巴菲特致股东的信(1988年)

⑥有价证券

有价证券

在为我们的保险业务选择有价证券投资之时,我们主要有五种选择(1)长期股票投资;(2)长期固定收益债券;(3)中期固定收益债券;(4)短期现金等价物;(5)短期套利交易。

对于这五种类型的交易,我们没有特别的偏好,我们只是持续不断地寻找,最高的税后回报率预计的数学期望值,且仅限于我们认为了解和熟悉的投资,我们无意让与短期的报告收益好看,我们的目标是让长期的账面价值极大化。

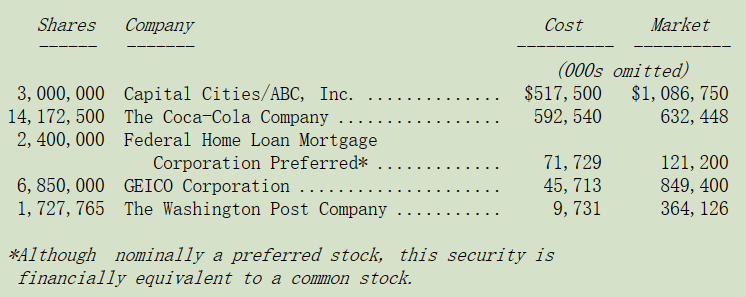

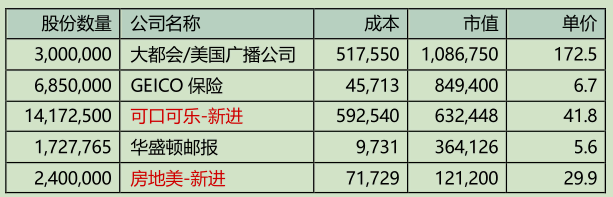

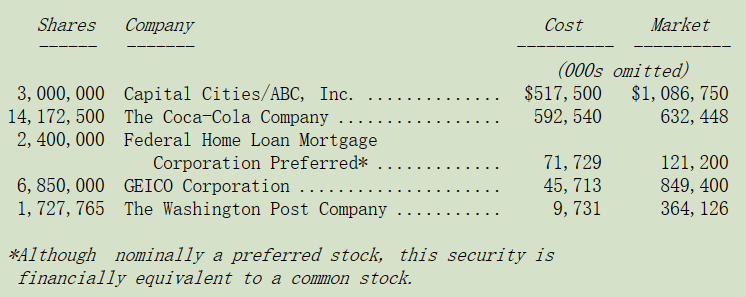

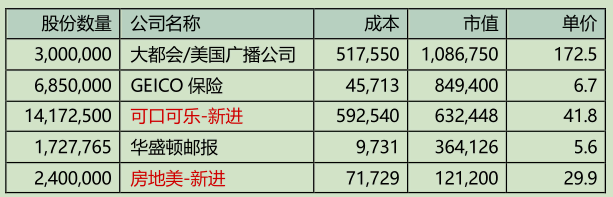

o 下表是我们市值超过 1 亿美元以上的普通股投资(不包括套利交易,这部分我们后面再谈),一部分投资属于伯克希尔关系企业所持有。

我们永久的持股,大都会/ABC、GEICO 保险与华盛顿邮报依旧不变,同样不变的是我们对于这些管理阶层无条件的敬仰,不管是大都会/ABC 的汤姆.墨菲与丹·伯克(Dan Burke)、GEICO 保险的比尔·斯奈德(Bill Snyder)和路易·辛普森(Lou Simpson),还有华盛顿邮报的凯瑟琳·格雷厄姆与迪克·西蒙斯(Dick Simmons),查理跟我对于他们所展现的才能与品格同感敬佩。

他们的表现,就我们最近距离的观察,与许多公司的 CEO 截然不同,所幸我们能与后者保持适当的距离,因为有时这些 CEO 实在是不胜任,但却总是能够坐稳其宝座,企业管理最讽刺的就是不称职的老板要比不称职的下属更容易保住其位置。

假设一位秘书在应征时被要求一分钟要能够打 80 个字,但录取之后被发现一分钟只能打 50 个字,很快地她就可能会被炒鱿鱼,因为有一个相当客观的标准在那里,其表现如何很容易可以衡量的出来;同样的,一个新进的业务员,若是不能马上创造足够业绩,可能立刻就被解雇,为了维持纪律,很难允许有例外情形发生。

但是一个 CEO 表现不好,却可以无限期的撑下去,一个原因就是根本没有一套可以衡量其表现的标准存在,就算真的有,也是写的很模糊,或是能含混解释过去,即便是错误与过失一再发生也是如此,有太多的公司是等老板先射出业绩之箭,再到墙上把准心描上去。

另外一个很重要但却很少被提起的老板与员工之间的差别是,老板本身没有一个直接可以衡量判断其表现的上司,业务经理不可能让一颗老鼠屎一直留在他那一锅粥之内,他一定会很快地把它给挑出来,否则可能连他自己都会有问题,同样的一个老板要是请到一位无能的秘书,也会有相同的动作。

但 CEO 的上司也就是董事会却很少检视其绩效,并为企业表现不佳负责,就算董事会选错了人,而且这个错误还持续存在又怎样?即使因为这样使得公司被接收,通常交易也会确保被逐出的董事会成员有丰厚的利益(且通常公司越大,甜头越多)。

最后董事会与 CEO 之间的关系应该是要能够意气相投,在董事会议当中,对于 CEO 表现的批评就好象是在社交场合中打嗝一样不自然,但却没有一位经理人会被禁止不准严格地审核打字员的绩效。

以上几点不是要一杆子打翻一条船,大部分的 CEO 或是董事会都相当努力、能干,有一小部分更是特别的杰出,但查理跟我在看过很多失败的例子之后,更加对于我们能够与前面三家公司优秀的经理人共事感到非常幸运,他们热爱他们的事业,想法跟老板一致,且散发出才气与品格。

o 1988 年我们做出两项重大的决定,大笔买进房地美与可口可乐,我们打算要持有这些股票很长的一段期间。事实上当我们发现我们持有兼具杰出企业与杰出经理人的股权时,我们最长的投资期间是永久,我们跟那些急着想要卖出表现不错的股票以实现获利,却顽固地不肯出脱那些绩效差的股份的那群人完全相反。彼得林奇曾生动地将这种行为解释成铲除花朵浇灌野草。我们持有房利美的股份比例是法令规定的上限,这部分查理在后面会详加为各位说明,因为他们是 Wesco 子公司旗下互助储贷所投资,所以在我们的合并资产负债表当中,这些持股将以成本而非市价列示。

我们持续将投资集中在少数我们能够了解的公司之上,只有少部分企业是我们想要长期持有的,因为当我们好不容易找到这样的公司时,我们会想要达到一定的参与程度,我们同意 Mae West 的看法:好东西当然是多多益善。

o 去年我们中期免税债券投资减少了约一亿美元,所有卖出的债券都是在 1986 年 8 月 7 日之后才取得的,当这些债券由产险公司所持有的时候,其中 15%的利息收入是要课税的。

剩下我们仍持有约 8 亿美元的债券,都是属于适用 1986 年租税改革法案完全免税的祖父级债券,出售的债券将有些许的获利,而继续持有的债券平均到期日大概是六年,其市价大概略高于帐面价值。

去年我们曾提及我们所持有的已破产的 Texaco 石油短期与中期公司债券,1988 年我们已经将所有头寸处分了,获利约 2200 万美元,此举将使得我们在固定收益债券的投资部位减少 1 亿美元。

去年我们还提到了另外一个深具固定收益特色的投资:亦即所罗门公司 9%可转换优先股,这种特别股特别要求公司提拨偿债基金,自 1995 年到 1999 年间分批赎回,伯克希尔将这些投资以成本列示在帐上,基于查理所提的原因,现在的估计市价以从前一年度略低于成本,转变为 1988 年的略高于成本。

我们与所罗门 CEO 约翰·古弗兰(John Gutfreund)之间良好的关系,随着几年来的合作日益增进,但我们还是无法判断投资银行业的前景,不管是短期、中期或是长期皆然,这是一个难以预估未来获利水平的产业,我们仍然相信我们所拥有的转换权益会在其有效期内,对我们产生相当大的贡献,然而这种特别股的价值主要还是来自于其固定收益,而不是股权特性之上。

o 我们对于长期债券的规避依旧不变,唯有当我们对于货币的长期购买力有信心时,我们才会对这类的债券有兴趣,但这种稳定性却根本没办法预期,因为不管是社会或是选出来的官员,实在是有太多的优先事项是与购买力的稳定性相冲突的。所以目前我们唯一持有的长期债券就是华盛顿公用电力供应系统 WPPSS,其中有些期限较短,有一些则是分几年赎回的高息票,目前资产负债表上帐列成本为 2.47 亿美元,目前市价约为 3.52 亿美元。

我们在 1983 年年报中曾经解释过购买 WPPSS 的理由,现在很高兴跟大家报告,结果完全符合我们当初的预期,在买进的时候,债券的评级被暂时取消,估计税后的投资回报率约为 17%,最近它被标普评为 AA-等级,按目前的市价大概只有比最高等级债券的投资回报好一点。

在 1983 年的年报中,我们比较了投资 WPPSS 与一般企业的差异,结果显示这次的投资要比当时同期间所从事并购案还要好,假设两者皆以为无财务杠杆的基础下进行。

不过我们在 WPPSS 的愉快经历并未能改变我们对于长期债券的负面看法,除非再让我们碰到暂时僵住的大案子,因为短暂的问题使得其市价严重的被低估。

〔译文源于芒格书院整理的巴菲特致股东的信〕