务皆由国民保险的Don负责。

盖可保险

盖可保险在1983年的表现之好,其程度跟我们自己掌管的保险事业差劲的程度一样,跟同业平均水准111相比,盖可保险在加计预估分配给保户的股利后的数字为96,在这之前我从不认为它能够表现的如此之好,这都要归功于优异的企业策略与经营阶层。

Jack与Bill在承销部们一贯维持着良好的纪律(其中包含最重要的适当的损失准备提列)而他们的努力从新事业的开展以来就获得了回报,加上投资部门的Lou Simpson,这三个人组成了保险业的梦幻队伍。

我们拥有盖可保险大约三分之一的股权,依比例约拥有二亿七千万的保费收入量,约比我们本身所有的还多80%,所以可以这么说我们拥有的是全美最优质的保险业务,但这并不代表我们就不需改进自有的保险业务。

〔译文基于梁孝永康所编《巴菲特致合伙人+致股东的信全集》修改完善〕