巴菲特致股东的信(1991年)

⑨可流通普通股

可流通普通股

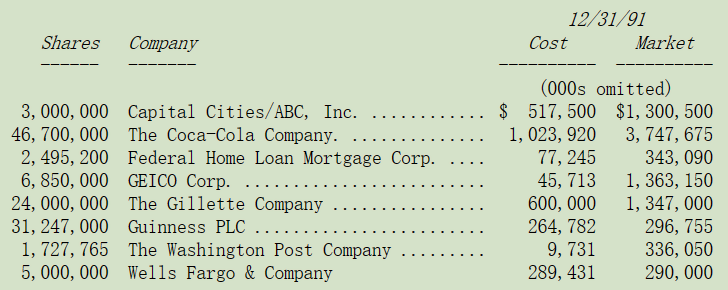

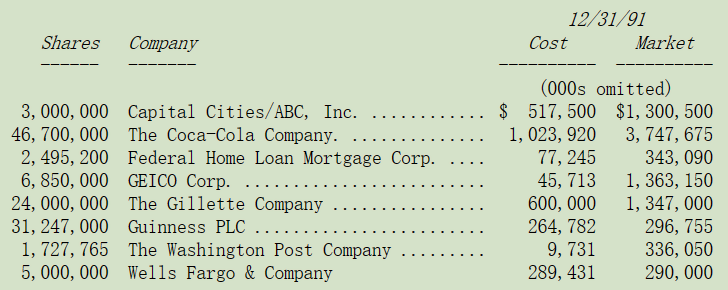

下表是我们超过一亿美元以上的普通股投资,一部分的投资系由伯克希尔拥有不到 100%的子公司所持有。

一如往常,以上这张表显示我们躺平式的投资方式,健力士是我们最新的投资部位,至于其它七项主要的投资都是一年前就持有的(如果把吉列从优先股转换成普通股也包含在内的话),其中六项持股数量保持不变,唯一的例外是房地美,我们投资的股数略微增加(均价 58.94 增持 95200 股)。我们以不变应万变的做法主要是反应我们把股票市场当作是财富重新分配的中心,而钱通常由好动的投资人流到有耐心的投资人手中。我嘴巴可能闭的不够紧,我认为最近几件事情显示,许多躺赢的富人招到许多攻击,因为他们好象没做什么事就使得本身的财富暴涨,而那些精力充沛的富人,如房地产大亨、企业并购家与石油钻探大亨等,却眼睁睁地看着自己的财产大幅缩水了。

我们在健力士的持股代表伯克希尔第一次对海外公司进行大规模的投资,不过健力士所赚的钱与可口可乐、吉列刮胡刀等美国公司却极为类似,主要都是依赖国际部门的营运,确实以国际性的眼光来看,健力士与可口可乐的盈利来源有相当的共通性,(但是大家绝对不能将自己最爱的饮料搞混掉,像我个人的最爱依旧是樱桃可口可乐)。(注:健力士得益于日本烈酒业务的大幅增长)

我们不断地在寻找那些容易理解、具有持续性且令人垂涎三尺的经济特征的大型企业,并且由有能力与才干并以股东利益为导向的管理层经营,虽然这些重要的要求并不一定保证结果就会令人满意,当然我们一定要以合理的价格投资并且确保我们的被投资公司绩效表现与我们当初所评估的一致。寻找行业超级明星的投资方法,是我们唯一能够成功的机会。查理跟我的天资实在是有限,以我们目前操作的资金规模,实在是无法靠着买卖一些平凡普通的企业来赚取足够的利益。当然我们也不认为其它人可以通过像小蜜蜂从一朵花飞到另一朵花的方法来实现长期的成功。事实上我们认为,将这些短线交易活跃的机构称为投资者,就像是把一再搞一夜情的人称作为浪漫主义者一样。

今天假设我的投资天地仅限于比如说奥马哈地区的私人企业,那么首先,我们会仔细地评估每家企业的长期经济特征,第二,我会再评估经营者的特质,第三,再以合理的价格买进一小部分的股权。既然我不可能雨露均沾地去买城里所有公司的股权,那么,为什么伯克希尔在面对全美一大堆上市大公司时,就要采取不同的策略?既然要找到伟大企业和优秀的经理人是如此的困难,那为什么我们要拋弃那些已经被证明过的投资对象呢?(通常我喜欢把它们称做是狠角色),我们的座右铭是:如果你一开始就成功了,那就不要费力再去试别的了。

著名经济学家凯恩斯,他的投资绩效跟他的理论思想一样杰出,在 1934 年 8 月 15 日他曾经写了一封信给生意伙伴 Scott,上面写到:“随着时光的流逝,我越来越相信正确的投资方式是,将大部分的资金投入到自己了解的企业和自己完全信任的管理层之上,将资金分散到自己知之甚少且没有特别理由信任的一大堆公司上,以控制风险的做法是错误的……一个人的知识与经验肯定是有限度的,在任何时候,我个人认为,自己有资格充分信任的企业很少超过两三家。”

〔译文源于芒格书院整理的巴菲特致股东的信〕