巴菲特致股东的信(1985年)

⑤保险业务

保险业务

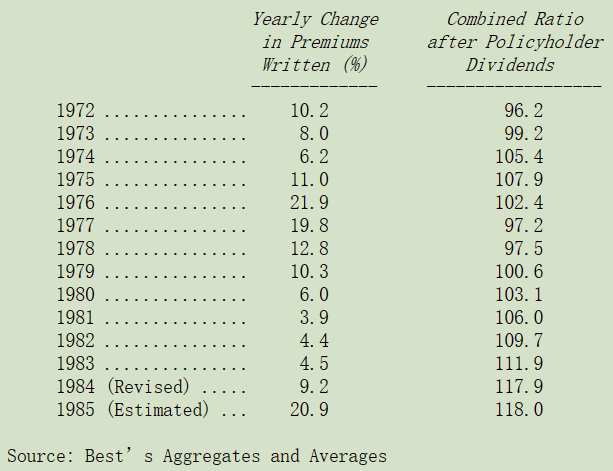

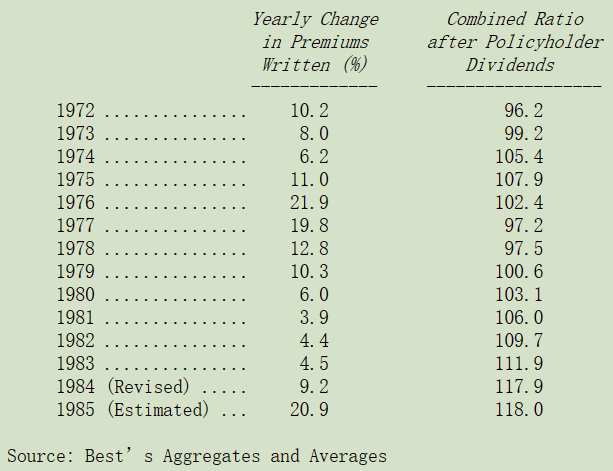

下表是年报中常见表格的更新版本,列示保险业务的两项关键数字:

综合比率代表总保险成本(已发生的损失加上费用)与保费收入的比较:低于100的比率表示承保利润,高于100的比率表示亏损。

1985 年保险业整体的业绩有点不寻常,保费收入大幅成长,如果投保损失与前几年一样以固定比率成长,约比通货膨胀率高几个百分点,那么综合比率就会明显下降。但 1985 年的承保损失并没有配合,尽管这几年通货膨胀显着放缓,但承保损失却反常地加速,1984 年增长 16%,1985 年更是惊人地增长了 17%,超过通货膨胀率13 个百分点,创下新记录。

灾难并不是损失成本激增的主因,虽然 1985 年确实有几次相当大的飓风发生,但 1984 年和 1985 年所有灾难造成的总损失约为保费量的 2%,这比例不算异常。投保汽车、房屋、员工或其它投保标的出险的也没有爆增。

承保损失激增的部分原因是去年业界大幅提升损失准备,就像报告所显示的,这场景就像检讨会议,都在大喊“我有罪,我有罪”,保险业务经理人一窝蜂地承认前几年损失准备拨备不足,业界的集体修正显著影响了今年的业绩。

承保损失激增的另外一个更令人不安的因素是社会或司法通膨成本的增加,在陪审团和法官评估责任和损害时,保险人的支付能力具有压倒性的重要性。无论保单条款、事实真相或先前判例如何,越来越多的人在觊觎财大气粗的保险公司。

这成为保险业预测未来的最不确定的因素。尽管如此,短期前景还不错,整个 1985 年保费增长不断改善(按季度 15%-19%-24%-22%),除非发生巨灾,否则 1986 年综合比率有望大幅下降。

然而获利改善的情况无法持续太久,经济上有两个主要原因,一是大宗商品企业只有当价格稳定或供给短缺的情况下才能维持不错的获利水平,二是行业景气转暖且业者资金充裕时便会猛增产能。

在 1982 年年报中,我曾广泛地讨论大宗商品化企业的特点,一般的投保人不太在乎产品的差异而只关注价格,几十年来行业联盟式的制度使得价格居高不下,但这种情况如今已不复见到。保险产品现在的定价方式,与自由市场存在的任何其他商品一样:当供给吃紧,价格自然上升,反之就不会。

目前,保险行业许多业务线的产能供应紧张,虽然保险业跟大部分的行业不同,所谓的供应紧张仅仅是心态上而非实质性的(承保意愿低迷),只要保险业者愿意,他可以签下无限数量的保单,这期间只会受到监管机构和行业评级机构 Best's 的压力。而公司管理层和监管当局的承保意愿只跟资本实力有关,更多的资本代表更多的冲动,也意味着乐意签下更多的保单。在大宗商品企业,如钢铁或铝业,增加产能需要很长的准备时间。而在保险业资本可以立刻到位,因此供给不足的情况可能马上就会消失。

这就是目前实际发生的状况,1985 年大约 15 家保险公司筹集了超过 30 亿美元的资金,以便在价格高位吃进所有可能的生意,而且 1986 年以来资金募集的速度越来越快。

如果产能继续以这种速度增加,不用多久马上会出现杀价竞争的情况,之后获利也会承压。而这一切都要归咎那些大幅增资的业者,然而,批评人士应该明白:正如我们的纺织业一样,市场经济的变化导致每个保险公司做出的决策本身似乎是明智的,但就行业整体来说,竞争降低了集体的盈利能力。

以往年报我曾告诉过大家,伯克希尔强大的资本状况(堪称业界之最)有一天能让我们在保险业拥有明显的竞争优势,随着市场的紧缩,这一天已到来了。在经过长期的停滞之后,去年我们的保费收入增加了 2 倍多,伯克希尔的财务实力(以及过去优异的承保记录)是我们最好的竞争力。

我们正确地预见到许多保险和再保险的大客户会转向高质量保险公司,在 1985 年他们许多保单无法兑现的时候才发现,保单只是一张欠条。如今这些客户都被伯克希尔雄厚的资产实力吸引上门,而另外一点是我们没有预见到的发展过程,那就是我们有能力为重大风险承保从而使我们脱颖而出。

要理解这一点,你必须对巨额风险有一些认识,以往有许多保险公司都很愿意承保此类保单,他们这么做是基于再保险的安排,他们自己只要保留一小部分的风险,而将大部分的风险转嫁给再保业者。例如,一单 2500万保额的董事和经理人责任险,承保公司通过各种超额损失再保险合同,将超过 2400 万损失责任签发给再保险公司承担,而自己只留下一个 100 万的零头。按业界的说法是,保单总额很高,但净额很少。

在任何的再保安排中,最重要的问题是保费收入应如何公平在各个风险层级中分配。例如前面的管理层责任险案例,签发保单的保险公司应保留多数保费以承担其前面第一个 100 万的损失风险,以及应该向再保人转嫁多少保费以公平的承担 100-2500 万之间的损失风险。

一种解决这种难题的方法叫做 Patrick Henry 法则:我只有一盏灯可以指引我的脚,那就是经验之灯。换句话说,再保业者需要多少保费才能公平的补偿其所承担的损失要依据过去的经验。

但不幸的是经验之灯根本不够亮,因为大部分业务都是“长尾”业务,往往需要在许多年之后才能真正知道发生了多少损失。而且最近经验之灯不仅黯淡下来还存在误导,也就是说,法院倾向于给予缺乏先例的巨额赔偿金,使得再保业者依据过去经验推估变成一场灾难。Patrick Henry 失效,换成 Pogo:未来已今非昔比了。

近年来,再保险业务不断增长的不确定性,叠加许多经验不足的新进者,使得直保公司倾向通过保留远高于风险的保费比例,将风险转嫁给再保公司,仅仅承担较少额度的风险。这样的作法有时在直保公司与再保公司整体亏钱的情况下,直保公司甚至还能获利。但这种结局并不是故意的,对于更高风险水平下所产生最终成本,直保公司通常并不比再保公司了解更多。这种不平等现象在保险业中尤为明显,保险业正在发生巨大变化,损失也在飙升,例如职业舞弊、管理层责任险以及产品责任险等。在这些情况下,在保费严重不足的情况下,直保公司还在积极签发保单就不足为奇了。

1984 年,一家大型异常风险领域的领军企业的财务报告提供了一个例子,说明了直保公司与再保险公司的结果有多么不同。在那一年这家公司一共签下 60 亿元的保单,在保留其中的 40%约 25 亿后,将剩下的 35 亿转给再保公司,结果最后,保留部分理赔的损失只有不到 2 亿美元,非常不错的承保业绩。与此同时,分保出去的部分却使再保业者蒙受了 15 亿美元的损失,使得直保公司的综合比率不到 110,但再保公司却高达 140,这一结果不是自然灾害造成的,它来自普通保险损失,然而,发生的频率和损失都令人惊讶。虽然我尚未看到该公司今年的年报,但可想而知这种不平衡的情况一定还在继续。

这种情况已经好几年了,在直保和再保公司之间的保费合理分配仍无法粗略估计的大量业务线上,即使是一些反应较慢的再保业者都失去了兴趣。再保业者的行为就像马克吐温的猫一样:“一旦被热炉子烫过一次,便不会再去碰任何炉子,即使是冷的炉子也一样”,再保业者在长期的意外险遭遇了太多不愉快的意外,以至于到最后决定放弃这项业务(可能也是正确的),完全不理投保价格如何诱人,因此,某些业务的再保能力出现了严重短缺。

如此一来许多直保客户面临压力,他们再也不能够像以前一样,动不动就将上千万的保单转给再保业者。他们也没有能力与资本自行承接大额的保单,有的直保业者的承保总额也大幅缩水到净额附近。

在伯克希尔我们从来不玩这类盈利为目的分割游戏,最近几年,这样的作法使我们在某些业务处于严重劣势,不过现在情况发生逆转:我们拥有同业无法比拟的承保实力。只要我们认为价格合理,我们愿意承保其它大型业者都吃不下的保单。例如,我们愿意承担一次事件中损失 1000 万美元的风险,只要价格合理且其风险与我们已承保的风险无显著相关性。其他同业连承保一半的风险都不多见。尽管在不久之前,许多业者甚至愿意吃下十倍以上的保单,只要有再保业者来承担所有的损失。

1985 年我们旗下最大的保险公司国民保险在三期保险期刊上大幅投放广告,对外宣传愿意承保巨大风险的意愿。该广告只征集超过 100 万美金的大额保单,结果总计收到 600 条回函,最后产生约 5000 万美金保费,先不要高兴太早,由于属于长期保单,至少要经过五年以上才能确定这次成功的营销是不是承保成功。现在,一般的保险经纪人要接高额的保单,一定会首先找到我们的保险子公司。

正如我说过的,这段供应紧张的时期将会过去,大家还是会回到价格战。不过一两年内,我们在几项业务方面还是有很好的发挥空间,Mike Goldberg 在营运上作了许多的重要改进(本人先前的管理不当,提供他不少发挥的空间),尤其是最近几年他找了许多深具潜力的优秀人才进来(1985 年迈克把原麦肯锡部下阿吉特·贾因招进伯克希尔),明年他们将更有机会一显长才。

综合比率方面也有所改善,从 1984 年的 134%改善到 1985 年的 111%,但过去的不良影响仍在。去年我告诉你我在损失准备金方面犯的主要错误,并承诺每年向你更新损失调整的数字。当然,我做出这个承诺是因为我认为未来的记录会有很大的改善,但到目前为止,情况并非如此。细节详如后述。与前几年一样,它们在 1984年底揭示了严重的准备金不足。

几乎所有的准备金不足都发生在再保部分,而且很大程度上,都发生在几年前陆续到期的许多保单上。这种解释使我想起许多年前,通用再保的董事长告诉我的一个小故事,他说每年公司的经理人都告诉他“除了佛罗里达的飓风和中西部的龙卷风的话,今年的成绩一定很好”,到最后实在忍不住他召集这群人开会并建议他们干脆另外成立一个新的业务,叫作“除了保险公司”,专门把他们后来不想计入的业务放入其中。

不管是保险还是其它行业,应该把“除了”这个字眼从辞典里删除。如果你要参加比赛,就应该把对手所有的得分全部计入,任何一直把“除了”挂在嘴上的经理人,不停报告他从错误中吸取的教训,那么他可能会错过唯一重要的教训:错的不是剧本,而是演员。

当然做业务往往不可避免的会出些差错,而聪明的经理人一定能从中汲取教训,但诀窍是这个教训最好是从别人身上学来的,过去习惯犯错的经理人通常未来还是会继续犯错。

伯克希尔持有 38%股权的 GEICO 保险公司,在保费收入成长与投资收益方面皆表现突出,但在承保结果与其过去高标准相较却表现不佳,私家车与住宅房屋险是财产险业务中唯一显著恶化的重要险种。GEICO 保险也难逃一劫,虽然它的成绩比起其它主要的竞争对手要好得多。

Jack Byrne 在年中离开 GEICO 保险加入消防员基金保险公司,留下比尔·斯奈德(Bill Snyder)与路易辛普森(Lou Simpson)担任正副董事长,Jack 之前挽救 GEICO 保险免于破产的表现卓著,他的努力使得伯克希尔获益巨大,我们欠他太多。

我们同样要感谢 Jack 另一项成就,这是大多数杰出领导者无法做到的:他找到具有跟他一样特质的经理人来接替他,通过识别、吸引和发展 Bill 和 Lou的技能,Jack 使得他对公司的贡献与影响力超过他实际的任期。

〔译文源于芒格书院整理的巴菲特致股东的信〕