巴菲特致股东的信(1988年)

⑤保险业务

保险业务

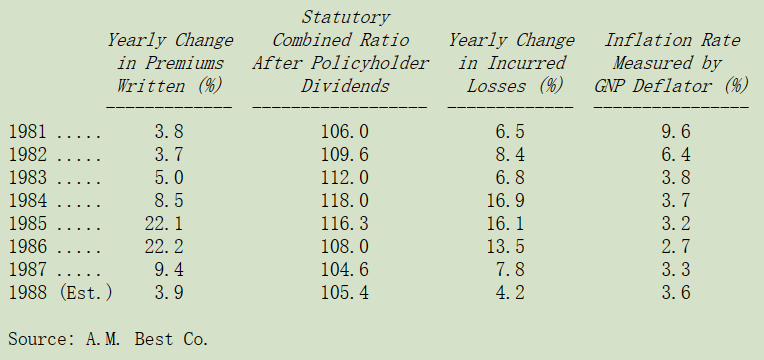

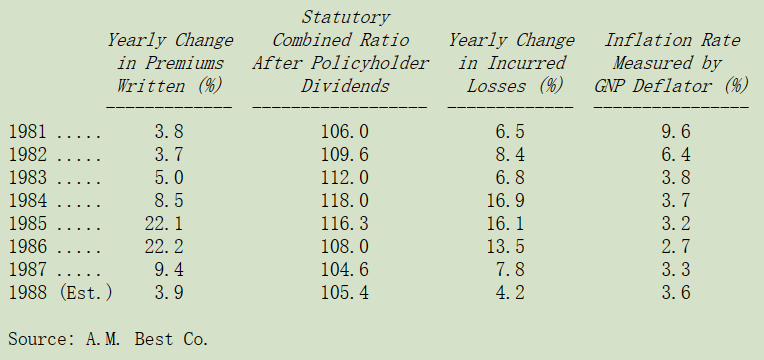

下表是有关保险业务的几项主要数据更新:

综合比率代表的是保险的总成本(损失加上费用)占保费收入的比率,100 以下代表会有承保盈利,100 以上代表会有承保损失,若把持有保费收入所产生的浮存金(扣除股东权益部分所产生的收益)所产生的投资收益列入考量,盈亏平衡点的范围大概是在 107-111 之间。

基于前几次年报所说明的理由,即使是通货膨胀在这几年来相对温和,我们预期保险业每年损失增长的比率约在 10%左右,若是保费收入增长没有到达 10%以上,亏损一定会扩大。虽然保险公司在景气不好时,会习惯性地将损失暂时隐藏起来,如表所示,1988 年行业整体的承保亏损有所增加,而这个趋势应该会继续持续下去,甚至在未来两年还会加速恶化。

产险业的获利情况不但是相当的低,而且也是不太受尊重的行业,(山姆戈德温(Samuel Goldwyn)曾颇具哲理地说过:生活中必须学会体验人生的苦痛酸涩)。商业中的一大讽刺是:许多行业做的要死要活的同时,还要被客户糟蹋;而有些赚翻了的行业,东西明明贵的要死,却是一个愿打一个愿挨。

以早餐麦片为例,它的投入资本回报率是汽车保险业的两倍多(这也是为什么家乐氏与通用磨坊的市净率是五倍,而大多数保险业者的市净率仅为一倍),麦片公司常常在调整产品售价,即便其生产成本没什么变化,但消费者却没什么抱怨。但要是换做是保险业者,就算只是为了反映成本而稍微调整一下价格,保户马上就会生气地跳起来,所以若你识相,显然去卖高价的玉米片比卖低价的汽车保险,要好得多。

一般大众对于保险业的敌视可能会造成严重的后果,去年秋天加州通过的一项 103 提案可能会大幅压低保险价格,尽管成本一再飙升,所幸法院正在重新检视这项提案,但这次投票所引发的不满情绪却未曾消减,即使提案被推翻,保险业者在加州已很难再有营运获利的空间,(谢天谢地,加州人还没有对巧克力糖果感到反感,若是103 提案也如保险般适用于糖果的话,喜诗可能被迫卖每磅 5.76 元而不是现在的每磅 7.6 元,果真如此,喜诗可能就要亏大钱了)。

对伯克希尔来说,这项法案的短期影响不大,因为即使在这法案之前,加州现行的费率结构也很难让我找到有获利的商机,然而这项压低保费的做法却会直接影响到我们持有 44%股权的 GEICO 保险,其有 10%的保费收入系来自加州。对 GEICO 更具威胁的是,其它州可能会通过提案或是立法的方式也采取类似的行动。

若民众坚持汽车保险费的价格一定要低于成本,则最后可能要由政府来直接负责,股东或可暂时补贴保户,但只有纳税人可以长期补贴他们。对大部分的财产意外险公司来说,社会化的汽车保险对于其股东不会有太大影响,因为由于这个产业是属于大众商品,保险业者所赚的投资回报平平,所以,若因此被政府强迫退出市场,也不会有太大的商誉损失。但 GEICO 保险就不一样了,由于它的成本低,相对地可以获得高报酬,所以可能会有很大的潜在商誉损失,而这当然会连带影响到我们。

在 1988 年伯克希尔的保费收入持续减少,到了 1989 年我们预期保费收入还会大幅下滑,一方面是因为消防员退休基金 7%的份额业务即将于八月底到期,届时依合约我们必须将未到期的保费退还,估计总共退回的金额8,500 万美元,这将使得我们第三季度的数字看起来有点奇怪,当然合同结束不会对利润造成太大的影响。

伯克希尔 1988 年的承保表现依旧相当不错,我们的综合比率约 104%(依照法定基础扣除结构化结算与金融再保),损失准备提列在前几年不佳后,连续两年情况还算良好。

我们的保费收入规模预计在未来几年内都会维持在相当低的水平,因为有利可图的生意实在是少之又少,随它去,在伯克希尔我们不可能在知道明明会亏钱的情况下,还去硬接生意,光是接看起来有赚头的生意,就让我们的麻烦够多了。

尽管(也或许正因为如此)我们的保单量少,可以预期我们的获利情况在未来几年内也会比同业来的出色,相较于保单量我们有高比例的浮存金,这对利润来说是个好兆头。在 1989-1990 年,我们的浮存金/保费收入比例至少会是同业水准的三倍以上,迈克·戈德伯格(Mike Goldberg)在阿吉特·贾恩(Ajit Jain)、迪诺斯·罗达瑙(DinosIordanou)和国民保险的经营团队的协助下使我们站在相当有利的位置。

某些时候(我们不知道什么时候)我们可能会被保险业务拖垮,有可能会是一些重大的自然或金融灾难,但我们也有可能会经历像 1985 年一样爆炸式增长,因为当其它同业因长期杀价抢单,一夕之间损失突然爆发,才发现损失提列准备远远不足,在那种情况下,我们一定会留住优秀的人才,保护好资本并尽量避免犯下重大的错误。

〔译文源于芒格书院整理的巴菲特致股东的信〕