巴菲特致股东的信(1991年)

⑪固定收益证券

固定收益证券

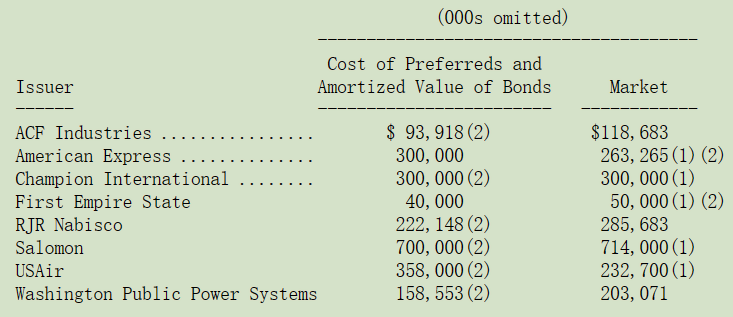

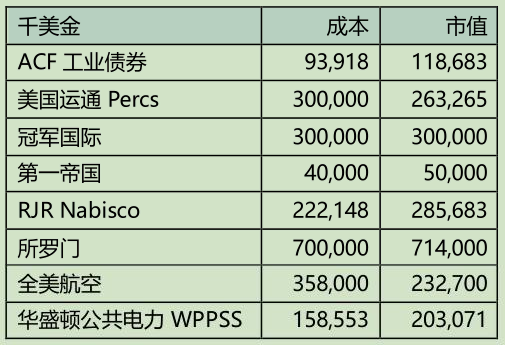

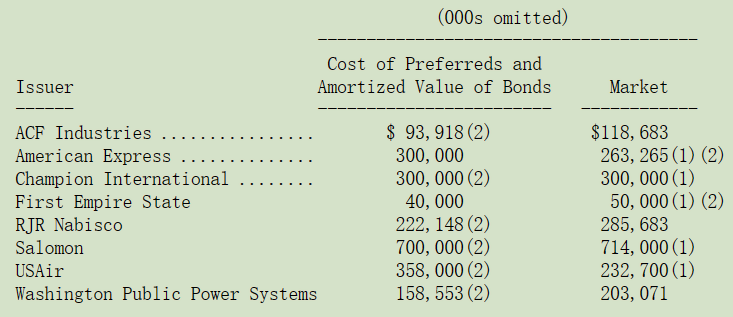

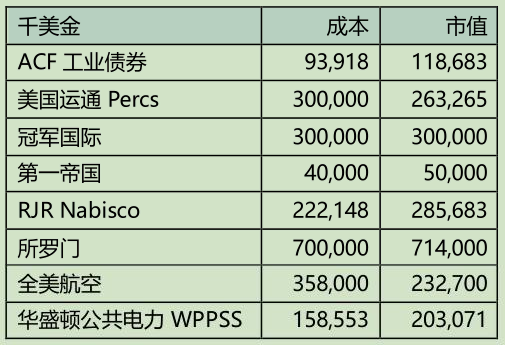

1991 年我们在固定收益证券这方面的投资有很大的变动,如同先前曾提到的我们的吉列可转换优先股到期,迫使我们转换为普通股;另外我们清仓了 RJR Nabisco 的债券,因为它在被转换后赎回;我们也买进了美国运通与第一帝国(一家布法罗的银行控股公司)的固定收益证券;我们还在 1990 年底买进了一些 ACF 工业的债券,以下是截至年底我们持有的主要部位:

(1)由查理和我确定的公允价值

(2)在我们财务报表中的账面价值

我们投资了 4,000 万美元在第一帝国 9%收益率的优先股上,在 1996 年前公司无法赎回,可以以每股 78.91美元转换为普通股,通常我会认为这样的规模对于伯克希尔来说实在是太小了,但由于我们对于该公司 CEI 鲍勃·威莫斯(Bob Wilmers)实在是过于崇敬,所以不管金额大小,还是希望有机会能与他一起合伙共事。

至于美国运通的投资则不是一般的固定收益证券,它算是一种 Perc:每年可以为我们 3 亿美元的投资贡献8.85%的股利收入,除了下述例外,那就是我们的优先股必须在发行后的三年内转换成最多 12,244,898 股的普通股,若有必要,转换比率会向下调整,以确定我们所收到的股份总值不超过 4.14 亿美元。因此,虽然对于可能取得的普通股价值有其上限,但相对地却没有下限,然而,这样的特别条款还包含一项规定,若是三年期限到时公司股价低于 24.5 美元时,可以有权请求延长转换期限一年。

总的来说,不管最近或是是长期而言,我们在固定收益证券上的投资表现还算不错,靠着这样的投资我们赚取大量的资本利得,在 1991 年这个数字大约在 1.52 亿美元左右,此外我们的税后回报率也远高于一般的固定收益证券。

尽管如此,我们还是发生一些小意外,没有比需要我亲自参与的所罗门事件更让人惊讶的了,当我在撰写这封信时,我也同时写了一封信放在所罗门的年度报告之内,我希望您能参阅这份报告,了解该公司的最新情况。(向纽约第七世贸大楼所罗门公司索取),虽然公司遭逢不幸,但查理跟我都相信,所罗门优先股价值在 1991 年略有增加,得益于低利率的环境加上所罗门普通股的股价回升。

去年我曾告诉各位除非航空业的经营环境在未来几年内加速恶化,否则我们在全美航空的投资应该可以有不错的结果,不过很不幸的随着中美、泛美与美西航空相继倒闭,1991 年正是航空业加速恶化的一年,(若是把时间延长为 14 个月,则还要包括大陆航空与 TWA 两家航空公司)。

我们对于全美航空投资的评价之所以如此的低,反应出整个产业目前所面临到的盈利前景不佳的风险,这个风险又因为法院鼓励已经宣布破产的航空公司继续营运而加剧,这些同业以低于一般成本价格卖票,因为破产者完全可以不必在乎其它还奄奄一息的同业所需负担的资金成本,为了避免营运停摆,它们可以靠着变卖资产来提供资金,从而避免被关闭。这种拆家具当柴烧的做法,有可能进一步危及其它营运还算正常的同业,然后引发多米诺骨牌效应,使得整个产业一败涂地。

赛斯·斯科菲尔德(Seth Schofield)在 1991 年成为全美航空公司的 CEO,正在对整个公司的营运做出重大调整,以提高其成为航空业仅存的几位幸存者之一的机会。在美国企业界,没有比经营一家航空公司还要困难的工作了,虽然大笔的资金已经投入到这个产业,但是从小鹰号诞生开始,航空业历史累积加总所产生的损失却是相当惊人,航空公司的经理人需要智力、勇气还要再加上经验,而毫无疑问的,Seth 同时具有以上三项的特质。

〔译文源于芒格书院整理的巴菲特致股东的信〕