巴菲特致股东的信(1992年)

⑥保险业务营运

保险业务营运

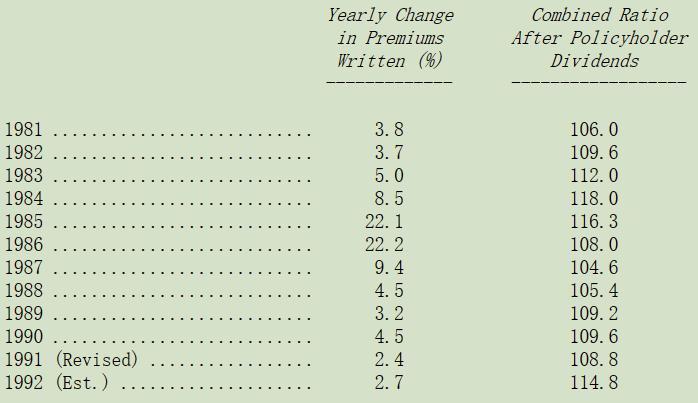

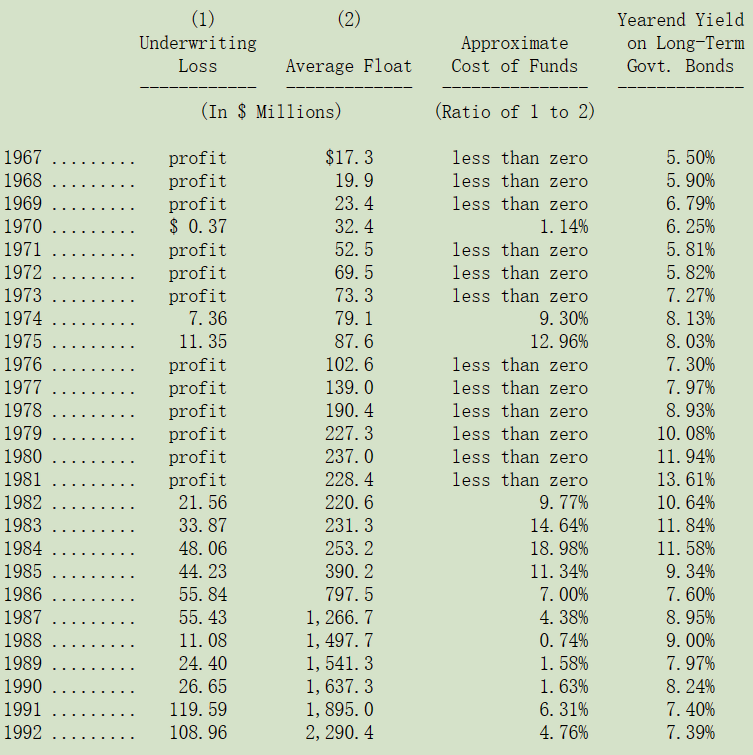

以下是我们通常表格的更新版本,列出财产保险行业的主要数字:

保险业务综合比率代表的是保险的总成本(损失加上费用)占保费收入的比率,100 以下代表会有承保利润,100 以上代表会有承保损失,若把持有保费收入浮存金(扣除股东权益部分所产生的收益)所产生的投资收益列入考量,损益两平的范围大概是在 106-110 之间。

1992 年的综合比率由于 Andrew 飓风的发生而增加了 4%,Andrew 飓风是史上最大的单一损失理赔事件,几家小型保险公司因此倒闭,此外,许多大型保险公司也意识到自己并未寻求到足够的再保险保护(只有当潮水退了,大家才知道谁在裸泳),还有一家大型的保险公司免于破产,因为他背后有钱的母公司迅速注入了资金。

尽管情况非常糟糕,还好 Andrew 没有往北 20-30 英哩侵袭到佛罗里达,或是往东侵袭到路易斯安那州,否则损失可能难以估计,总而言之,很多公司因为 Andrew 事件可能会重新考虑现有的再保险安排是否妥当。

大家知道伯克希尔一直都是巨灾再保险保单(超级猫)相当大的承保公司,或许规模已是全世界最大的,这类保单通常是由其它保险公司买来分散他们本身在重大意外事故所需承担的风险,也因此我们必须承受一大块Andrew 所造成的损失,金额约为 1.25 亿美元,这数字相当于我们一整年的保费收入,幸运的是,其它巨灾险保单实际发生的损失都相当轻微,所以结算下来全年的总损失只有 200 万美元,另外,我们投资的 GEICO 保险也因Andrew 飓风产生了一些损失,在扣除再保分摊与税负抵减之后,金额约为 5,000 万美元,依我们的持股比例大概要分摊 2,500 万美元,虽然这项损失不会反应在我们的帐上,但确实已对我们的透视收益造成负面影响。

在去年的年报中,我曾告诉各位,我们希望能从巨灾再保险业务中获得 10%的利润空间,但我还是要提醒各位在某些特定的年度中,有可能一下子大赚或是一下子大亏,然而 1991 年与 1992 年都是维持在损益两平的边缘,不过我还是认为这样的结果属于异常,同时我还是坚持在这行盈利可能大好大坏的预测。

我还是苦口婆心再提醒各位一下,巨灾险保单的特点,通常只有在两种情况发生时,理赔才会生效,首先,受我们保护的保险或再保公司的损失必须超过一定金额,也就是投保户的自留保额部分;第二,整个保险业界的损失也必须超过一定的上限,比如说 30 亿美元以上或甚至更多。第三,在大部分的状况之下,我们发行的保单只包含特定地区,像是美国一部分州、或是全美国或是除了美国的以外地区。第四,有许多保单也不是在第一次大型灾害发生后就须理赔,有的只保第二次或第三次甚至是第四次大灾害。最后,有些保单只保特定种类的灾害,比如地震,我们暴露的风险相当的大,我们有一张保单若是发生保单上指定的特定灾害发生的话,就必须给予保户 1 亿美元的理赔,(现在你应该知道我常常盯着气象频道盯到眼睛酸的原因了吧)。

目前,伯克希尔是全美国账面价值第二大的财产意外险公司,排名第一的是州立农业保险(State Farm),不过他们并不从事再保业务。因此,我们绝对有能力也有兴趣去承担别的保险公司无法承担的风险,随着伯克希尔的账面价值与盈利能力继续成长,我们承保的意愿也跟着增加,但是我必须强调,只有好的生意我们才愿意接,有人说:傻子的钱特别好骗。我想这句话也适用在再保险之上,事实上,我们拒绝了 98%以上的业务,我们在好业务和坏业务之间挑选客户的能力,反映了与我们自身的财务实力相匹配的管理能力。阿吉特·贾恩(Ajit Jain)负责经营我们的再保业务,堪称业界的翘楚。综上所述,只要保费价格合理,这些优势可以确保我们在巨灾再保险业继续成为主要的参与者。

当然,何谓合理的价格实在是很难去界定,灾害保险业者实在是很难依据过去的经验来预估未来。例如,若是全球温室效应确实存在的话,意外变量一定会增多,因为大气状况任何些微的转变就有可能造成气象形态的巨幅波动。此外,最近几年美国海岸地区人口爆炸性成长,这些地区又特别容易受到飓风的侵袭,而飓风正是巨灾再保险业务最大的肇事者,现在人口密集地区的一次飓风所造成的损失可能是 20 年前的十倍以上。

而且有时还会有意想不到的事情发生,比如说谁会想到南卡罗莱纳州的查尔斯顿地区竟然会发生大地震(1886年发生,里氏规模 6.6 级,造成 60 个人死亡),又有谁知道美国史上最严重的地震是 1812 年发生在密苏里州新马德里,规模估计 8.7 级,相比之下,1989 年发生在旧金山的大地震,规模只有 7.1 级,大家要知道每增加 0.1 级代表其释放的力量就要增加 10 倍。哪天要是加州发生大地震的话,将会对所有保险业者造成难以估计的损失。

当各位在检视我们季度财务报表时,大家一定要知道我们巨灾再保险的会计原则与一般保险有些许的不同,我们没有将巨灾险的保费收入,按保单承保期间平均分摊认列,我们必须等到整个承保期间结束,或是损失发生后才全部一次认列,我们之所以采取这样保守的做法,原因在于巨灾险保单在年底特别容易发生险情,尤其是天气状况往往变坏:在历史上前十大保险损失中,有九件是发生在下半年。此外,由于许多保单在第一次重大灾害发生时,并不理赔,所以若真的发生损失的话,通常会是在下半年。

对于巨灾再保险我们的会计原则底限就是,巨额的损失可能会发生在任何一季,但巨额的盈利只有在每年的第四季才有可能出现。

* * * * * * * * * * * *

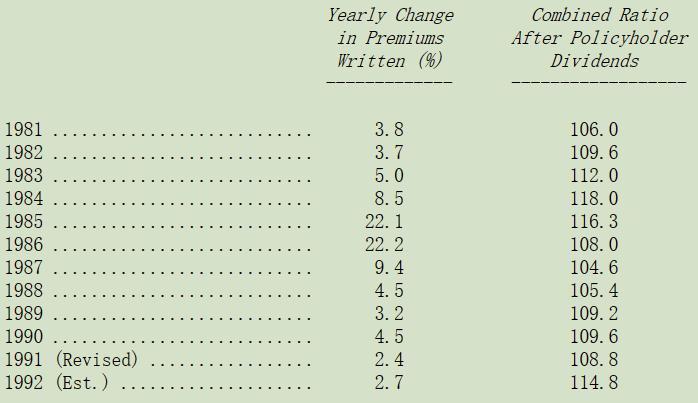

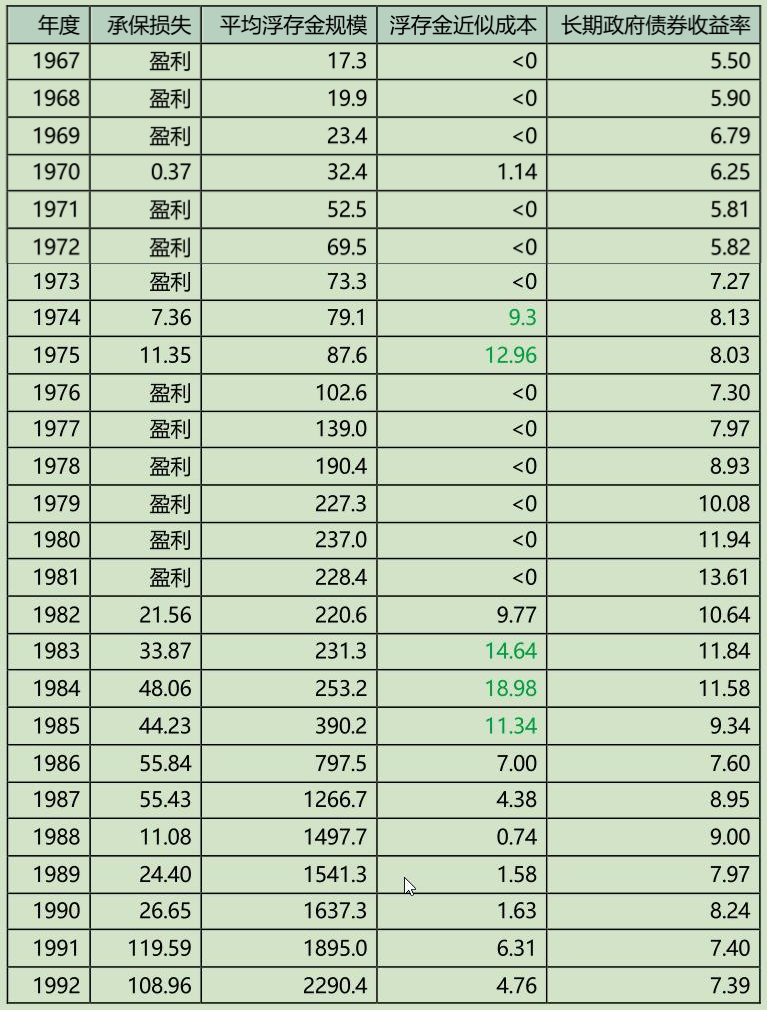

就像是过去几年我不断向各位提到的,我们保险业务真正重要的是,从保险业所取得的资金成本到底是多少,套句专业术语,就是浮存金成本,浮存金是指我们从保险业所取得大量的资金,它是将所有的损失准备、损失费用调整准备与未赚取保费加总后,再扣除应付佣金、预付并购成本及相关再保递延费用,至于浮存金的成本则是以我们所发生的承保损失来衡量。

下表是我们在 1967 年进入保险业后,浮存金的成本统计:

去年我们保险营运所产生的资金成本还是一样低于美国政府当年所新发行的公债利率,在过去 26 年的保险业务经营中,我们有 21 年是远胜于政府公债发行利率,而且是以巨大优势做到的。如果我们的平均资金成本高于政府公债的利率的话,我们实在就没有理由继续从事保险业了。

1992 年,如同以往年度,由 Don Wurster 领导的国民保险公司所经营的商用汽车与一般责任保险业务,以及 Rod Eldred 领导的住宅保险业务(Home-State),对于我们取得低廉的资金做出相当大的贡献,事实上,在去年这两家公司都有承保利润,也就是说所产生的保险浮存金的资金成本都是低于零。不过,我们大部分的浮存金是来自于阿吉特所开发出来的巨灾再保险,展望 1993 年,他所贡献的保费收入还会增加。

查理跟我相当喜爱保险业,这也是我们预期未来十年主要的利润来源。这个产业规模够大,在某些领域我们可以与全世界业者竞争,同时伯克希尔在财务实力方面也拥有特殊的竞争力。我们将继续寻求在保险业进行扩张的机会,不管是间接的,就像通过 GEICO 保险那样,还是直接的,就像取得中央州保险公司那样。

〔译文源于芒格书院整理的巴菲特致股东的信〕