巴菲特致股东的信(1986年)

⑤有价证券

有价证券

在去年我们的保险公司总计买近了七亿美元的免税政府公债,到期日分别在 8-12 年之间,或许你会觉得这样的投入表示我们对于债券情有独钟,不幸的是事实并非如此,债券充其量券只不过是个平庸的投资工具,它们不过是选择投资标的时看起来最不碍眼的投资替代品,虽然现在看起来也是,我突然发现我与好莱坞演员 MaeWest的喜好完全相反,她曾说:“我只爱两种男人,本国人或是外国人”,现在的我对股票与债券皆不感兴趣。

在保险公司随着资金持续涌入,我们当然必须将有价证券列入投资组合,一般来说我们只有五种选择:(1)长期股票投资,(2)长期固定收益债券,(3)中期固定收益债券,(4)短期现金替代品,(5)短期套利交易。

在其中股票算是最有乐趣的,当状况好时,我是说找到管理经营得当,良好经济特性但价值被低估的公司,很有机会你会挥出大满贯的全垒打,不过很不幸的是,目前我们根本找不到类似这样的标的。这不代表我们要预测未来的股市,事实上我们从来就不知道股市接下来到底是会涨还是会跌。

不过我们确知的是,贪婪与恐惧这两种传染病在股市投资世界里,会不断地反复上演,只是发生的时点很难准确预期,而市场波动程度与状况一样不可捉摸,所以我们要做的事很简单,当众人都很贪心大作时,尽量试着让自己觉得害怕;反之当众人感到害怕时,尽量让自己贪心一点。(别人贪婪我恐惧,别人恐惧我贪婪)

而当我在写这段文章时,整个华尔街几乎嗅不到一丝的恐惧,反而到处充满了欢乐的气氛,没有理由不这样啊?有什么能够比在牛市中,股东因股票大涨赚取比公司本身获利更多的报酬而感到更高兴的事,只是我必须很不幸的说,股票的表现不可能永远超过公司本身的获利表现。

反倒是股票频繁的交易成本与投资管理费用,将使得投资人所获得的报酬无可避免地远低于其所投资公司本身的获利,以美国企业来说,平均投资回报率为 12%,这表示其投资人平均所能获得的报酬将低于此数,牛市可以暂时模糊数学算术,但却无法推翻它。

第二种投资选择是长期债券,除非在特殊情况下,就像是我们在 1984 年年报曾提到的华盛顿公用电力系统所发行的公司债,(截至年底我们拥有该公司债券的未摊销成本为二亿一千万美元,市价则为三亿一千万美元),否则债券这种投资标的实在很难引起我们的兴趣。我们对于长期债券没有兴趣的原因在于对于未来十几年通货膨胀可能再度肆虐的潜在恐惧,长期而言,汇率的演变将取决于立法诸公的态度,这会威胁到汇率的稳定,进而影响到长期债券投资人的收益。

我们持续将资金运用在套利之上,然而不像其它套利客,每年从事几十个案子,我们只锁定在少数几个个案,我们限制自己只专注在几个已经公布消息的大案子,避开尚未明朗化的,虽然这样会让我们的获利空间减小,但相对的只要运气不要太差,我们预期落空的机率也会减少许多。

到年底为止,手上只有一个套利案子(Lear-Siegler)。另外还有一笔 1.45 亿美元的应收款项,这是联合利华用来买下庞氏公司(Chesebrough-Ponds)所欠我们的款项。套利是除了政府债券以外,短期资金运用的替代品,但风险与报酬相对都比较高,到目前为止,这些套利投资的报酬确实比政府债券要来的好的多,不过即便如此,一次惨痛的经历将使总成绩猪羊变色。

另外虽然有些不情愿,我们也将目光摆在中期的免税债券之上,买下这类债券我们将承担巨额损失的风险,若可能的话我们在到期之前就会把它们卖掉,当然这样的风险也提供我们相对的报酬,到目前为止未实现的获利还是比短期债券要来的好的多,不过这种高报酬在扣除可能承担损失的风险与额外的税负,其实报酬好不了多少,更何况还有可能估计错误,不过即便我们真的发生损失,其程度还是比我们不断在短期债券上打滚来的好。

无论如何,大家应该知道以目前的市场状况,我们在债券或股票的预期报酬都不会太高,目前我们可以做的,顶多是认赔处分一些债券,然后重新将资金投入到未来可能好一点的股票投资上,债券会发生损失的原因在于利率高涨,当然这同样也会压缩股票的价格。

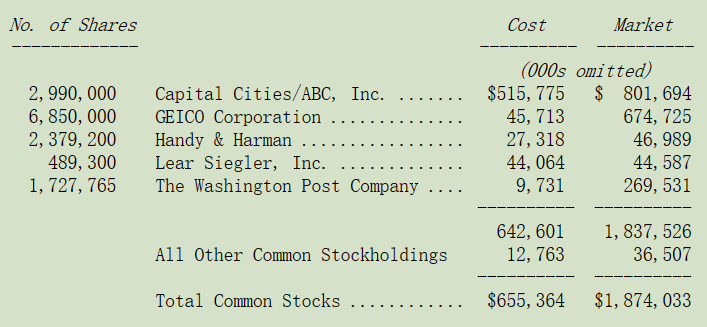

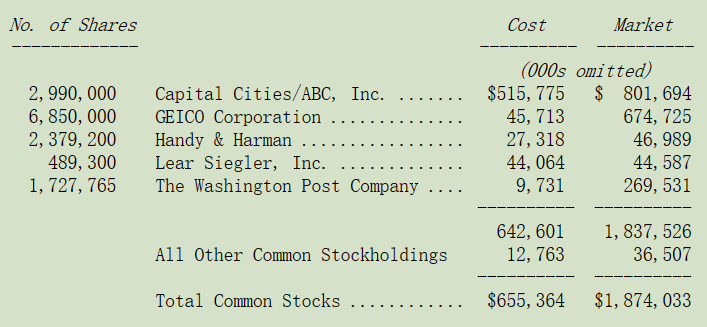

下表是我们截至 1986 年底金额超过 2500 万以上股票的投资组合,不包含 Wesco 金融与内布拉斯加家具店的少数股东权益。

大家要特别注意的是我们会将三项投资列为永久的投资组合,分别是大都会/ABC、GEICO 保险与华盛顿邮报,即便这些股票目前的价格看起来有些高估,我们也不打算把它们卖掉,就像即使有人出再高的价格,我们也不打算卖喜诗糖果或布法罗报纸一样。

这种态度现今看起来有点老套过时,现在当红的基金经理人所谓的企业组合意味着,每当华尔街的偏好、经营条件或新的企业“概念”决定了企业的重组时,所有这些企业都是“重组”的候选者,(奇怪的是重组的定义范围却只限于拋弃让人不快的企业,但却不包含最初购买企业的经理人与负责人本身,憎恨罪恶却深爱犯罪者,这种理论在财富 500 强中和救世军一样受欢迎。

基金经理人更是肾上腺素分泌过多,他们交易时间的行为让不断念经的苦行僧看起来显得安静许多,事实上机构投资人这个名词已成为自相矛盾的修饰名词,可以跟超级大虾米、女士泥巴摔角手、廉价律师相媲美。(Jumbo shrimp:jumbo 意为巨大,但 shrimp 却特指小虾,lady mudwrestler:lady 意为高雅洁净的女士,而mudwrestler 指泥地摔跤手,inexpensive lawyer:律师此时在美国属于高收入人群,收费廉价几乎不存在。三个词修饰语与主语都互相矛盾,充满不可能的感觉。)

尽管这种对于并购案的乐衷横扫整个美国金融界与企业界,但我们还是坚持这种“至死做自己”的策略,这是查理跟我唯一能够感到自在的方式,事实证明这种方式长期下来让我们有不错的获利,也让我们的经理人与被投资公司专注于本业之上而免于分心。

〔译文源于芒格书院整理的巴菲特致股东的信〕