巴菲特致股东的信(1989年)

⑤保险业务营运

保险业务营运

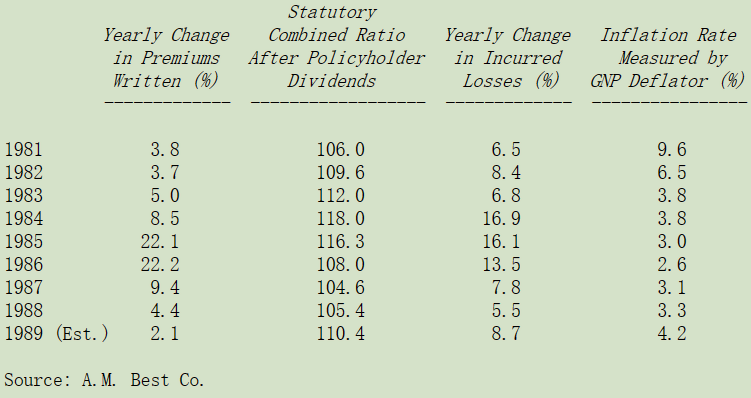

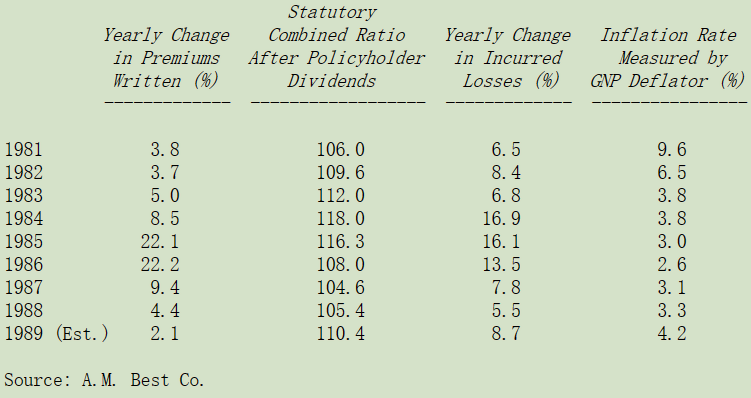

下表是财产意外险业的几项重要指数:

综合比率代表的是保险的总成本(损失加上费用)占保费收入的比率,100 以下代表会有承保收益,100 以上代表会有承保损失,若把持有保费收入浮存金(扣除股东权益部分所产生的收益)所产生的投资收益列入考量,损益两平的范围大概是在 107-111 之间。

基于前几次年报所说明的理由,即使是通货膨胀在这几年来相对温和,我们预期保险业每年损失增加的比率约在 10%左右,若是保费收入增长没有到达 10%以上,承保损失将会增加,(事实上过去 25 年以来,理赔损失系以 11%的速度在增长)。不过,保险公司在业务恶化时,会习惯性地降低准备金,可能会暂时掩盖恶化的程度。

去年我们曾说,在未来两年内综合比率肯定会继续上升,甚至还会加速。今年我们不会预测加速度,但必须重复去年的预测。保费收入的增长率远低于最低 10%增长的要求,而且大家要记住,10%只表示能抑止综合比率上升的情况,却不能使它下降。

1989 年综合比率增加的幅度略高于我们的预期,原因在于意外灾害(主要是 Hugo 雨果飓风)特别严重,这部分造成的影响大约占了 2 个百分点,假若 1990 年能够回到正常情况,相较于 1989 年因灾难升高的基础,综合比率可能只会增加一点点,然而到 1991 年,可能又会大幅度提高。

保险分析师常常会讨论到承保周期并预测它下一次反转的时点,如果那个名词是用来表示节奏性,则我们认为他们是用词不当,把这个产业情况完全搞错了。

几十年前,当产业界与政府监管机构合作以卡特尔方式开展业务时,这个词或许还适用。当时,综合比率有节奏波动只因两个原因,两者都与递延性相关。第一,分析过去的数据,并据以订定新的校正费率,并适用于所有的保险业者之上;第二,所有的保单通常是一至三年为期,这代表着一张错误定价的保单到期通常需要相当长时间,所以,新费率的实施影响有其递延性。这两个因素使得综合比率的变化有脉络可循,同时没有明显的价格竞争通常就保证行业利润会在整个周期中得到平滑,并获得满意的回报。

不过卡特尔的年代一去不复返了,现在行业中有几百家公司在销售同一种商品,价格各自独立,在这种情况下,不管所卖的商品是钢铁或是保单,除了产能短缺的情况之外,整体同业的获利一定很可怜。不过这些时期发生的频率,以及它们持续的时间决定了相关行业的平均盈利能力。

在大部分的产业,产能是以具体的事物来呈现,不过在保险的世界里,产能所代表的却是指财务数字,亦即假设一家公司的账面价值有 Y,那么他只能承接不超过 X 的保单。就实务而言,做这样的限制其实效果相当有限,主管机关、保险中介与客户对于资本紧张的保险公司的反应都很慢,而且,当公司严重夸大其资本时他们仍默许。因此,一家资本规模不大的保险公司,只要他们愿意,照样可以接下一大堆保单。归根结底,整个保险业的供给产能,主要还是视保险公司经理人本身的心态而定。

在了解内情之后,大家不难预知这个产业未来的获利情况,获利要好只有当供给短缺时才有可能发生,而供给短缺只有当保险业者感到害怕时才有可能发生,而偏偏这种情况又很少见,且可以确定短期之内不会出现。

有些分析师认为,最近刚实施的保险业新税法过于繁重,同时加上雨果飓风与加州大地震,将会使保险费率大幅提高。我们并不认同这样的看法,因为这些负面的因素并不会抑制同业以现在的价格承接保单的渴望,因此1990 年的保费收入应该无法增长 10%以上,也就是说,整体的承保亏损可能还会继续恶化。

业者同时也会宣称保险业需要调高价格才能维持一般美国企业的获利水平。当然事实确是如此,钢铁业也一样,但需求与欲望,和产业长期的获利并无绝对相关,反而是经济实质现况才是决定结果的关键因素。只有当价格不上涨,保险同业就不接生意时,保险业的获利能力才会提高,但现在离那样的情况还很远。

伯克希尔 1990 年的保费收入可能会降至 1.5 亿美元左右,从 1986 年的 10 亿保费收入一路跌下来。一方面是因为我们传统的业务持续在萎缩,一方面是消防员退休基金这项业务在去年 8 月已到期。但不管业务量下降多少,都不会影响到我们,我们完全没有兴趣去接那种明显会赔钱的保单,光是那些看起来有赚头的生意就够我们受的了。

然而我们对于价格合理的生意胃口却很足,1989 年有一件事可以说明这一点,它那就是巨灾再保险业务(超级猫),也就是直接保险公司(也包含再保公司本身)购买的再保合约,以保护自己免受像是龙卷风或是飓风等单一灾难事件所可能引发巨额损失的风险。在这些再保合约中,原始的保险公司可能会保留一个单一的损失上限,如1000 万美金,然后在此之上买进好几层的再保险。当损失超过自留的部分时,再保公司依规定就要支付超过的部分,最高比例可达 95%,(之所以要求保险公司本身每层保留 5%,是为了让保险公司与再保公司站在同一阵线,避免保险公司慷再保公司之慨)。

CAT 保险的保单通常是一年期,一般可以自动延期一年,这样的条款主要是保护保险公司避免因为重大灾害发生后投保出现空窗期,事件发生的持续期间通常由合约限定在 72 小时以内,在这种定义之下,一场持续三天的大风暴所造成的损害,可被归类为单一事件。要是大风暴持续四天以上,则保险公司可以切割出其受害最惨重的72 小时,超过的部分则必须视为另一个独立的事件。

1989 年有两件特殊的事件发生,第一,雨果飓风给南卡罗莱纳州造成 40 亿美元的损失,这是在加勒比海发生相同规模的灾害之后仅仅 72 小时多一点;第二,几个礼拜之后,加州大地震又接连发生,造成难以估计的保险损失。受到两次或有可能是三次重大灾难冲击,许多有买 CAT 保险的直接保险公司及再保险公司,要么自动使用了第二次投保权,要么不确定是否自己这样做了。

在当时许多卖 CAT 保单的业者亏了一屁股,尤其是第二次自动投保部分,根本收不到足够多的保费。由于有许多变量,保费通常会是保额的 3-15%不等。几年来,我们一直认为这种保费是不够的,所以没有介入这个市场。

但是 1989 年的大灾害,使得许多 CAT 业者穷于填补保险客户的伤口,使得地震灾后保单供给发生短缺,保费价格很快地就回到相当吸引人的水准,尤其是 CAT 保险公司本身为自己所买的再保保单。立竿见影的是,伯克希尔主动提出可以承保价值高达 2.5 亿美元的灾难保单,并在行业刊物上登了广告宣传。虽然没有达到我们预期的额度,但我们忙碌了十天下来,所签的保单金额也是相当可观。

世界上再没有其它再保公司会像我们一样,愿意一口气接受如此大金额的投保,当然也有保险公司偶尔会愿意接下 2.5 亿美金的灾害理赔保险,但前提是能向其它保险公司分保出去,当他们找不到分散风险的再保公司时,他们会马上退出市场。

相反,伯克希尔的政策则是保留保额,而不是把他们分保出去,当保险费率看起来有利可图,我们很愿意承担更多的风险,以外界的标准而言,那应该是个大数字。

我们之所以愿意承担比一般保险公司更多的风险,主要有两个原因:(1)以监管标准,我们的保险公司账面价值高达 60 亿美金,位居全美第二;(2)我们并不在乎每季或每年的短期收益数字,只要长期而言,这些决策是基于稳健获利的立场所作的明智决定。

很明显的如果我们承保 2.5 亿保额的巨灾再保险,并全部保留下来,很有可能我们会在一个季度内损失 2.5亿,这种机率虽然很低,却并不表示没有可能,若真的发生那样的损失,我们的税后损失大概会是 1.65 亿,尽管这大大超过伯克希尔一个季度所赚的收益,但这只会让我们丢了面子,还不至于失了里子。

这种姿态在保险业界来说实在是少之又少,典型的做法是,保险公司愿意接下很多的保单以确保公司每年可以获得一个平庸的收益,但他们却不愿意公司在某一个单季发生大额的损失,即使这种导致短期损失的策略可以获致更长远的利益。我想我能够体谅他们的立场,对股东最有利的事并不一定对经理人最有利。幸运的是,查理和我的工作保障与身家利益与所有的股东皆一致,我们愿意被人当作是傻子,只要我们自己知道我们不是个傻子。

事实上我们这样的经营策略让我们成为市场上的稳定力量,当供给短缺时,我们可以马上进场满足大家的需求,而当市场过于饱和时,我们又会立即退出市场观望,当然我们这样的做法并不只是为了达到市场的稳定而已,我们之所以会这样做是因为我们认为这样才是最合理、对大家最有利的做法,当然这样的做法间接达到稳定市场的效果,在这种情况下,亚当·斯密所说的市场“看不见的手”确实起作用了。

现阶段,相较于保费收入,我们浮存金规模相当大,这样的情形应该可以让我们往后几年获得像 1989 年那样不错的结果。承保损失应该也可以接受,相较之下我们靠投资所赚得的收益却更为惊人,只是这种好现象可能会随着浮存金的流失而渐渐光芒不再。

不过在某个时点,还是有机会能够让我们找到大额且有利可图的生意,Mike Goldberg 与其经营团队(RodEldred,Dinos Iordanou,Ajit Jain,Phil Urban,Don Wurster),长期而言可以为我们创造有利的地位。

〔译文源于芒格书院整理的巴菲特致股东的信〕