巴菲特致股东的信(1989年)

⑥有价证券

有价证券

在为我们的保险业务选择有价证券投资之时,我们主要有五种选择:(1)长期股票投资;(2)长期固定收益债券;(3)中期固定收益债券;(4)短期现金等价物;(5)短期套利交易。

对于这五种类型的交易,我们没有特别的偏好,我们只是持续不断地寻找最高的税后回报率,以预计的数学期望值衡量,并且仅限于我们自认为理解并熟悉的投资上,我们无意让与短期的报告收益好看,我们的目标是让长期的账面价值极大化。

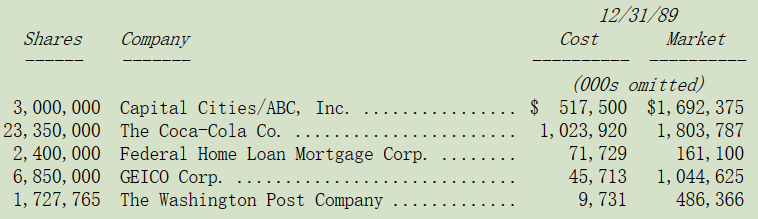

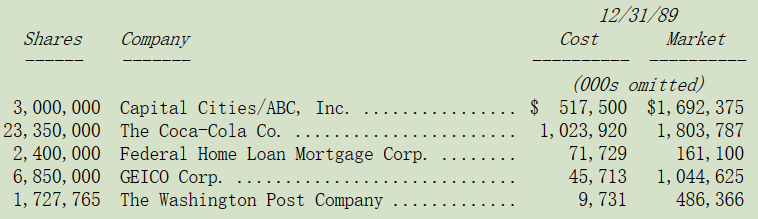

o 下表是我们市值超过一亿美元以上的普通股投资,一部分的投资系属于伯克希尔关系企业所持有。

表上的投资组合与去年几乎相同,只有一项投资的持股有变动,我们将可口可乐的持股数由去年的 1,417 万股提高到今年的 2,335 万股。

这次的可口可乐投资,提供了一个机会来证明你们的董事长对投资机会的反应是多么的快速,不管这些机会是如何的不明确或是被隐藏。我记得我是在 1935 年或 1936 年第一次喝到可口可乐的,不过可以确定的是,我从1936 年开始以 25 分钱半打从巴菲特父子杂货店批货后,在以每罐 5 分钱卖给邻居街坊,作为我个人从事高毛利零售业的开端,我也深深观察到这项产品给消费者特殊的吸引力及背后所代表庞大的商机。

在往后的 52 年内当可口可乐席卷全世界的同时,我也持续地注意到这种特质,然而在同一时间,由于我个人过于小心谨慎以致于竟然连一股都没有买,反而将大部分的个人资产投注在有轨电车公司、风车公司、煤炭公司与邮票公司之类的股票之上,(如果你认为这是我编造的笑话,我可以再告诉大家确实的公司名称),直到 1988 年的夏天,我的大脑才与眼睛建立了联系。

一时之间,我的观感与眼界大开,经过 1970 年代一度委靡不振之后,可口可乐在 1981 年新任 CEO 郭思达的带领下,焕然一新,郭思达加上唐·基奥(Don Keough 曾经是我在奥马哈的对街邻居),经过思考并聚焦了公司的政策后,切实地加以执行,使得本来就已是全世界最无处不在的产品又平添新动力,尤其是来自海外的营收更呈现爆炸性的成长。

利用其罕见的营销与财务方面的技能,郭思达将可口可乐产品的成长与股东的利益极大化,通常一家消费性商品的 CEO,基于个人过去的经验与个性,会偏向公司的营销或财务一边而牺牲其他方面,但是郭思达却能够将两者调和到极致的境界,这样的结果实在是股东们前世修来的好福气。

当然我们应该在郭思达与唐开始接掌公司时,就早点买进该公司的股票,事实上,要是我有足够的远见,早在 1936 年我就应该说服我爷爷干脆卖掉杂货店,然后将钱全部用来买进可口可乐的股票,这次我终于吸取了教训,不过照这种情况看来,距离下一次我灵光一现的时间,可能要再等上个 50 年以上吧!

就像是我上次所提到的,相较于过去,我们这些被投资公司的股价已高于其内在价值,虽然目前这种价位还没有高到令人流鼻血,但难免会受到大盘波动的影响,当然股价下挫一点都不会造成我们的困扰,甚至反而对我们有利,但不可避免地可能会造成伯克希尔年度账面价值的减少。我们认为,至少在未来三年中有一年,这种减少几乎是肯定会发生。事实上,只要我们的投资组合总市值同比下降 10%左右,伯克希尔的净资产就会下降。

我们持续受惠于这些被投资公司经理人,他们高品格、能力佳且设身处地为股东着想,我们能够有这么好的投资绩效,可以说是完全仰赖这些经理人不凡的人格特质。

o 去年我曾向各位报告,1989 年可能会减少在套利投资方面的活动,结果正是如此,套利投资是短期资金的替代去处,有时我们手头上没有太多的现金,就算是有我们也宁愿选择不参与套利,主要的原因是因为最近这些企业活动实在是没有太大的经济意义,从事这类套利交易就好象是在玩博傻游戏,正如华尔街人士 Ray DeVoe 所说,天使回避的地方傻瓜却趋之若骛。我们三不五时会从事大型的套利交易,但只有当我们觉得胜算颇大时,才会考虑进场。

o 除了后面会提到的三项可转换优先股投资之外,我们大幅减少在中长期的固定收益债券部位,尤其是长期部分,唯一持有的就是华盛顿公用电力系统 WPPSS 债券,其息票从低到高不等。去年我们处分了部分当初以相当低折价买进的低息债券,处分价格只比高级免税债券略低,是原始投资成本的一倍,外加每年 15-17%的免税利息收益。保留了 WPPSS 高息债券,有些即将在 1991 年或 1992 年到期,剩下的则会在 1990 年中到期时赎回。

年内还卖了不少中期的免税债券,当初买下这些债券时就曾说过,只要时机成熟找到更好的投资标的,我们会很高兴地把他们给处分掉,不管届时的价格是高于或是低于我们的投资成本,如今时机确实成熟了,所以我们便将大部分的债券出清,所得的报酬还算不错,总结下来我们 1989 年从出售免税债券所获得的税前收益大概在5,100 万左右。

o 我们将出售债券所得的收入连同期初帐上的现金与年中所赚取的收益,通通买进三种可转换优先股,第一种是在 7 月,我们投资吉列公司优先股 6 亿美金,年息 8.75%,十年强制赎回,并有权以 50 美元的价格转换为普通股;之后,我们又投资全美航空优先股 3.58 亿美金,年息 9.25%,十年强制赎回,并有权以 60 美元的价格转换为普通股;最后在年底,我们又投资造纸公司冠军国际集团优先股 3 亿美金,年息 9.25%,十年强制赎回,并有权以 38 美元的价格转换为普通股。

与标准可转换优先股不同,这次我们所拥有的是在限定时间内不得出售或转换的,所以,我们无法从普通股的短期价格波动中获利。并且我已经加入吉列的董事会,至于美国航空或是冠军公司则没有,(我很喜欢现有加入的董事会,但由于分身乏术可能无法再加入其它公司的董事会)。

吉列的业务与我们喜爱的类型非常相近,查理跟我都熟悉这个产业的经济状况,因此我们相信可以对这家公司的未来做一个合理的预估,(若是没有试过吉列新的感应式刮胡刀,赶紧去买一个来试试!),但是我们就没法预测投资银行业、航空业或是造纸业的未来经济前景,(我们在 1987 年买下所罗门公司的可转换债券)。当然这并不表示他们的未来就是悲观的,基本上我们是不可知论者,而不是无神论者。所以,由于我们对这些业务缺乏强而有力的论点支撑,因此我们在这些产业上所采的投资方式就必须与那些显而易见的好公司好产业有所不同。

不过有一点很重要,我们只跟我们喜欢、欣赏且信任的人打交道,像是所罗门的 John Gutfreund、吉列的Colman Mockler Jr.、全美航空的 Ed Colodny 与冠军国际的 Andy Sigler 都符合我们的标准。

同时他们对我们也相当的信任,坚持让我们的优先股在可完全转换的基础上拥有不受限制的投票权,这在一般美国大企业融资案里头并不多见,事实上他们相信我们是聪明的老板,看的是未来而不是现在,就像我们相信他们是聪明的经理人一样,不但会看未来同时也会顾及现在。

这种可转换优先股的投资方式可以确保,即便是我们被投资的公司面临产业前景不佳的环境时,仍能确保我们可以得到普通的回报。但如果它们能够获得与美国工业普遍水平相当的回报,我们将获得确实诱人的结果。我们相信吉列在 Colman 的领导之下,吉列将远远超过这一水平。另外即使是面临产业不佳的前景,John 与 Andy应该也不会让我们失望。

不管在任何情况之下,我们预期这些可转换优先股都可以让我们收回本金加上股利无虞,然而若是我们真的只能收回这些,那么这样的结果将是相当令人失望的,因为我们必须被迫牺牲流动性,这有可能让我们在往后的十年内错失更好的投资机会。在这种情况下,在一般的优先股对我们没有任何吸引力的时期里,我们将只能获得优先股股息。所以,唯一对伯克希尔有利的是,我们的被投资公司本身的普通股也能有优异的表现。

这需要靠好的经营团队再加上可以忍受的产业环境,不过我们相信,伯克希尔对这四家公司的资金投入,也能够对这些公司与其股东的长远利益有所帮助,这是由于,他们可以确信,这些公司的背后,现在有一个稳定又关心公司的大股东在默默地支持他们。在与被投资对象打交道时,查理和我将给予支持、提供分析帮助,并立场客观。我们认识到,我们正在与经验丰富的首席执行官合作,他们能充分掌控自己的业务,但我想,他们应该也会很珍惜,我们这些与产业背景完全不相关的客观人士所给予他们的经验交流。

这些可转换优先股的回报,当然比不上那些具有经济优势却还没被市场发现的好股票,或许也比不上那些我们可以买下 80%以上股权的,拥有优秀管理层的优良企业并购案,但大家要知道后面这两种投资机会相当的稀少,实在是可遇不可求,尤其是以我们现在的资金规模,实在是很难找的到适合的投资标的。

总而言之,查理跟我认为这类的可转换优先股投资应该可以让我们获得比一般固定收益债券更好的投资收益,同时我们也可以在这些被投资公司中扮演一种次要的但富有乐趣和建设性的角色。

〔译文源于芒格书院整理的巴菲特致股东的信〕