巴菲特致股东的信(1990年)

附录A:美国钢铁公司宣布全面更新计划

附录 A:

美国钢铁公司宣布全面更新计划(巴菲特意在嘲讽 80 年代垃圾债券的会计诈骗)

*本文是格雷厄姆于 1936 年所写未对外公开的讽刺性文章,并于 1954 年提供给巴菲特

Myron C. Taylor,美国钢铁公司的董事长,今天宣布令人期待已久,有关全世界最大的制造公司的全面更新计划,与预期相反的,公司的制造或是销售政策全部没有变动,反而是会计帐务系统做了大幅度的调整,在采取一系列最新最好的现代会计与财务措施之后,公司的获利能力因而大幅增进,即使是在景气不佳的 1935 年,在采用新的会计制度下,估计每股收益还是可以达到 50 美元的水准,这项改造计划是经由 Messrs 等人经过广泛的研究调查后制定的,其中主要包含六大点:

(1)将厂房价值减少到负的 10 亿美元;

(2)普通股每股面额减到一美分;

(3)以认股权的方式支付所有的薪水与奖金;

(4)存货的帐面价值减为 1 美元;

(5)原有特别股改成不必马上支付利息 50%折价发行的公司债;

(6)建立 10 亿美元的或有负债准备

以下就是这项全面更新计划的官方完整声明:

美国钢铁公司的董事会很高兴向大家宣布,在经过对产业界所面临的问题广泛地研究之后,我们已经核准了一项重新塑造公司会计制度的方案,一项由特别委员会主导并经 Messrs 等人协助之下完成的调查显示,我们公司在运用最先进的会计制度方面远远落后于其它美国企业,通过这样的做法,公司不必负担额外的支出,经营与销售政策也不必改变,就可以不费吹灰之力地大大改善获利能力,所以大家一致决定不但要立即跟进采用,而且还要将这项技术发展到淋漓尽致的境界,董事会所采用的做法,主要可以归纳为以下六点:

1,固定资产减为负的 10 亿美元

许多代表公司都已将其帐列厂房价值减为象征性的 1 美元,好让其损益表免于折旧费用沉重的负担,特别委员会指出如果它们的厂房只值 1 美元,那么美国钢铁的的固定资产比起它们来说还要少很多,事实上近来大家都承认一项事实,许多厂房对公司来说实际上是一种负债而不是资产,除了要摊提折旧之外,还要负担税金、维修及其它开支,因此董事会决定要从 1935 年开始将资产打销,从原先帐列 1,338,522,858.96 美元减少为负的1,000,000,000 美元。

这样做法的效益相当明显,随着工厂逐渐折减,所代表的负债也相对地减少,因此以往每年 4,700 万的折旧费用不但可以免除,以后每年还可以有 5,000 万美元的折旧利益,一来一往等于让公司的获利至少增加 9,700 万美元。

2,将普通股面值减少到 1 美分。

3,所有的薪资与奖金一律以认股权的方式发放。

许多企业早已将本应支付给经营主管薪水奖金的大笔支出改以不必认列费用的股票认股权方式取代,这种现代化的创新做法很明显地还没有被充分运用,所以董事会决定采取一项更先进的做法。

企业所有的员工将发给认购价为 50 美元的认股权作为薪资的替代,而普通股面额则减少到 1 美分。

这项计划很明显的有下列好处:

A、公司将不再有任何的薪资支出,参考 1935 年的情况,每年估计将因此省下 2.5 亿美元。

B、同时,所有员工的报酬将因此增加好几倍,因为在新的会计原则之下公司帐上显示的每股收益将因此大增,从而使得公司的股价远高于认股权所设定的 50 美元认购价,于是所有的员工都将因为认股权的行使而受惠,所得到的报酬将远比他们原来领的现金收入要高的多。

C、通过这些认股权的行使,公司因此还可以实现额外特别的年度利益,而由于我们将普通股面额设定为 1 美分,因此每认购一股便能产生 49.99 美元的收益,虽然就会计学保守的立场,这些收益可能无法显现在损益表之上,但却可以在资产负债表上以资本溢价的方式单独列示。

D、企业的现金部位也会因此大大地增强,每年不但不再有 2.5 亿美元的薪资流出,通过行使 500 万股认股权的做法,每年还可以创造 2.5 亿美元的现金流入,公司惊人的获利能力加上坚强的现金部位将使得我们可以随心所欲地配发股利,然后我们又可以通过行使认股权的方式补强现金实力,之后又可以有更高的配股能力,如此一直循环下去。

4,帐列存货价值调为 1 美元

在经济衰退时因为必须将存货价值调整至市价,公司可能会因此蒙受巨额的损失,因此许多公司,尤其是钢铁与纺织公司纷纷将其帐列存货价值压到相当低的程度,而成功地解决这方面的问题,有鉴于此美国钢铁公司决定采用一种更积极的做法,打算将存货价值一举压低到 1 美元的最低限度,在每年底都会进行这样的动作,将存货予以调整,差异的数字则全部摆到前面所提到的或有准备科目项下。

这种新做法的好处相当的大,不但可以消除存货耗损的可能性,同时也可大大地增进公司每年的获利能力,每年初存货因为帐列价值只有 1 美元,所以将因出售而获得大笔的收益,经估计通过这种新会计方法的运用将可使我们每年至少增加 1.5 亿美元的收益,而碰巧的是,这个数字与我们每年冲销的或许准备金额相当。

特别委员会的一项报告建议为了维持一致性,应收帐款与约当现金最好也能够将帐面数字调整为 1 美元,同时也一样可以有先前所提的好处,但这个提案现在被驳回,因为我们的签证会计师认为,任何应收帐款或约当现金若冲回,最好还是先贷记原有科目,而不是直接作为损益表上的收入,但是我们也预期这种老掉牙的会计原则应该很快会更新,好与现代趋势做接轨,而等新原则一通过之后,我们一定会马上将这份报告的建议列为优先执行的方案。

5,将现有特别股改成不必马上支付利息 50%折价发行的公司债。

过去许多公司在面临景气不佳的时候,大都利用买回自己原先发行大幅折价的债券来弥补其经营上的损失,不幸的是由于美国钢铁公司的债信一向都还算不错,所以没有类似这样的油水可以趁机捞一笔,但现代更新计划解决了这样的难题。

报告建议原先发行的每一股特别股全部换成面额 300 美元不必支付利息的债券,并且可分为十期以面额的50%赎回,总计将要发行面额 10.8 亿美元的债券,每年有 1.08 亿美元到期,并由公司以 5,400 万美元的价格赎回,同时公司每年将可因此增加 5,400 万美元的获利。

就像是第 3 条所述的薪资奖金计划,这样的安排将可以让公司与其特别股股东一体受惠,后者可以确定在五年内收回现有特别股面额的 150%,因为短期的有价证券实在是没有多少回报率,所以不必付息的特点算是无关紧要,如此一来公司每年将可以减少 2,500 万的特别股股息,再加上每年多出 5,400 万美元的获利,加总之后将可获得每年 7,900 万的收益。

6,建立 10 亿美元的或有负债准备

董事们有信心经过上述的安排,公司未来不管在任何情况下,都可以确保拥有令人满意的获利能力,然而在现今的会计原则下,公司最好不要承担任何可能的潜在损失的风险,因为最好能够事先先建立一个或有损失负债准备以兹因应。

特别委员会因此建议公司可以建立一个 10 亿美元的或有负债准备,就像是先前所述的,存货价值调整为 1 美元的差异将由这个准备来吸收,同时为了怕将来或有准备消耗殆尽,每年还将固定由资本公积提拨补充,因为后者通过股票选择权的运用每年将至少可以增加 2.5 亿美元(见前面第 3 点),所以随时准备好可供或有准备补充之用。

通过这样的安排,董事会必须坦承他们很遗憾还不能够向其它美国大企业一样,充分地运用各种方法,让股本、资本公积、或有负债与资产负债表其它科目互通有无,事实上我们必须承认,目前我们公司所作的分录还过于简单,根本没有达到一般业界那样能够利用最先进的手法,让整个会计程序神秘复杂化,然而对此董事会还是强调在规划革新方案时,必须坚持清楚明了的原则,虽然这样做会对公司的获利能力有所影响。

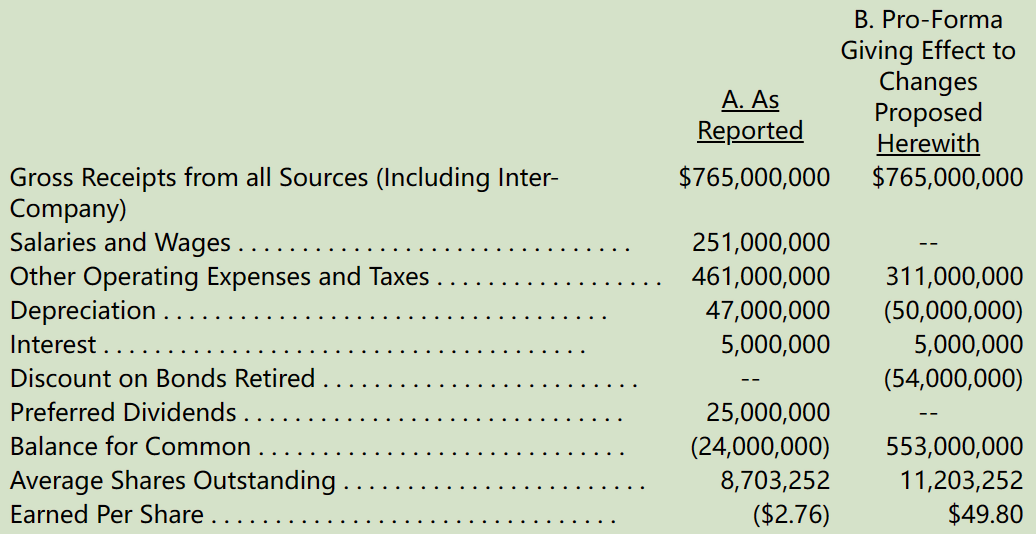

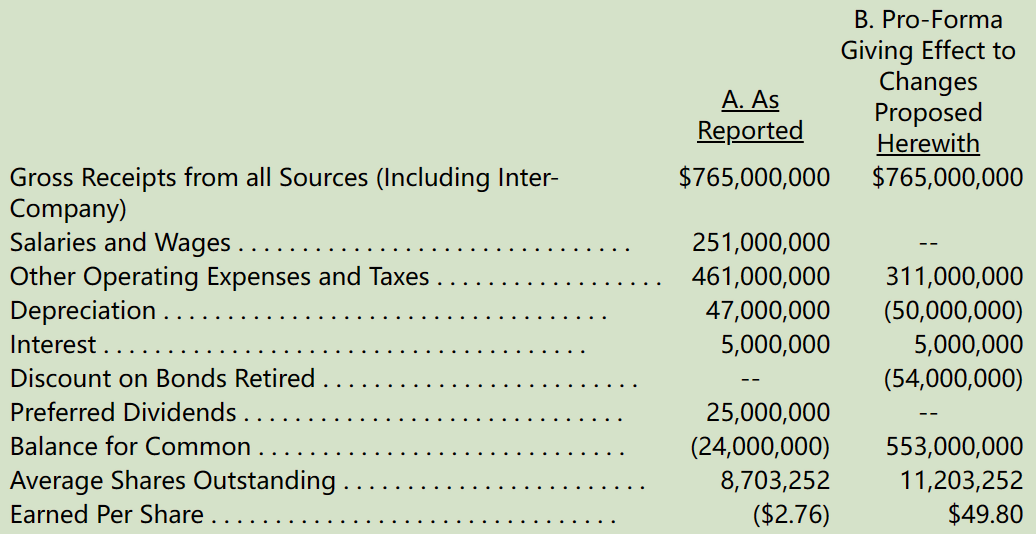

为了显示新方案对于公司获利能力的影响到底有多大?我们特别列出 1935 年分别在两种不同基础下的损益状况:

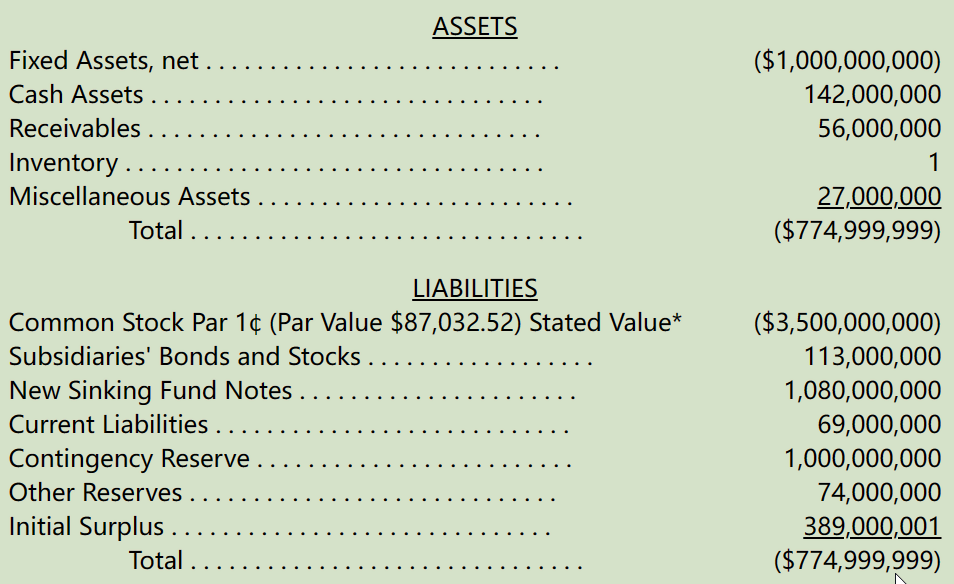

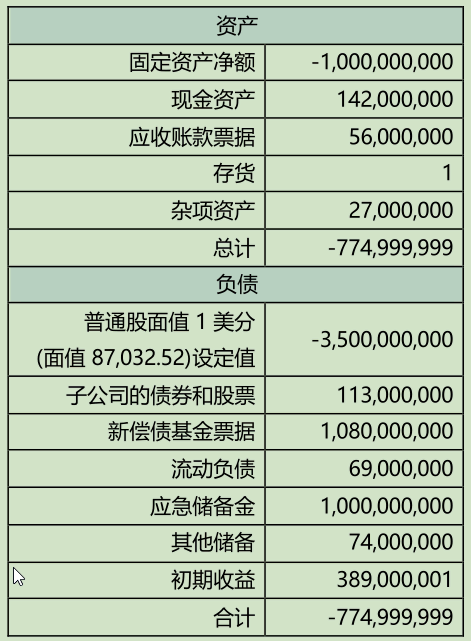

为了配合有点老旧的会计原则,下表是美国钢铁 1935 年 12 月 31 日的合并资产负债表,在经过新会计方案调整后的资产负债科目状况。

注:由于普通股股本给定的规定值与面值不同,根据弗吉尼亚州的法令,公司必须重新设立。

实在是不必要跟各位股东报告,更新过后的资产负债表与原先的报表将会有很大的不同,我想为了让公司的获利大增因此必须就资产负债科目做很大的调整,大家应该不会对此有太多的意见。

总而言之,董事会这一连串措施,包含将厂房价值调为负数、薪水删掉、存货降到几乎为零,将可使美国钢铁在产业的竞争力大为增加,我们将可以因此以非常低的价格销售我们所生产的产品,同时还可以保有很好的获利,董事会也认为在这项更新计划之下,我们将可以彻底打败竞争对手,直到我们达到反托拉斯法 100%市场占有率的最高上限。

当然在准备这份报告时,董事会不是不知道同业也有可能仿效我们这类的做法,使得我们这样做的效益大打折扣,但是我们有信心美国钢铁身为提供钢铁用户这类新式服务的先驱领航者,一定能够维持住客户的忠诚度,不论是老客户或是新客户,当然若是有任何意外,美国钢铁仍将通过我们新设立的会计研究实验室,致力于研发出更新的会计做帐原则,以继续保持我们的优势地位。

〔译文源于芒格书院整理的巴菲特致股东的信〕