巴菲特致股东的信(1989年)

③报告收益来源

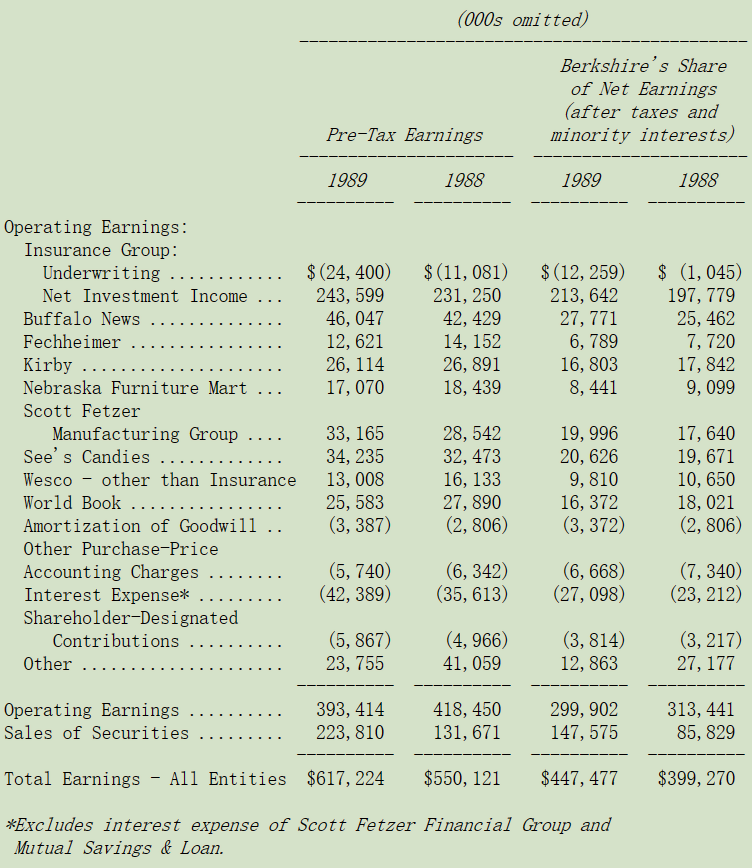

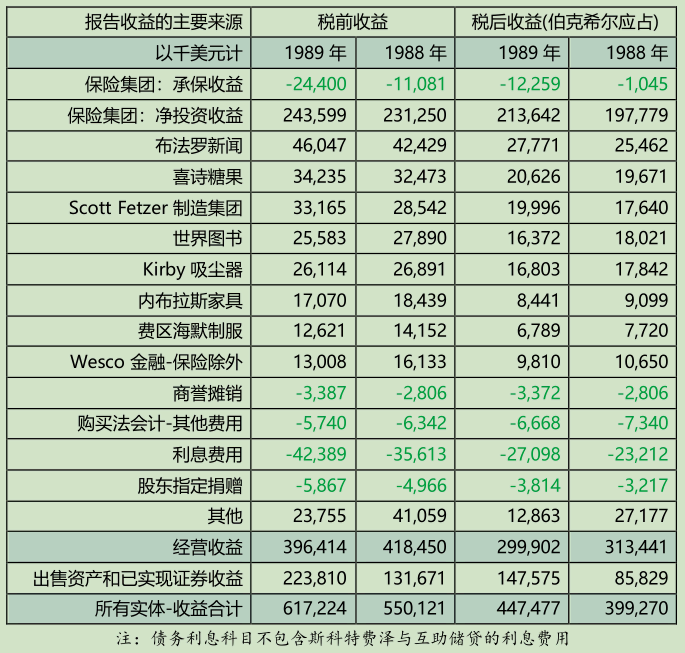

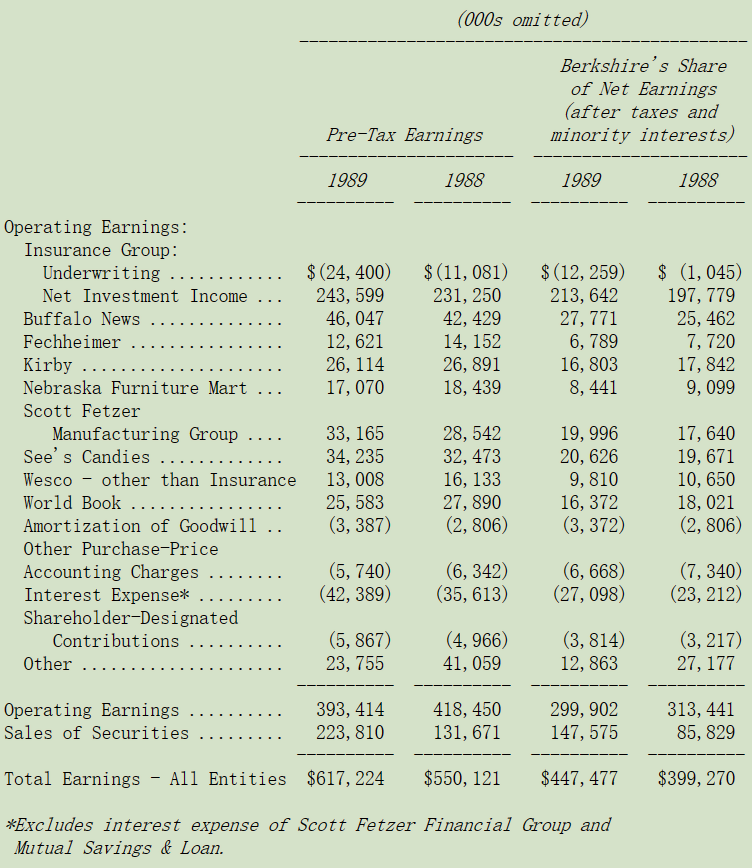

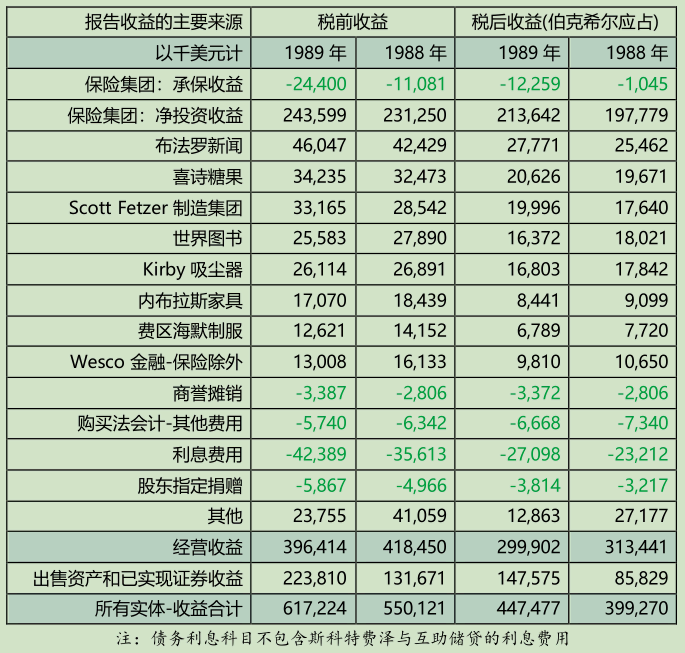

报告收益来源

下表列示伯克希尔报告收益的主要来源,在这张表中商誉的摊销与购买法会计调整数会从个别被投资公司分离出来,单独加总列示,之所以这样做是为了让旗下各业务的收益状况,不因我们的投资而有所影响,过去我一再地强调我们认为这样的表达方式,较之 GAAP 要求以个别企业基础做调整,不管是对投资者或是管理者来说,更有帮助,当然最后损益加总的数字仍然会与经审计的 GAAP 数字一致。

年报中还有企业个别部门的信息,有关 Wesco 公司的信息,我强烈建议大家可以看看查理·芒格所写的年报,里头包含查理在 1989 年 5 月写给美国储贷联盟的一封公开信,信中传达对于其推行政策的不满并做出辞去在其组织中的职位。

在后面我会提到重新将伯克希尔的部门分类为四大项,这是查理跟我认为可以帮助大家计算本公司内在价值的最好方式,以下的资产负债表与损益表就是依此分类表示:(1)保险业务,并将主要投资部位归类,(2)制造、出版与零售业务,扣除非经营性资产与购买法会计调整,(3)金融业务子公司,如互助储贷与斯科特费泽财务公司,(4)其它项目,包含前述非经营性资产(主要是有价证券投资),购买法调整,还有 Wesco 与伯克希尔母公司一些其它的资产与债务。

如果你将这四个部门的收益与账面价值加总,会得到与经会计师依 GAAP 审计的数字一致,然而我还是必须强调这四类表述方式并未经过会计师的审计,我想他们还是选择不要看的好。

除了报告收益外,实际上,我们还受惠于 GAAP 不能认列的收益,后面我列出的五家主要被投资公司在1989 年收到的税后现金股利收入合计是 4,500 万美元,然而若依照投资比例我们可以分得的税后收益却高达2.12 亿美元,这还不包含我们在 GEICO 保险与可口可乐身上所获得的资本利得,而若将这应得的 2.12 亿收益分给我们,则在扣除应付的所得税之后,公司报告的收益可能会大幅增加为 5 亿美元,而不是现在的 3 亿美元。

你必须决定的是,这些未分配的收益是否与我们帐上已经列示的收益具备同样的价值。我们相信他们是,甚至认为可能更有价值。之所以得出“一鸟在林胜于两鸟在手”这个结论是因为,与其把收益交到我们手中,还不如留给才华横溢且以股东利益为导向的经理人继续去运用发挥,通常我不会对一般的经理人有这么高的评价,但以这几家公司来说,的确是实至名归。

我们认为,伯克希尔的基本盈利能力可以用透视收益的方法来衡量,也就是我们将被投资公司未分配给我们的收益加到报告的经营收益之上,这两种情况下都不包括资本利得。为了使我们的内在价值平均每年增长 15%,我们的透视收益也必须要以同等的速度增加,因此我们相当需要现有的被投资公司给予我们更多的支持,同时也需要时时增加新进的成员才有办法达到这 15%的目标。

〔译文源于芒格书院整理的巴菲特致股东的信〕