巴菲特致股东的信(1988年)

③报告收益来源

报告收益来源

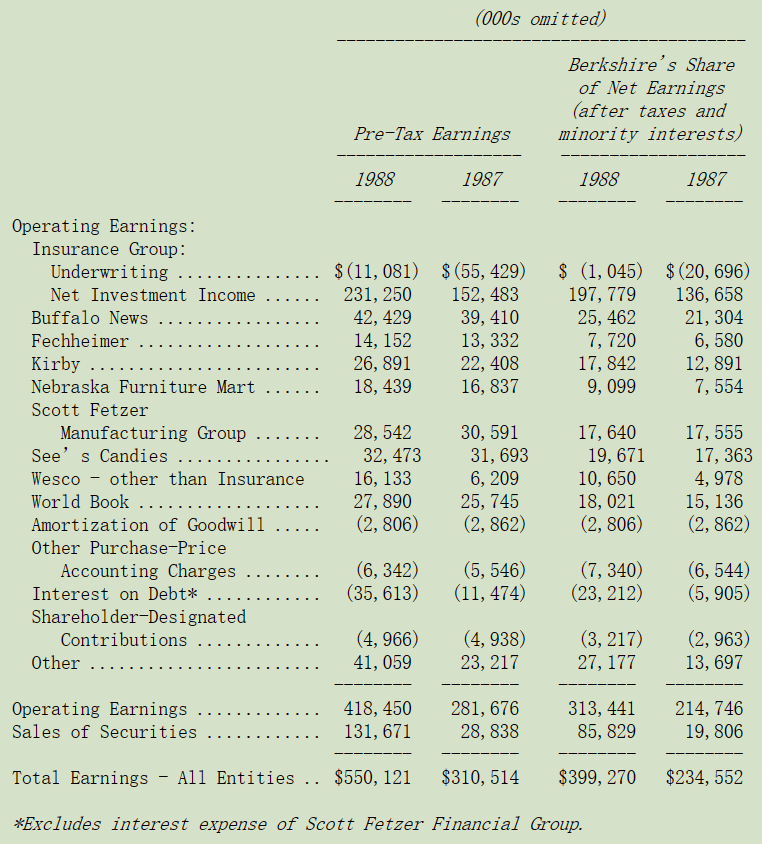

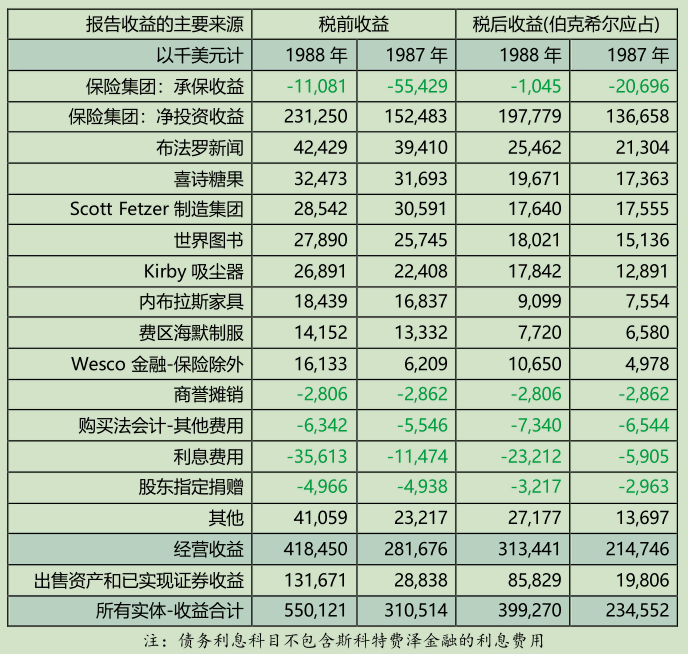

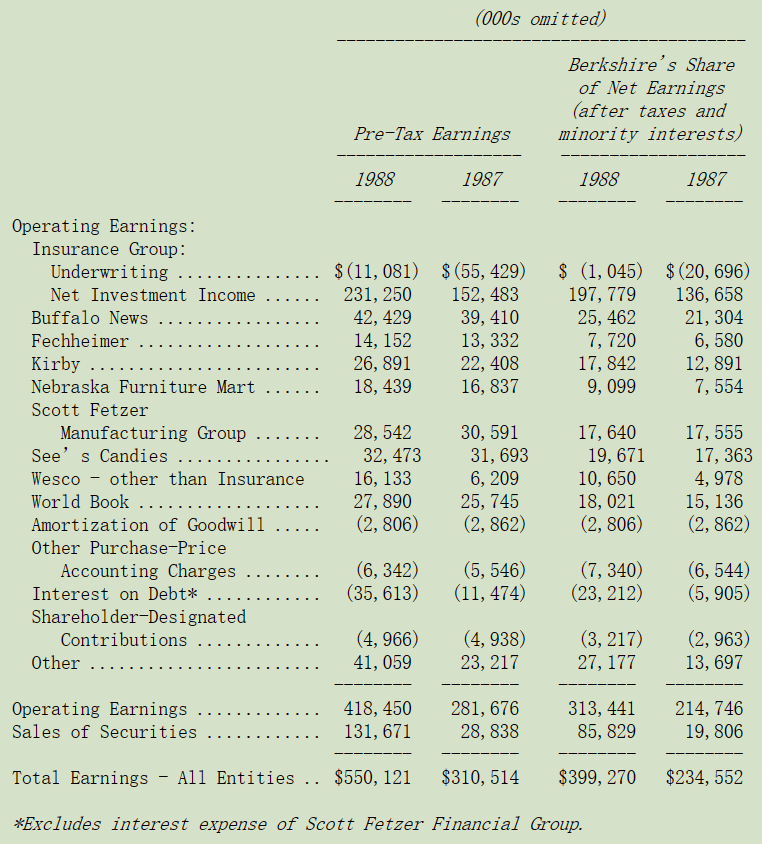

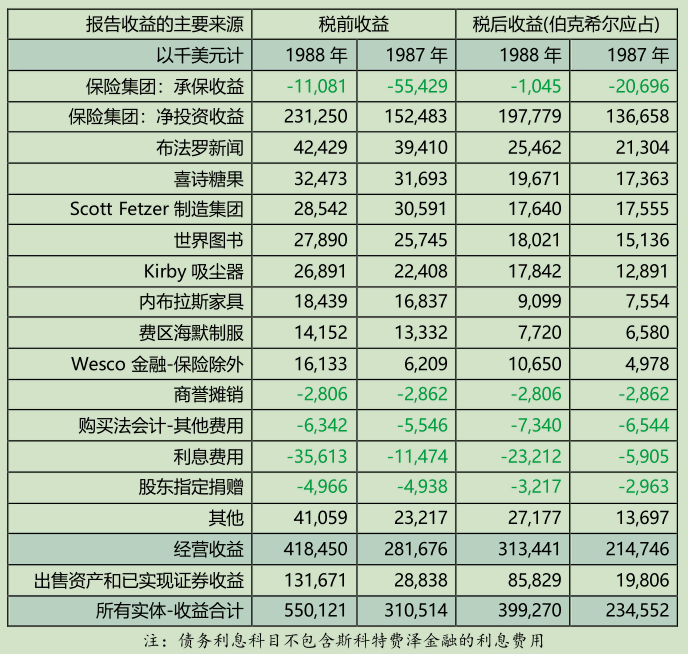

除了提供给各位最新四个部门的会计资料,我们一如往常还是会提列出伯克希尔报告收益的主要来源。

下表的商誉摊销数与购买法会计调整数会从个别被投资公司分离出来,单独加总列示,之所以这样做是为了让旗下各业务的收益状况,不因我们的投资而有所影响。过去我一再地强调,较之 GAAP 我们认为这样的表达方式更有帮助,不管是对投资者或是管理层来说,当然最后损益加总的数字仍然会与经审计的 GAAP 数字一致。

年报中还有企业个别部门的信息,有关 Wesco 公司的信息,我强烈建议大家可以看看查理·芒格所写的年报,里头包含我看过对储贷机构危机事件写得最贴切的一篇文章,另外也可以顺便看看精密钢铁厂,这家 Wesco在 1979 年购买的子公司,其所处的产业竞争相当激烈,但经理人戴夫·希尔斯特罗姆(Dave Hillstrom)仍然努力创造出相当不错的绩效,虽然手头上缺乏资料来证明,但我相信他的表现绝对在同行中排第一。

我们旗下各项营运业务所创造的收益,不管是依绝对值或是与同业相较,实在是相当出色,对此我们衷心感谢这些辛苦的经理人,你我应该感到庆幸能与他们一起共事。

在伯克希尔,这样的共事关系可以维持相当长久,我们不会因为这些杰出优秀的明星经理人年纪到了一定程度就把他们给换掉,不管是 65 岁或是 B 夫人在 1988 年所打破的 95 岁上限,明星的经理人绝对是可遇不可求的稀罕宝贝,不能仅仅因为蛋糕上插满了蜡烛(年纪太大)就被丢弃。相较之下,我们对于新培养的 MBA 企管硕士的评价就没有那么高了,他们的学术经历看起来总是很吓人,讲起话来头头是道,但他们个人往往缺乏对公司的全情投入和普遍的商业常识。实在是很难去教菜狗那套老把戏。

以下是我们非保险业务的最新运营情况:

o 在内布拉斯加家具店,B 夫人坐着她的轮椅继续前进。自从 44 岁那年以 500 块美金开始创业,至今已有 51个年头,(要是当初有 1,000 块的话,现在可能更不得了),对于 B 夫人来说,就是再多十岁也不嫌老。

这家长期以来全美最大的家具店到现在还在持续成长,去年秋天,又新开了一家占地 20,000 平方英呎的独立折扣店,让我们的产品线在各种价格都应有尽有。

最近一家在全美地区经营相当成功的狄乐(Dillard)百货公司打算进军奥马哈地区,它在其它主要地区的分店都设有家具部门,事实上他们在这方面也做的相当成功,不过就在其奥马哈分店开幕的前夕,狄乐百货总裁威廉·狄乐先生(William Dillard)却宣布这家分店决定不卖家具,他特别提到内布拉斯加家具店时表示:我们不想和他们竞争,我们认为他们差不多是最好的了。

在布法罗新闻报,我们赞扬广告的价值。我们在内布拉斯加家具店的策略,证明了我们所宣扬的政策确实可行。过去三年来,内布拉斯加家具店是《奥马哈世界先锋报》的最大 ROP 广告客户,(ROP 是指直接印在报纸而非夹报式的广告),据我所知,除此之外没有一家报纸的主要广告客户是家具商,同时我们也在堪萨斯等地区刊登广告,所得到的反应也相当不错。做广告确实是值得的,只要你所要介绍的东西值得推荐。

B 夫人的儿子路易和他的儿子们组成了一支梦幻队伍,跟这个家族一起共事实在是一种享受,所有的成员品格与才能兼备。

o 去年我曾明确地表示,布法罗新闻报 1988 年的税前收益一定会下滑,事实证明要不是有 Stan Lipsey,结果可能会如我所预测,像其它同规模的报纸同样地下滑,很高兴 Stan 让我看起来很愚蠢。

虽然我们去年调涨的价格较同业水准略低,同时印刷与工资成本调整的幅度与同业一致,但 Stan 还是让毛利率又扩大一些,在报纸业没有其它人可以像他这样有更好的经营绩效,而且还能够让读者得到如此丰富的新闻,我们相信,我们的新闻比率,绝对是同样规模或甚至更大报纸中最高的,1987 年是 49.8%,1988 年是 49.5%,不管获利状况如此,我们一定会努力将这个比率维持在 50%上下。

查理跟我在年轻的时候就很热爱新闻事业,而买下布法罗新闻报的 12 年来,让我们渡过许多快乐时光,我们很幸运能够找到像穆雷·莱特(Murray Light)这样杰出的总编辑,让我们一入主布法罗报纸后,便深深引以为傲。

o 喜诗糖果在 1988 年总共销售了 2,510 万磅重的糖果,本来在十月前整个销售前景看起来不太乐观,但拜圣诞节旺季特别旺所致,整个局势跟着扭转。

就像我们以前告诉各位的,喜诗的糖果旺季越来越向圣诞节集中,1988 年 12 月份税前获利 2,900 万,占整个年度 3,250 万的 90%,(如此你应该相信圣诞老人真的存在了吧),12 月的旺季使得伯克希尔第四季的收益看起来相当不错,另外第一季度的增长则是因为世界百科全书年度出版,所以也会有一波小高潮。

查理跟我是在买下喜诗糖果五分钟之后,决定让 Chuck Huggins 负责这家公司的管理,在看过他这些年来的绩效之后,你可能会怀疑为何我们要考虑那么久!

o 在费区海默,海德曼家族(Heldmans)就好象是布鲁姆金家族(Blumkins)的辛辛那提版,不管是家具业或者是制服业,在经济上都不是很有吸引力的行业,也只有卓越的管理才能让股东们获得好的投资回报,这正是五位Heldmans 家族成员为伯克希尔所作的贡献。职业棒球大都会队的发言人,Ralph Kiner 曾说:比较该队投手SteveTrout 与他的父亲 DizzyTrout 也是底特律老虎队著名投手,你就会发现虎父无犬子。

费区海默在 1988 年进行了一项规模颇大的并购案,查理跟我对于他们相当有信心,所以我们连看都没有看就同意了这项交易。很少有管理层能得到我们这样的信任,即便是财富 500 强企业的管理层。

因为这项并购案以及内部自身的成长,费区海默 1989 年的营业额可望大幅成长。

o 拉尔夫·谢伊(Ralph Schey)管理的所有业务,包含世界图书公司、柯比吸尘器与斯科特费泽制造集团,在1988 年的表现皆相当出色,由其管理的资本获得的回报仍然十分出色。

在斯科特费泽制造集团当中,又以坎贝尔豪斯菲尔德(Campbell Hausfeld)家用器具最突出,这家全美最大的中小型压缩机生产商,从 1986 年以来,收益已翻倍有余。

柯比吸尘器与世界百科全书的 1988 年销售数量都大幅成长,尤其在外销业务更是强劲,9 月开始,随着莫斯科当地最大的一家美国书店开幕,世界百科全书在苏联也能买到了,并成为该店唯一在售的一套百科全书。

Ralph 的个人能力真是惊人,除了同时经营 19 项业务之外,他还投入相当精力在克里夫兰医院、Ohio 大学,凯斯西部储蓄,以及一家风险资本管理公司 VC,该公司投出了 16 家总部位于 Ohio 的新公司,并复活了许多其它公司。拉尔夫堪称 Ohio 与伯克希尔之宝。

〔译文源于芒格书院整理的巴菲特致股东的信〕