巴菲特致股东的信(1986年)

④保险业务

保险业务

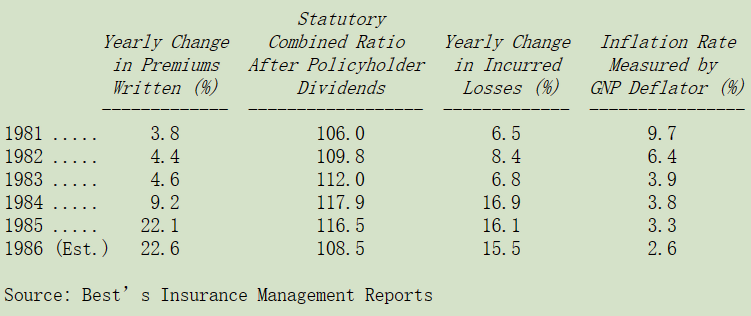

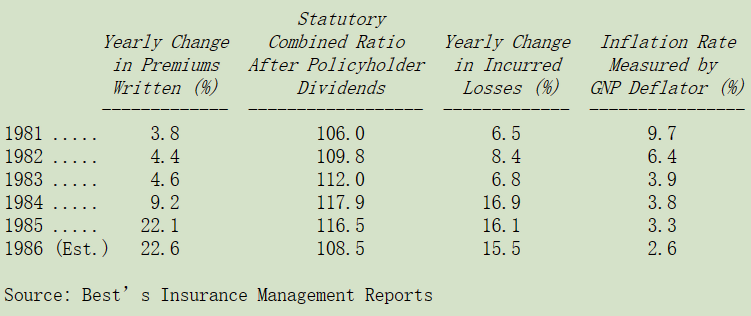

下表是我们固定提供的保险业统计数字,今年起多加了发生损失与 GNP 通膨指数两项,保费成长与损失比率与 1986 年差异,可用来解释为何整年度的承保表现能够大幅改善的原因。

综合比率代表保险总成本(发生损失加上费用)占保费收入的比例,若比率低于一百,表示承保有收益,反之则会有损失,若将保险公司从保户那边收到的保费(又称浮存金),运用在投资所赚取的收益列入考虑后(扣除股东权益部分),比率在 107-112 间会是损益平衡点。

保险业务经营的逻辑,若用以下列简表来说明,其实一点都不复杂,当保费收入年增长率只能在 4%到 5%游移时,承保损失一定会增加,这不是因为意外、火灾、暴风等意外灾害发生更频繁,也不是因为通货膨胀的关系,主要的祸首在于社会与司法成本的膨胀,一方面是因为司法诉讼案件大幅增加,一方面是因为法官与陪审团倾向超越原先保单上所订的条款,扩大保险理赔的范围,若这两种情况在未来没有好转,则可以预见的是,保费收入年增长必须达到 10%以上才有可能损益两平,即使目前一般通货膨胀的水准维持在 2%到 4%之间也一样。

如表上所示,保险业保费收入增长的速度甚至高于理赔损失增加的速度,因此承保损失大幅下降,去年的年报我们就已预先报告可能会有这种情形发生,同时还判断这样的荣景只是短暂的,很不幸的再一次我们一语中的,今年保费增长的速度已大幅减缓,从第一季的 27.1%一路下滑到第四季的 18.7%,而且我们预期还会进一步下滑,最后很有可能会落到 10%的损益两平点之下。

但尽管如此,只要 1987 年没有发生什么重大的灾难,由于保费调整的递延性,承保结果还是能够改善,通常在保费调整的半年到一年后,效果会反应到公司的收益之上,但好景通常不易维持,过不了多久一切又会回到原点。

保险商品的定价行为与一般商品的定价模式几乎一模一样,唯有在供给短缺时价格才会上来,但偏偏这种光景维持不了多久,当获利旭日东升时,马上就有人会进来泼冷水,增加投入资金抢食大饼(老牌保险公司会向投资者大量投放新股,以增加资本。此外,新成立的保险公司,急于以新发行市场的有利价格出售股票),结果,当然会埋下不少后遗症:供给增加,代表价格下跌,跟着获利剧减。

当保险业龙头在要求他们的同业在定价时要维持同行之谊,我们可以观察到一个有趣的现象,他们会问为什么我们不能从历史经验中学到教训,不管景气低潮或高峰,都能够合理的定价以维持适当的获利呢?他们当然希望保险费能够像华尔街日报一样,一开始定价就很高,同时又能够每年持续稳定的调涨价格。

但这种诉求得到的效果,就像内布拉斯加州种植玉米的农夫,要求全世界其它种植玉米的农夫一起遵守道德规范一样有限,事实上道德诉求的效果极其有限,重点是如何让玉米的产量变少,最近两年来保险同业从资本市场上所募集的资金,导致保险能力激增,就好象是新进耕种的玉米田一样,结果是更多更多的玉米产量,只会使市场价格进一步滑落。

我们自己本身的保险业务在 1986 年的表现还算不错,展望明年一样乐观,虽然市场的状况让我们获益不少,但真正要感谢的却是旗下经理人优异的能力与表现。

我们的综合比率从 1985 年的 111 减少到 1986 年的103,此外我们的保费增长亦是出色,虽然最后的数字现在还无从得知,但我确信我们是前 100 强保险公司中成长最快的,诚然有一部分的成长来自于我们与消防人员退休基金的巨额合约,但即使扣除这部分,我们仍能维持第一。

有趣的是在 1985 年我们是所有保险业者中成长最慢的一家,事实上我们是不增反减,而只要市场情况不佳时,我们仍会维持这样的做法,我们保费收入忽上忽下并不代表我们在这个市场来来去去,事实上我们是这个市场最稳定的参与者,随时作好准备,只要价格合理,我们愿意不计上限签下任何高额的保单,不像其它业者“今天还在,明天就不干了”。所以当其它同业因资金不足或慑于巨大的损失退出市场时,保户会大量涌向我们,且会发现我们早已作好准备,反之当所有业者抢进市场,大幅杀价甚至低于合理成本时,客户又会受到便宜的价格所吸引,离开我们投入竞争对手的怀抱。

我们对于价格的坚持,对客户来说一点困扰也没有,当他发现有更便宜的价格时,随时可以离去,同样地对我们的员工也不会造成困扰,我们不会因为景气循环一时的低潮就大幅裁员。我们奉行不裁员的政策,事实上这也是为了公司好,否则担心业务量减少而被裁员的员工,可能会想尽办法不顾一切地创造大量无效业务。

这在国民保险公司所从事的汽车保险与一般责任保险最可以看出,同业是如何一会儿贪生怕死,一会儿又勇往前进。在 1984 年的最后一季,该公司平均月保费收入是 500 万美元,大约维持在正常的水准,但到了 1986年的第一季,却大幅攀升至 3,500 万美元,之后又很快地减少到每月 2,000 万元的水准。相信只要竞争者持续加入市场,并杀价竞争,该公司的业务量还会继续减少。讽刺的是,部分新成立的保险公司的经理人,正是几年前跟我们竞争并破产倒闭的保险公司那批原班人马。不可思议的是我们竟然还要通过政府强制的担保基金机制,来分摊他们部分的损失。现在我们发现他们用一个新名字承保了同样的业务,这简直是战争贩子。

这种我们称之为巨灾再保险的险种(超级猫)在 1986 年大幅成长,且在未来也会扮演相当重要的角色,通常一次所收取的保费就可能超过 100-300 万美元,有的甚至还更高,当然这项业务会高度波动,不管是保费收入或是承保获利,但我们雄厚的财务实力与高度的承保意愿(只要价格合理)使我们在市场上相当有竞争力。另一方面,我们在结构清偿业务则因为现在的价格不理想而接近停摆。

1986 年损失准备的变动详附表,数字显示我们在 1985 年底所犯的估计错误,在今年已渐渐浮现,就像去年我提醒各位的,我们所提的负债准备与事实有很大的出入,而造成连续三年一连串的错误,若照木偶奇遇记的标准,我的鼻子可能早已能够吸引众人的目光。

当保险公司主管事后补提适当的损失准备,他们通常会解释成损失准备”加强”,以冠上合理的说法,理直气壮地好象的是真要在已经健全的财务报表上再多加一层保障,事实上并非如此,这只是修正以前所犯错误的婉转说法而已(虽然可能是无心的)。

在 1986 年我们特别花了一番功夫在这上面做调整,但只有时间能告诉我们先前所作的损失准备预测是否正确。

而尽管在预测损失与产品营销上我们遭遇极大的挑战,我们仍乐观地预期我们的业务量能够成长并获取不少利润,只是前进的步伐可能会不太规则,甚至有时还会出现令人不太愉快的结果发生,这是一个变化多端的行业,所以必须更加小心谨慎,我们时时谨记伍迪艾伦所讲的,一只羊大可以躺在狮子的旁边,但你千万不要妄想好好地睡一觉。

在保险业我们拥有的优势是我们的心态与资本,同时在人员素质上也渐入佳境,此外,利用收得保费产生的浮存金进行投资方面,更是我们竞争的长期优势。在这个产业也唯有多方条件配合,才有机会成功。

* * *

由伯克希尔持有 41%股权的 GEICO 保险公司,在 1986 年表现相当突出,就整个产业而言,个人险种的承保表现一般来说不如商业险种,但以个人险种为主要业务的 GEICO 保险其综合比率却降低到 96.9,同时保费收入亦增长了 16%,另外该公司也持续买回自家公司的股份,总计一年下来流通在外的股份减少了 5.5%,我们依投资比例所分得的保费收入已超过五亿美元,大约较三年前增加一倍。GEICO 保险的帐目是全世界保险公司中最好的,甚至比伯克希尔本身都还要好。

GEICO 保险之所以能够成功的重要因素,在于该公司从头到脚彻底地精简营运成本,使得它把其它所有车险公司远远拋在脑后,该公司去年的成本费用和损失调整费用占保费收入的比例只有 23.5%,许多大公司的比例甚至比 GEICO 保险还要多出 15%,即使是像好事达保险(Allstate)与州立农业保险(StateFarm)等车险直销业者成本也比 GEICO 保险高出许多。

若说 GEICO 保险是一座价值不菲且众所仰望的商业城堡,那么其与同业间的成本与费用差异就是它的护城河,没有人比 Bill,也就是 GEICO 保险的主席,更懂得如何去保护这座城堡,靠着持续降低成本开支,他不断地将这个护城河加大,使得这城堡更加稳固,过去两年间,GEICO 保险创造了 23.5%超低成本率,下降 0.6%。展望未来,这项比率仍将持续下降,若能够同时再兼顾产品品质与客户服务的话,这家公司的前途将无可限量。

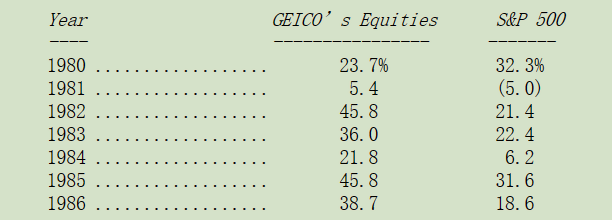

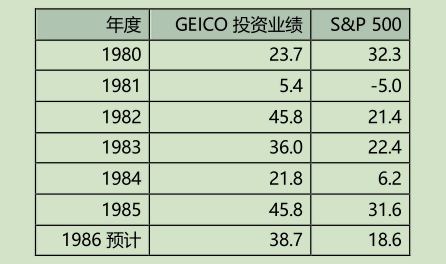

另外 GEICO 保险这一飞冲天的火箭,其第二阶段动力由负责投资部门的副主席路易·辛普森(Lou Simpson)提供,比起辛普森于 1979 年接掌该公司投资部门后的绩效,身为母公司伯克希尔投资主管的我,实在觉得有点汗颜,而也因为我们拥有这家公司大部分的股权,使我在向各位报告以下数字时,能够稍微心安理得一些。

必须再次强调的是以上的数字不但是漂亮极了,更由于其稳定成长的态势,辛普森能够不断地找到价值被低估的股票加以投资,所以风险相对很低,也很少会产生损失.

总而言之 GEICO 保险是一家由好的经理人经营的好公司,我们很荣幸能与他们一起共事。

〔译文源于芒格书院整理的巴菲特致股东的信〕