巴菲特致股东的信(1991年)

④透视收益

透视收益

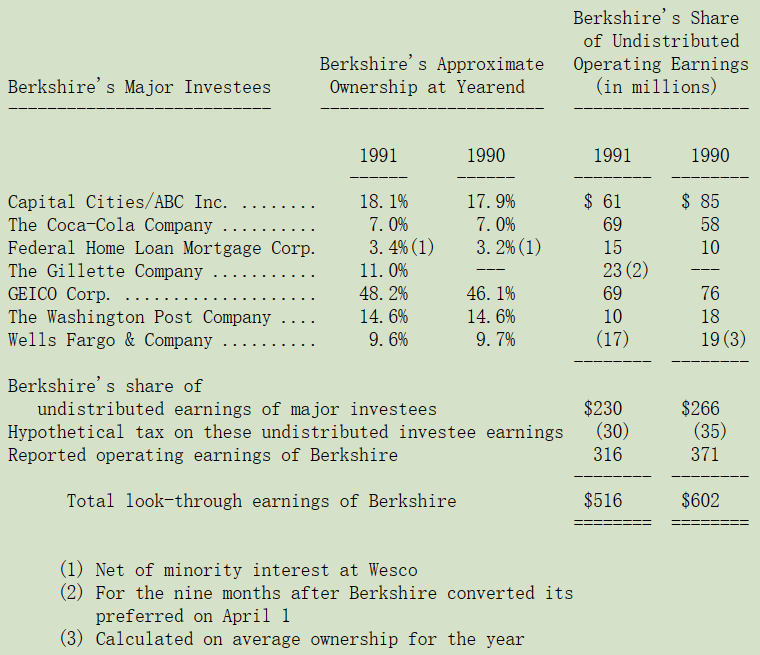

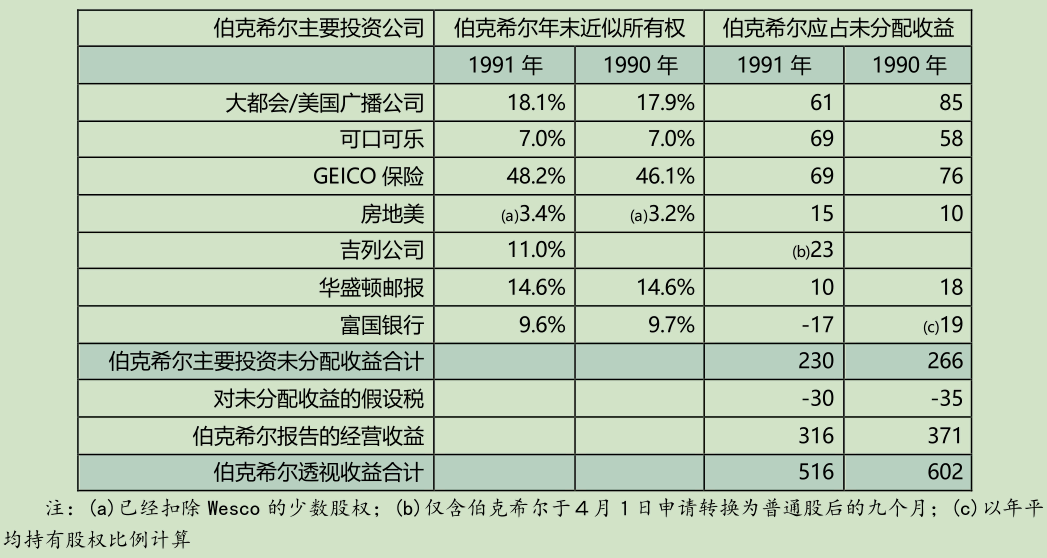

之前我们曾经讨论过透视收益,其主要包括:(1)前段所提到的报告收益,加上(2)主要被投资公司按 GAAP 未反映在我们帐上的保留收益,扣除(3)若这些保留收益分配给我们时,估计可能要缴的所得税。

我曾经告诉各位,长期而言,如果我们的内在价值期望以 15%增长的话,透视收益每年也必须增长 15%。事实上,自 1965 年现有管理层接手以来,公司的透视收益几乎与帐面价值一样,年化增长率为 23%。

然而去年我们的透视收益不但没有增加,反而减少了 14%,这样的下滑主要导源于去年年报就曾经向各位提过的两项因素,那时我就曾经警告各位,这些将对我们的透视收益会有负面的影响。

首先,我曾告诉各位,旗下媒体业务的收益,不管是直接的报告收益,还是间接的透视收益一定会减少,事实证明确是如此。第二,在 4 月 1 日,我们的吉列优先股被要求转为普通股,1990 年来自优先股的税后收益是4,500 万美元,大概比 1991 年三个月的股利总和加上九个月的普通股透视收益还多一点。

另外有二项我没有意料到的结果,也影响到我们 1991 年的透视收益。首先,我们在富国银行的利益大概仅维持损益两平(所收到的股利收入被其累积亏损所抵消),去年我说富国银行取得这样结果的可能性很低,但也不是全无可能。第二,我们的保险业务的收益虽然算是不错,但明显下降了。

各位可以从下表看出我们是如何计算透视收益的,不过我还是要提醒各位这些数字有点粗糙,(被投资公司所分配的股利收入已经包含在保险业务的净投资收益项下)。

* * * * * * * * * * * *

我们也相信投资人可以通过专注于自己的透视收益而受益,通过计算他们就会了解到,其投资组合所应分配到的真正收益的合计数。所有投资人的目标,应该是要建立这样一个投资组合:其透视收益能在从现在开始的十年内极大化。

这种方式将会迫使投资人思考企业真正的长期远景而不是短期的股价表现,从而藉此改善其投资绩效。当然就长期而言,投资决策的绩效还是要建立在股价表现之上,但价格将取决于未来的盈利能力。投资就像是打棒球一样,想要得分,大家必须将注意力集中到场上,而不是紧盯着计分板。

〔译文源于芒格书院整理的巴菲特致股东的信〕