巴菲特致股东的信(1992年)

⑤透视收益

透视收益

之前我们曾经讨论过透视收益,其主要包括有(1)前段所提到的报告收益,加上(2)主要被投资公司的保留收益,按一般公认会计原则未反应在我们公司报告上的收益,扣除(3)若这些未反应的收益分配给我们时,估计可能要缴的所得税。虽然没有任何一项数字是完美的,但我们相信,透视收益相比 GAAP 的数字更能够反应伯克希尔实际的盈利状况。

我曾经告诉各位,长期而言,如果我们的内在价值也期望以 15%的幅度来成长的话,透视收益每年也必须增加 15%,1992 年我们的透视收益约为 6.04 亿美元,而到 2000 年为止,若要以 15%的目标,透视收益必须成长到 18 亿美元,要完成这样的目标,代表我们旗下的营运事业及主要的被投资公司必须要有更杰出的表现,同时我们本身的资本配置也要更有效率才行。

我们不敢保证届时一定可以达到 18 亿美元的目标,甚至很有可能根本就达不到,不过这个目标还是对我们的决策有帮助,每当我们现在在分配资金时,我们都会想到要如何将 2000 年的透视收益极大化。

不过,我们对于长期目标的专注并不代表我们就不注重短期结果,总的来说我们早在 5-10 年前就预先规划设想,而当时所作的举动现在才开始慢慢地回收,如果每次信心满满的播种,最后的收成却一再让人失望的话,农夫就应该要好好地检讨原因了,(不然就是农地有问题,投资人必须了解,对于某些公司甚至是某些产业,根本就没有所谓的长期性策略),就像是你可能会特别留心,那些利用会计手法或出售资产增加短期利润的经理人,同样,你也应该怀疑那些一再未能实现承诺,却把长期目标一直挂在嘴上的经理人,(即使是爱莉丝一再听到女王关于明天就有果酱的说教,她最后也会忍不住要求,总有一些应该今天有吧!)

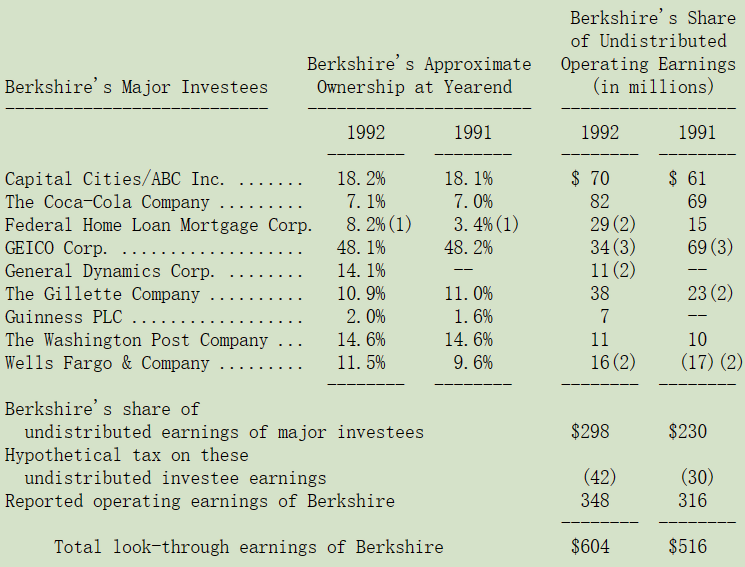

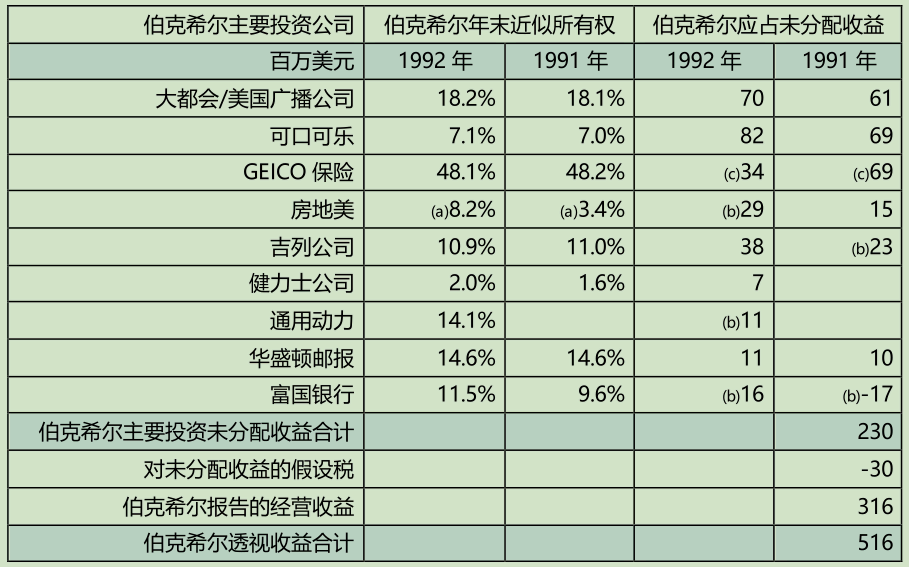

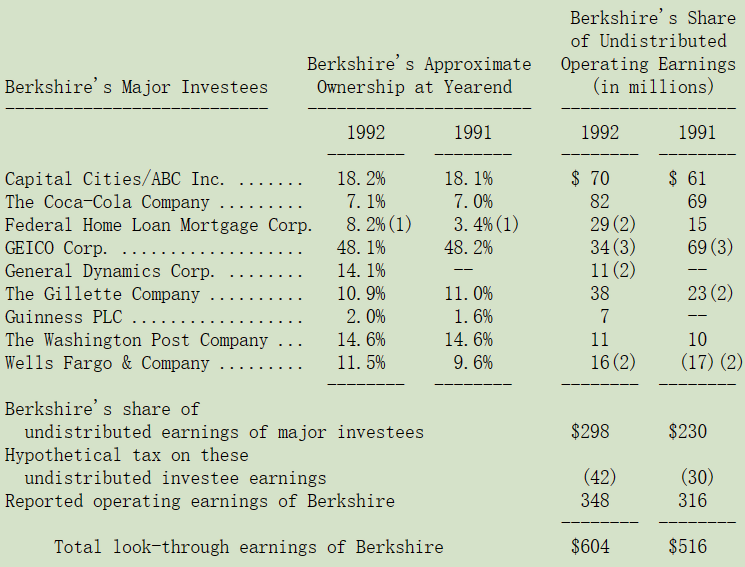

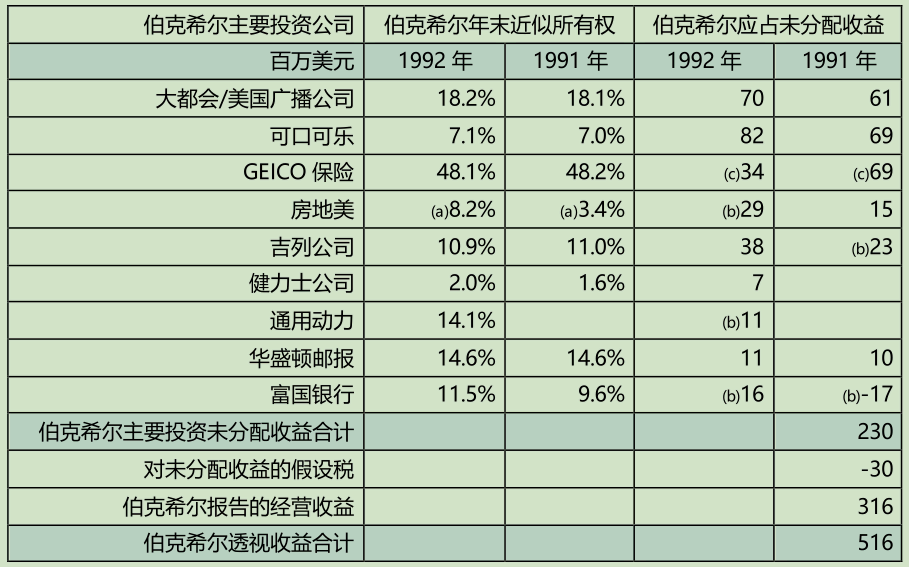

各位可以从下表看出我们是如何计算透视收益的,不过我还是要提醒各位这些数字非常粗糙,(被投资公司所分配的股利收入已经包含在保险业务的净投资收益项下)。

(1)已扣除 wesco 的少数股权

(2)以年平均持有股权比例计算

(3)扣除经常性且金额大的已实现资本利得

〔译文源于芒格书院整理的巴菲特致股东的信〕