巴菲特致股东的信(1984年)

⑤保险运营

保险运营

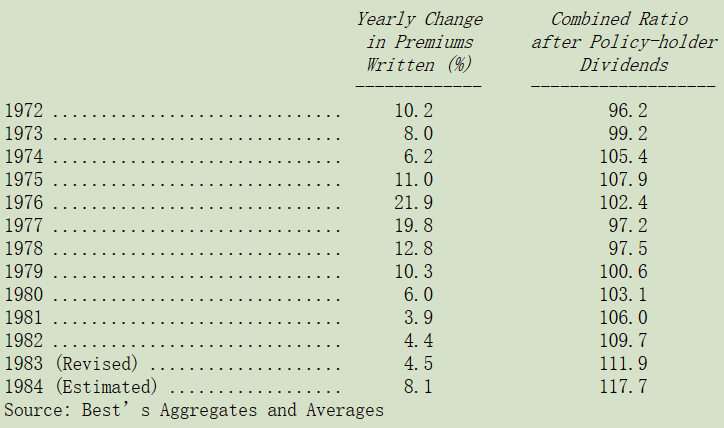

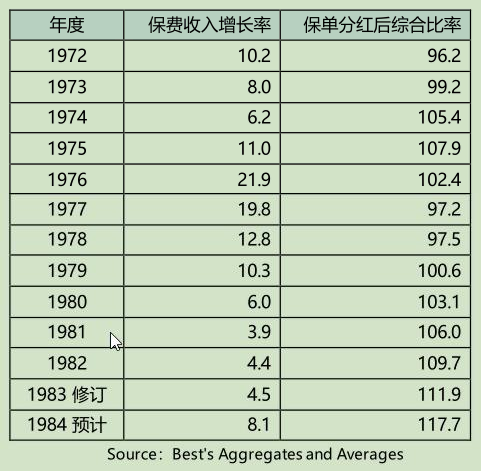

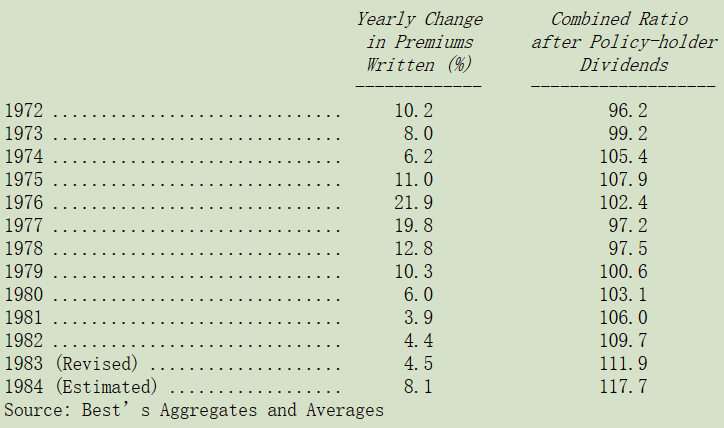

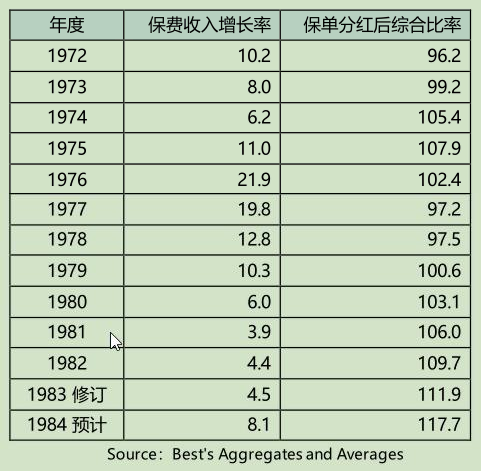

下表列出了保险业的两个关键数据:

Best 的统计数据反映了几乎整个行业的状况。综合比率代表总保险成本(发生的损失加上费用)与保费收入之比,低于 100 表示承保盈利,高于 100 表示亏损。

多年来我们一直重申,要使综合比率基本保持不变,保险行业每年必须将保费提高 10%。我们提出这一政策时,假设运营费用占保费金额的百分比将保持相对稳定,理赔损失将以每年约 10%的速度增长,这是因为承保规模增加、通货膨胀和扩大保险单承保范围的司法裁决的综合影响。

令人沮丧的事实证明,我们的观点非常准确,从 1979-1984 年间,我们保费总增长 61%,年均增长 10%,1984 年的综合比率几乎与 1979 年的 100.6 相同。相反,同业保费增加只有 30%,综合比率则变成 117.7。今天我们仍相信保费金额的年增长率是承保获利趋势的关键指标。

目前来看 1985 年的保费增长将超过 10%,因此,假设灾难处于正常水平,我们预计综合比率将在年底前开始下降。然而,根据我们全行业的损失假设(即每年增加 10%),需要五年每年 15%的保费增长才能使综合比率恢复到 100。这意味着 1989 年时行业保费须翻一番,这似乎是不太可能。所以,我们预期保费每年将增长略高于10%,在激烈价格战竞争的情况下,行业综合比率将维持在 108-113 之间。

我们自己在 1984 年的综合比率是可怜的 134,我们在报告此比率时,不包括结构化结算和损失准备金假设。这是连续第三年我们的表现比同业水准差,我们预期 1985 年综合比率会有所改善,而且改善程度会比同业要好。Mike Goldberg 自从从我手中接下保险业务后已纠正了不少我先前所犯下的错误。此外,过去几年我们的业务集中在一些表现不如预期的业务保单上,这种情况开始压制竞争同业甚至淘汰一些出局,随着竞争局势的打破,我们在 1984 年下半年开始提高部分业务的保费价格,并且不怕流失客户。

多年来我一再告诉各位,我们卓越的财务实力可能有一天将有助于我们取得保险营运的竞争优势,而这一天可能已经来临,毫无疑问我们是全美最强大的财产意外险保险公司,资本状况远远优于规模更大的知名公司。

同样重要的是,我们的战略便是要保持这种优势,保单购买者用钱所换到的只是一纸承诺,而这纸承诺的价值必须要经得起所有可能的逆境的考验,而非顺境。最少,它必须要能够经得起长期低迷金融市场和特别不利的承保状况的双重考验,我们保险子公司,有意愿也有能力,确保其承诺在任何状况下兑现,这显然没有太多保险公司能做到。

我们的财务实力,对于去年曾提过的结构化结算(分阶段赔付)与损失准备提列业务来说,是一项特殊资产。结构化结算中,理赔人与申请再保的保险公司,必须要百分之百确定在往后的几十年内能顺利获得支付,很少有财产意外险公司能够符合这种要求,事实上只有少数几家公司能让我们有信心将我们自己的风险再保出去。

我们在这方面的业务取得增长,我们持有用以弥补假设负债的资金从 1620 万增长至 3060 万美元,我们预期这项业务将继续增长,并大大加速。为了支持这一预期增长,我们向旗下哥伦比亚保险公司大幅增资,该公司是我们的再保险部门,专门从事结构化结算和损失准备金假设,虽然竞争颇为激列但获利却也令人满意。

(注:伯克希尔 1969 年底出售科恩零售后,于 1970 年成立了内布拉斯加州再保险公司,后改名为哥伦比亚保险公司,并将国民保险的再保险业务纳入其中。)

GEICO 保险与往常一样多是好消息,该公司 1984 年在其主要业务的投保客户大幅增加,而其投资部们的表现一样优异,虽然年末承销业绩转差,但仍远好于同业,截至去年底我们拥有该公司 36%的权益,若以其产险总保费收入 8.85 亿美元计,我们的权益约有 3.2 亿美元左右,大约是我们自己承保量的二倍。

过去几年给大家汇报过,GEICO 保险的股价涨幅明显超越其本业的表现,虽然业绩表现也非常出色,GEICO保险在我们公司的帐面价值成长幅度超过该公司本身内在价值的成长幅度,而我同时也警告各位,股票相对于业务表现的过度上涨显然不可能每年都发生,总有一天其股价的表现将逊于本业。这句话在 1984 年应验了,去年GEICO 保险在伯克希尔的帐面价值没什么变动,不过其公司的内在价值却大幅增加,而由于 GEICO 保险代表着伯克希尔 27%的净值,当其市场价值迟滞不前,直接便影响到伯克希尔净值成长的表现,对于这样的结果,我们一点也不会感到不满,我们宁愿要 GEICO 保险的企业价值增加 X 倍而股价却在下跌,也不要公司内在价值减半而股价飙升。就 GEICO 而言,与我们所有的投资一样,我们关注的是业务表现,而不是市场表现。如果我们对业务的预期正确,市场终将反映。

所有的伯克希尔股东皆从 GEICO 保险管理团队的才华中获益匪浅。他们是 Jack Byrne、Bill Snyder 与 LouSimpson,在他们的核心业务低成本的汽车与房屋住宅保险,GEICO 保险拥有显著且持续的竞争优势,这在商业上是一种罕见的资产,在金融服务领域更是几乎不存在。GEICO 本身就说明了这一点:尽管该公司拥有卓越的管理,除核心业务之外,GEICO 在其他领域的所有努力都无法实现卓越的盈利能力。在保险行业中,像 GEICO 这样的竞争优势提供了异常资本回报的潜力,并且 Jack 和 Bill 继续展现出实现这一潜力的高超技巧。

GEICO 保险核心业务所产生的资金,大部分皆交由路易·辛普森(Lou Simpson)来投资,路易是一个智慧与理性兼具的罕见人才,这项人格特征产生了出色的长期投资业绩。以低于平均水平的低风险,产生了迄今为止保险业中最好的回报。我对以上三位杰出经理人表达赞赏与感谢之意。

〔译文源于芒格书院整理的巴菲特致股东的信〕