巴菲特致股东的信(1991年)

⑧保险业营运

保险业营运

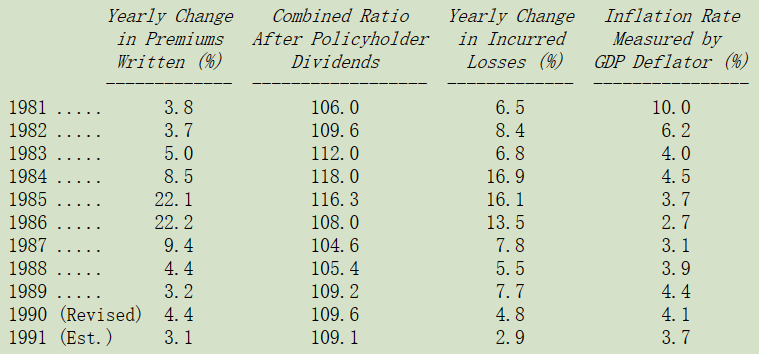

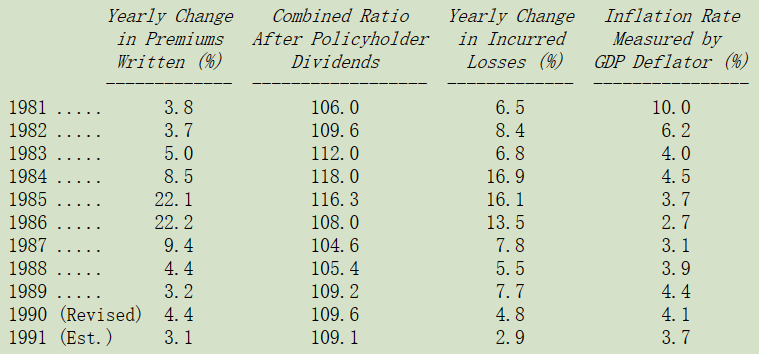

下表是财产意外险业的最新的几项关键数据年度变化:

综合比率代表的是保险的总成本(损失+费用)占保费收入的比率,100 以下代表会有承保利润,100 以上代表会有承保损失,若把持有保费收入浮存金(扣除股东权益部分所产生的收益)所产生的投资收益列入考量,损益两平的范围大概是在 107-111 之间。

基于前几次年报所说明的理由,即使是通货膨胀在这几年来相对温和,我们预期保险业每年损失增加的比率约在 10%左右,若是保费收入增长没有到达 10%以上,损失一定会增加,(事实上过去 25 年以来,理赔损失系以11%的速度在增长),若是同期保费收入增长率大幅落后于 10%,承保损失一定会继续增加。

然而,当保险业状况恶化时,普遍存在损失准备提列不足的现象,使得恶化的程度可以获得暂时的掩饰。这正是去年度所发生的事,虽然保费收入增长不到 10%,但综合比率非但没有像我所预测地那样恶化反而还有点改善,损失准备的统计资料显示这样的现象实在是相当令人怀疑,这也可能导致 1991 年的比率将更进一步恶化,当然就长期而言,这些利用会计手法掩盖运营问题的经理人还是要面对真正的麻烦,到最后这类经理人会变得跟许多病入膏肓的病人对医生说的一样:“我实在是负担不起一次手术费,不过你会接受一小笔钱把我的 X 光片给补一补吗?”

伯克希尔的保险业务发生了变化,使得我们自己或行业的综合比率与我们的业绩基本无关,对我们来说真正重要的是,我们从保险业所获得的资金成本,通俗的说就是浮存金的成本。

浮存金,我们靠保险业务所取得的大量资金,系指将所有的损失准备金、损失费用调整准备金与未赚取保费加总后,再扣除应付代理商佣金、预付并购成本及相关再保递延费用,浮存金的成本则是以我们所发生的承保损失来衡量。

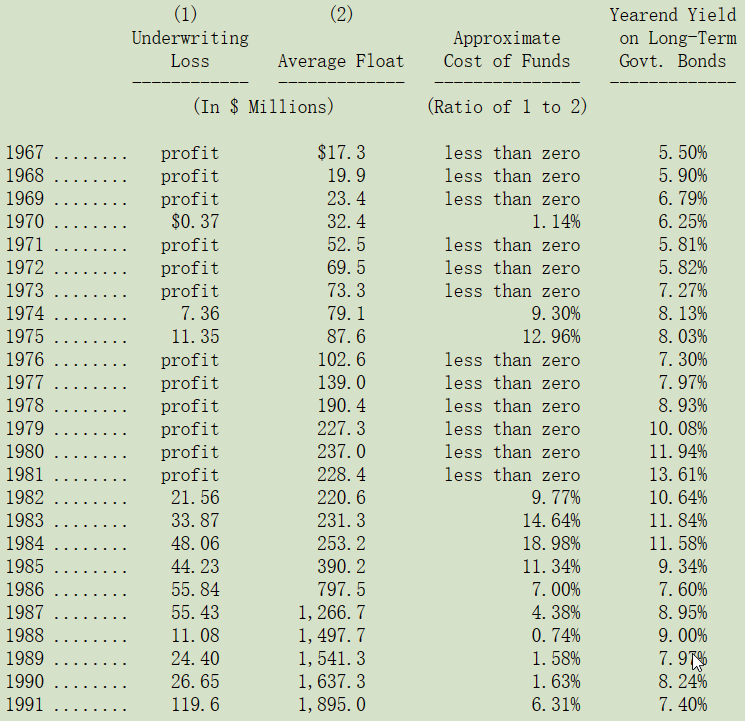

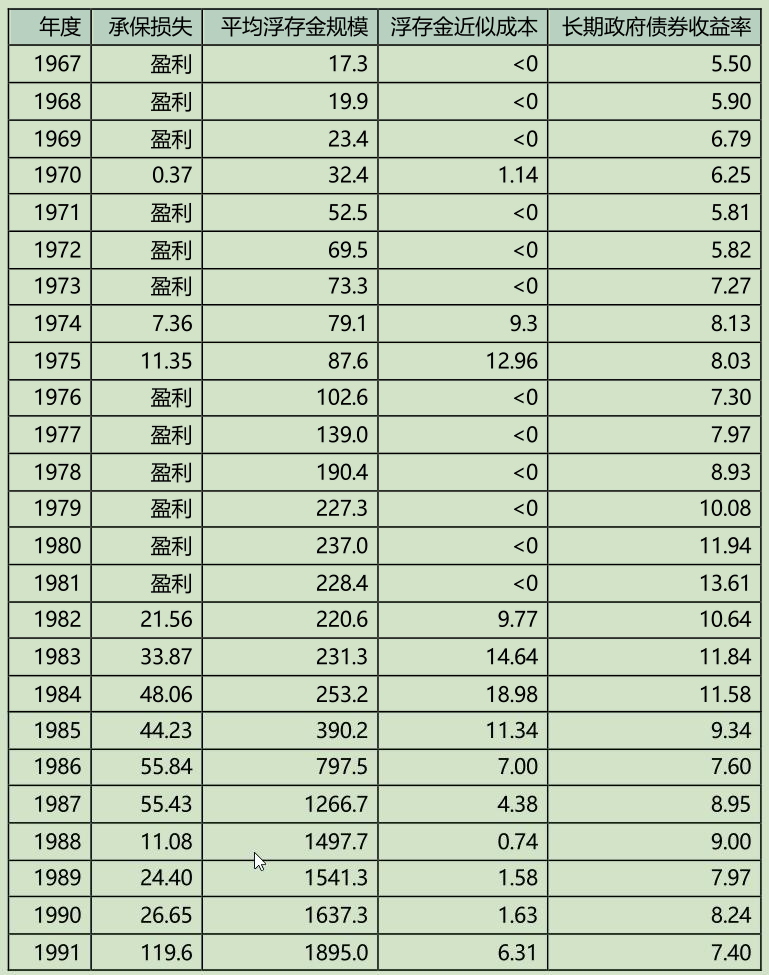

下表是我们在 1967 年进入保险业后,浮存金的成本统计。

正如各位看到的,我们 1991 年的资金成本甚至比美国政府新发行的长期公债利率还低。事实上在过去 25 年的保险业务经营中,我们有 20 年是远低于政府公债发行利率,而且差距的幅度通常都相当可观,同时所持有的浮存金数量也以惊人的幅度增长,当然这只有在资金成本低的情况下,才称得上是好现象。展望未来,浮存金的数量还会继续增长,对我们而言,最大的挑战是这些资金是否能以合理的成本取得。

伯克希尔一直都是巨灾再保险保单(超级猫)非常大的承保者,或许是全世界规模最大的,这类保单通常是由其它保险公司买来保护自己免受重大意外事故损失,这类保险的盈利情况波动相当的大,就像是去年我曾经提过的,一亿美元的巨灾险保费收入,这大约是我们预期一年所能接到的业务量,可能可以让我们有一亿美元的盈利(只要当年度没有重大灾害发生),也可能让我们产生二亿美元的损失(只要当年度发生连续几个飓风或地震)。

当我们对这项业务设定价格时,预计从长期来看,将支付我们收到的保费的 90%左右。当然在任何一个特定年度,我们可能大赚或是大亏,一部分的原因在于一般公认会计原则 GAAP 并不允许我们在没有重大灾害发生的年度提列损失准备金,以弥补其它年度一定会发生的损失。事实上,以一年为期的会计期间并不适合这类的保险业务,所以换句话说当你在评断我们公司的年度绩效时,一定要特别注意到这一点。

去年照我们的定义可能会有一件巨灾险保单要付上我们年度保费收入的 25%,因此我们预计 1991 年这类业务的承保利润大约是 1,100 万美元。或许你很好奇想要知道 1991 年所发生的最大灾害是什么?它既不是奥克兰大火也不是 Bob 飓风,而是 9 月在日本发生的台风造成的损失估计在 40-50 亿美元上下。若以上限估计,这个数字将超过 Hugo 飓风先前所创下的最高损失记录。

保险业者总会需要大量的再保险来规避航海与航空以及天然灾害等意外事故,在 1980 年代许多再保险保单都是由外行人来承接,这些人根本就不知道这类保险的风险有多高,所以他们现在的财务状况已经面目全非,在我亲自经营伯克希尔这项业务时也是如此。保险业者如同投资人一样,仍会一再重复过去所发生的错误,只要有一、两年意外灾害较少,就会有无知的业者跳出来,并以极低的保单价格杀价竞争。

然而只要市场上费率看起来合理,我们就会继续留在这一行里,而在推销这类保单时,我们所拥有的最大竞争优势就是我们的财务实力。有远见的客户都知道许多再保业者可以很轻松地接下保单,但是当重大的意外灾害接连发生时,要他们支付赔偿金可能就有点困难,(有些再保业者就像 Jackie Mason 所说的一样:我可以一辈子不花钱,只要我不买任何东西),相对地,伯克希尔在任何极端的状况下,都能够履行他所做出的承诺。

总的来说,保险业提供伯克希尔相当大的机会,Mike Goldberg 在他接手这项业务之后,就一直缔造出优异的成绩,也使得保险子公司成为我们非常宝贵的资产,虽然我们无法以精确的数字来衡量。

〔译文源于芒格书院整理的巴菲特致股东的信〕