巴菲特致股东的信(1992年)

④报告收益来源

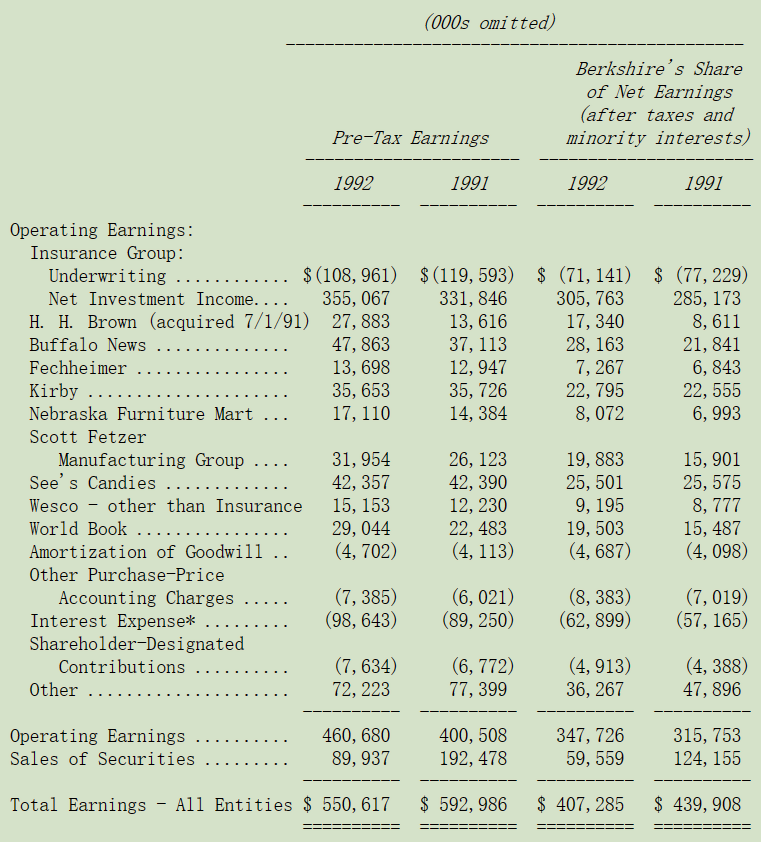

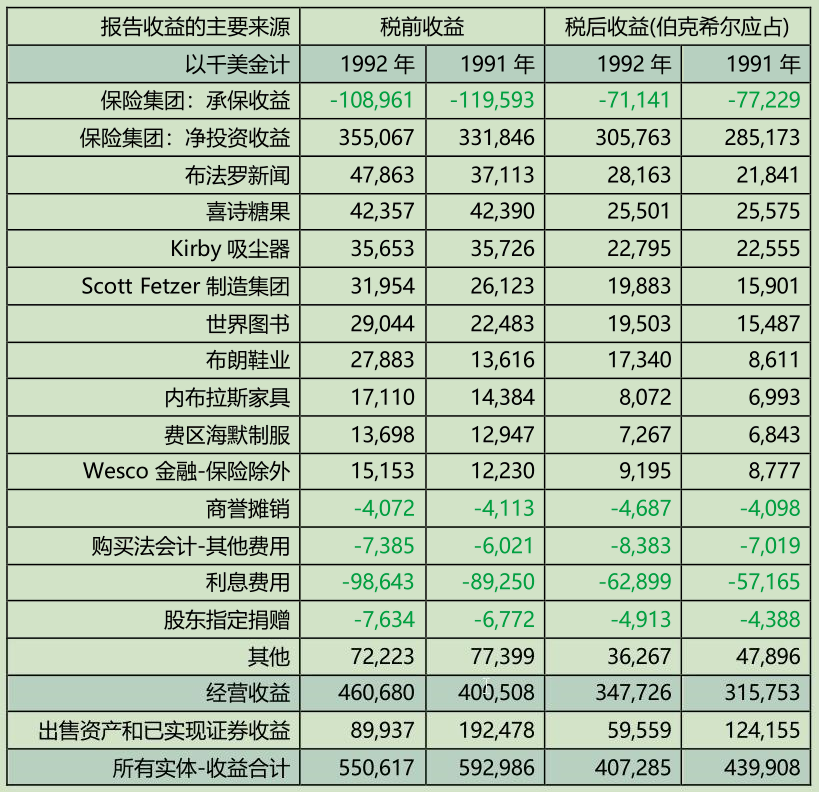

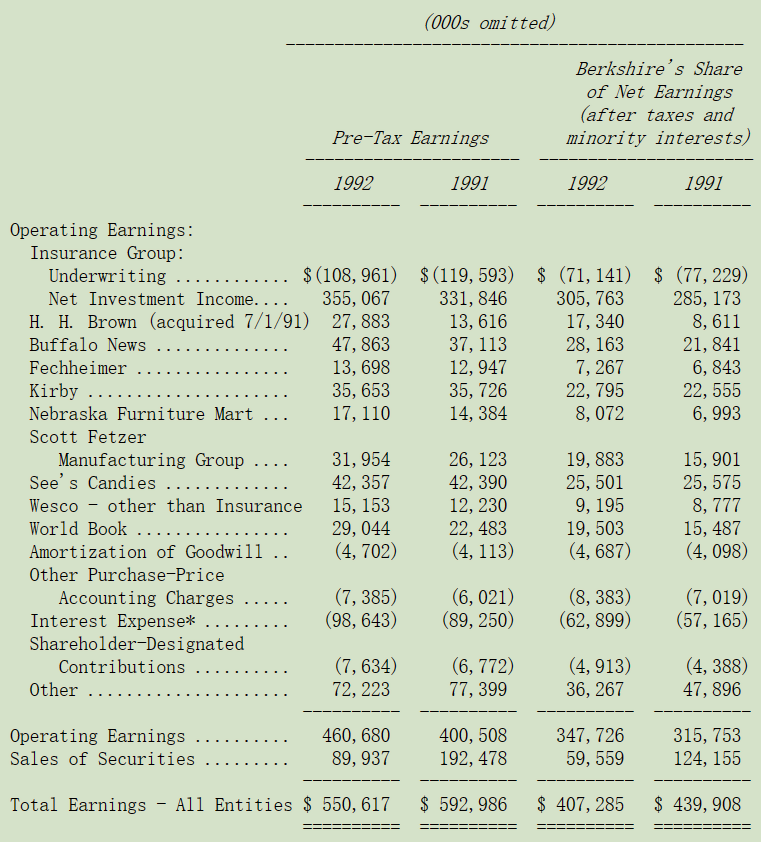

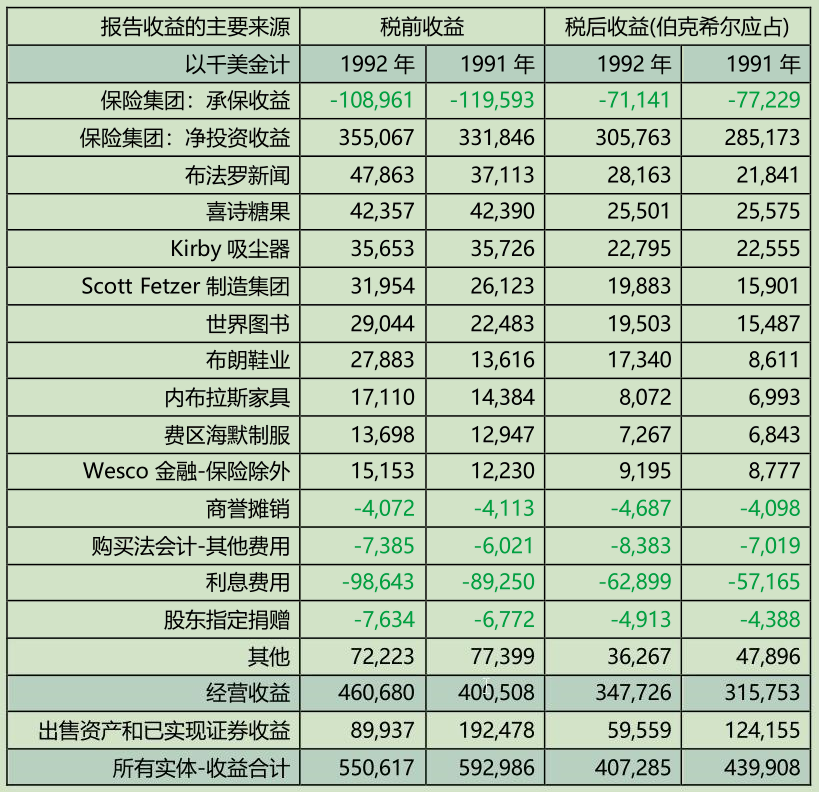

报告收益来源

下表显示伯克希尔报告收益的主要来源,在这张表中商誉的摊销数与购买法会计调整数会从个别被投资公司分离出来,单独加总列示,之所以这样做是为了让旗下各事业的收益状况,不因我们的投资而有所影响,过去我一再地强调我们认为这样的表达方式,较之一般公认会计原则要求以个别企业基础做调整,不管是对投资者或是管理者来说,更有帮助,当然最后损益加总的数字仍然会与经会计师查核的数字一致。

注:债务利息不包含斯科特费泽与互助储贷的利息费用,另外加计 1992 年与 1991 年分别赎回可转换债券所额外支付的 2250 万与 570 万溢价。

在年报中你可以找到依照一般公认会计原则编制,详细的各部门信息,我们的目的是希望,为你提供所有查理跟我认为在评估伯克希尔价值时,应该必要的所有资讯。

〔译文源于芒格书院整理的巴菲特致股东的信〕